1/ ENDOWMENT BASICS

I get it. It’s fun to pat yourself on the back when your 401k beat Swensen...but before that victory lap, let’s walk through some basics.

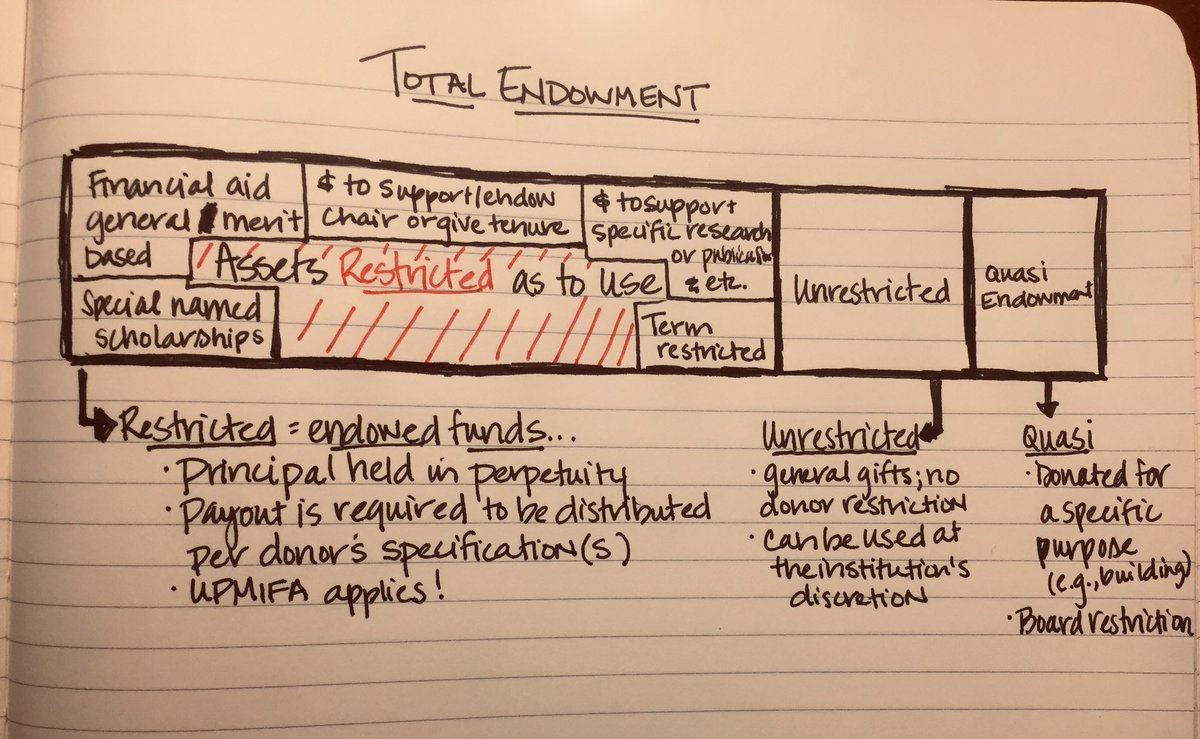

Most of you quote returns and see an endowment as a giant pool of $ vs this, which is how I see an endowment:

I get it. It’s fun to pat yourself on the back when your 401k beat Swensen...but before that victory lap, let’s walk through some basics.

Most of you quote returns and see an endowment as a giant pool of $ vs this, which is how I see an endowment:

2/ it’s not just a giant pool of money to spend however...it’s made up of (a) restricted (donor designated; endowed $$ that support a specific thing; ‘spending’ below original value is frowned upon), (b) unrestricted (no specification), and (c) quasi restricted assets

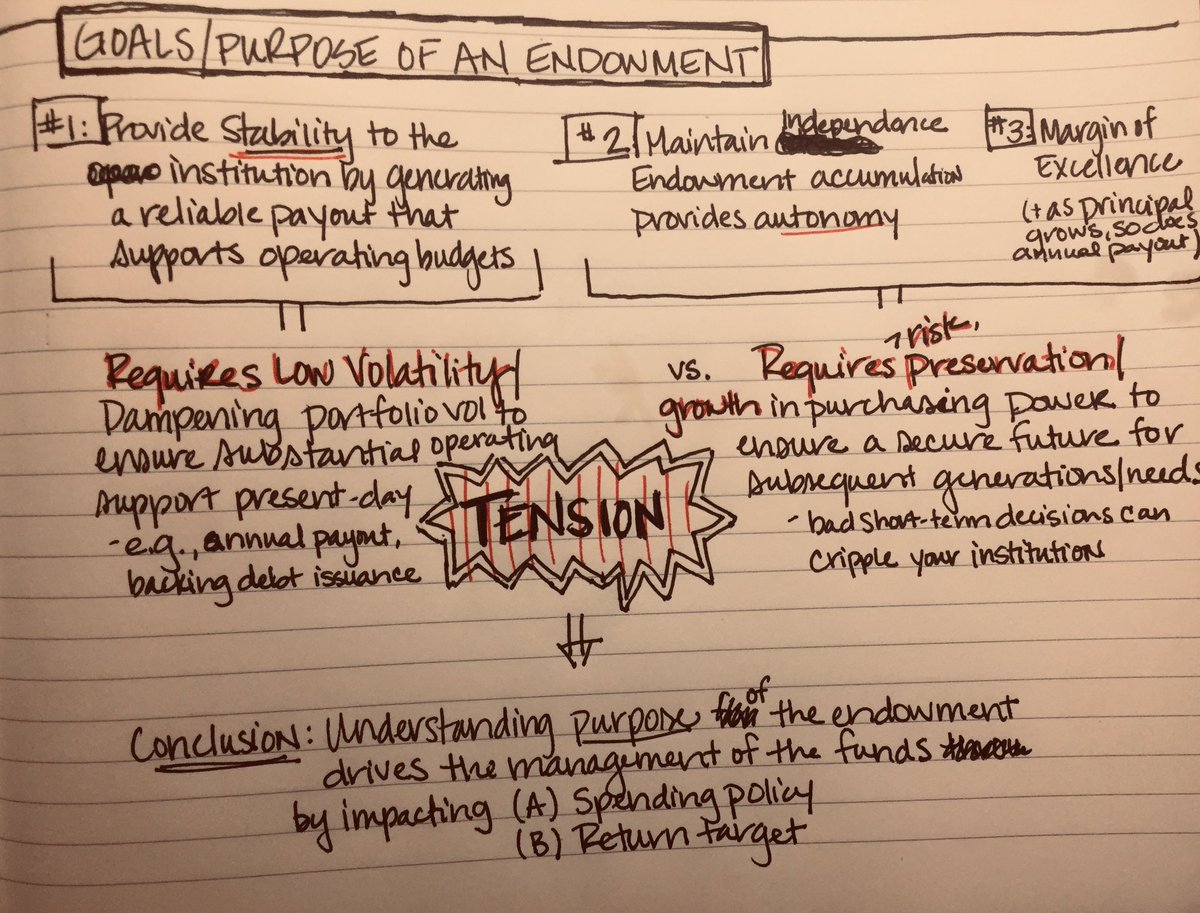

3/ Now before evaluating returns, let’s consider...WHAT’S THE POINT?!

It can vary by type/sub-type of institution, but generally, an endowment serves three purposes: 1) supports operations w/annual payout, 2) independence, and 3) creates a margin of excellence

It can vary by type/sub-type of institution, but generally, an endowment serves three purposes: 1) supports operations w/annual payout, 2) independence, and 3) creates a margin of excellence

4/ (above) It’s paramount to ‘get’ the inherent conflicts w/in endowment mgmt:

The long term desire to maintain/grow purchasing power requires equities& risk (eek vol!), while the near-term desire to provide a reliable payout for budget requires low vol (but we lose growth!)

The long term desire to maintain/grow purchasing power requires equities& risk (eek vol!), while the near-term desire to provide a reliable payout for budget requires low vol (but we lose growth!)

5/ the tension!...WHAT’S AN ENDOWMENT MGR TO DO?!

Be a freakin’ fiduciary, that’s what! That means creating spending and investment goals that ensure both asset preservation AND stable annual budget support...(purpose + these goals are the starting point of your IPS https://abs.twimg.com/emoji/v2/... draggable="false" alt="💕" title="Zwei Herzen" aria-label="Emoji: Zwei Herzen">)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💕" title="Zwei Herzen" aria-label="Emoji: Zwei Herzen">)

Be a freakin’ fiduciary, that’s what! That means creating spending and investment goals that ensure both asset preservation AND stable annual budget support...(purpose + these goals are the starting point of your IPS

6/ while I don’t manage an endowment for a university— feel free to jump in if you do—typically you’re looking at...

Spending rate = 4-6%

Target return = 8-10%+

Spending rate = 4-6%

Target return = 8-10%+

7/ remember people...the spending rate is annual (and often subject to cap/floor)

The return target is an objective; a long term goal, annualized.

Endowments are managed to exist in perpetuity. Forever.

The return target is an objective; a long term goal, annualized.

Endowments are managed to exist in perpetuity. Forever.

8/ so, now we’ve covered  https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> endowments are complex,

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> endowments are complex,  https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> thoroughly understanding the total enterprise is key, and

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> thoroughly understanding the total enterprise is key, and  https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> mgmt is futile w/out investment & spending goals...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> mgmt is futile w/out investment & spending goals...

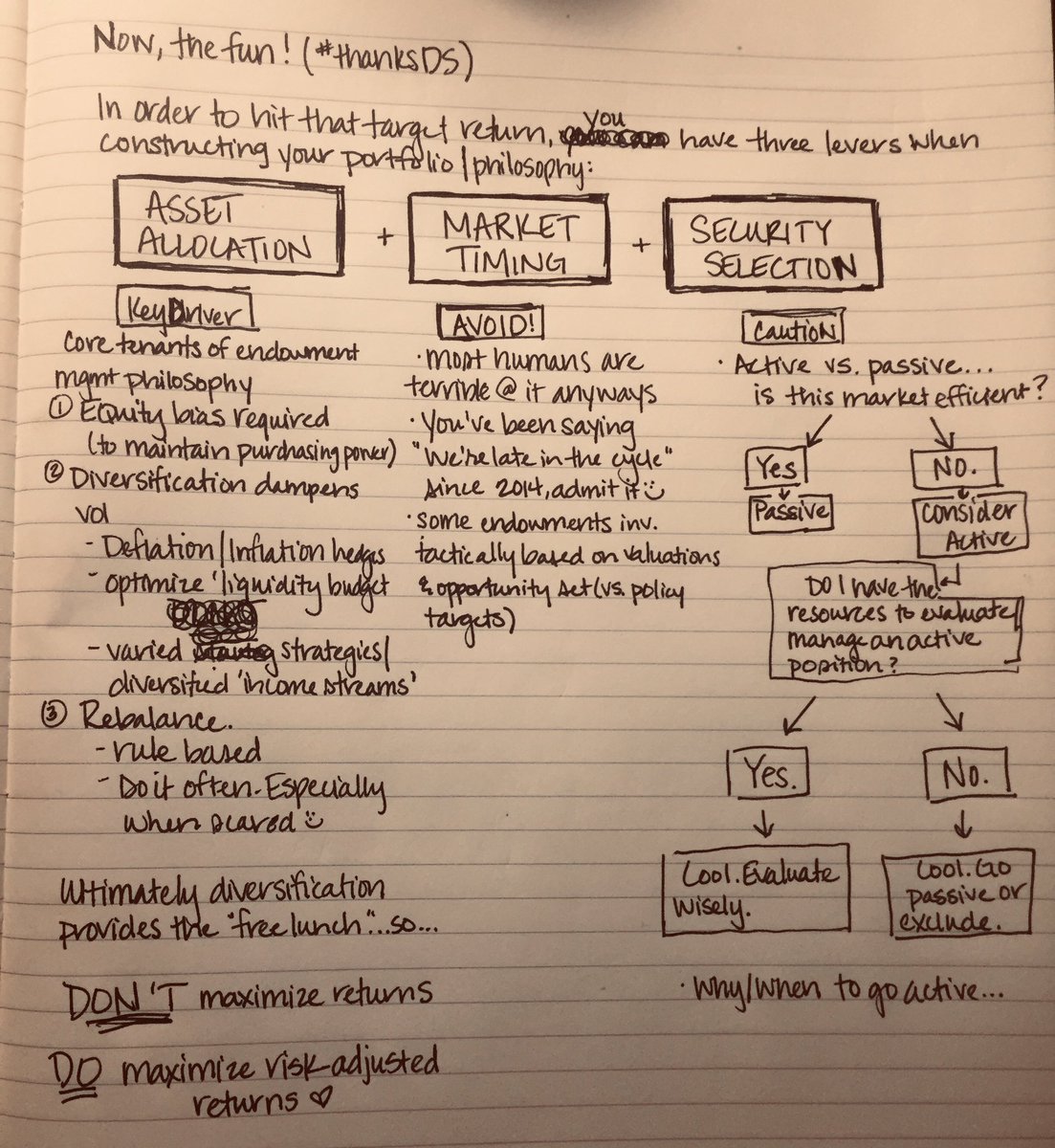

So now, let’s talk philosophy...

portfolio mgmt= AA+market timing+security selection decisions

So now, let’s talk philosophy...

portfolio mgmt= AA+market timing+security selection decisions

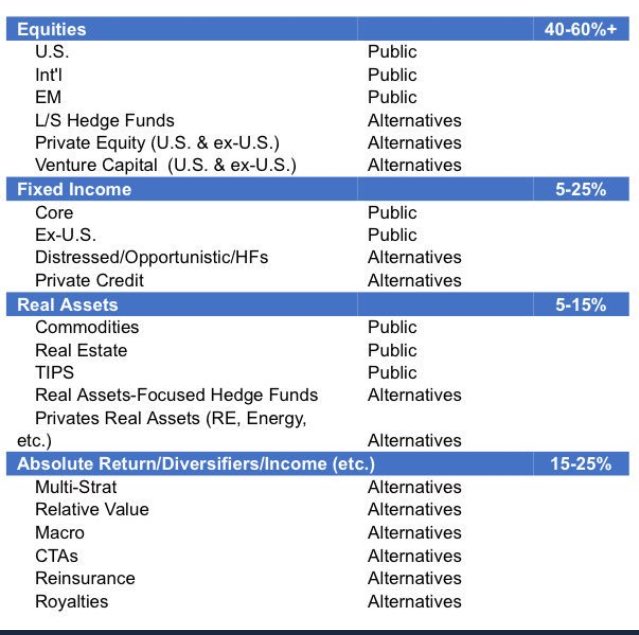

9/ as I’ve discussed before this all results in a portfolio that often looks roughly like the one below. Where:

Equities = growth

FI = deflation hedge ( https://abs.twimg.com/emoji/v2/... draggable="false" alt="😏" title="Grinsendes Gesicht" aria-label="Emoji: Grinsendes Gesicht">)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😏" title="Grinsendes Gesicht" aria-label="Emoji: Grinsendes Gesicht">)

Real assets = inflation hedge

Diversifiers = vol dampening

And now I will address your questions of why Alts/active...

Equities = growth

FI = deflation hedge (

Real assets = inflation hedge

Diversifiers = vol dampening

And now I will address your questions of why Alts/active...

10/ IF YOUR FRIENDS JUMPED OFF A CLIFF...?

Question 1: why alts in 2019 if passive is winning?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎉" title="Partyknaller" aria-label="Emoji: Partyknaller"> Endowments are still beating over 20yr period (perpetuity

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎉" title="Partyknaller" aria-label="Emoji: Partyknaller"> Endowments are still beating over 20yr period (perpetuity https://abs.twimg.com/emoji/v2/... draggable="false" alt="👌" title="Ok hand" aria-label="Emoji: Ok hand">)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👌" title="Ok hand" aria-label="Emoji: Ok hand">)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack"> Historically, illiquidity has paid off (inefficient mkts only), esp for value-sensitive souls...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack"> Historically, illiquidity has paid off (inefficient mkts only), esp for value-sensitive souls...

Question 1: why alts in 2019 if passive is winning?

11/ [Wait did she just say that?!]

<steps on soap box, taps mic>

$$ inflows can lead to https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> in mkt efficiency (e.g., buyouts)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben"> in mkt efficiency (e.g., buyouts)

Inflows have led to competition; business owners are wise to PE...hence rise in PPMs

It’s likely many PE investors may be disappointed

<steps on soap box, taps mic>

$$ inflows can lead to

Inflows have led to competition; business owners are wise to PE...hence rise in PPMs

It’s likely many PE investors may be disappointed

12/ I‘m w/Swenson too...investing in alts for the sake of investing in alts is not a winning strategy. It requires expertise + significant resources.

I read through 500-1000 pages per PE commitment https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf"> AND endowments typically do have access to better private opportunities...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf"> AND endowments typically do have access to better private opportunities...

I read through 500-1000 pages per PE commitment

13/ in the framework/ I reiterate endowments invest in PE for growth. It adds risk. It is leveraged small caps w/ control. PE DOES NOT dampen vol. Top quartile+ is required.

When done right, PE: buys at good price, adds value through op improvements, and begins w/the end mind

When done right, PE: buys at good price, adds value through op improvements, and begins w/the end mind

14/ Stockholm syndrome?

In reality, many private mkts are becoming less inefficient, buying at good prices is harder, and terms have...well let’s just say, READ THE DOCS.

w/ that said, many offices have better access to better data, so PE still pays off + fulfills its role..

In reality, many private mkts are becoming less inefficient, buying at good prices is harder, and terms have...well let’s just say, READ THE DOCS.

w/ that said, many offices have better access to better data, so PE still pays off + fulfills its role..

15/ Question 2: whatabout (return vs S&P, return vs. 70/30, etc)????

• PER MY PREVIOUS TWEETS, endowments make a 5%ish payout yearly, requiring stability/dampened vol that 100% equity can’t deliver

• endowments must grow, which is hard with a 30% FI drag on returns

• PER MY PREVIOUS TWEETS, endowments make a 5%ish payout yearly, requiring stability/dampened vol that 100% equity can’t deliver

• endowments must grow, which is hard with a 30% FI drag on returns

16/ stated differently... the goal of diversification is to maximize risk adjusted returns (not just ‘returns’) and to attempt to do so 10 years ago without the benefit of knowing the future as many of you do when you now comment on endowment returns out of context  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">

17/ Plus, remember: endowments typically have substantial restricted assets (ex: Harvard has 13,000+), and

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❌" title="Kreuzzeichen" aria-label="Emoji: Kreuzzeichen"> an equity-like drawdown could lead to impairment/no payout

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❌" title="Kreuzzeichen" aria-label="Emoji: Kreuzzeichen"> an equity-like drawdown could lead to impairment/no payout

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❌" title="Kreuzzeichen" aria-label="Emoji: Kreuzzeichen"> not enough risk could lead to erosion by inflation

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❌" title="Kreuzzeichen" aria-label="Emoji: Kreuzzeichen"> not enough risk could lead to erosion by inflation

Both cases you’re not fulfilling donor wishes

Both cases you’re not fulfilling donor wishes

18/ question 3: why compensate endowment professionals vs peer returns?

From what little I know of university offices, it’s typically only a portion of variable comp and often held back and/or invested alongside the fund, so alignment is better than it sounds at first blush

From what little I know of university offices, it’s typically only a portion of variable comp and often held back and/or invested alongside the fund, so alignment is better than it sounds at first blush

19/ Question 4: I think endowments should invest passively.

Based on an arbitrary passive portfolio & time period, you win. But consider: Michael Phelps placed 2nd in 3 Olympic races, but if you’re building a winning swim team, you gotta consider his 28 golds, no? ;) #metaphors

Based on an arbitrary passive portfolio & time period, you win. But consider: Michael Phelps placed 2nd in 3 Olympic races, but if you’re building a winning swim team, you gotta consider his 28 golds, no? ;) #metaphors

20/ Question 5: key ingredients for success? [definition matters, but IMO:]

1) Governance: most offices have a committee that sets goals/oversees, etc. I have a great Committee. It‘s critical.

2) Understanding the ‘why’/unique institutional needs

3) being skeptical, contrarian

1) Governance: most offices have a committee that sets goals/oversees, etc. I have a great Committee. It‘s critical.

2) Understanding the ‘why’/unique institutional needs

3) being skeptical, contrarian

21/ Tapping out/will address remaining questions later. Thx for staying w me!

To close: get bogged down in the miniutiae of endowment mgmt, but appreciate that US universities distribute ~$29 billion YEARLY

Add foundations, and we’re talking serious societal benefits https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙌" title="Raising hands" aria-label="Emoji: Raising hands">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙌" title="Raising hands" aria-label="Emoji: Raising hands"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="💕" title="Zwei Herzen" aria-label="Emoji: Zwei Herzen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💕" title="Zwei Herzen" aria-label="Emoji: Zwei Herzen">

To close: get bogged down in the miniutiae of endowment mgmt, but appreciate that US universities distribute ~$29 billion YEARLY

Add foundations, and we’re talking serious societal benefits

Read on Twitter

Read on Twitter

)" title="5/ the tension!...WHAT’S AN ENDOWMENT MGR TO DO?!Be a freakin’ fiduciary, that’s what! That means creating spending and investment goals that ensure both asset preservation AND stable annual budget support...(purpose + these goals are the starting point of your IPS https://abs.twimg.com/emoji/v2/... draggable="false" alt="💕" title="Zwei Herzen" aria-label="Emoji: Zwei Herzen">)" class="img-responsive" style="max-width:100%;"/>

)" title="5/ the tension!...WHAT’S AN ENDOWMENT MGR TO DO?!Be a freakin’ fiduciary, that’s what! That means creating spending and investment goals that ensure both asset preservation AND stable annual budget support...(purpose + these goals are the starting point of your IPS https://abs.twimg.com/emoji/v2/... draggable="false" alt="💕" title="Zwei Herzen" aria-label="Emoji: Zwei Herzen">)" class="img-responsive" style="max-width:100%;"/>

endowments are complex, https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> thoroughly understanding the total enterprise is key, and https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> mgmt is futile w/out investment & spending goals... So now, let’s talk philosophy...portfolio mgmt= AA+market timing+security selection decisions" title="8/ so, now we’ve covered https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> endowments are complex, https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> thoroughly understanding the total enterprise is key, and https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> mgmt is futile w/out investment & spending goals... So now, let’s talk philosophy...portfolio mgmt= AA+market timing+security selection decisions" class="img-responsive" style="max-width:100%;"/>

endowments are complex, https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> thoroughly understanding the total enterprise is key, and https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> mgmt is futile w/out investment & spending goals... So now, let’s talk philosophy...portfolio mgmt= AA+market timing+security selection decisions" title="8/ so, now we’ve covered https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> endowments are complex, https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> thoroughly understanding the total enterprise is key, and https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen"> mgmt is futile w/out investment & spending goals... So now, let’s talk philosophy...portfolio mgmt= AA+market timing+security selection decisions" class="img-responsive" style="max-width:100%;"/>

)Real assets = inflation hedge Diversifiers = vol dampeningAnd now I will address your questions of why Alts/active..." title="9/ as I’ve discussed before this all results in a portfolio that often looks roughly like the one below. Where:Equities = growthFI = deflation hedge (https://abs.twimg.com/emoji/v2/... draggable="false" alt="😏" title="Grinsendes Gesicht" aria-label="Emoji: Grinsendes Gesicht">)Real assets = inflation hedge Diversifiers = vol dampeningAnd now I will address your questions of why Alts/active..." class="img-responsive" style="max-width:100%;"/>

)Real assets = inflation hedge Diversifiers = vol dampeningAnd now I will address your questions of why Alts/active..." title="9/ as I’ve discussed before this all results in a portfolio that often looks roughly like the one below. Where:Equities = growthFI = deflation hedge (https://abs.twimg.com/emoji/v2/... draggable="false" alt="😏" title="Grinsendes Gesicht" aria-label="Emoji: Grinsendes Gesicht">)Real assets = inflation hedge Diversifiers = vol dampeningAnd now I will address your questions of why Alts/active..." class="img-responsive" style="max-width:100%;"/>