A thread on how i started my investment journey.

1. I was tired of being broke and wanted to do something about it

2. I started reading alot of personal finance books

3. The book that stood for me was @WarrenIngram "How to make your first million"

1. I was tired of being broke and wanted to do something about it

2. I started reading alot of personal finance books

3. The book that stood for me was @WarrenIngram "How to make your first million"

4. Asked myself the question what do i want my money to do for me , break this down to 6 months, 1 year, 2 years and 5 years as a start

5. I started reading and following people on twitter @stealthy_wealth @ImcocoMash @Richards_Karin @briteless @JustOneLap just to name a few

5. I started reading and following people on twitter @stealthy_wealth @ImcocoMash @Richards_Karin @briteless @JustOneLap just to name a few

This motivated me to start http://www.capetalk.co.za/features/82/the-personal-finance-series/articles/355899/supersaver-julia-has-stopped-saving-she-s-still-r330-000-richer-than-a-year-ago">https://www.capetalk.co.za/features/...

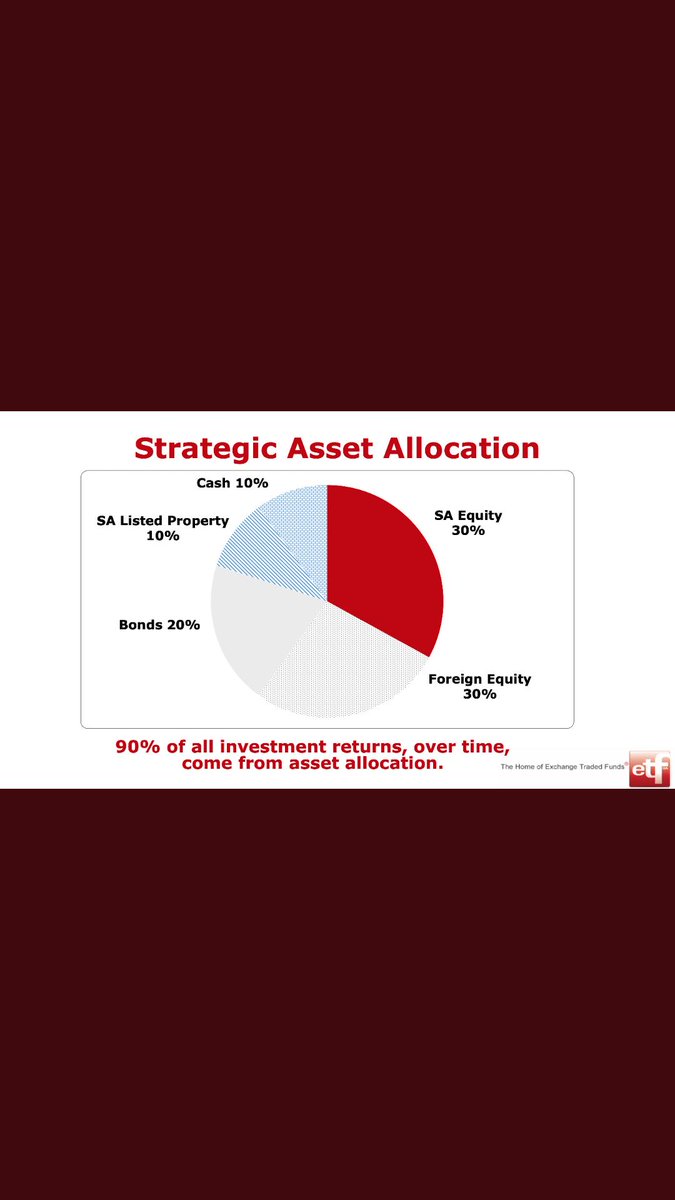

Once i had defined what i wanted my money to do for me , i then had to decide which asset class to invest in and how much i was going to invest in each, see diagram below i got from @JustOneLap

Based on asset allocation

1. I opened an emergency fund in a savings account that easily for short term needs so i wouldn& #39;t turn to debt or investment money

2. I decided what amount i could invest on a monthly basis, this amount was R2750

3. I opened an acc with Easyequities

1. I opened an emergency fund in a savings account that easily for short term needs so i wouldn& #39;t turn to debt or investment money

2. I decided what amount i could invest on a monthly basis, this amount was R2750

3. I opened an acc with Easyequities

2. I use 3 accounts on the EasyEquities, account 1 Tax free account where i buy Exchange Traded Funds (ETFs) i like to think of these as a "basket of shares"

2.Account 2 is for buying shares and account 3 is my USD account where i buy US shares

3. I invest on a monthly basis

2.Account 2 is for buying shares and account 3 is my USD account where i buy US shares

3. I invest on a monthly basis

Consistency is key, have to keep investing no matter what happens because we all know life happens , when life does happen reduce monthly contribution but always try and catch up the next month

2. My goal is financial freedom for my family but i need to get the basics right

2. My goal is financial freedom for my family but i need to get the basics right

Get the foundation right, invest now, get the power of compound interest on your side and in a few years time when the power of compound interest is working for you, you will be able to afford the nice things cash instead of using debt. Surround yourself with like minded people

Read on Twitter

Read on Twitter