CREDIT SCORES EXPLAINED  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💳" title="Credit card" aria-label="Emoji: Credit card">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💳" title="Credit card" aria-label="Emoji: Credit card">

(What they mean, why they matter and the reason you should ALWAYS monitor yours)

THREAD BELOW https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏾" title="Down pointing backhand index (medium dark skin tone)" aria-label="Emoji: Down pointing backhand index (medium dark skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏾" title="Down pointing backhand index (medium dark skin tone)" aria-label="Emoji: Down pointing backhand index (medium dark skin tone)">

(What they mean, why they matter and the reason you should ALWAYS monitor yours)

THREAD BELOW

Credit scores/ratings are something that most have heard of yet so many young people haven’t bothered to discover their own

If you’re unsure on what it is and why it should be a major concern of yours then keep reading!

If you’re unsure on what it is and why it should be a major concern of yours then keep reading!

CREDIT SCORE: This is a rating that is used by creditors such as banks/financial lenders to determine whether or not you qualify for loans/credit and how much

Any time you open up an account or even take out a phone contract a credit check is run to find out your score!

Any time you open up an account or even take out a phone contract a credit check is run to find out your score!

Every company has their own rating systems and all have different criterias so there is no ‘one size fits all’ when it comes to credit scores

The best thing you can do is focus on getting it as high as possible!

The best thing you can do is focus on getting it as high as possible!

So many people dismiss this topic all together until they walk into Apple looking to finance the new iPhone 11 Pro Max and find out that their application has been rejected likely to poor credit ratings

Want to prevent this? Let’s look into what can build up your score!

Want to prevent this? Let’s look into what can build up your score!

1. PAY YOUR BILLS ON TIME

Sounds silly but consistent late payment on your bills can really harm your credit score

Phone bill £20 higher this month than it was last? You may choose to stick it to the man and not pay but it only hurts you!

Pay it now and dispute it later! https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobile phone" aria-label="Emoji: Mobile phone">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📱" title="Mobile phone" aria-label="Emoji: Mobile phone">

Sounds silly but consistent late payment on your bills can really harm your credit score

Phone bill £20 higher this month than it was last? You may choose to stick it to the man and not pay but it only hurts you!

Pay it now and dispute it later!

2. GET A CREDIT CARD

Now I know a lot of people have their own feelings towards this so only do this if you feel comfortable

Using a credit card for purchases and making regular repayments can really benefit your score!

CONTD https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏾" title="Right pointing backhand index (medium dark skin tone)" aria-label="Emoji: Right pointing backhand index (medium dark skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏾" title="Right pointing backhand index (medium dark skin tone)" aria-label="Emoji: Right pointing backhand index (medium dark skin tone)">

Now I know a lot of people have their own feelings towards this so only do this if you feel comfortable

Using a credit card for purchases and making regular repayments can really benefit your score!

CONTD

A smart way to use credit cards is to use them for big purchases that you ALREADY have the money for and repay either instantly or when your next statement comes

Credit Cards offer an extra layer of buyer protection plus you look super reliable to lenders! https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Money with wings" aria-label="Emoji: Money with wings">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Money with wings" aria-label="Emoji: Money with wings">

Credit Cards offer an extra layer of buyer protection plus you look super reliable to lenders!

3. CRUNCH THOSE DEBTS

We’ve all made mistakes and overspent where we shouldn’t have but make an active effort to crunch those debts!

Even on part time wages, work out how much you can put aside every month to tackle your debts and make regular payments to them!

We’ve all made mistakes and overspent where we shouldn’t have but make an active effort to crunch those debts!

Even on part time wages, work out how much you can put aside every month to tackle your debts and make regular payments to them!

4. PAY OFF TWICE

This is such a major code on the cheat manual, pay off your debts twice each month!

If you’ve worked out that you’re setting aside £100 a month to pay your debts

Pay £50 at the beginning and the remainder 14 days later

CONTD https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏾" title="Right pointing backhand index (medium dark skin tone)" aria-label="Emoji: Right pointing backhand index (medium dark skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏾" title="Right pointing backhand index (medium dark skin tone)" aria-label="Emoji: Right pointing backhand index (medium dark skin tone)">

This is such a major code on the cheat manual, pay off your debts twice each month!

If you’ve worked out that you’re setting aside £100 a month to pay your debts

Pay £50 at the beginning and the remainder 14 days later

CONTD

Even though you’re paying the same amount, the splitting up of these payments give the illusion that you’re more reliable at making repayments and reflect positively on your credit score!

It’s a no brainer!

It’s a no brainer!

5. GET ON THE ELECTORAL ROLL

Aka register to vote! It’s much harder for you to gain credit if lenders have no idea who you are or are unable to verify who you are!

If you want to check and see if you’re registered, have a google or go on your local council’s site!

Aka register to vote! It’s much harder for you to gain credit if lenders have no idea who you are or are unable to verify who you are!

If you want to check and see if you’re registered, have a google or go on your local council’s site!

6. SET UP DIRECT DEBITS

Mama still pays your phone bills? If you’re one of the few lucky ones to still have that be you then as much as it’s great, you’re missing out on building credit!

Having direct debits whether it be gym memberships or phone bills can help raise that score

Mama still pays your phone bills? If you’re one of the few lucky ones to still have that be you then as much as it’s great, you’re missing out on building credit!

Having direct debits whether it be gym memberships or phone bills can help raise that score

HOW DOES A BAD SCORE AFFECT ME?

If your score isn’t up to scratch, it can hinder you from:

• Mortgage applications

• Credit cards

• Loans

• Phone contracts

• Car insurance

• Home insurance

All of which are pretty significant if not now then in the future

If your score isn’t up to scratch, it can hinder you from:

• Mortgage applications

• Credit cards

• Loans

• Phone contracts

• Car insurance

• Home insurance

All of which are pretty significant if not now then in the future

If you have/have had any kind of fraudulent activities take place on your accounts, that could also be detrimental to your score

If that is the case then something called a CIFAS will be placed on your file

If that is the case then something called a CIFAS will be placed on your file

It is super important to check your file regularly because you could have a CIFAS or a different alert on your file hindering you from taking out credit which isn’t even your fault

If you find yourself in that situation, contact your bank! https://abs.twimg.com/emoji/v2/... draggable="false" alt="📞" title="Telephone receiver" aria-label="Emoji: Telephone receiver">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📞" title="Telephone receiver" aria-label="Emoji: Telephone receiver">

If you find yourself in that situation, contact your bank!

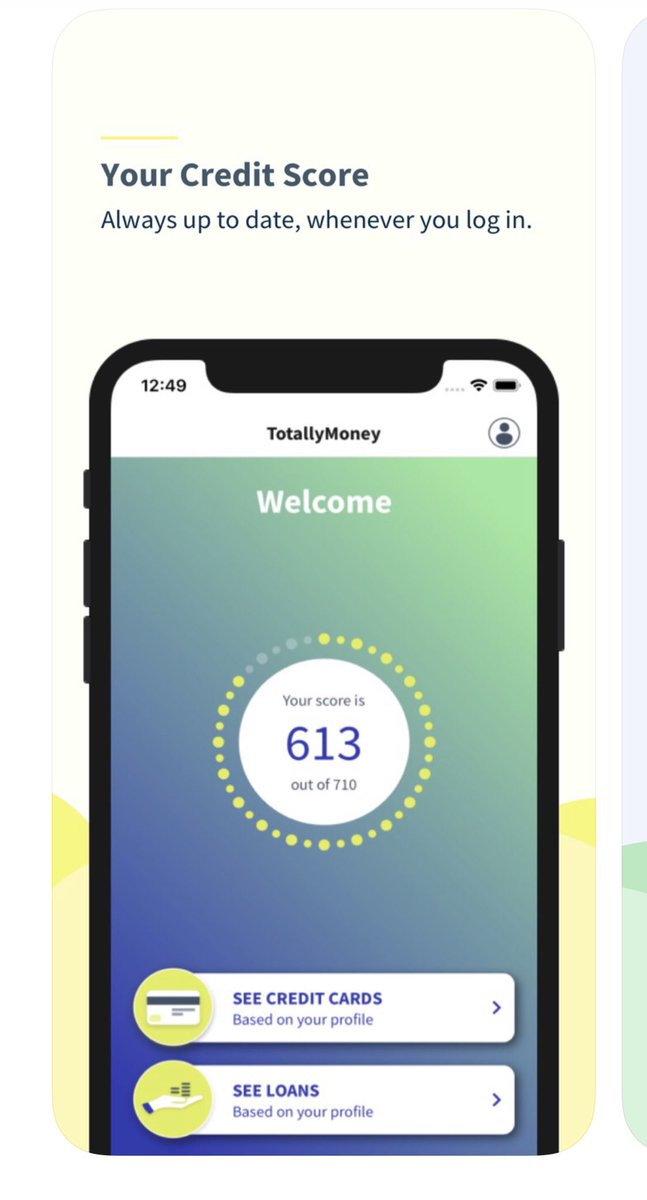

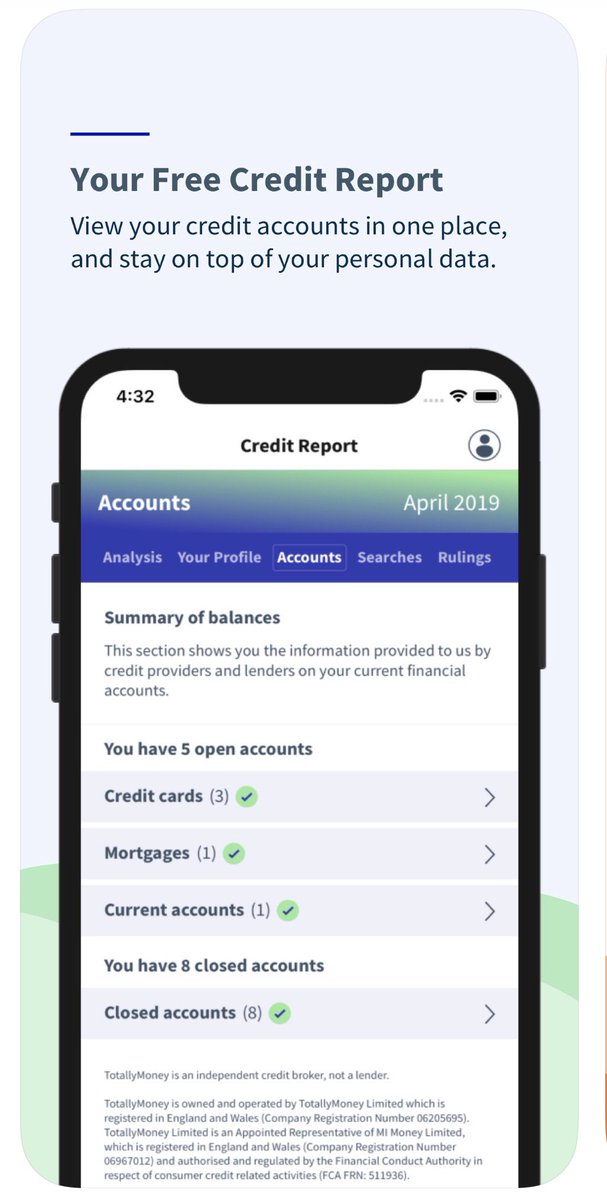

HOW TO CHECK YOUR SCORE

The app Totally Money is great as it gives you an up to date score, allows you to see if any checks have been made on your account and what, if any, alerts are on your account

It’s also completely free to use!

The app Totally Money is great as it gives you an up to date score, allows you to see if any checks have been made on your account and what, if any, alerts are on your account

It’s also completely free to use!

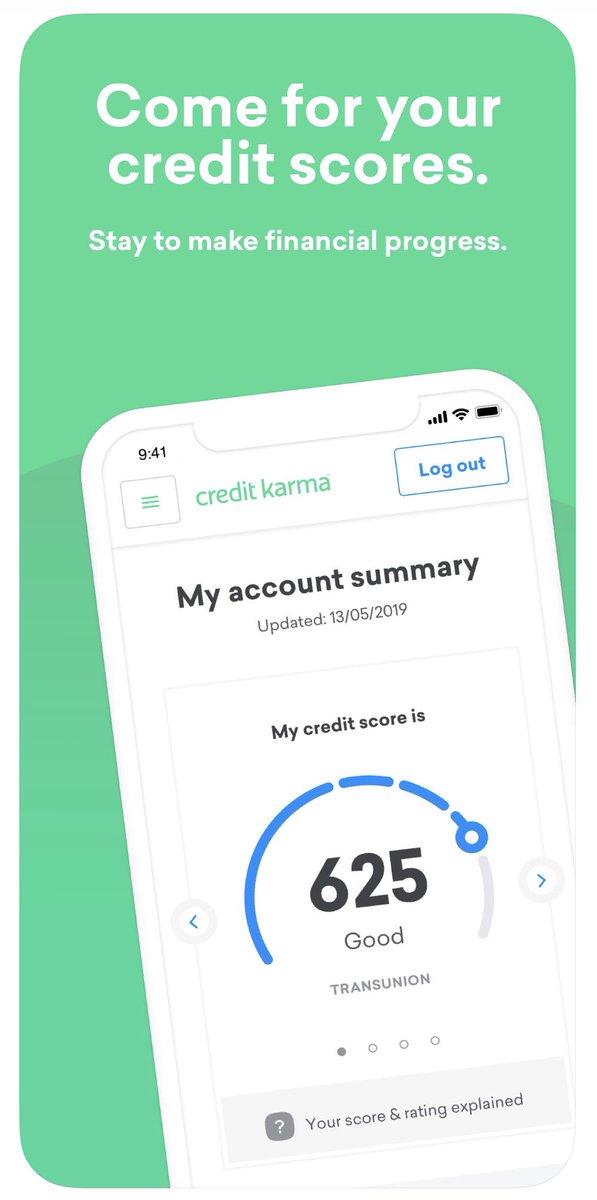

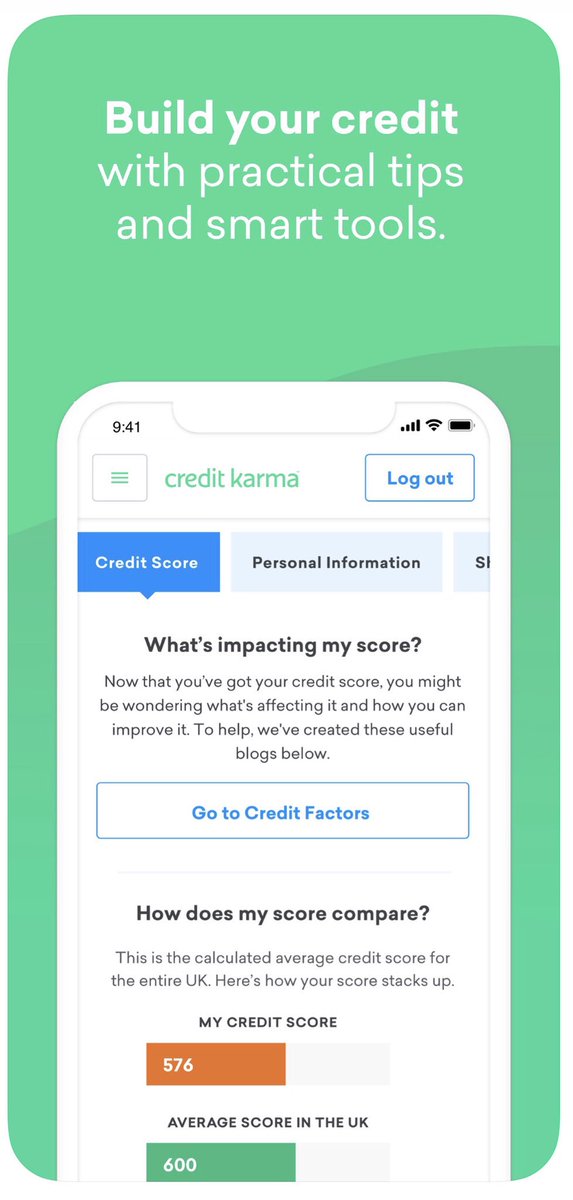

Credit Karma is also another completely free app that allows you to check your score and gives you tips to help build up your credit score

It will also alert you to any changes that may occur on your credit file

It will also alert you to any changes that may occur on your credit file

There are plenty of different websites too such as Experian which allow you to view your credit file free of charge

Pick what works best for you!

Pick what works best for you!

If you have any other helpful tips to drop then drop them below!  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Money with wings" aria-label="Emoji: Money with wings">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Money with wings" aria-label="Emoji: Money with wings">

You don’t want to jeopardise your future by allowing bad credit to determine your future so be a forwards thinker and grab a hold of your future!

Here’s to creating a successful future! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥂" title="Clinking glasses" aria-label="Emoji: Clinking glasses">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥂" title="Clinking glasses" aria-label="Emoji: Clinking glasses">

Here’s to creating a successful future!

Read on Twitter

Read on Twitter