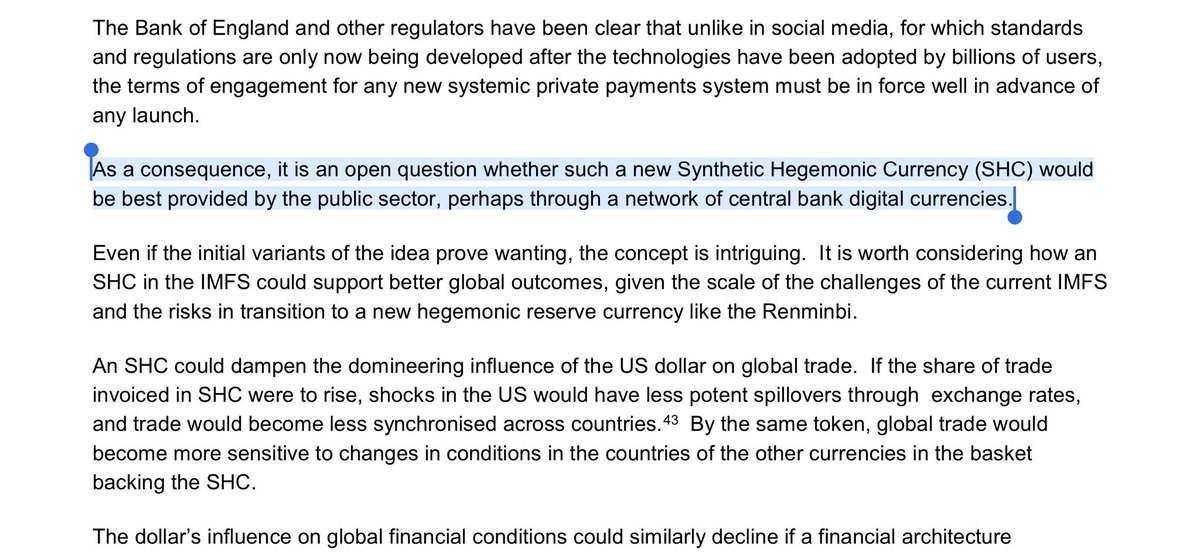

Find out the latest from the Bank of England on how Central Bank Synthetic Hegemonic Currencies (SHC) complement the legacy financial system and support monetary policy through a #NetworkofCentralBankDigitalCurrencies #DLT #Blockchain https://www.bankofengland.co.uk/-/media/boe/files/speech/2019/the-growing-challenges-for-monetary-policy-speech-by-mark-carney.pdf">https://www.bankofengland.co.uk/-/media/b...

What I said in Zug. @bankofengland states, that central bank currencies should be run by central banks to complement the existing system, providing stability, efficiency and managing risk. The beginnings of rearchitecting the entire financial system! https://twitter.com/gverdian/status/1144187491680968704?s=21">https://twitter.com/gverdian/...

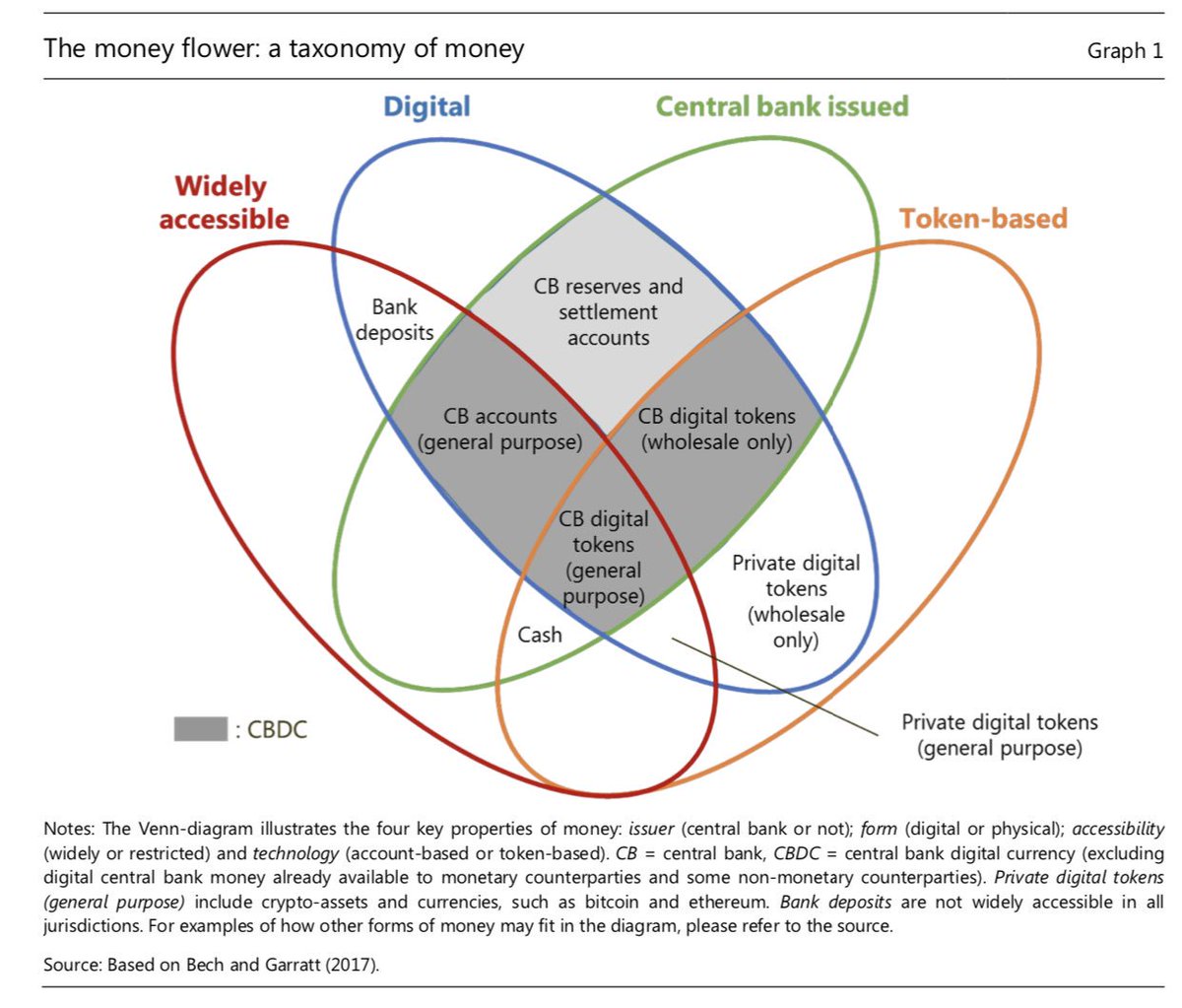

According to @BIS_org, this is how central bank currencies fit into the financial system. https://www.bis.org/cpmi/publ/d174.pdf">https://www.bis.org/cpmi/publ...

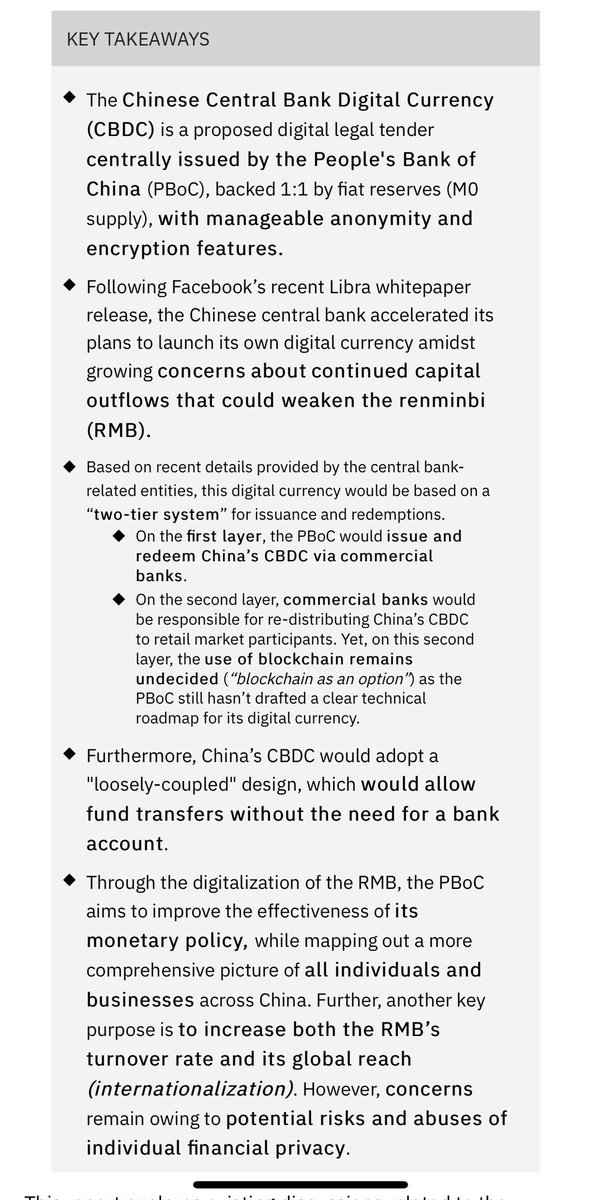

CBDC overview from People’s Bank of China https://info.binance.com/en/research/marketresearch/img/issue16/Binance-Research-China-Central-Bank-Digital-Currency.pdf">https://info.binance.com/en/resear...

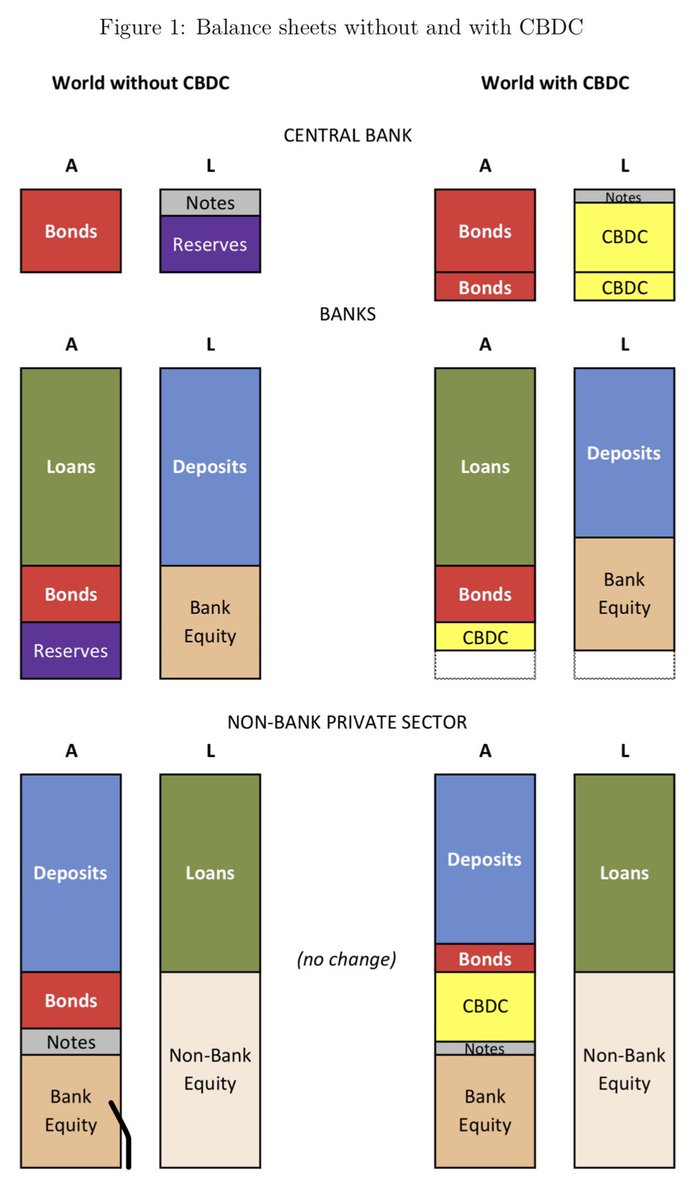

@BoE_Research from 2018 on how CBDCs can be treated by a central bank. This is what Assets and Liabilities look like in a world with CBDC. PDF: https://www.bankofengland.co.uk/-/media/boe/files/working-paper/2018/broadening-narrow-money-monetary-policy-with-a-central-bank-digital-currency.pdf?la=en&hash=26851CF9F5C49C9CDBA95561581EF8B4A8AFFA52">https://www.bankofengland.co.uk/-/media/b... https://twitter.com/boe_research/status/997463768899768320?s=21">https://twitter.com/boe_resea...

Today, @BIS_org releases Embedded supervision: how to build regulation into blockchain finance

https://www.bis.org/publ/work811.pdf">https://www.bis.org/publ/work...

https://www.bis.org/publ/work811.pdf">https://www.bis.org/publ/work...

@ecb’s Benoît Cœuré: Digital challenges to the international monetary and financial system. “Global central banks need to join forces and jointly investigate the feasibility of central bank digital currencies (CBDCs).“ Full speech: https://www.ecb.europa.eu/press/key/date/2019/html/ecb.sp190917~9b63e0ea23.en.html?utm_source=ecb_twitter&utm_medium=social&utm_campaign=190917_speech_BC">https://www.ecb.europa.eu/press/key...

President of ECB #MarioDraghi replied to MEP Eva Kaili & recognizes future potential as means of payment while keeping an open mind for the utility of a crypto-Euro https://twitter.com/EvaKaili/status/1177594744798617600?s=20">https://twitter.com/EvaKaili/...

From @BIS_org:

#G7 report says #stablecoins might work better than other cryptocurrencies as a means of payment & store of value; they could contribute to more efficient & inclusive global payment arrangements only if significant risks are addressed https://www.bis.org/cpmi/publ/d187.htm">https://www.bis.org/cpmi/publ...

#G7 report says #stablecoins might work better than other cryptocurrencies as a means of payment & store of value; they could contribute to more efficient & inclusive global payment arrangements only if significant risks are addressed https://www.bis.org/cpmi/publ/d187.htm">https://www.bis.org/cpmi/publ...

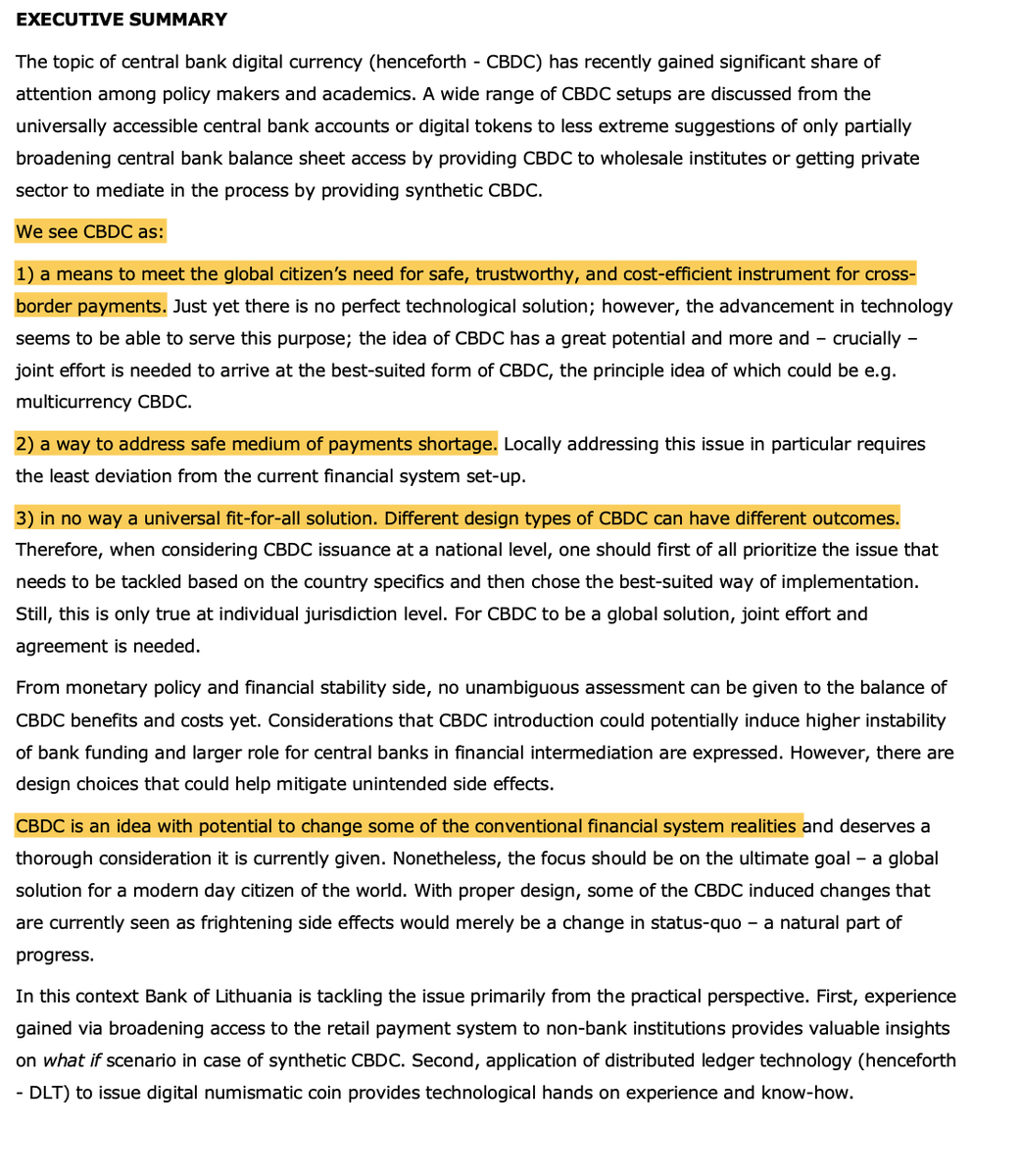

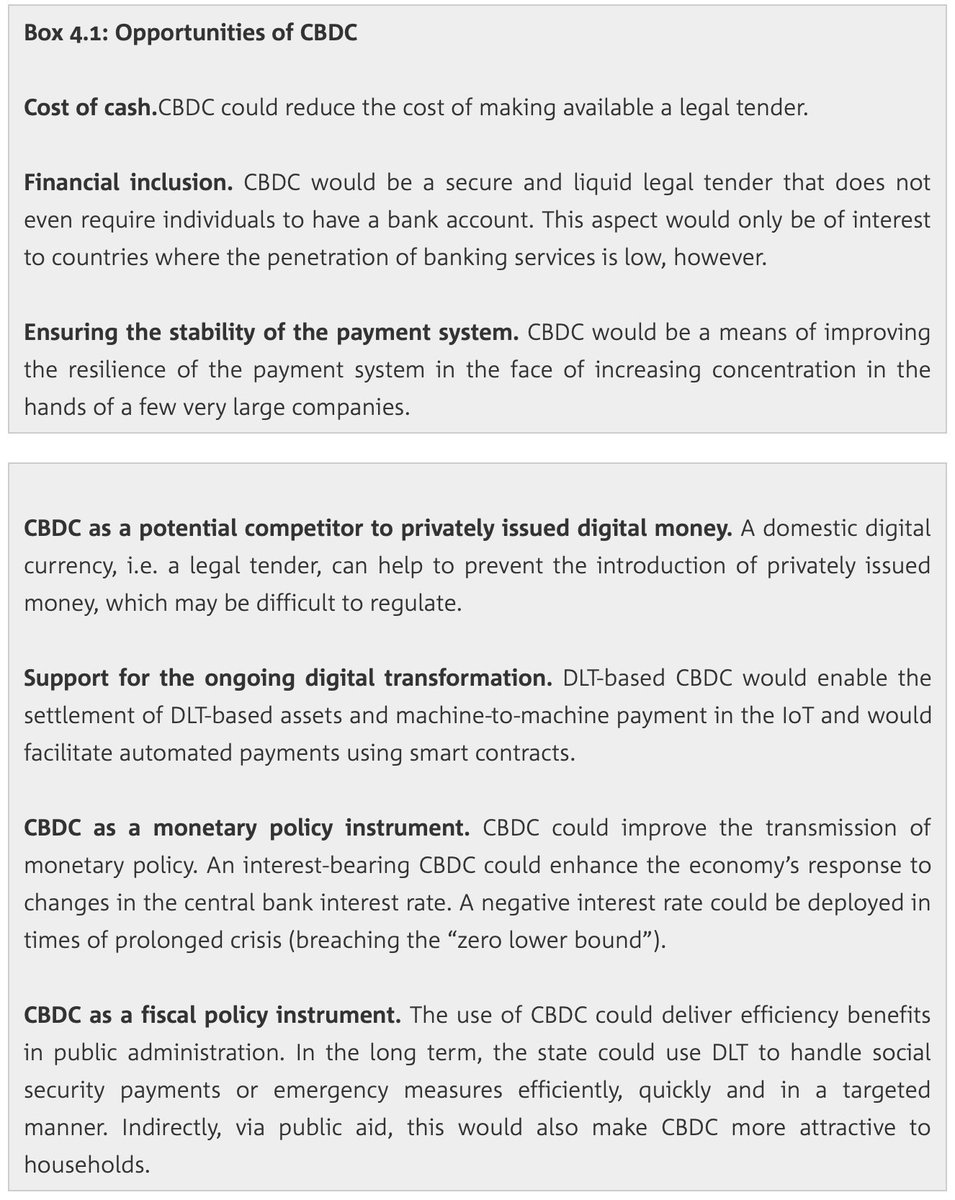

Report from the Central Bank of Lithuania @Lietuvosbankas, see CBDCs:

1) as a means for safe, trustworthy and cost-efficient instrument

2) as a way to address payments shortage

3) with different design types

4) Change the conventional financial system

https://www.lb.lt/en/publications/no-29-aiste-juskaite-sigitas-siaudinis-tomas-reichenbachas-cbdc-in-the-whirpool-of-discussion">https://www.lb.lt/en/public...

1) as a means for safe, trustworthy and cost-efficient instrument

2) as a way to address payments shortage

3) with different design types

4) Change the conventional financial system

https://www.lb.lt/en/publications/no-29-aiste-juskaite-sigitas-siaudinis-tomas-reichenbachas-cbdc-in-the-whirpool-of-discussion">https://www.lb.lt/en/public...

@BIS_org paper on Wholesale Digital Tokens; digital tokens that could potentially be used to effect settlement. This report focuses on the role of digital tokens as a means of settling wholesale transactions. https://www.bis.org/cpmi/publ/d190.htm">https://www.bis.org/cpmi/publ... PDF: https://www.bis.org/cpmi/publ/d190.pdf">https://www.bis.org/cpmi/publ...

@IMFNews can help in 3 ways: by informing the policy debate, by convening relevant parties to discuss policy options, and by helping countries develop policies.

The IMF is helping member countries consider CBDC options and seek advice.

https://blogs.imf.org/2019/12/12/central-bank-digital-currencies-4-questions-and-answers/">https://blogs.imf.org/2019/12/1...

#CBDC #sCBDC

The IMF is helping member countries consider CBDC options and seek advice.

https://blogs.imf.org/2019/12/12/central-bank-digital-currencies-4-questions-and-answers/">https://blogs.imf.org/2019/12/1...

#CBDC #sCBDC

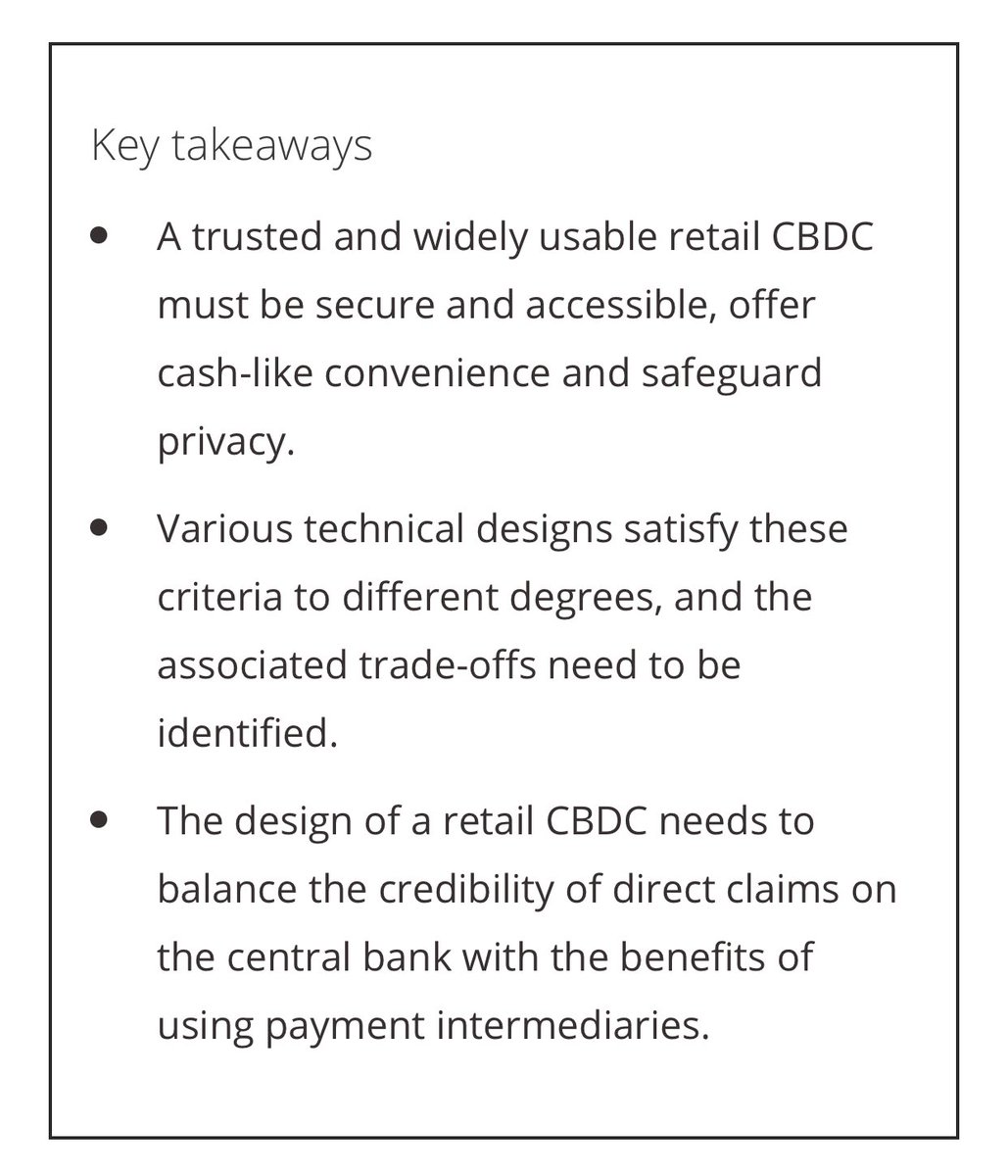

@ecb paper: Exploring anonymity in central bank digital currencies

Latest research shows that it is possible to build a simplified payment system for central bank digital currencies.

https://www.ecb.europa.eu/paym/intro/publications/pdf/ecb.mipinfocus191217.en.pdf">https://www.ecb.europa.eu/paym/intr... #CBDC #sCBDC

Latest research shows that it is possible to build a simplified payment system for central bank digital currencies.

https://www.ecb.europa.eu/paym/intro/publications/pdf/ecb.mipinfocus191217.en.pdf">https://www.ecb.europa.eu/paym/intr... #CBDC #sCBDC

@EU_Commission: EU Consultation on how to shape the regulatory framework for crypto-assets and stablecoins: https://twitter.com/EU_Finance/status/1207635617418534913?s=20">https://twitter.com/EU_Financ...

@ecb Working Paper: Tiered CBDC and the Financial System. https://www.ecb.europa.eu/pub/pdf/scpwps/ecb.wp2351~c8c18bbd60.en.pdf?9bd63a4ddea2300dca05f2ccaa08c0e0">https://www.ecb.europa.eu/pub/pdf/s...

@ESMAComms Strategic Orientation 2020-22.

“A sound legal framework for crypto-assets are increasingly becoming areas of focus for ESMA together with the other ESAs, the ESRB, the ECB and the European Commission.”

https://www.esma.europa.eu/sites/default/files/library/esma22-106-1942_strategic_orientation_2020-22.pdf">https://www.esma.europa.eu/sites/def...

“A sound legal framework for crypto-assets are increasingly becoming areas of focus for ESMA together with the other ESAs, the ESRB, the ECB and the European Commission.”

https://www.esma.europa.eu/sites/default/files/library/esma22-106-1942_strategic_orientation_2020-22.pdf">https://www.esma.europa.eu/sites/def...

Digital Dollar Project

Determine advantages of a digital USD, convene private sector thought leaders, & propose possible models to support the public sector.

The Project will develop a framework for potential, practical steps to establish a dollar CBDC. https://www.digitaldollarproject.org"> https://www.digitaldollarproject.org

Determine advantages of a digital USD, convene private sector thought leaders, & propose possible models to support the public sector.

The Project will develop a framework for potential, practical steps to establish a dollar CBDC. https://www.digitaldollarproject.org"> https://www.digitaldollarproject.org

@BIS_org Central bank group to assess potential cases for central bank digital currencies. The group includes @bankofcanada, @bankofengland, @Bank_of_Japan_e, @ecb, @riksbanken, @SNB_BNS_en https://www.bis.org/press/p200121.htm">https://www.bis.org/press/p20... #CBDC

@wef publishes the Central Bank Digital Currency Policy‐Maker Toolkit. A framework covering:

– Retail, wholesale, cross‐border CBDC and alternatives in private money such as “hybrid CBDC”

– Large, small, emerging and developed countries.

http://www3.weforum.org/docs/WEF_CBDC_Policymaker_Toolkit.pdf">https://www3.weforum.org/docs/WEF_... #CBDC

– Retail, wholesale, cross‐border CBDC and alternatives in private money such as “hybrid CBDC”

– Large, small, emerging and developed countries.

http://www3.weforum.org/docs/WEF_CBDC_Policymaker_Toolkit.pdf">https://www3.weforum.org/docs/WEF_... #CBDC

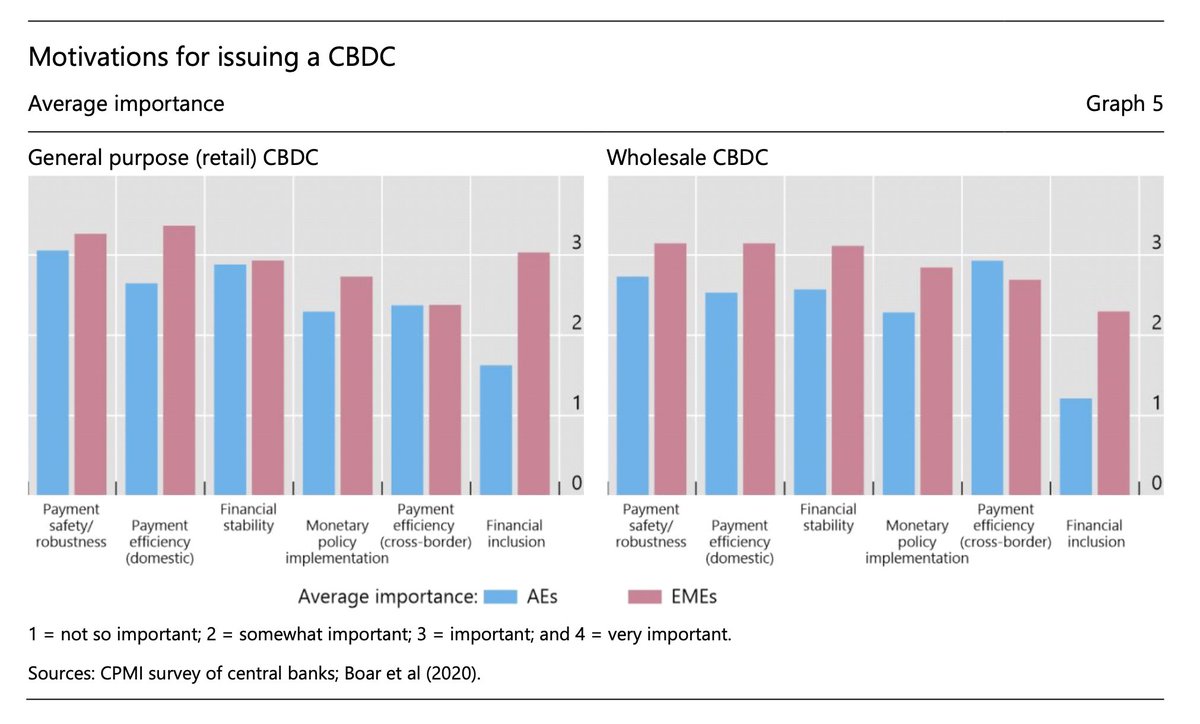

@BIS_org Impending arrival of CBDCs - a sequel to the survey on central bank digital currency. Covering the motivations of CBDCs including financial stability, domestic and cross border payments, monetary policy and financial inclusion. https://www.bis.org/publ/bppdf/bispap107.pdf">https://www.bis.org/publ/bppd... #CBDC #CentralBanks

Why Central Bank Digital Currencies Are The Killer App For Blockchain In 2020 #CBDC

Mobile payments alone are a $5.5T opportunity by 2025

@bis estimates that over 80% of the central banks are looking at blockchain as a place to issue digital currencies https://www.forbes.com/sites/biserdimitrov/2020/02/06/why-central-bank-digital-currencies-are-the-killer-app-for-blockchain-in-2020/">https://www.forbes.com/sites/bis...

Mobile payments alone are a $5.5T opportunity by 2025

@bis estimates that over 80% of the central banks are looking at blockchain as a place to issue digital currencies https://www.forbes.com/sites/biserdimitrov/2020/02/06/why-central-bank-digital-currencies-are-the-killer-app-for-blockchain-in-2020/">https://www.forbes.com/sites/bis...

The central banks of Britain, the euro zone, Japan, Canada, Sweden and Switzerland announced a plan last month to share their findings to look at the case for issuing digital currencies, amid growing debate over the future of money.

@Reuters https://uk.reuters.com/article/us-cenbank-digital/six-central-banks-to-hold-digital-currency-meeting-in-april-nikkei-idUKKBN1ZZ348">https://uk.reuters.com/article/u... #CBDC

@Reuters https://uk.reuters.com/article/us-cenbank-digital/six-central-banks-to-hold-digital-currency-meeting-in-april-nikkei-idUKKBN1ZZ348">https://uk.reuters.com/article/u... #CBDC

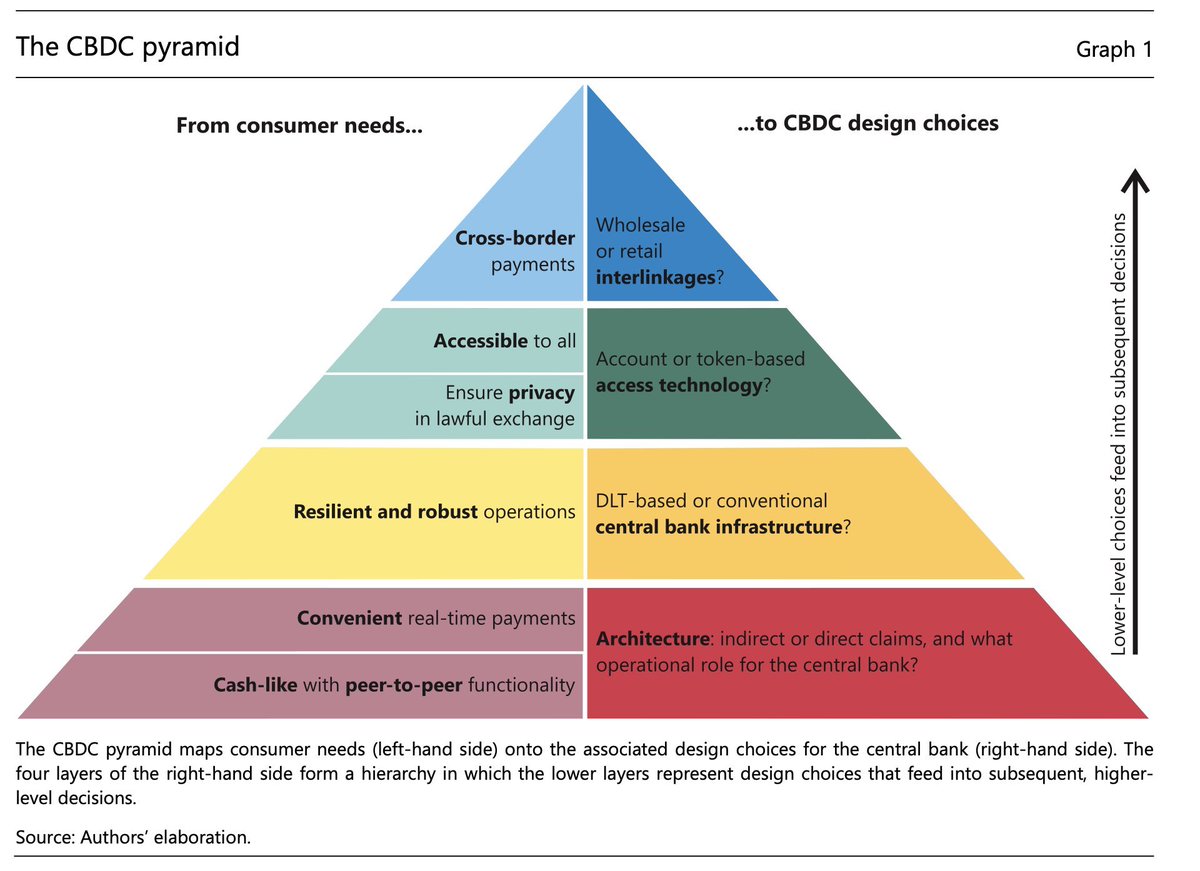

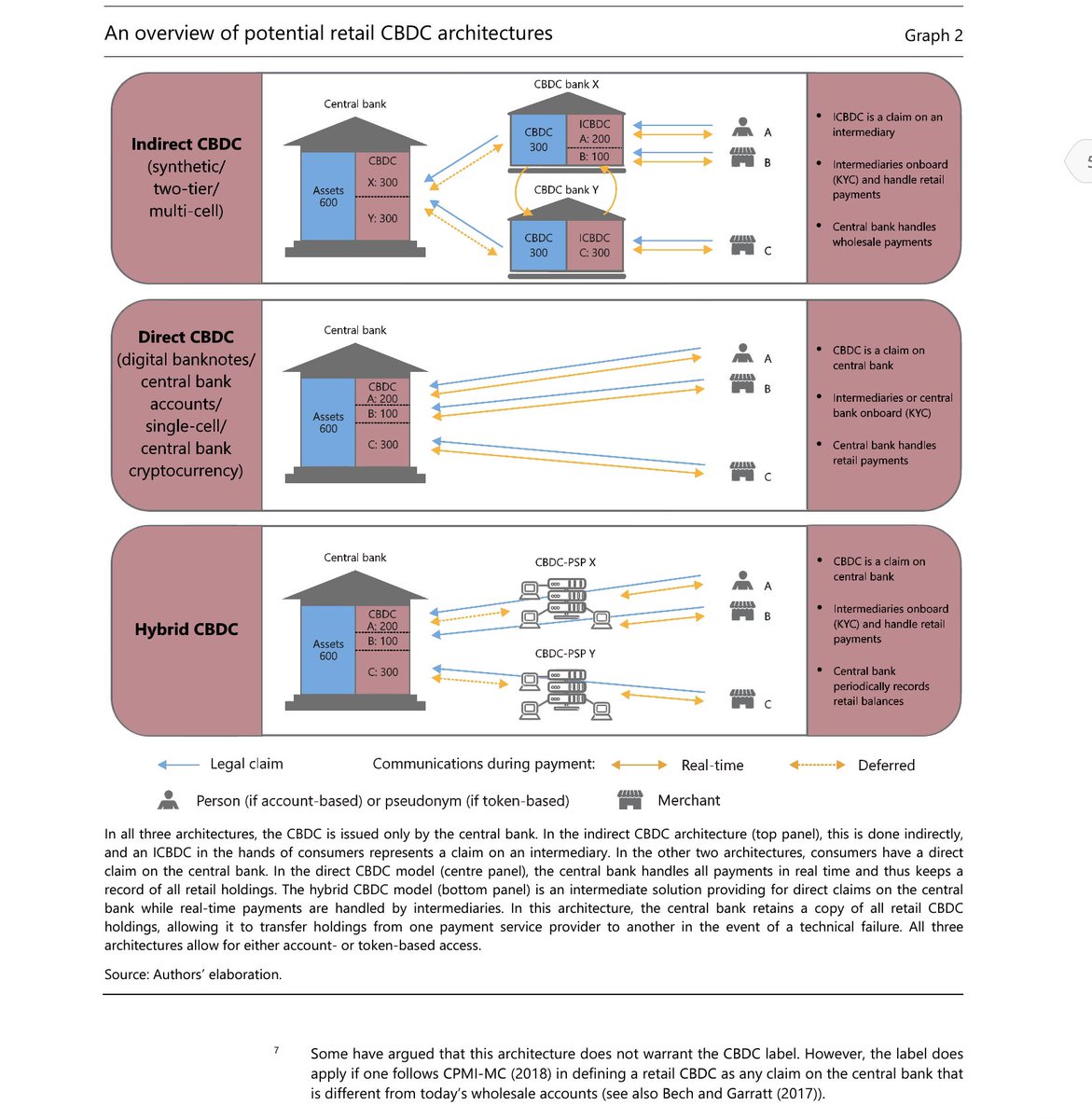

@BIS_org The technology of retail central bank digital currency. https://www.bis.org/publ/qtrpdf/r_qt2003j.pdf">https://www.bis.org/publ/qtrp... #CBDC

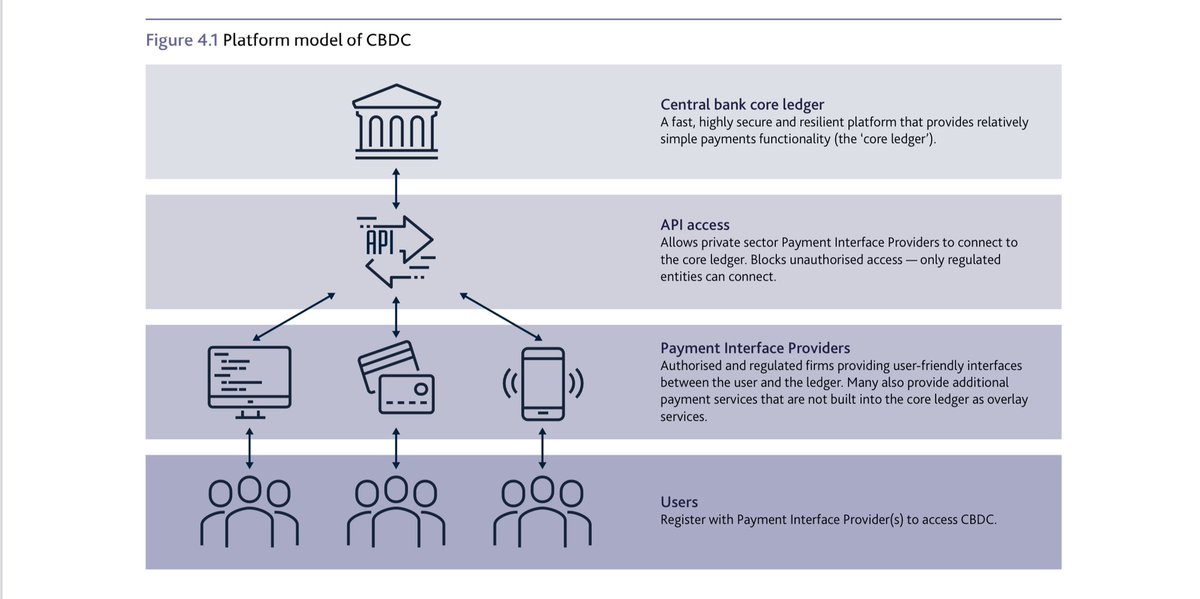

@bankofengland Paper: Should we innovate to provide the public with electronic money — or Central Bank Digital Currency (CBDC) — as a complement to physical banknotes? https://www.bankofengland.co.uk/-/media/boe/files/paper/2020/central-bank-digital-currency-opportunities-challenges-and-design.pdf?la=en&hash=DFAD18646A77C00772AF1C5B18E63E71F68E4593">https://www.bankofengland.co.uk/-/media/b... #CBDC #RTGS

https://twitter.com/quant_network/status/1247478633209442305?s=21">https://twitter.com/quant_net... https://twitter.com/quant_network/status/1247478633209442305">https://twitter.com/quant_net...

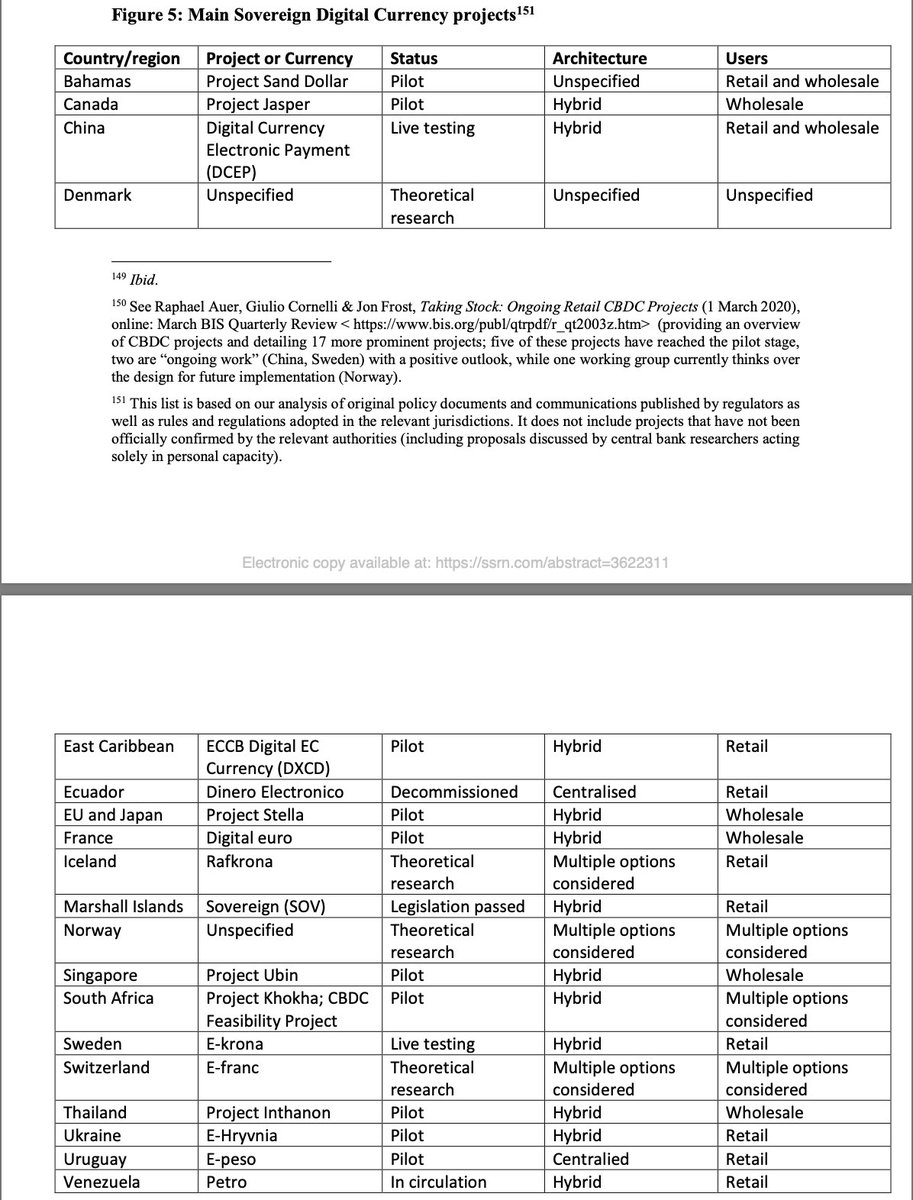

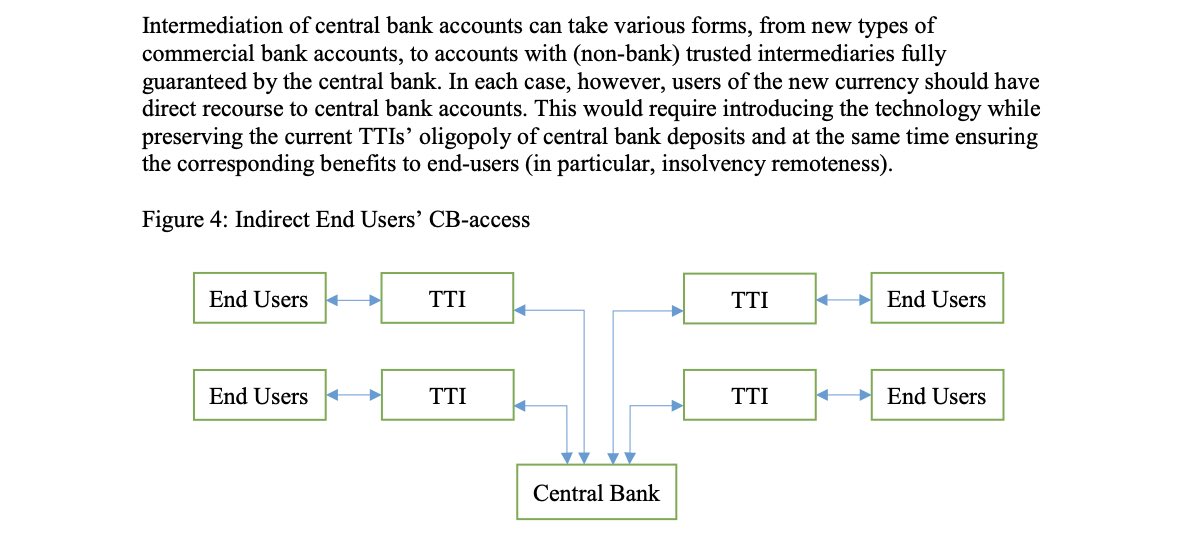

@EBI_EU Working Paper: After Libra, Digital Yuan and COVID-19: Central Bank Digital Currencies and the New World of Money and Payment Systems

Covering end user CB access and the status of Digital Currency projects.

PDF: https://poseidon01.ssrn.com/delivery.php?ID=113078126115091090124091100003099027003089005085064035004100096071017006074073007069098036057038114126109090023005002005103122010075001029042125089113102106103001020013063024022073092124114020069073022115119116023009031124107070123120099125113078084&EXT=pdf">https://poseidon01.ssrn.com/delivery....

#CBDC #DLT #Blockchain

Covering end user CB access and the status of Digital Currency projects.

PDF: https://poseidon01.ssrn.com/delivery.php?ID=113078126115091090124091100003099027003089005085064035004100096071017006074073007069098036057038114126109090023005002005103122010075001029042125089113102106103001020013063024022073092124114020069073022115119116023009031124107070123120099125113078084&EXT=pdf">https://poseidon01.ssrn.com/delivery....

#CBDC #DLT #Blockchain

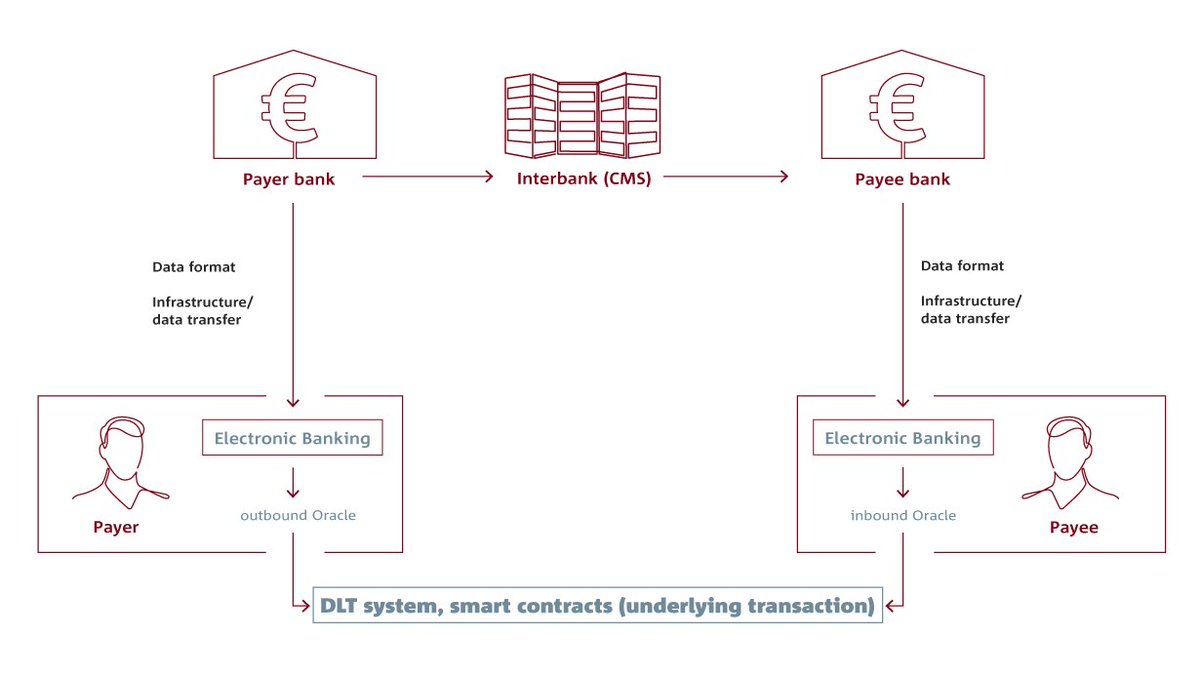

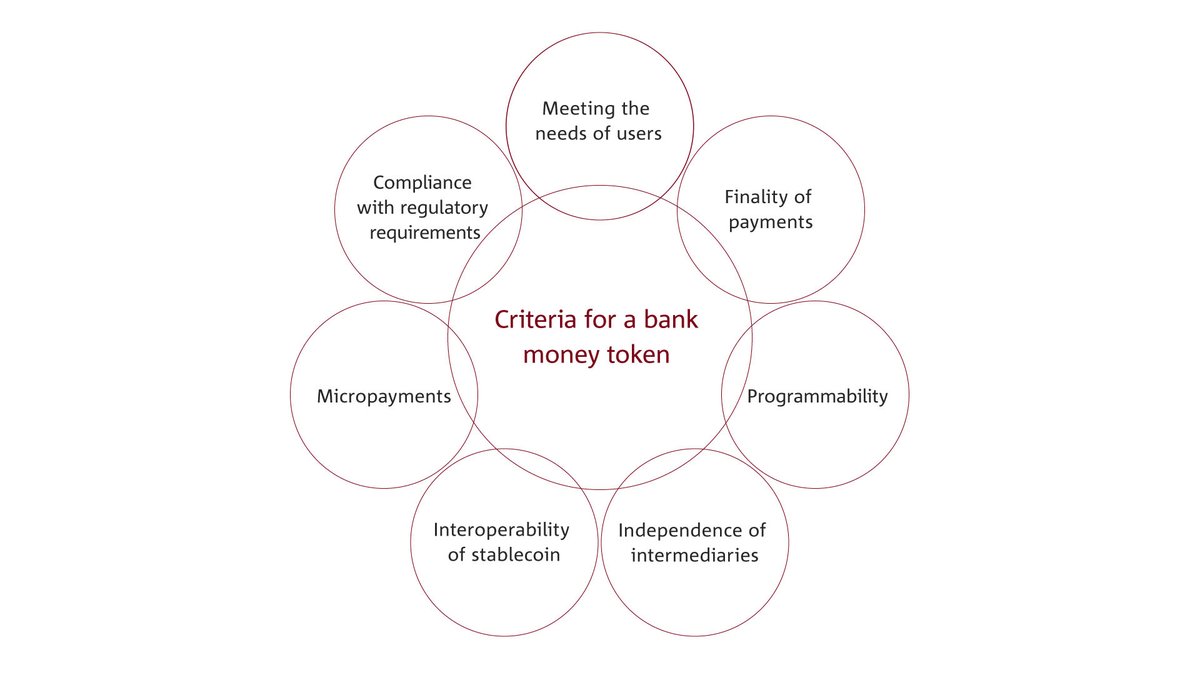

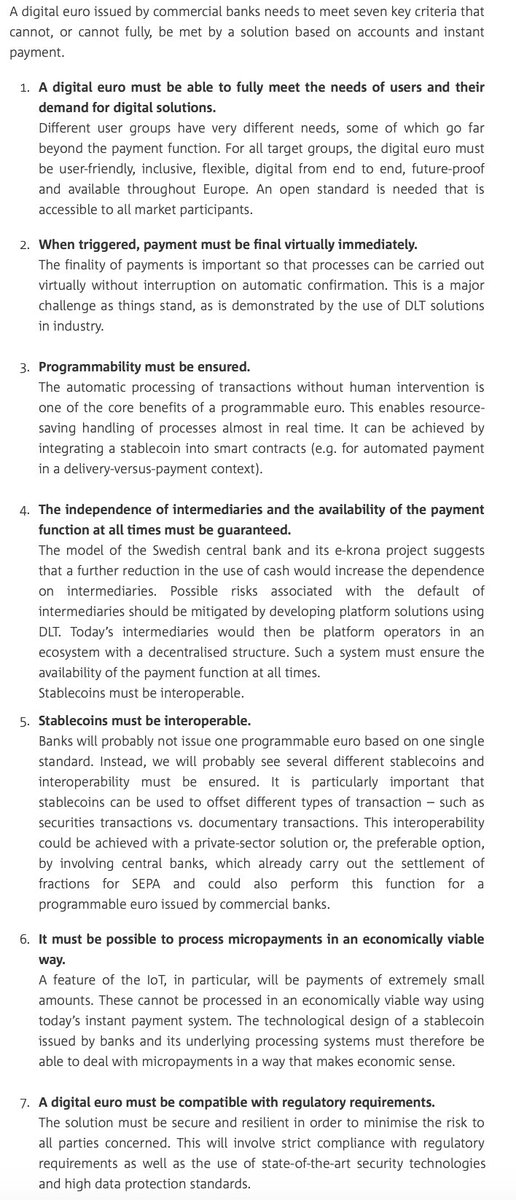

Europe’s answer to Libra – potential and prerequisites of a programmable euro by the Association of German Banks @bankenverband

https://en.bankenverband.de/newsroom/comments/europe-answer-libra/

Highlighting">https://en.bankenverband.de/newsroom/... interoperability: A digital euro issued by commercial banks needs to meet seven key criteria.

#CBDC #DLT

https://en.bankenverband.de/newsroom/comments/europe-answer-libra/

Highlighting">https://en.bankenverband.de/newsroom/... interoperability: A digital euro issued by commercial banks needs to meet seven key criteria.

#CBDC #DLT

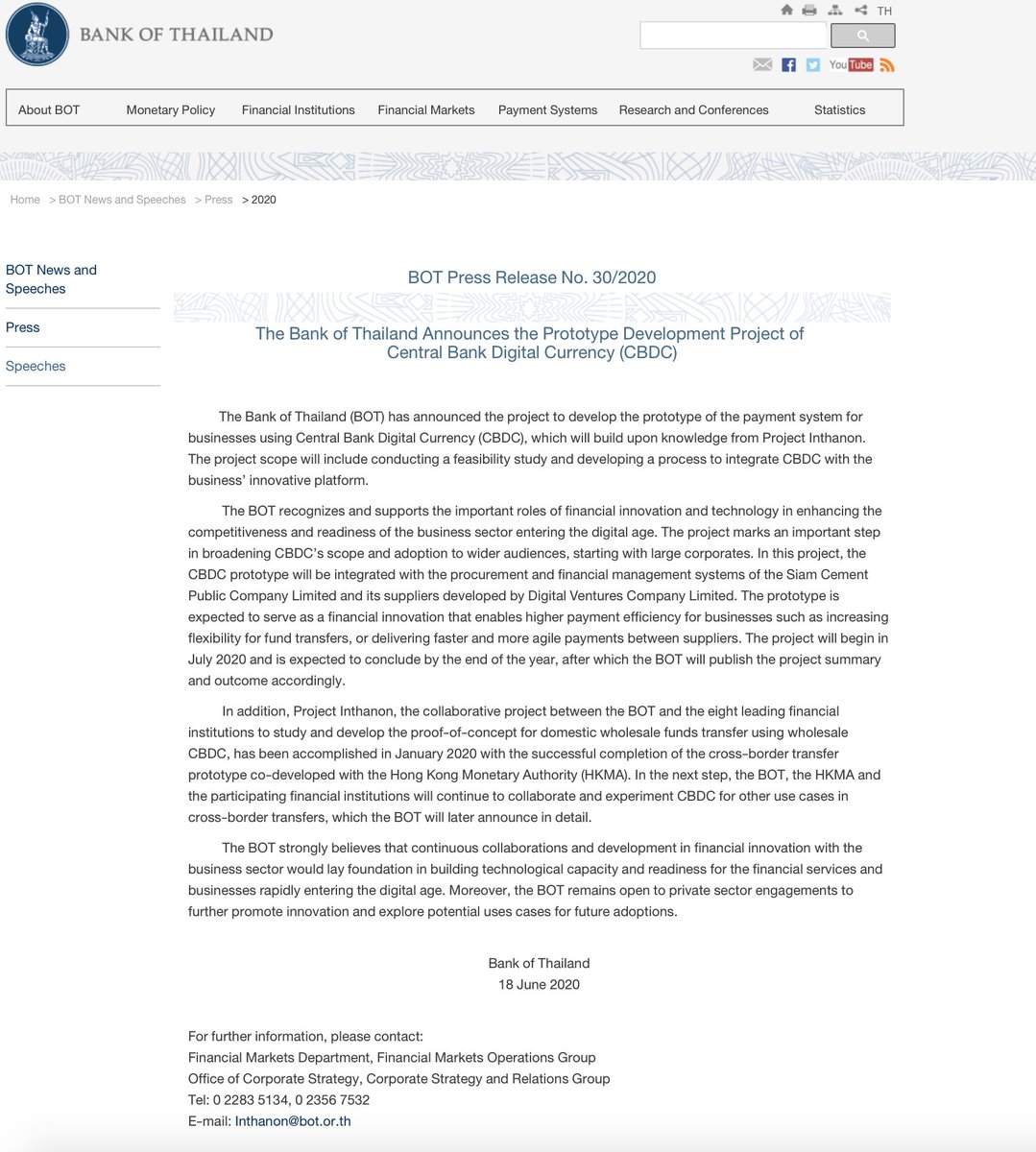

@bankofthailand announces the Prototype Development Project of

Central Bank Digital Currency (CBDC).

The project marks an important step in broadening CBDC’s scope and adoption to wider audiences, starting with large corporates.

https://www.bot.or.th/English/PressandSpeeches/Press/2020/Pages/n3063.aspx">https://www.bot.or.th/English/P...

Central Bank Digital Currency (CBDC).

The project marks an important step in broadening CBDC’s scope and adoption to wider audiences, starting with large corporates.

https://www.bot.or.th/English/PressandSpeeches/Press/2020/Pages/n3063.aspx">https://www.bot.or.th/English/P...

@bankofengland Staff Working Paper No. 879

Dollar shortages and central bank swap lines https://www.bankofengland.co.uk/-/media/boe/files/working-paper/2020/dollar-shortages-and-central-bank-swap-lines.pdf?la=en&hash=25513897C06F75757806FF2D0CBD15B64F0E14D5">https://www.bankofengland.co.uk/-/media/b...

Dollar shortages and central bank swap lines https://www.bankofengland.co.uk/-/media/boe/files/working-paper/2020/dollar-shortages-and-central-bank-swap-lines.pdf?la=en&hash=25513897C06F75757806FF2D0CBD15B64F0E14D5">https://www.bankofengland.co.uk/-/media/b...

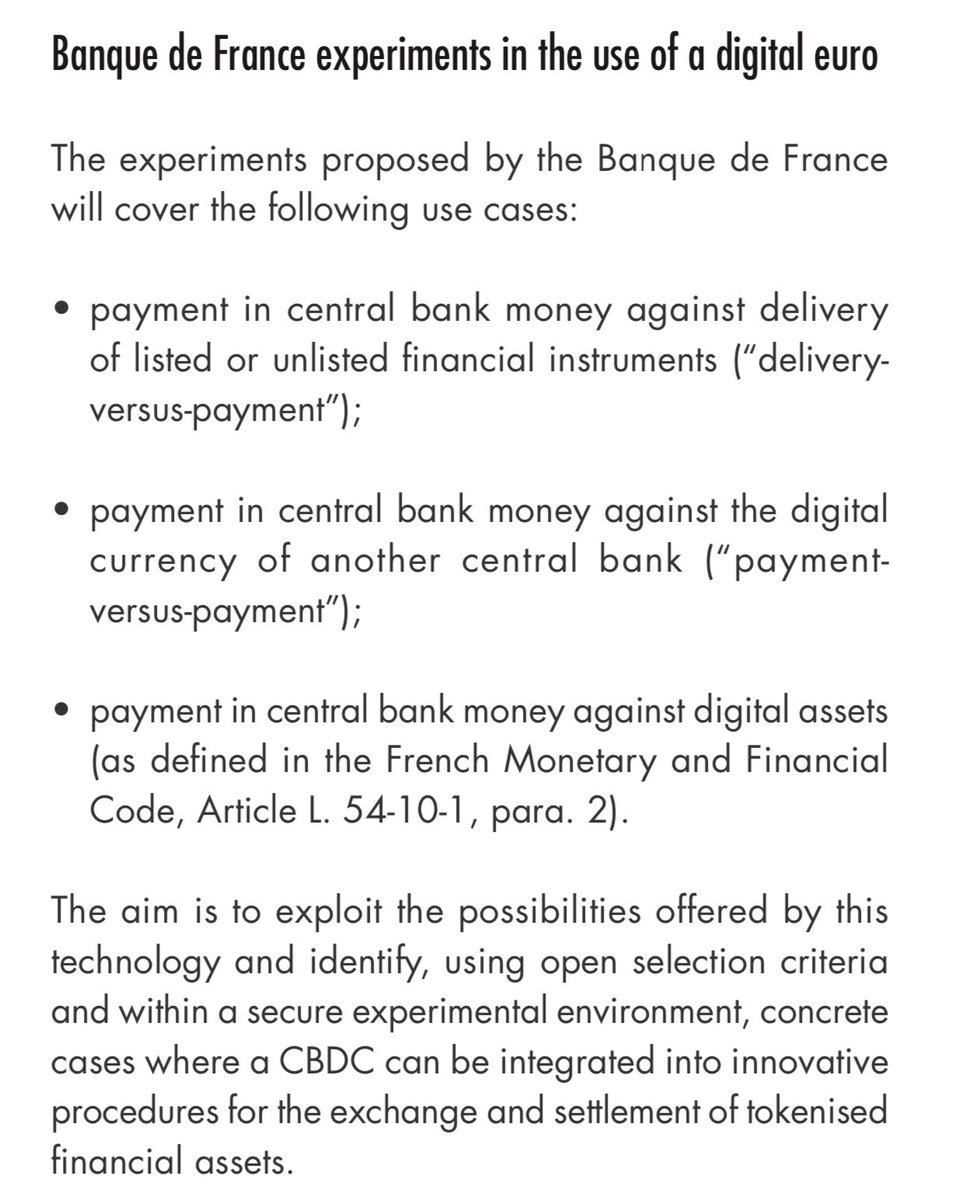

@banquedefrance CBDC use cases

- CBDC DvP

- CBDC PvP (Cross Border)

- CBDC v Digital Assets

PDF: https://www.banque-france.fr/sites/default/files/medias/documents/bdf-230-1_digital-currencies_en.pdf

https://www.banque-france.fr/sites/def... href="https://twtext.com//hashtag/CBDC"> #CBDC

- CBDC DvP

- CBDC PvP (Cross Border)

- CBDC v Digital Assets

PDF: https://www.banque-france.fr/sites/default/files/medias/documents/bdf-230-1_digital-currencies_en.pdf

@federalreserve Governor Lael Brainard provided a broad description of the Fed’s ongoing research and plans in the potential development of a U.S. central bank digital currency (CBDC)

https://www.forbes.com/sites/jasonbrett/2020/08/13/federal-reserve-reveals-research-plans-for-digital-dollar/">https://www.forbes.com/sites/jas...

Research by @MIT https://www.bostonfed.org/news-and-events/press-releases/2020/the-federal-reserve-bank-of-boston-announces-collaboration-with-mit-to-research-digital-currency.aspx">https://www.bostonfed.org/news-and-...

The CBDC race is on!

https://www.forbes.com/sites/jasonbrett/2020/08/13/federal-reserve-reveals-research-plans-for-digital-dollar/">https://www.forbes.com/sites/jas...

Research by @MIT https://www.bostonfed.org/news-and-events/press-releases/2020/the-federal-reserve-bank-of-boston-announces-collaboration-with-mit-to-research-digital-currency.aspx">https://www.bostonfed.org/news-and-...

The CBDC race is on!

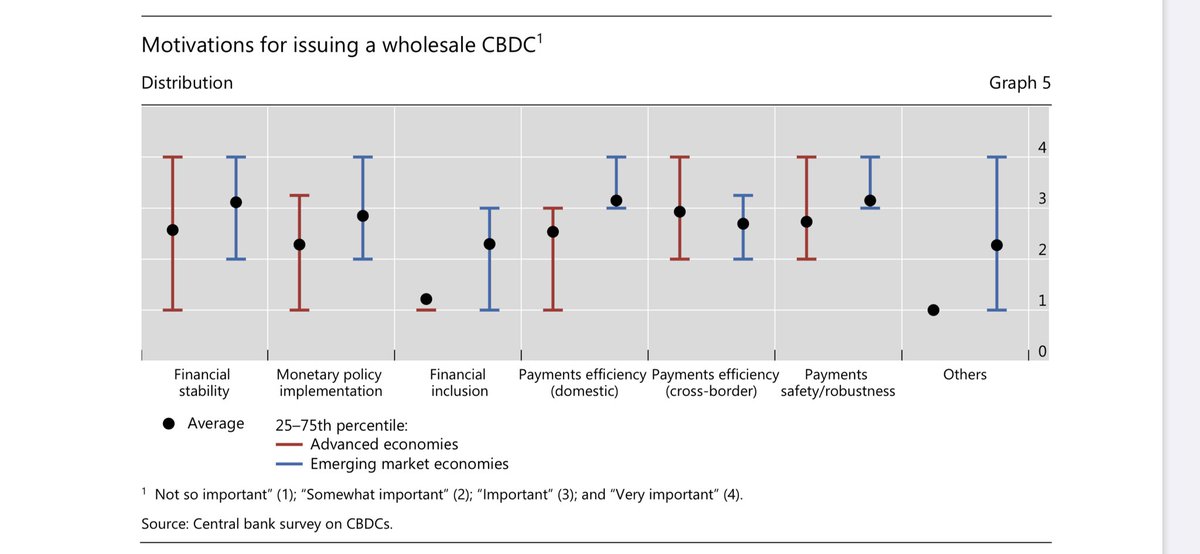

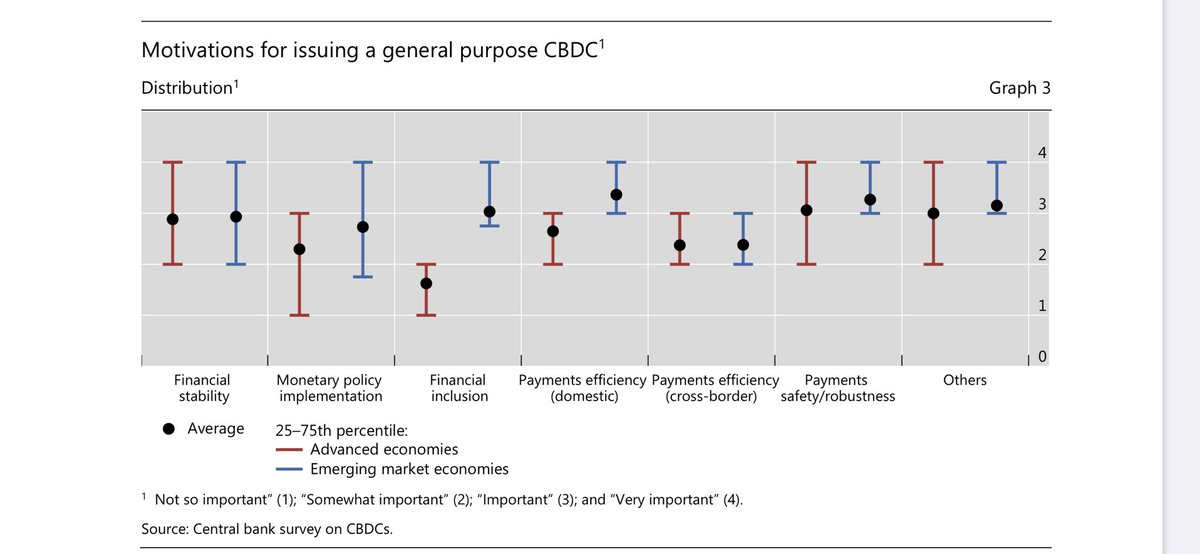

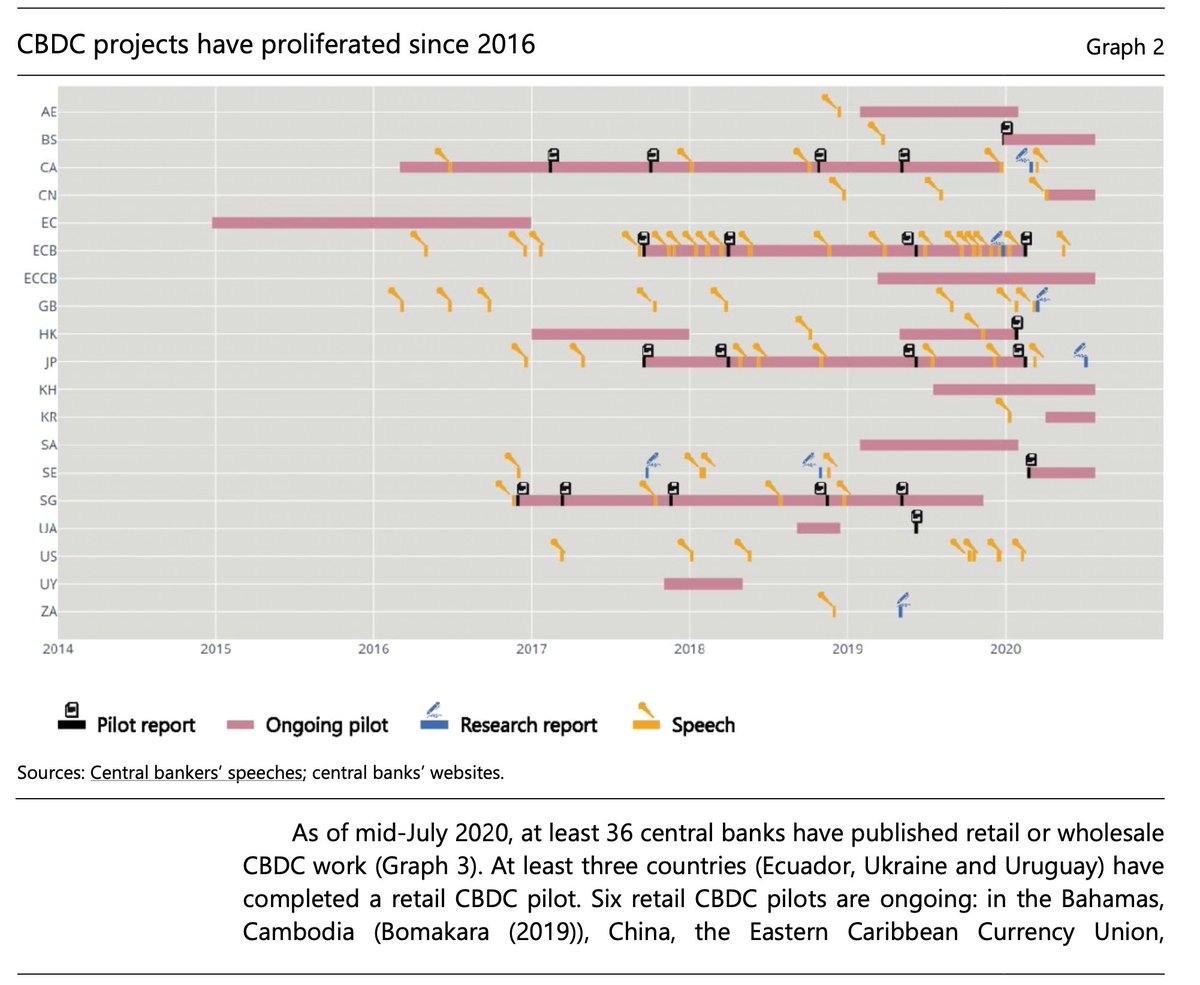

@BIS_org Working Papers No 880

Rise of the central bank digital currencies: drivers, approaches and technologies

Covering:

- Number of CBDC projects since 2016

- Motivations for issuing Retail & Wholesale CBDCs

PDF: https://www.bis.org/publ/work880.pdf

https://www.bis.org/publ/work... href="https://twtext.com//hashtag/CBDC"> #CBDC

Rise of the central bank digital currencies: drivers, approaches and technologies

Covering:

- Number of CBDC projects since 2016

- Motivations for issuing Retail & Wholesale CBDCs

PDF: https://www.bis.org/publ/work880.pdf

@LSE_SRC, @uclcbt and @LSEnews publish new paper by @PaoloTasca Geoff Goodell and Hazem Danny Al-Nakib.

“Now is the time for action to undertake development of such a [CBDC] system” to help respond against system risks to the system.

https://www.systemicrisk.ac.uk/publications/special-papers/digital-currency-and-economic-crises-helping-states-respond">https://www.systemicrisk.ac.uk/publicati...

#CBDC

“Now is the time for action to undertake development of such a [CBDC] system” to help respond against system risks to the system.

https://www.systemicrisk.ac.uk/publications/special-papers/digital-currency-and-economic-crises-helping-states-respond">https://www.systemicrisk.ac.uk/publicati...

#CBDC

Read on Twitter

Read on Twitter

#CBDC" title=" @banquedefrance CBDC use cases - CBDC DvP - CBDC PvP (Cross Border)- CBDC v Digital Assets PDF: https://www.banque-france.fr/sites/def... href="https://twtext.com//hashtag/CBDC"> #CBDC" class="img-responsive" style="max-width:100%;"/>

#CBDC" title=" @banquedefrance CBDC use cases - CBDC DvP - CBDC PvP (Cross Border)- CBDC v Digital Assets PDF: https://www.banque-france.fr/sites/def... href="https://twtext.com//hashtag/CBDC"> #CBDC" class="img-responsive" style="max-width:100%;"/>

#CBDC" title=" @BIS_org Working Papers No 880Rise of the central bank digital currencies: drivers, approaches and technologiesCovering: - Number of CBDC projects since 2016- Motivations for issuing Retail & Wholesale CBDCsPDF: https://www.bis.org/publ/work... href="https://twtext.com//hashtag/CBDC"> #CBDC">

#CBDC" title=" @BIS_org Working Papers No 880Rise of the central bank digital currencies: drivers, approaches and technologiesCovering: - Number of CBDC projects since 2016- Motivations for issuing Retail & Wholesale CBDCsPDF: https://www.bis.org/publ/work... href="https://twtext.com//hashtag/CBDC"> #CBDC">

#CBDC" title=" @BIS_org Working Papers No 880Rise of the central bank digital currencies: drivers, approaches and technologiesCovering: - Number of CBDC projects since 2016- Motivations for issuing Retail & Wholesale CBDCsPDF: https://www.bis.org/publ/work... href="https://twtext.com//hashtag/CBDC"> #CBDC">

#CBDC" title=" @BIS_org Working Papers No 880Rise of the central bank digital currencies: drivers, approaches and technologiesCovering: - Number of CBDC projects since 2016- Motivations for issuing Retail & Wholesale CBDCsPDF: https://www.bis.org/publ/work... href="https://twtext.com//hashtag/CBDC"> #CBDC">

![@LSE_SRC, @uclcbt and @LSEnews publish new paper by @PaoloTasca Geoff Goodell and Hazem Danny Al-Nakib. “Now is the time for action to undertake development of such a [CBDC] system” to help respond against system risks to the system. https://www.systemicrisk.ac.uk/publicati... #CBDC @LSE_SRC, @uclcbt and @LSEnews publish new paper by @PaoloTasca Geoff Goodell and Hazem Danny Al-Nakib. “Now is the time for action to undertake development of such a [CBDC] system” to help respond against system risks to the system. https://www.systemicrisk.ac.uk/publicati... #CBDC](https://pbs.twimg.com/media/EjFDmNuWsAE-7AS.jpg)