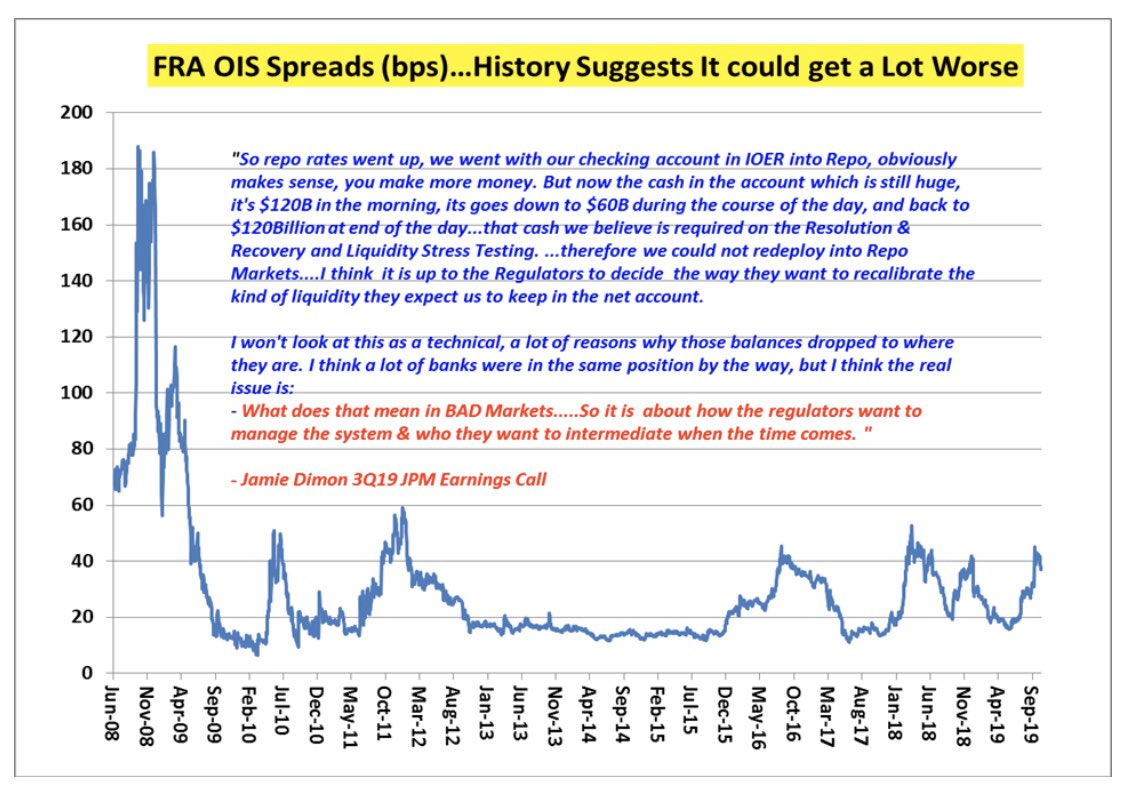

@MacroMorning $JPM + $BAC still hung with > $1/2 Trillion Fed Funds Sold/RevRepo Loans in 3Q19. What happens 2 distribution of reserves within system when they check out? Despite Fed Repo + QE4 Blunt Hose..still within context of GSIB Score choke down, SCB, CLAR, RLAP etc. $TLT

$DXY funding shortages are a structural issue....that involves the trade off between $XLF bank safety (regulations) & liquidity deployment in a supposedly “Ample Reserve Regime” QE Floor System that doesn’t have a reverse gear. $TLT

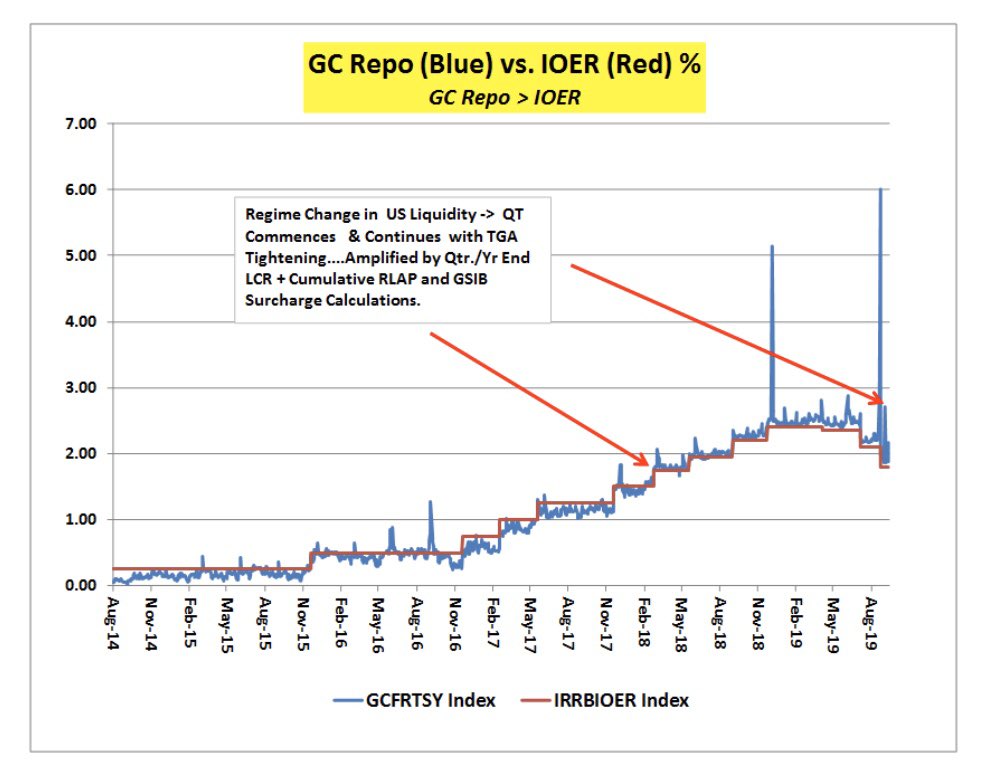

So now we have established that $DXY liquidity can’t even handle middle of month corporate tax payments - despite QE4 + Fed Repo.. spiked to 2.17%... now that’s come & gone...GC still at 1.95%... Newsflash.. IOER is 1.80%... so still 15bps wider. Just waiting 4 next flare up.

Read on Twitter

Read on Twitter