Guys, we are in WEEK 45 of the #52WeekChallenge. Seeing a lot of conversations on the TL about money. Anxiety about job security, questions of mobile loans, anxiety about the rate cap repeal and what it means for those with bank loans.

I promised you one #SaveWithMshwari chat every week for 10 weeks. Last week was crazy, but I want to make it up to you by having two chats this week.

Week 43 #SaveWithMshwari chat was about off-plan houses. The perils and the opportunities https://twitter.com/RookieKE/status/1187625523847090176">https://twitter.com/RookieKE/...

This week, our chat is about how to invest in real estate if you are not a multi-millionaire. This is coming up later today.

As I prepare, tell me what you think our next chat should be about. What do you want us to learn this week? #SaveWithMshwari

Gah. My promises are worse than a politician& #39;s. I& #39;ve been trying to perfect this chat but at this rate it will happen in December. So I& #39;ll just do it in bits.

Periodic reminder: These Twitter chats provide useful information, but they are meaningless unless you do something about your finances. So make that #52WeekChallenge deposit as we speak #SaveWithMshwari

Can you really get rich by saving money? You cannot grow wealth without saving. We forgo consumption, consolidate the money, then invest. Real estate especially calls for this cycle cos you can& #39;t buy land/house off one month& #39;s savings #SaveWithMshwari https://www.youtube.com/watch?v=nS7vjkrEXTA">https://www.youtube.com/watch...

To start, I want to make a distinction between retail and institutional investing when it comes to real estate. Institutional is where a company or a wealthy person develops property for resale. Retail, is you and I wanting to own some real estate as an investment

I also want to differentiate between residential real estate and commercial real estate. Home-ownership is something we have discussed extensively before. The math that goes into home-ownership is different from investment real estate math. #savewithmshwari

I would want us to focus on retail investors. Sisi wananchi wa kawaida. Folk who do not have money lying in the bank looking for real estate to buy. Those of us who need to save for years to invest in real estate.

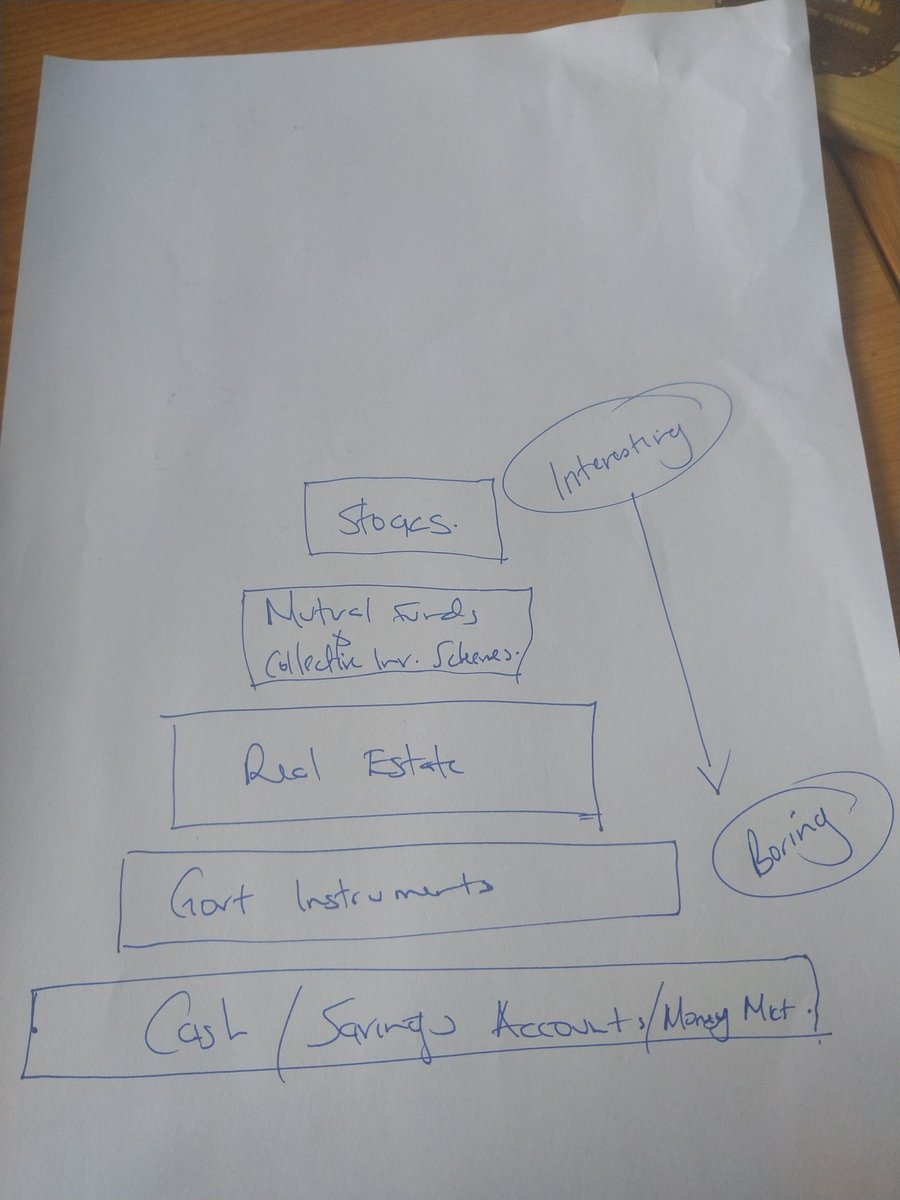

To start with, I want to say that real estate is a fairly boring asset class. And this is by design. In the hierarchy of assets, real estate is right at the bottom above government bonds.

I& #39;ve even done a graphic of the most common investment classes. Apologies in advance for the handwriting, I missed my calling to be a doctor.

Boring - low variability in returns / low risk

Interesting - high variability in returns / high risk

Boring - low variability in returns / low risk

Interesting - high variability in returns / high risk

This means real estate is less risky than the rest - its returns do not fluctuate as much as the ones above it. But also the returns you should expect from real estate are just as low. #SaveWithMshwari

How do we calculate returns in real estate? There are two components:

1. The yield. This is the cash you get from it month to month in rental income. This is a percentage of the cost of the property.

1. The yield. This is the cash you get from it month to month in rental income. This is a percentage of the cost of the property.

E.g if you buy a property for 8 million bob, and it fetches 400k per annum, it means it has a yeild of 5%.

2. Capital gains. This is the increase in the value of the property. This gets realised when you engage a valuer, they tell you the value has increased.

2. Capital gains. This is the increase in the value of the property. This gets realised when you engage a valuer, they tell you the value has increased.

I want to say that capital gains is theoretical but not entirely useless. Until you put the property to market, you can& #39;t really say you have gained.

But it is not useless, because you can take loans based on the property& #39;s valuation.

But it is not useless, because you can take loans based on the property& #39;s valuation.

If the returns are so low (looking at rentals), why do we still invest in real estate? Why not go for an all-stocks portfolio for example, or invest in business? #SaveWithMShwari

Real estate versus a business? This is the wrong question to ask. The entrepreneurship question depends on a whole different set of math from the investments question

Read about this here. http://www.rookie-manager.com/why-buy-stocks-when-you-can-always-invest-in-business/">https://www.rookie-manager.com/why-buy-s...

Read about this here. http://www.rookie-manager.com/why-buy-stocks-when-you-can-always-invest-in-business/">https://www.rookie-manager.com/why-buy-s...

Real estate versus stocks? As you& #39;ve seen in that graphic, they rank differently. It should not be an either or. The two ideally should be part of a well-balanced investment portfolio. One gives you excitement, the other holds you down.

Real estate gives you a base, and passive cashflows that you can leverage to make other investments or even invest in business. Stocks give you capital gains that you realize on sale. #SaveWithMshwari

Our Looking Back series in the stocks column looks at how stocks grow our wealth, and also the skill-set you need to develop to be a stocks investor #SaveWithMshwari

http://www.rookie-manager.com/category/investing/stocks/">https://www.rookie-manager.com/category/...

http://www.rookie-manager.com/category/investing/stocks/">https://www.rookie-manager.com/category/...

Spoiler alert. This thread will end by encouraging us to pool resources for real estate investment - as opposed to waiting when we are wealthy enough to do it alone. And I& #39;ll provide a path for that. Not today though #SaveWithMshwari

Real estate investment can take at least 4 forms. All are valid but require different skill sets.

1. Land banking. Where you buy large tracts of land with the belief that as population grows, demand for land will go up and you will be able to dispose at a higher price.

Examples of this: buying land near planned universities, SGR etc etc. A good way to land bank is to look at city/town growth trends and follow those.

Land banking was very popular a few years back, with people claiming that you can triple your money in a year, by buying plots sijui in Kitengela. While these things sometime happen, land-banking is a long-term play.

The best way to do this is to look at city/town growth trends and make intelligent predictions on where land will be needed next.

2. Packaging. This is a step further from banking. Here you buy land, and improve its value. E.g dividing it into plots, getting titles to the plots etc.

If you& #39;ve dabbled in real estate, you know of land that has share certificates and allocation letters instead of titles etc. A packager clears these things out. They then may opt to sell these plots to individuals at a profit

3. Land developer. You go a step further, create a master plan for the land, secure services (water, electricity, sewer), maybe make basic road access.

Then you sell either to individuals or a developer. #SaveWithMshwari

Then you sell either to individuals or a developer. #SaveWithMshwari

4. Builder. Here, you erect a structure on the land either for sale, or for rentals.

#SaveWithMshwari

#SaveWithMshwari

As an individual, you can buy land small-time and this is one path to be a real estate investor. But it takes time, and you will pay significantly more than someone who is buying large chunks of it. #SaveWithMshwari

You can save for years and take loans to develop rentals, but unless you are significantly wealthy, this becomes the only major investment you make. And we do not want this. Real estate is not exciting. Returns are low. #SaveWithMshwari

So the next Twitter chat, which will be a continuation of this thread, we will talk about pooled real estate investment. #SaveWithMshwari

As we wait for that, @dnahinga fashioned a building plan around the #52WeekChallenge which espouses the jenga pole pole (build slowly) philosophy that I love so much #SaveWithMshwari http://ub.co.ke/index.php/2017/01/06/revealed-building-a-3-bedroom-house-in-one-year-using-the-52weekchallenge-savings-plan/">https://ub.co.ke/index.php...

Also as we are talking real estate, let& #39;s not ignore the counties. There& #39;s growth there too, not just in the city/cities.

On home-ownership, here& #39;s a chat. The thread and the discussions #52WeekChallenge 2018 Edition. #SaveWithMshwari https://twitter.com/RookieKE/status/960179842359676928">https://twitter.com/RookieKE/...

Finishing this Twitter chat today.

This tweet is a bookmark/commitment. Work has really gotten in the way of my tweeting of late https://abs.twimg.com/emoji/v2/... draggable="false" alt="😭" title="Loudly crying face" aria-label="Emoji: Loudly crying face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😭" title="Loudly crying face" aria-label="Emoji: Loudly crying face"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="😭" title="Loudly crying face" aria-label="Emoji: Loudly crying face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😭" title="Loudly crying face" aria-label="Emoji: Loudly crying face"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="😭" title="Loudly crying face" aria-label="Emoji: Loudly crying face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😭" title="Loudly crying face" aria-label="Emoji: Loudly crying face"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤣" title="Rolling on the floor laughing" aria-label="Emoji: Rolling on the floor laughing">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤣" title="Rolling on the floor laughing" aria-label="Emoji: Rolling on the floor laughing"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤣" title="Rolling on the floor laughing" aria-label="Emoji: Rolling on the floor laughing">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤣" title="Rolling on the floor laughing" aria-label="Emoji: Rolling on the floor laughing">

This tweet is a bookmark/commitment. Work has really gotten in the way of my tweeting of late

I really should consider running for office cos my promises!

Anyway, here is part 2 of investing in real estate!

Anyway, here is part 2 of investing in real estate!

We are in Week 48 of the #52WeekChallenge 4 weeks to go to the end of the year. As you think about your 2020 vision board, give your savings a head start by saving. #SaveWithMshwari http://www.rookie-manager.com/ten-weeks/ ">https://www.rookie-manager.com/ten-weeks...

If you tend to get carried away by holiday festivities, deposit your January rent, school fees, transport etc to your M-Shwari lock savings account this week. You can withdraw in January #SaveWithMShwari

Onto our chat. Now, pooled real estate investing hinged on two factors:

1. That typical real estate returns are low returns - you therefore do not want all your money locked up in real estate. This needs to be one of the many investments you make. #SaveWithMshwari

1. That typical real estate returns are low returns - you therefore do not want all your money locked up in real estate. This needs to be one of the many investments you make. #SaveWithMshwari

2. It takes time to accumulate enough money to make a substantial investment. Especially for us employed folk. It could take years to save up enough to buy a plot of land. #SaveWithMshwari

Doing it together means you get in early, and take advantage of the growth, even as you build your capital. For example, if it would take you 10 years to buy a rental property, doing it with 10 friends mean you own part of a rental property from year 1 #SaveWithMshwari

By year 10, you will each have a property, but also those properties will have been growing and generating rentals.

Where do you start? First, by getting like-minded people. You do not have to be friends, but:

- Your objectives have to be aligned.

- You must be financially aligned. i.e. you must be able to agree on how much you all can comfortably invest

- Your objectives have to be aligned.

- You must be financially aligned. i.e. you must be able to agree on how much you all can comfortably invest

You want to be between 10-20 members. You want an optimal number where at least once every year or two you will be able to make an acquisition or an investment. Contributing for too long without buying something is a recipe for dormancy. #SaveWithMshwari

Agree on a strategy. Further up this thread, we looked at ways to invest in real estate. Decide whether you want to land bank, to be developers, or to buy finished rental houses #SaveWithMshwari

Key to a great strategy is deciding where you want to end up as a group. Do you want to each have a rental house in 7 years? Do you want a company that generates X in rental income in 20 years? Is it a retirement plan? #SaveWithMshwari

Work backwards to agree on monthly contributions. Remember, this is not your only investment, so agree on an amount you can all sustain for the long term. #SaveWithMshwari

You don& #39;t want to set a high amount, halafu come school opening day, or December, some of the members cannot pay up.

A way to set this is by secret ballot. Where every member writes the amount they are comfortable contributing, and you go with the lowest amount. #SaveWithMshwari

It is also a good idea to have startup capital. A large amount of money that gives you a boost to enable you make your first investment no matter how small. You can agree to raise it in a year. #SaveWithMshwari

e.g you can set the monthly contributions at 5k a month starting immediately, and then say in a year, each member should build their capital up to say, 300k. Or something.

Agree on the T&Cs. Write a shareholder& #39;s agreement that deals with all the eventualities. What happens if a member wants to leave? How do you admit new members? What if a member stops contributing?

Agree on governance. Meetings are compulsory btw, so agree on an interval that is manageable for all members, and penalties for missing meetings. Meetings are what keep you focused. #SaveWithMshwari

Register a company, open a bank account etc. Your constitution/shareholder& #39;s agreement should define how this works. #SaveWithMshwari

Clearly document your vision and stratey and have every member make a commitment by signing off on it.

Start contributing right after your first formal meeting. Do not get stuck in analysis paralysis.

To conclude this long topic. I am thinking of putting together a matchmaking event for folks who want to do pooled real estate investments but haven& #39;t found likeminded folk. If you& #39;re interested, please fill in this survey https://forms.gle/n8nSLbE6p62mRs3d8">https://forms.gle/n8nSLbE6p...

Disclaimer: For now I& #39;ll be able to do this matchmaking for folks based in Kenya.

Read on Twitter

Read on Twitter