1/ September 18th marks the 61st anniversary of the most valuable network effect of all time: the credit card. How did we get here? Read on. And read @opinion_joe ‘s book “Piece of the Action” for more...

2/ The epicenter of the revolution was Fresno, California. Facebook started with the contained network of Harvard students; the humble credit card started with 60,000 people in Fresno and a prominent company called Bank of America, then a California-only bank.

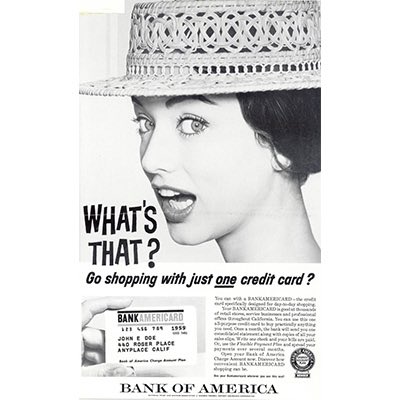

3/ There was no application. 60,000 people just got a BankAmericard in the mail on September 18, 1958, ready to use.

4/ There were “charge cards” like Diner’s Club before the BankAmericard Fresno drop, but there was no “credit” being extended. And you could go to a bank and get a loan, or get an installment loan for a specific purchase, but in person.

5/ The credit card came out of Bank of America’s corporate think tank, called the “Customer Services Research Department,” run by a 41 year old man named Joe Williams.

6/ Consumers were used to paying on credit, but each line of credit was either specific to a merchant (e.g., Sears), or a burdensome process requiring a new loan (in person) from the bank.

7/ Williams thought the credit card -- a multi-merchant product -- would fix that. It really had two purposes: convenience and lending.

8/ Fresno at the time had about 250,000 people, and *45% of all Fresno families* were Bank of America customers.

9/ Credit card fees were set at 6% for merchants, and consumers -- who just randomly got this card without applying -- got between $300 and $500 in instant credit.

10/ The brilliance of the 60,000 person drop is that Williams had effectively started with the chicken, in the classic chicken/egg cold start problem. On day 1, cardholders simply *existed* which permitted BoA to sign up all merchants who didn’t have existing proprietary programs

11/ So Williams started in a seemingly random, highly concentrated town, immediately enlisted existing customers, and focused on fast-moving, small merchants -- not the giants like Sears -- all backed by a massive advertising campaign.

12/ More than 300 merchants in the city signed up, the first being Florsheim Shoes (still around!).

13/ Within 3 months, BoA was expanding concentrically -- to Modesto to the north and Bakersfield to the south, and within a year San Francisco, Sacramento, and Los Angeles. Within 13 months of Fresno, there were 2 million cards issued and 20,000 merchants onboarded.

14/ After the Fresno drop, other banks followed. Chase Manhattan was 5 months later on the east coast.

15/ Williams assumed that collections would be a breeze, that late payments would never cross 4%, and that existing bank credit systems would work. Instead, less than 2 years after Fresno, Joe Williams quit BoA due to a series of disasters. The credit card almost died then+there

16/ Delinquencies were over 20%. Fraud was out of control as criminals figured out how to replicate cards. Merchants (harbinger of things to come) hated paying 6% and the first battles over fees began. Some of them stole from the bank or customers, too.

17/ And more broadly -- and this is now illegal -- simply giving people cards without having them apply, and without them understanding the consequences of wanton spending, created far more bad debt than BoA had ever seen (on a customer % basis).

18/ The huge losses and mounting pressure almost caused BoA to kill the card program altogether. The founder was ousted. Instead, BoA persevered, and just a few years later BankAmericard turned a profit and grew like a rocketship, transforming how people pay and borrow.

19/ Eventually, BankAmericard became a non-profit consortium called Visa -- uniting many banks with competing credit cards. A competing consortium called MasterCharge, later MasterCard, did the same with another set of banks.

20/ Credit cards and payment cards are arguably the most valuable network in the world, with at least $1T of publicly traded market cap (Visa, MasterCard, the banks who issue them, etc)...all starting off in a little town called Fresno, on a random day in September of 1958.

21/ More on how credit cards work today and their history: https://youtu.be/vR-uvPPdI_M ">https://youtu.be/vR-uvPPdI...

22/ And how all of this — and the creation of this powerful network effect — has an impact on how I think about crypto (old tweetstorm from last year): https://twitter.com/arampell/status/1042226753253437440?s=21

FIN">https://twitter.com/arampell/...

FIN">https://twitter.com/arampell/...

Read on Twitter

Read on Twitter