"Edge of your seat excitement" - Tom Cruise. "Riveting" - Rex Reed

Let& #39;s begin... Medicare for All, free college and the Green New Deal, are conservatively estimated to cost more than +/-$45t over 10 years....

Chapter 1. The setup (scene from Survivor)

To fund this monstrosity, new tax schema have been proposed: A wealth tax, a 70% top tax rate and a financial transactions tax. All of this pain would only raise +/- $300b a year. An insurmountable hurdle of red

http://gabriel-zucman.eu/files/saez-zucman-wealthtax-warren.pdf">https://gabriel-zucman.eu/files/sae...

To fund this monstrosity, new tax schema have been proposed: A wealth tax, a 70% top tax rate and a financial transactions tax. All of this pain would only raise +/- $300b a year. An insurmountable hurdle of red

http://gabriel-zucman.eu/files/saez-zucman-wealthtax-warren.pdf">https://gabriel-zucman.eu/files/sae...

If Americans want European-style government services, they should be ready for European-style broad-based taxes like the value-added tax (VAT), high payroll taxes, and relatively flat income taxes, which fall primarily on taxpayers in the middle of the income distribution.

And, they should be ready for painful reforms to their social programs, less state-paid health insurance, more stringent eligibility requirements and so on, all the while new tax body blows are landing on them

Taxes, EU vs U.S.

In Eu, individual income taxes, payroll tax, and consumption tax called VATs are the largest portion of most countries’ tax revenue. Wage taxes make up the largest share of tax revenue for every EU-OECD country (EU+Org for Economic Co-operation and Development)

In Eu, individual income taxes, payroll tax, and consumption tax called VATs are the largest portion of most countries’ tax revenue. Wage taxes make up the largest share of tax revenue for every EU-OECD country (EU+Org for Economic Co-operation and Development)

The marginal tax wedge represents how much tax a worker must pay on the next dollar of income earned. If a worker is considering driving for Uber for a little additional income, the marginal tax wedge shows how much of that additional income the worker would get to keep.

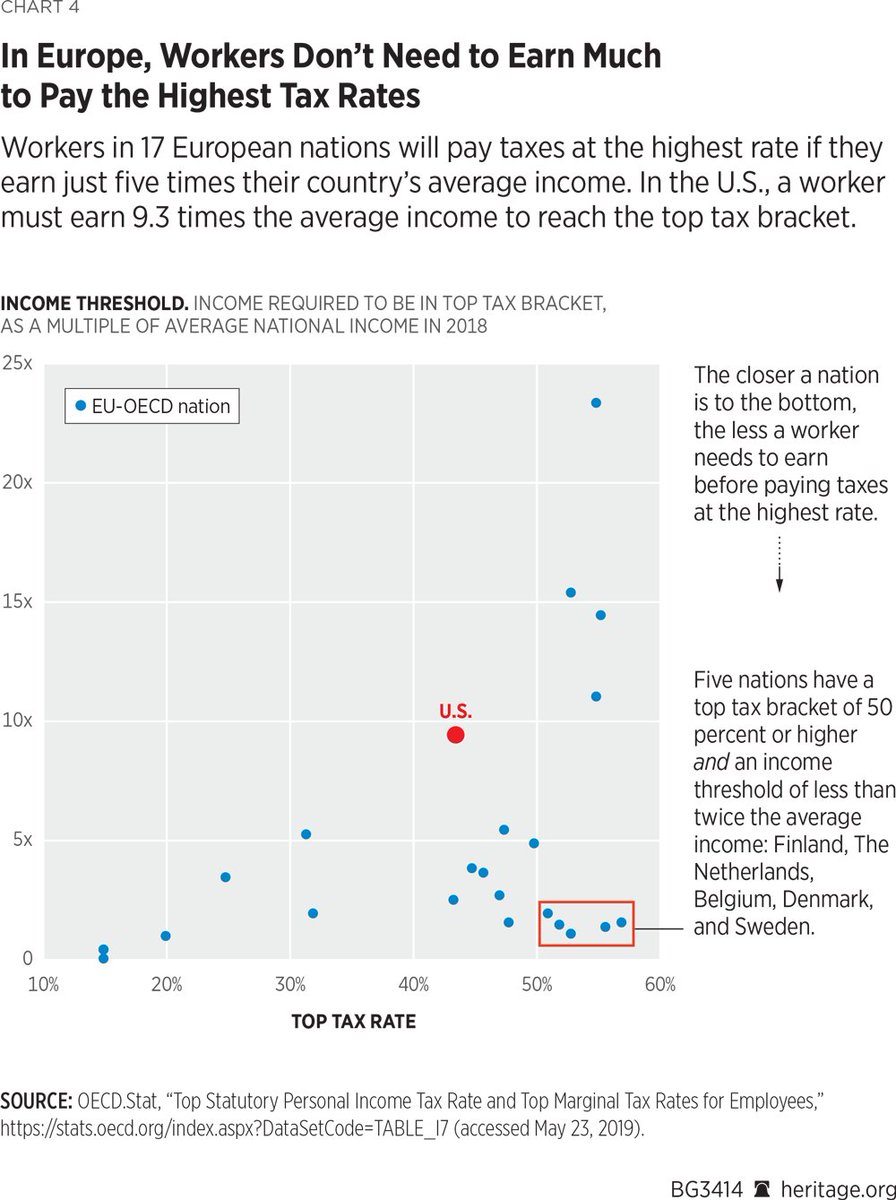

Many EU countries apply their top marginal income tax rates to average or close to average income earners. In 11 EU countries, top combined federal and sub-federal income tax rates apply to people with less than two times the average country wage.

In addition to higher wage tax rates than the U.S., EU countries also have significantly higher consumption tax rates.

The average EU rate was 21.8% in 2016 vs

The average state and local sales tax in the U.S of 6.4% in the same year.

The average EU rate was 21.8% in 2016 vs

The average state and local sales tax in the U.S of 6.4% in the same year.

(Much of this was snatched and shuffled from https://www.heritage.org/taxes/report/progressive-road-map-soaking-the-middle-class">https://www.heritage.org/taxes/rep... )

VAT TAX (“what is it” you bellow)

VAT is a different taxing system, an additional burden, tacked to every purchase the gov decides is worthy of punishment. If they deem books, then every book has a new cost.

VAT TAX (“what is it” you bellow)

VAT is a different taxing system, an additional burden, tacked to every purchase the gov decides is worthy of punishment. If they deem books, then every book has a new cost.

VATs are collected at each stage of “production”, whereas retail sales taxes are collected only at the point of final sale. (There are dif systems for calculating and collecting VAT so I’m keeping this a 20,000ft view. The ground level view is excruciatingly painful regardless)

It’s a tax conveyor belt, every time a firm buy inputs it has an incentive to make sure that the previous firm paid the VAT that was due at that earlier stage of production. You are your brothers tax keeper

In the U.S, most of the consumption tax revenue is collected by state governments through a sales tax at the point of sale. We are the only country (thankfully) in the OECD that does not use a VAT to raise a majority of consumption tax revenue.

Chapter 2. Plan in action

For tax regimes it’s the best mousetrap they have to raise large amounts of revenue quickly and surreptitiously, If they want to collect more money, they won’t have to wait a day. Its a switch they flip.

For tax regimes it’s the best mousetrap they have to raise large amounts of revenue quickly and surreptitiously, If they want to collect more money, they won’t have to wait a day. Its a switch they flip.

In 1967 the U.S. and Europe each collected about $0.27 in taxes for every $1.00 produced. The U.S. is still collecting that much, but Europe’s tax burden has shot up from 27% to over 40%

Since the start of the financial crisis in 2008, worldwide VAT (and GST, not discussed here) rates have risen rapidly, with the standard rate hitting a high of 27% in Hungary.

“Yang, who announced his candidacy in late 2017, is proposing a 10% VAT targeting companies like Amazon and Google.” https://www.cnbc.com/2019/03/18/value-added-tax-wont-push-companies-out-of-the-us-presidential-candidate-andrew-yang.html">https://www.cnbc.com/2019/03/1...

The problem is that this law was created to target big companies and Google’ish companies use mechanisms, some legal, some not, some privileged by the State, to avoid their share of taxes.

Every non Amazon’ian business firm will be burdened by the cost of innumerable record keeping and collection for the government. And that begets new problems, an inexorable push of the business system toward “vertical mergers” and the reduction of competition.

EMPLOYMENT: You ever wonder why EU has horrible UNemployment?

One reason is VAT lowering demand for labor. Those co& #39;s fired EEs, then get soaked up by Gov as employer of last resort = raising the VAT. Bad policy is the curse that keeps on cursing https://mises.org/library/consumption-tax-critique">https://mises.org/library/c...

One reason is VAT lowering demand for labor. Those co& #39;s fired EEs, then get soaked up by Gov as employer of last resort = raising the VAT. Bad policy is the curse that keeps on cursing https://mises.org/library/consumption-tax-critique">https://mises.org/library/c...

MACHINERY: Any firm that buys machinery, can deduct the embodied VAT from its own tax liability; but if it hires workers, it can make no such deduction. The result will be to spur over-mechanization and more firing of laborers.

VAT is REGRESSIVE it is a proportional tax on consumption, lower-income households tend to spend a larger proportion of their income than higher-income households, the VAT imposes higher burdens, as a share of current income, on lower-income households. https://www.tandfonline.com/doi/full/10.1080/00220388.2017.1400015">https://www.tandfonline.com/doi/full/...

INFLATION: Additionally, increasing the indirect taxes makes consumption more and more costly and therefore has an inflationary effect, which makes the poor to suffer the most. https://economics21.org/html/philly%E2%80%99s-soda-tax-will-disproportionately-hurt-poor-2186.html">https://economics21.org/html/phil...

Chapter 3. The payoff

There are incentives to hide consumption. If the political solution to this is to make people file for VAT refunds whereby everyone must declare everything, we are then back to accountants and lawyers to lower their tax hit, a privilege of higher incomes

There are incentives to hide consumption. If the political solution to this is to make people file for VAT refunds whereby everyone must declare everything, we are then back to accountants and lawyers to lower their tax hit, a privilege of higher incomes

Correcting to make VAT PROGRESSIVE are (more) policies that may offset the impact of the VAT on low-income households thru either either refundable income tax credits or outright payments.

Ex. = VAT rate is 10%, a $3k demogrant would equal VAT paid on the first $30k of a household’s consumption. HH& #39;s that spent exactly $30k on consumption would pay no net tax. Those that spent less receive a net subsidy. Those that spent more pay a 10% VAT on purchases above $30k.

This will of course create new distortions as many people will be working poor, but above the threshold for subsidies. (this thread discusses part of that problem in “Obamacare” https://twitter.com/adamscrabble/status/1162543615916294145">https://twitter.com/adamscrab...

Flat tax is proposed as a SUBSTITUTE for our current tax system, while as the VAT is often suggested as an ADDITION to it....

If we get rid of all other taxes, and make the VAT highly progressive, and the government carves out things like health care (20% of GDP), you could see rates of 70% or even 100%. (100% is possible with a VAT. A 100% VAT generates 50% of GDP as revenue)

In the end, there is no point in talking about tax rates in isolation.

If you want lower rates, you need less spending. If we have high spending, we will have high rates.

/end

"Boom, you got Yang& #39;d"

If you want lower rates, you need less spending. If we have high spending, we will have high rates.

/end

"Boom, you got Yang& #39;d"

"See that lady with the shopping cart

She keep a shottie cocked in the hallway

Damn she look pretty old Ghost

She work for Kevin, she & #39;bout 77

She paid her dues when she smoked his brother in law at his bosses& #39; wedding..." Ghostface, Shakey dog https://wapo.st/2pAAHvi ">https://wapo.st/2pAAHvi&q...

Read on Twitter

Read on Twitter Kick a** thread about the VAT tax. And you."Edge of your seat excitement" - Tom Cruise. "Riveting" - Rex ReedLet& #39;s begin... Medicare for All, free college and the Green New Deal, are conservatively estimated to cost more than +/-$45t over 10 years...." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> Kick a** thread about the VAT tax. And you."Edge of your seat excitement" - Tom Cruise. "Riveting" - Rex ReedLet& #39;s begin... Medicare for All, free college and the Green New Deal, are conservatively estimated to cost more than +/-$45t over 10 years...." class="img-responsive" style="max-width:100%;"/>

Kick a** thread about the VAT tax. And you."Edge of your seat excitement" - Tom Cruise. "Riveting" - Rex ReedLet& #39;s begin... Medicare for All, free college and the Green New Deal, are conservatively estimated to cost more than +/-$45t over 10 years...." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> Kick a** thread about the VAT tax. And you."Edge of your seat excitement" - Tom Cruise. "Riveting" - Rex ReedLet& #39;s begin... Medicare for All, free college and the Green New Deal, are conservatively estimated to cost more than +/-$45t over 10 years...." class="img-responsive" style="max-width:100%;"/>