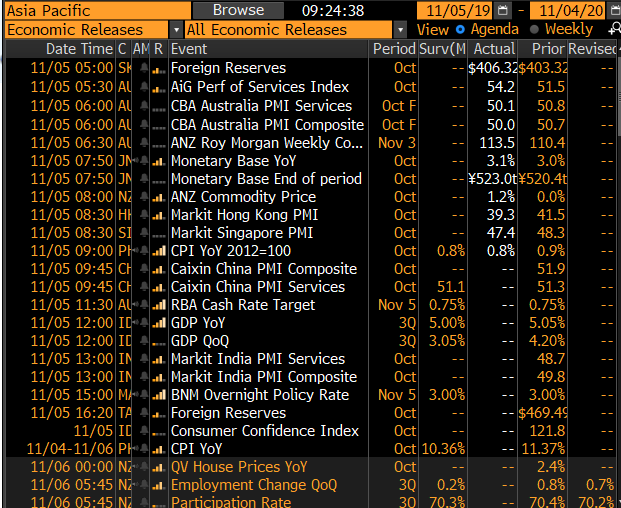

China Caixin services due in 20 mins & exps of slowing. HK is not doing well but Singapore not bouncing either. In the Philippines, inflation sub 1% means more rate cuts (RRR + policy rate) as growth sags. Indonesia Q3& #39;ll GDP& #39;ll be 5% again since 2013 so something & #39;s got to give.

Of course we got the RBA today & data for Australia is, well, could be better. Retail sales disappointed yesterday while the PMIs show sagging services.

So a hold for the RBA at 0.75% but likely to iterate low rates, which is a global story.

Where is the growth? Totally wanted!

So a hold for the RBA at 0.75% but likely to iterate low rates, which is a global story.

Where is the growth? Totally wanted!

This whole trade-deal, phase 1, partial deal semantics are missing the key point of growth conundrum we have in the world, esp developed world.

We got a double Ds problem - debt & worsening demographic. CB rate cuts, trade-deals etc are just smoothing the structural downturn https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc48ud83cudffb" title="Left pointing backhand index (light skin tone)" aria-label="Emoji: Left pointing backhand index (light skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc48ud83cudffb" title="Left pointing backhand index (light skin tone)" aria-label="Emoji: Left pointing backhand index (light skin tone)">

We got a double Ds problem - debt & worsening demographic. CB rate cuts, trade-deals etc are just smoothing the structural downturn

Services slowed as expected to 51.1 from 51.3 but composite bounced on manufacturing, which diverges from state that shows further contraction while Caixin shows expansion to 51.7

Both state & Caixin show slowing services https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc48ud83cudffb" title="Left pointing backhand index (light skin tone)" aria-label="Emoji: Left pointing backhand index (light skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc48ud83cudffb" title="Left pointing backhand index (light skin tone)" aria-label="Emoji: Left pointing backhand index (light skin tone)">

Both state & Caixin show slowing services

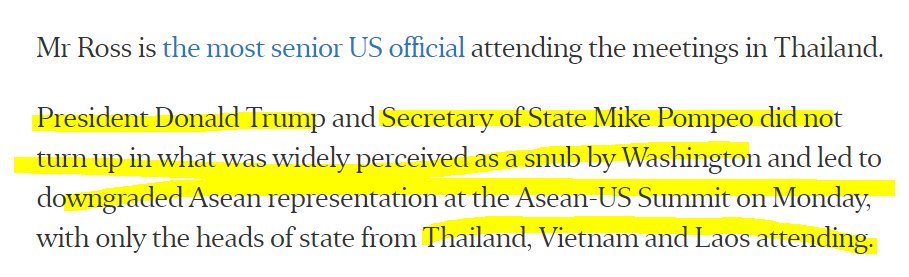

Btw, beyond the economic news flow that we get from Asia, which shows weakening growth momentum, esp China, the regional geopolitical news for China is diff

Watch the no show by Pres trump & Mike Pompeo & how that is perceived by ASEAN. If you don& #39;t show up, & others do, then..

Watch the no show by Pres trump & Mike Pompeo & how that is perceived by ASEAN. If you don& #39;t show up, & others do, then..

News written by Agence France-Presse but prominently circulated by the Jakarta Post (also others in Southeast Asia).

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)"> https://www.thejakartapost.com/seasia/2019/11/04/asean-leaders-snub-us-meeting-after-trump-skips-asean-summit-.html">https://www.thejakartapost.com/seasia/20...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)"> https://www.thejakartapost.com/seasia/2019/11/04/asean-leaders-snub-us-meeting-after-trump-skips-asean-summit-.html">https://www.thejakartapost.com/seasia/20...

Here is another scathing op ed by the Jakarta Post: https://www.thejakartapost.com/academia/2019/11/05/recreational-visit-by-us-commerce-secretary-ross.html">https://www.thejakartapost.com/academia/...

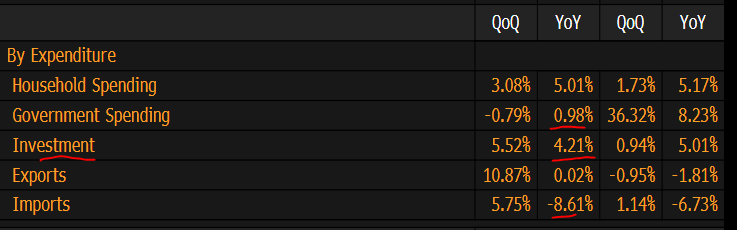

As expected, Indonesia grew by 5% in Q3 19 - the same rate it has grown since 2013. Yep, true story. I don& #39;t know how an economy can grow at the same rate for so long but Indonesia has. Gov spending is weak & investment slowing & imports contracting HARD https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">. Where& #39;s the growth?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">. Where& #39;s the growth? https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddeeud83cudde9" title="Flag of Indonesia" aria-label="Emoji: Flag of Indonesia">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddeeud83cudde9" title="Flag of Indonesia" aria-label="Emoji: Flag of Indonesia">

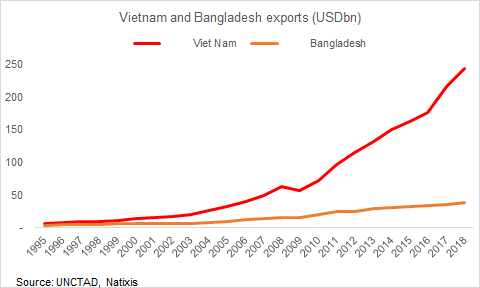

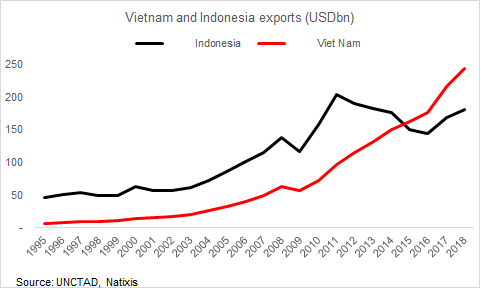

What about Vietnam? Surpassed Indo

So u can see here that even though Indonesia has been growing at 5% real growth rates since 2013 (nominally higher because it got inflation obvs), EXPORTS HAVE BEEN FALLING. In other words, Indonesia& #39;s exports as a share of GDP declining. Meaning, it has been turning more inward!

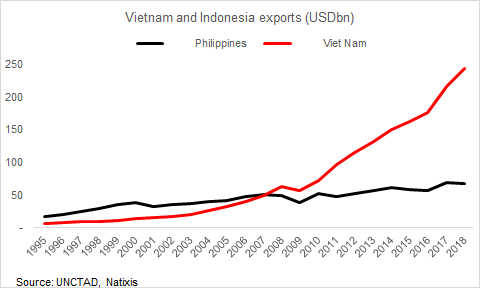

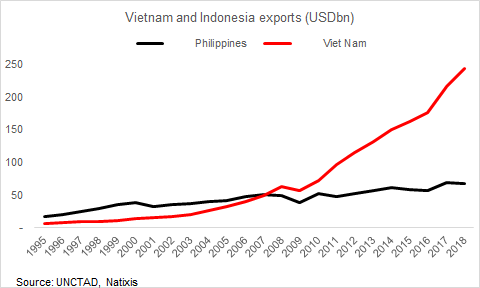

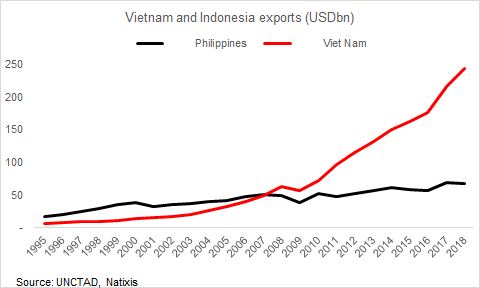

No, the Philippines, I/m not forgetting about u. The Philippines is doing even WORSE. Been saying this since I moved to Asia in 2011 that the Philippines is doing very badly in terms of tradeable merchandise sectors (OK for services via BPO, remittances, etc).

Want to see? https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddf5ud83cudded" title="Flag of Philippines" aria-label="Emoji: Flag of Philippines">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddf5ud83cudded" title="Flag of Philippines" aria-label="Emoji: Flag of Philippines"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddfbud83cuddf3" title="Flag of Vietnam" aria-label="Emoji: Flag of Vietnam">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddfbud83cuddf3" title="Flag of Vietnam" aria-label="Emoji: Flag of Vietnam">

Want to see?

Did u know that the Philippines used to be an electronic powerhouse (yes, semiconductor etc)? But that has been gradually hollowed out. Electronic share of exports falling. Weak infrastructure is to blame (both hard & soft). Philippines exports as a share of GDP is 20% (Indo 17%)

That chart of the Philippines stagnating in exports. In 2018, it was USD67bn, which makes it 20% of GDP. Vietnam exported USD244bn of goods last year. That makes it 3.6Xs than the Philippines (VN has a smaller GDP). The Philippines can export more! Has a lot to offer to the world

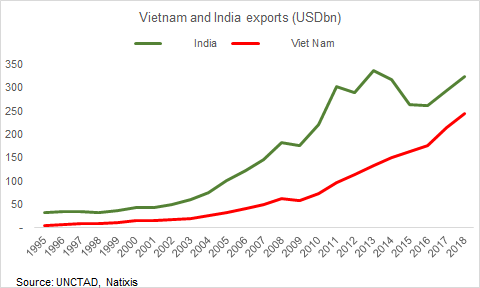

Ready? India exported 12% of GDP in 2018 or USD323bn (nominal GDP is 2.7trn). Want to see it compared to Vietnam? India peaked in 2013 at USD337bn & fell sharply & now recovered to 2013 nominal level.

The gap b/n India & Vietnam narrowed from USD205bn in 2013 to now only 79bn https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">

The gap b/n India & Vietnam narrowed from USD205bn in 2013 to now only 79bn

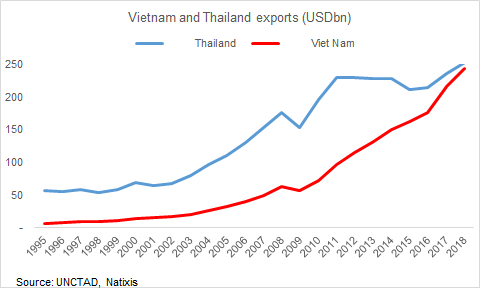

Well, let& #39;s do Thailand b/c we know that the baht REER is too tight (baht strongest performing currency in Asia) & the BOT needs to cut by 25bps.

OK, Thailand & Vietnam are now almost the same. The export gap is only USD8.9bn in 2018 vs 131bn in 2011

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddfbud83cuddf3" title="Flag of Vietnam" aria-label="Emoji: Flag of Vietnam">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddfbud83cuddf3" title="Flag of Vietnam" aria-label="Emoji: Flag of Vietnam"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddf9ud83cudded" title="Flag of Thailand" aria-label="Emoji: Flag of Thailand">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddf9ud83cudded" title="Flag of Thailand" aria-label="Emoji: Flag of Thailand">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">

OK, Thailand & Vietnam are now almost the same. The export gap is only USD8.9bn in 2018 vs 131bn in 2011

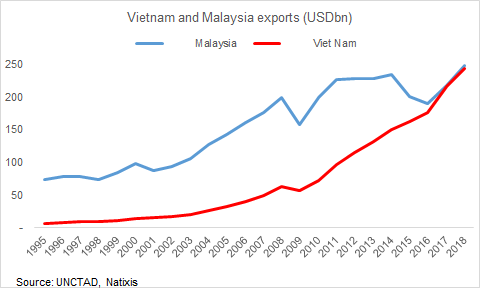

For my Malaysian followers out there, are u ready???

This is going to surprise you. Vietnam & Malaysia have almost the SAME nominal export in value. The gap narrowed to USD3.7bn in 2018.

Malaysia surpassed Vietnam by USD130bn in 2011. Now only in low single bn digits https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">  https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddf2ud83cuddfe" title="Flag of Malaysia" aria-label="Emoji: Flag of Malaysia">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddf2ud83cuddfe" title="Flag of Malaysia" aria-label="Emoji: Flag of Malaysia"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddfbud83cuddf3" title="Flag of Vietnam" aria-label="Emoji: Flag of Vietnam">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddfbud83cuddf3" title="Flag of Vietnam" aria-label="Emoji: Flag of Vietnam">

This is going to surprise you. Vietnam & Malaysia have almost the SAME nominal export in value. The gap narrowed to USD3.7bn in 2018.

Malaysia surpassed Vietnam by USD130bn in 2011. Now only in low single bn digits

Takeaways

a) When u see a country reporting export growth, ask, WHAT IS THE LEVEL VS 5YRS AGO? If it& #39;s the same & u see growth, then u know that competitiveness has DECLINED despite cyclical trends

b) Exports matter. A structural decline means an erosion of competitiveness. Yep

a) When u see a country reporting export growth, ask, WHAT IS THE LEVEL VS 5YRS AGO? If it& #39;s the same & u see growth, then u know that competitiveness has DECLINED despite cyclical trends

b) Exports matter. A structural decline means an erosion of competitiveness. Yep

Can do this w/ a portfolio/index performance too:

a) If they tell u this is the WORLD BEATING INDEX (China in 2019), ask them, if I gave u 100 bucks 10 years ago, what& #39;s the level now?

b) If it& #39;s the same, then the growth u see is just CYCLICAL & u haven& #39;t accumulated wealth https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc48ud83cudffb" title="Left pointing backhand index (light skin tone)" aria-label="Emoji: Left pointing backhand index (light skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc48ud83cudffb" title="Left pointing backhand index (light skin tone)" aria-label="Emoji: Left pointing backhand index (light skin tone)">

a) If they tell u this is the WORLD BEATING INDEX (China in 2019), ask them, if I gave u 100 bucks 10 years ago, what& #39;s the level now?

b) If it& #39;s the same, then the growth u see is just CYCLICAL & u haven& #39;t accumulated wealth

History matters. Wealth, personal or national, is a long haul, not just a daily, weekly, monthly, yearly punt. It takes time to accumulate, preserve, & growth wealth.

So pay attention. Do not let people fool u w/ the volatility of prices. Watch the level & deflate that by CPI https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc48ud83cudffb" title="Left pointing backhand index (light skin tone)" aria-label="Emoji: Left pointing backhand index (light skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc48ud83cudffb" title="Left pointing backhand index (light skin tone)" aria-label="Emoji: Left pointing backhand index (light skin tone)">

So pay attention. Do not let people fool u w/ the volatility of prices. Watch the level & deflate that by CPI

Read on Twitter

Read on Twitter

. Where& #39;s the growth?https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddeeud83cudde9" title="Flag of Indonesia" aria-label="Emoji: Flag of Indonesia">" title="As expected, Indonesia grew by 5% in Q3 19 - the same rate it has grown since 2013. Yep, true story. I don& #39;t know how an economy can grow at the same rate for so long but Indonesia has. Gov spending is weak & investment slowing & imports contracting HARDhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">. Where& #39;s the growth?https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddeeud83cudde9" title="Flag of Indonesia" aria-label="Emoji: Flag of Indonesia">" class="img-responsive" style="max-width:100%;"/>

. Where& #39;s the growth?https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddeeud83cudde9" title="Flag of Indonesia" aria-label="Emoji: Flag of Indonesia">" title="As expected, Indonesia grew by 5% in Q3 19 - the same rate it has grown since 2013. Yep, true story. I don& #39;t know how an economy can grow at the same rate for so long but Indonesia has. Gov spending is weak & investment slowing & imports contracting HARDhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">. Where& #39;s the growth?https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddeeud83cudde9" title="Flag of Indonesia" aria-label="Emoji: Flag of Indonesia">" class="img-responsive" style="max-width:100%;"/>

Want to see something? Here is a chart showing how Indonesia is doing - BADLY in terms of exports. How badly you may ask. It PEAKED in 2011 at USD203bn (Indo nominal GDP is ~1trn). Indonesia exported USD180bn in 2018 so a big drop since 2011.What about Vietnam? Surpassed Indo" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc4bud83cudffb" title="Waving hand sign (light skin tone)" aria-label="Emoji: Waving hand sign (light skin tone)">Want to see something? Here is a chart showing how Indonesia is doing - BADLY in terms of exports. How badly you may ask. It PEAKED in 2011 at USD203bn (Indo nominal GDP is ~1trn). Indonesia exported USD180bn in 2018 so a big drop since 2011.What about Vietnam? Surpassed Indo" class="img-responsive" style="max-width:100%;"/>

Want to see something? Here is a chart showing how Indonesia is doing - BADLY in terms of exports. How badly you may ask. It PEAKED in 2011 at USD203bn (Indo nominal GDP is ~1trn). Indonesia exported USD180bn in 2018 so a big drop since 2011.What about Vietnam? Surpassed Indo" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc4bud83cudffb" title="Waving hand sign (light skin tone)" aria-label="Emoji: Waving hand sign (light skin tone)">Want to see something? Here is a chart showing how Indonesia is doing - BADLY in terms of exports. How badly you may ask. It PEAKED in 2011 at USD203bn (Indo nominal GDP is ~1trn). Indonesia exported USD180bn in 2018 so a big drop since 2011.What about Vietnam? Surpassed Indo" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddfbud83cuddf3" title="Flag of Vietnam" aria-label="Emoji: Flag of Vietnam">" title="No, the Philippines, I/m not forgetting about u. The Philippines is doing even WORSE. Been saying this since I moved to Asia in 2011 that the Philippines is doing very badly in terms of tradeable merchandise sectors (OK for services via BPO, remittances, etc). Want to see? https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddf5ud83cudded" title="Flag of Philippines" aria-label="Emoji: Flag of Philippines">https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddfbud83cuddf3" title="Flag of Vietnam" aria-label="Emoji: Flag of Vietnam">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddfbud83cuddf3" title="Flag of Vietnam" aria-label="Emoji: Flag of Vietnam">" title="No, the Philippines, I/m not forgetting about u. The Philippines is doing even WORSE. Been saying this since I moved to Asia in 2011 that the Philippines is doing very badly in terms of tradeable merchandise sectors (OK for services via BPO, remittances, etc). Want to see? https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddf5ud83cudded" title="Flag of Philippines" aria-label="Emoji: Flag of Philippines">https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddfbud83cuddf3" title="Flag of Vietnam" aria-label="Emoji: Flag of Vietnam">" class="img-responsive" style="max-width:100%;"/>

" title="Ready? India exported 12% of GDP in 2018 or USD323bn (nominal GDP is 2.7trn). Want to see it compared to Vietnam? India peaked in 2013 at USD337bn & fell sharply & now recovered to 2013 nominal level. The gap b/n India & Vietnam narrowed from USD205bn in 2013 to now only 79bnhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">" class="img-responsive" style="max-width:100%;"/>

" title="Ready? India exported 12% of GDP in 2018 or USD323bn (nominal GDP is 2.7trn). Want to see it compared to Vietnam? India peaked in 2013 at USD337bn & fell sharply & now recovered to 2013 nominal level. The gap b/n India & Vietnam narrowed from USD205bn in 2013 to now only 79bnhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddf9ud83cudded" title="Flag of Thailand" aria-label="Emoji: Flag of Thailand">https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">" title="Well, let& #39;s do Thailand b/c we know that the baht REER is too tight (baht strongest performing currency in Asia) & the BOT needs to cut by 25bps. OK, Thailand & Vietnam are now almost the same. The export gap is only USD8.9bn in 2018 vs 131bn in 2011 https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddfbud83cuddf3" title="Flag of Vietnam" aria-label="Emoji: Flag of Vietnam">https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddf9ud83cudded" title="Flag of Thailand" aria-label="Emoji: Flag of Thailand">https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddf9ud83cudded" title="Flag of Thailand" aria-label="Emoji: Flag of Thailand">https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">" title="Well, let& #39;s do Thailand b/c we know that the baht REER is too tight (baht strongest performing currency in Asia) & the BOT needs to cut by 25bps. OK, Thailand & Vietnam are now almost the same. The export gap is only USD8.9bn in 2018 vs 131bn in 2011 https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddfbud83cuddf3" title="Flag of Vietnam" aria-label="Emoji: Flag of Vietnam">https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddf9ud83cudded" title="Flag of Thailand" aria-label="Emoji: Flag of Thailand">https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddf2ud83cuddfe" title="Flag of Malaysia" aria-label="Emoji: Flag of Malaysia">https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddfbud83cuddf3" title="Flag of Vietnam" aria-label="Emoji: Flag of Vietnam">" title="For my Malaysian followers out there, are u ready???This is going to surprise you. Vietnam & Malaysia have almost the SAME nominal export in value. The gap narrowed to USD3.7bn in 2018. Malaysia surpassed Vietnam by USD130bn in 2011. Now only in low single bn digits https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddf2ud83cuddfe" title="Flag of Malaysia" aria-label="Emoji: Flag of Malaysia">https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddfbud83cuddf3" title="Flag of Vietnam" aria-label="Emoji: Flag of Vietnam">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddf2ud83cuddfe" title="Flag of Malaysia" aria-label="Emoji: Flag of Malaysia">https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddfbud83cuddf3" title="Flag of Vietnam" aria-label="Emoji: Flag of Vietnam">" title="For my Malaysian followers out there, are u ready???This is going to surprise you. Vietnam & Malaysia have almost the SAME nominal export in value. The gap narrowed to USD3.7bn in 2018. Malaysia surpassed Vietnam by USD130bn in 2011. Now only in low single bn digits https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83dudc47ud83cudffb" title="Down pointing backhand index (light skin tone)" aria-label="Emoji: Down pointing backhand index (light skin tone)"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddf2ud83cuddfe" title="Flag of Malaysia" aria-label="Emoji: Flag of Malaysia">https://abs.twimg.com/emoji/v2/... draggable="false" alt="ud83cuddfbud83cuddf3" title="Flag of Vietnam" aria-label="Emoji: Flag of Vietnam">" class="img-responsive" style="max-width:100%;"/>