A thread summarizing ALL of our analysis on #China .

I think this is required as there are still misconceptions what& #39;s going on in the world #economy at the moment.

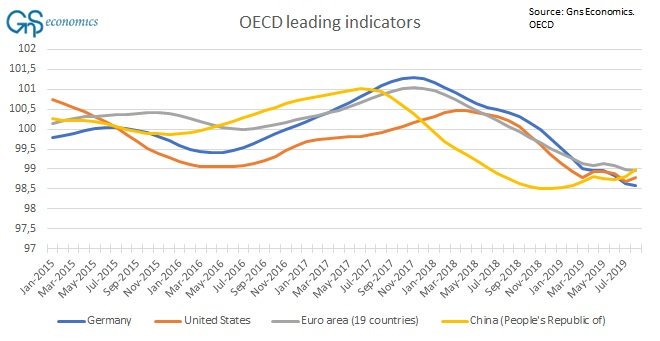

Everything starts with the notion that China (not the #Fed or the #ECB) has been driving the global cycle. 1/

I think this is required as there are still misconceptions what& #39;s going on in the world #economy at the moment.

Everything starts with the notion that China (not the #Fed or the #ECB) has been driving the global cycle. 1/

This was revealed to us, when we were making an in-depth analysis on the world economy in early 2017 to understand, why it had recovered with a break-neck speed from the deep slump of 2015.

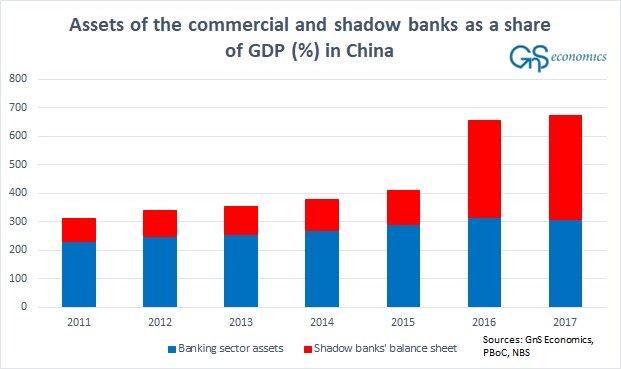

The & #39;culprit& #39; for this mystery turned out to be the shadow banks of China. 2/

The & #39;culprit& #39; for this mystery turned out to be the shadow banks of China. 2/

Their size to GDP three-folded in just one year, meaning that in 2016 China launched what was probably the biggest debt-stimulus operation ever seen.

It was no surprise that the world economy made a miraculous recovery.

But, China had been on a perilous path much longer. 3/

It was no surprise that the world economy made a miraculous recovery.

But, China had been on a perilous path much longer. 3/

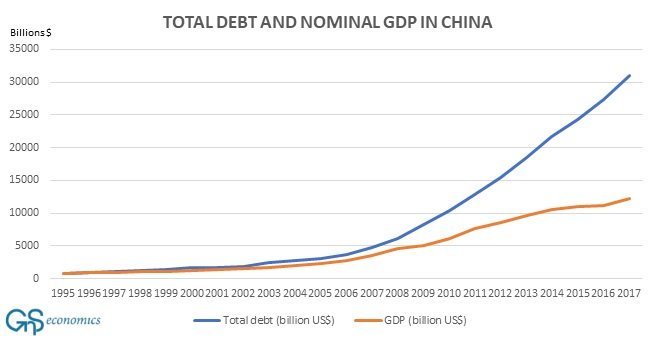

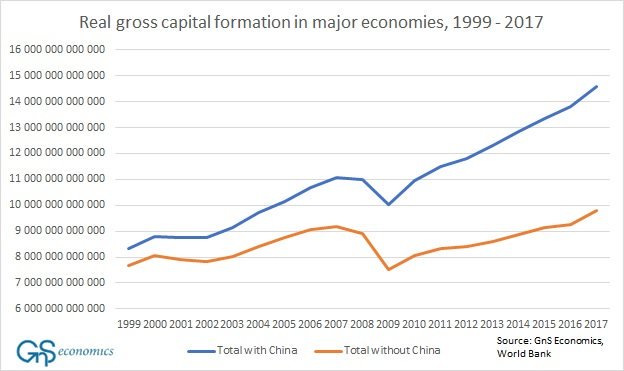

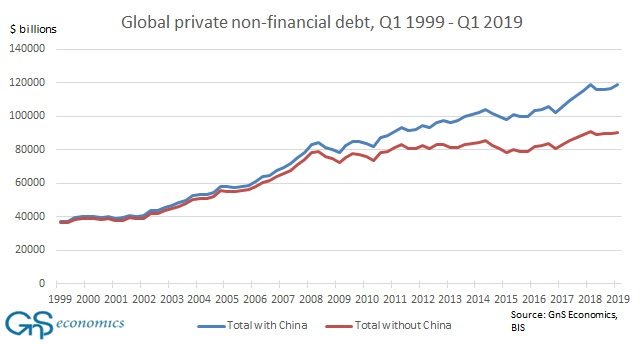

After the 2008 crisis, China had launched a far-reaching stimulus operation that carried the world economy into a recovery.

Whoppingly, China accounted for over 50 percent of all capital investments in major economies between 2009 and 2017. 4/

Whoppingly, China accounted for over 50 percent of all capital investments in major economies between 2009 and 2017. 4/

Moreover, more than 60% of all the new money (debt) created globally had come from China, mostly created by it& #39;s commercial banks.

This was naturally totally unsustainable, but more troubles were on the horizon of the "Chinese Miracle". 5/

This was naturally totally unsustainable, but more troubles were on the horizon of the "Chinese Miracle". 5/

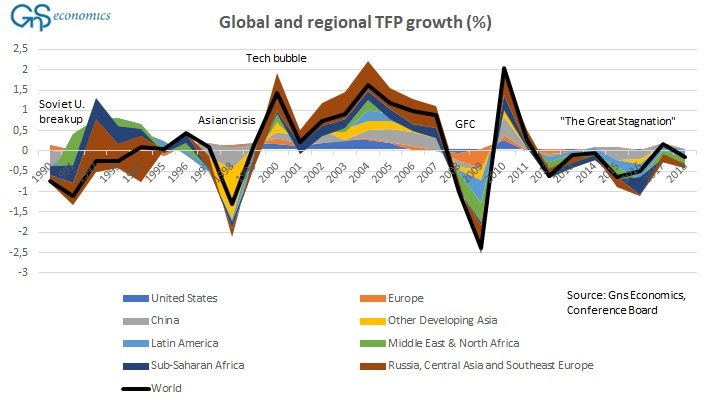

The massive debt stimulus, enacted mostly through the government own enterprises, was turning growingly unproductive.

In 2011, China slipped into a productivity stagnation from which it has never recovered. 6/

In 2011, China slipped into a productivity stagnation from which it has never recovered. 6/

With the help of the major central banks over-resuscitating the global economy, this pushed the whole world economy into a productivity stagnation.

Effectively, the global economy "zombified". 7/

Effectively, the global economy "zombified". 7/

China started to scale back it& #39;s lending spree in late summer 2017, which started to slow the global economy.

The tax-breaks of President Trump carried to world economy in 2018, but the engine of global growth (China) was already sputtering. 8/

The tax-breaks of President Trump carried to world economy in 2018, but the engine of global growth (China) was already sputtering. 8/

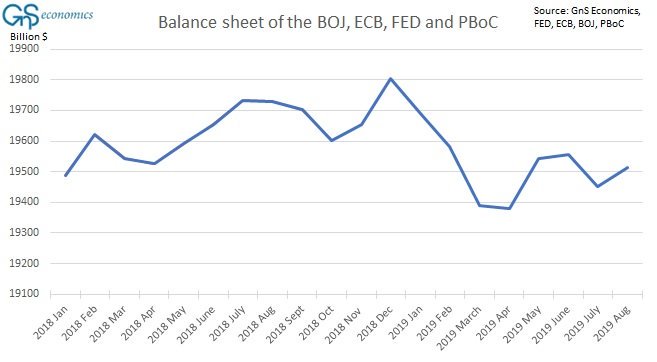

The end of 2018 brought a shock to the world economy.

The decline of global central bank balance sheet had started in August 2018, and two months later the asset markets were in trouble.

The #Fed and the PBoC panicked, and "pivoted" pushing liquidity into the markets. 9/

The decline of global central bank balance sheet had started in August 2018, and two months later the asset markets were in trouble.

The #Fed and the PBoC panicked, and "pivoted" pushing liquidity into the markets. 9/

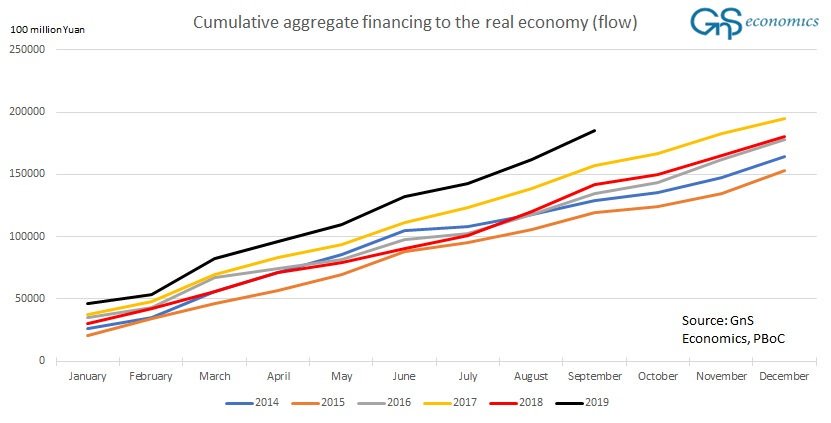

The Chinese economy was also in serious trouble causing Chinese leaders to panic and issue massive additional stimulus in Q1 2019, including around $320 billion for infrastructure projects, and over $300 billion worth of tax-cuts.

Explained here. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">10/ https://gnseconomics.com/en_US/2019/06/17/june-2019-forecasts/">https://gnseconomics.com/en_US/201...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">10/ https://gnseconomics.com/en_US/2019/06/17/june-2019-forecasts/">https://gnseconomics.com/en_US/201...

Explained here.

Probably due to the approaching 70th anniversary of the People& #39;s republic, China, again, enacted massive additional debt stimulus through both the commercial and shadow banking sectors in August and September.

China& #39;s "deleveraging-story" was effectively dead. 11/

China& #39;s "deleveraging-story" was effectively dead. 11/

But, despite of massive debt and fiscal stimulus, China& #39;s econ. growth kept on falling. China has, thus, very likely reached "debt saturation", on which we warned in January.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">

China simply cannot reflate its (or global) economy anymore. 12/ https://gnseconomics.com/en_US/2019/01/23/the-gray-rhino-known-as-china/">https://gnseconomics.com/en_US/201...

China simply cannot reflate its (or global) economy anymore. 12/ https://gnseconomics.com/en_US/2019/01/23/the-gray-rhino-known-as-china/">https://gnseconomics.com/en_US/201...

This was recently "confirmed" in a very informative piece on the ability of China to increase debt to create growth.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">/13 https://www.ft.com/content/8cb854e4-ffbe-11e9-b7bc-f3fa4e77dd47">https://www.ft.com/content/8...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">/13 https://www.ft.com/content/8cb854e4-ffbe-11e9-b7bc-f3fa4e77dd47">https://www.ft.com/content/8...

Alas, it& #39;s useless to think that the #centralbanks, with their additional mon. easing and QE, could turn the global cycle around.

We are currently experiencing a & #39;bounce& #39; from China& #39;s massive early fall stimulus, which is unlikely to continue and/or to be effective. 14/

We are currently experiencing a & #39;bounce& #39; from China& #39;s massive early fall stimulus, which is unlikely to continue and/or to be effective. 14/

Read on Twitter

Read on Twitter