MORTGAGES EXPLAINED  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏘" title="House buildings" aria-label="Emoji: House buildings">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏘" title="House buildings" aria-label="Emoji: House buildings">

(What are they, how can I get one and what I need to jump on the property ladder)

THREAD BELOW https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏾" title="Down pointing backhand index (medium dark skin tone)" aria-label="Emoji: Down pointing backhand index (medium dark skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏾" title="Down pointing backhand index (medium dark skin tone)" aria-label="Emoji: Down pointing backhand index (medium dark skin tone)">

(What are they, how can I get one and what I need to jump on the property ladder)

THREAD BELOW

Mortgages seem like a word that many of us have heard but few of us know much about. Can I get one now? Today? Isn’t deposit money enough to qualify?

Don’t know the answers? Keep reading!

Don’t know the answers? Keep reading!

JUST A NOTE: in this thread, I’m going to talk about mortgages on a more broader scale

If you’d like me to break down the different types of mortgages, let me know and I’ll do another thread! https://abs.twimg.com/emoji/v2/... draggable="false" alt="📝" title="Memo" aria-label="Emoji: Memo">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📝" title="Memo" aria-label="Emoji: Memo">

If you’d like me to break down the different types of mortgages, let me know and I’ll do another thread!

MORTGAGES - a loan from a bank to purchase property by which the property is used as collateral

In simple terms, the bank lends you money to purchase your property HOWEVER, they are the legal owners of it until your debt is paid IN FULL

In simple terms, the bank lends you money to purchase your property HOWEVER, they are the legal owners of it until your debt is paid IN FULL

What does that actually mean, isn’t the property mine?

Well technically no. The bank has lent you the money in exchange for being the owner until you’ve returned every dime of that loan to them

If you begin to forfeit payments then they can repossess the property as it’s theirs

Well technically no. The bank has lent you the money in exchange for being the owner until you’ve returned every dime of that loan to them

If you begin to forfeit payments then they can repossess the property as it’s theirs

How do I qualify for one?

Whether or not you qualify for a mortgage and how much that is for depends on a few factors:

• Deposit amount

• Income

• Level of existing debt

• Credit score

If any one of these factors aren’t up to scratch, it could work against you!

Whether or not you qualify for a mortgage and how much that is for depends on a few factors:

• Deposit amount

• Income

• Level of existing debt

• Credit score

If any one of these factors aren’t up to scratch, it could work against you!

How does a mortgage work?

Usually you’ll put down a cash deposit for property which is typically between 5 - 10% of the property price

The remainder is paid back with interest through the medium of a mortgage over an agreed, fixed number of months

Usually you’ll put down a cash deposit for property which is typically between 5 - 10% of the property price

The remainder is paid back with interest through the medium of a mortgage over an agreed, fixed number of months

If you’re a Londoner like me then you’ll know that it is almost impossible for any of us to become home owners as prices are at an all time high

There are government schemes to help first time buyers purchase a home, have a read of my thread below! https://twitter.com/ikeeyah_/status/1178401060853075971?s=21">https://twitter.com/ikeeyah_/...

There are government schemes to help first time buyers purchase a home, have a read of my thread below! https://twitter.com/ikeeyah_/status/1178401060853075971?s=21">https://twitter.com/ikeeyah_/...

If you’ve got your head in the game and have almost/saved up your deposit amount, happy day! Time to go house shopping!

But wait, how much will the bank actually lend me?

But wait, how much will the bank actually lend me?

With mortgages, the bank typically lends 4x/5x your annual salary

EXPLAINED:

If you have an annual salary of £20,000, the bank will lend you a maximum of £100,000 towards your property

If you’ve saved up a £15k deposit and the property value is 150k, we have a problem https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥴" title="Woozy face" aria-label="Emoji: Woozy face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥴" title="Woozy face" aria-label="Emoji: Woozy face">

EXPLAINED:

If you have an annual salary of £20,000, the bank will lend you a maximum of £100,000 towards your property

If you’ve saved up a £15k deposit and the property value is 150k, we have a problem

The importance of having a sufficient deposit amount is stressed often but I can’t stress enough how important your income is!

I can see some of the cogs in your brains turning thinking you can ‘embellish’ your annual incomes a little bit, am I right?

I can see some of the cogs in your brains turning thinking you can ‘embellish’ your annual incomes a little bit, am I right?

WRONG! You have to provide a full financial history for the bank!

Bills, payslips, account balances, debts, all the good stuff!

If you’re thinking moving from part time to full time employment, the bank needs to see at least 3 months worth of payslips

Bills, payslips, account balances, debts, all the good stuff!

If you’re thinking moving from part time to full time employment, the bank needs to see at least 3 months worth of payslips

The bank doesn’t do these checks because they want to poke a hole in your dreams of becoming a homeowner by 22, they are giving you a substantial loan amount and need to make sure that you’re good for it!

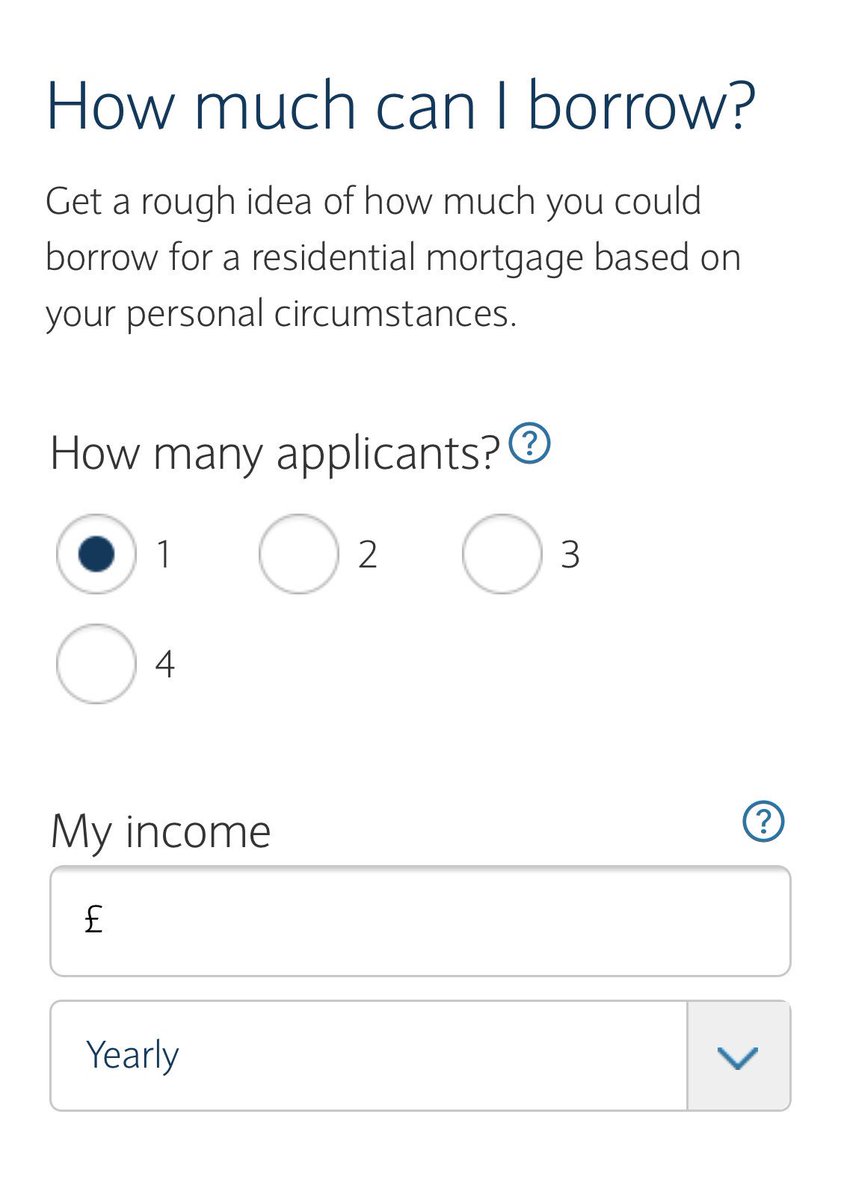

Want to check if you’re good for a mortgage?

Loads of banks offer their own types of calculators but Barclays have one so you can figure out how much you’d be able to borrow based on your income and spending

(It’ll come up with a google search)

Loads of banks offer their own types of calculators but Barclays have one so you can figure out how much you’d be able to borrow based on your income and spending

(It’ll come up with a google search)

If you need me to make a thread going into detail about the different types of mortgages then let me know

If you have anything else to add then please do

Message me if you have any questions either here or on Instagram - @ikeeyah https://abs.twimg.com/emoji/v2/... draggable="false" alt="💕" title="Two hearts" aria-label="Emoji: Two hearts">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💕" title="Two hearts" aria-label="Emoji: Two hearts">

If you have anything else to add then please do

Message me if you have any questions either here or on Instagram - @ikeeyah

Read on Twitter

Read on Twitter