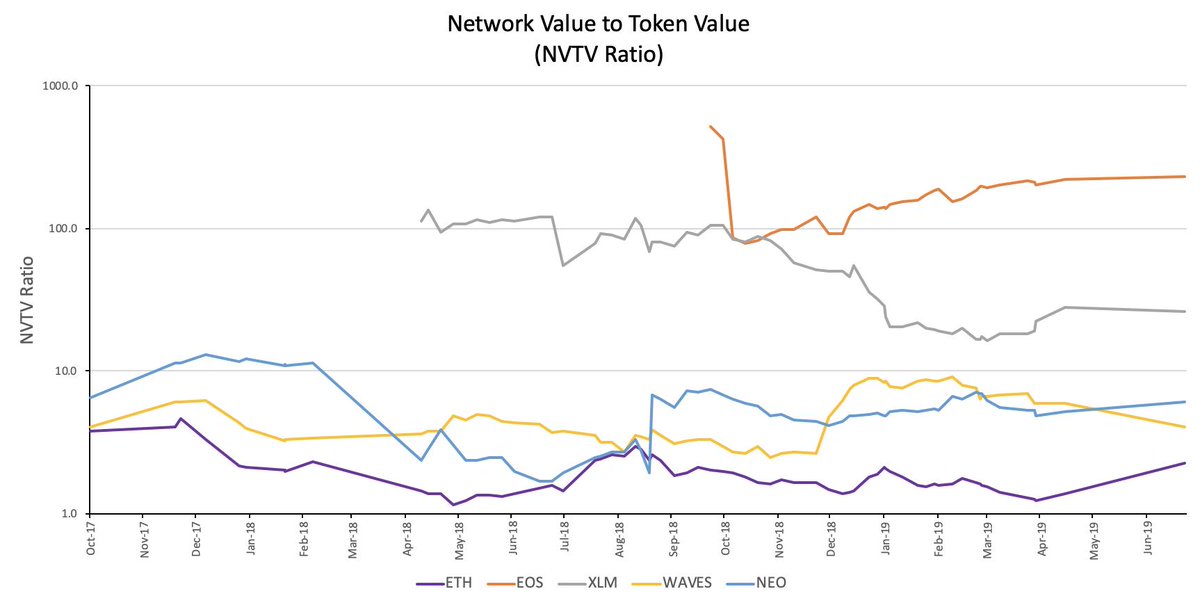

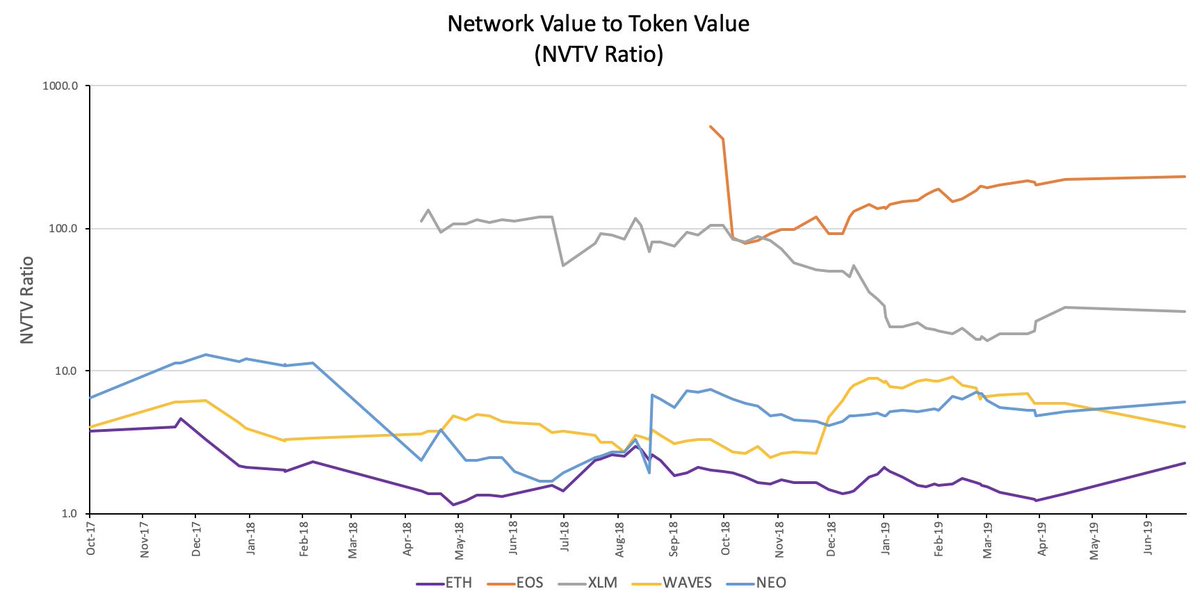

New metric from the @placeholdervc team to assess relative valuations of smart contract platforms:

Network Value to Token Value ( #NVTVratio).

Network Value to Token Value ( #NVTVratio).

2/ The #NVTVratio divides the network value of a smart contract platform by the total value of all assets launched on that platform.

For example, #Ethereum currently trades at ~2x the value of all the assets on its platform, whereas #EOS trades at 234x.

For example, #Ethereum currently trades at ~2x the value of all the assets on its platform, whereas #EOS trades at 234x.

3/ A hope here is the #NVTVratio can help us get around faked transaction volumes and other forms of manipulation that have thus far made the #NVTratio less useful for smart contract platforms.

4/ The ratio has its own flaws, but our thinking is the market price of assets is the most "efficient metric" #crypto has.

Dividing the total market value of the base asset (eg, $ETH), by all the assets secured by it (eg, ERC20s, ERC721s, etc), yields a less manipulated metric.

Dividing the total market value of the base asset (eg, $ETH), by all the assets secured by it (eg, ERC20s, ERC721s, etc), yields a less manipulated metric.

5/ As with PE or PS ratios in stocks, the higher the value of the #NVTVratio, the more richly (speculatively) the market is pricing the asset.

With $EOS at > 200x and $ETH at 2x, #Ethereum is looking massively undervalued on this basis.

Or, $EOS+friends = massively overvalued

With $EOS at > 200x and $ETH at 2x, #Ethereum is looking massively undervalued on this basis.

Or, $EOS+friends = massively overvalued

6/ It& #39;s long been a discussion in #crypto whether the value of all the assets anchored into a platform can be greater than the value of the base platform& #39;s asset (for security reasons).

Such a scenario signifies an #NVTVratio that is < 1, which we have yet to see.

Such a scenario signifies an #NVTVratio that is < 1, which we have yet to see.

7/ Thank you to @alexhevans who pulled the data from @CoinMarketCap& #39;s tokens page: https://coinmarketcap.com/tokens/views/all/

We& #39;re">https://coinmarketcap.com/tokens/vi... sure the data can be improved & sincerely hope member(s) of the industry run with and improve this metric to the benefit of all

cc @coinmetrics @onchainfx @TheTIEIO

We& #39;re">https://coinmarketcap.com/tokens/vi... sure the data can be improved & sincerely hope member(s) of the industry run with and improve this metric to the benefit of all

cc @coinmetrics @onchainfx @TheTIEIO

Read on Twitter

Read on Twitter