Sony - $SNE:

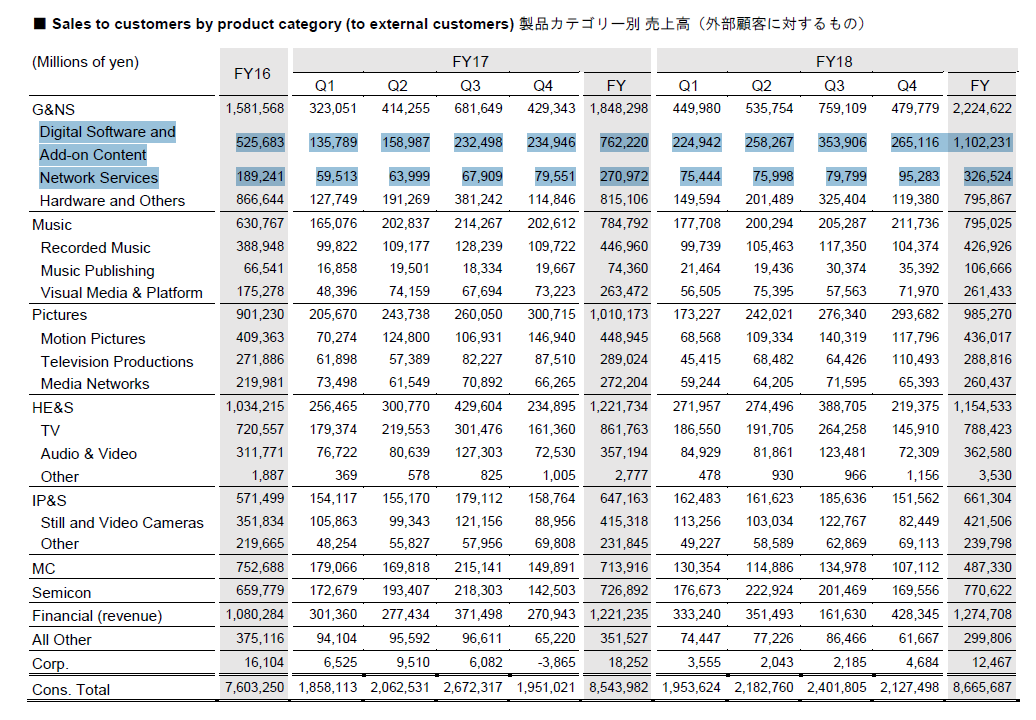

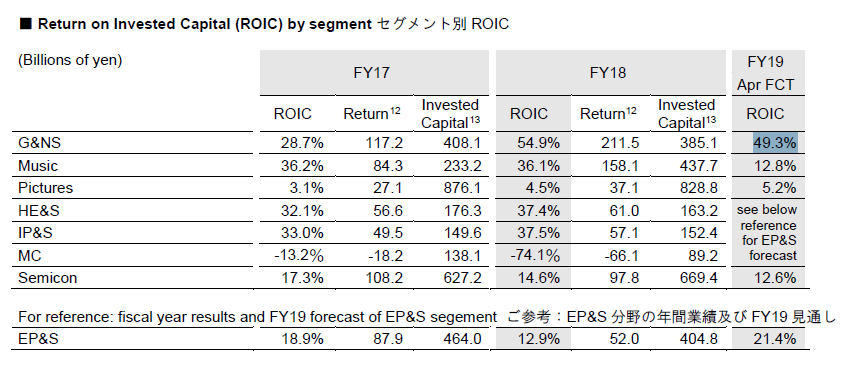

$13bn gaming revenue from Digital Software & Network services alone, up ~38% yoy. ~50% ROIC.

36.4mn PlayStationPlus Subs.

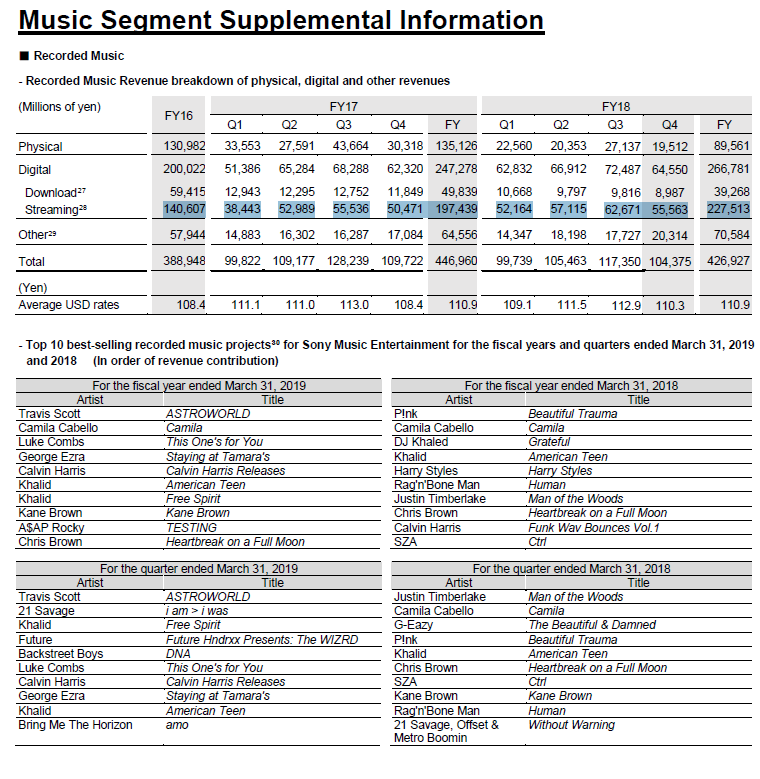

$2.1bn music streaming revenue.

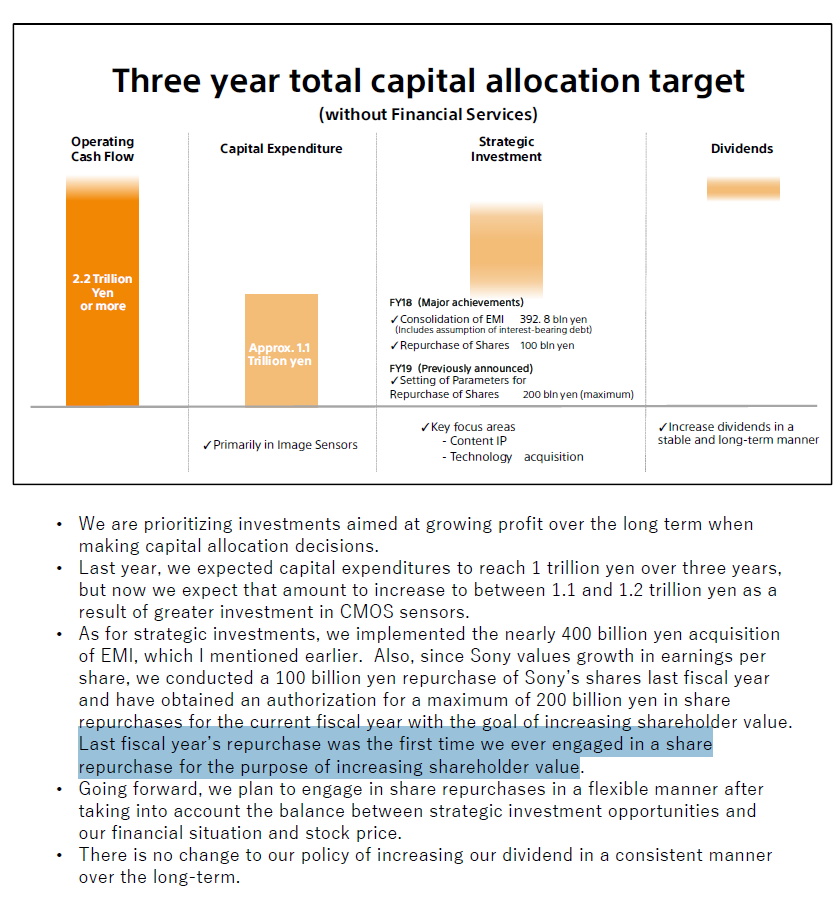

Bought back stock last year for the 1st time ever.

$13bn gaming revenue from Digital Software & Network services alone, up ~38% yoy. ~50% ROIC.

36.4mn PlayStationPlus Subs.

$2.1bn music streaming revenue.

Bought back stock last year for the 1st time ever.

$SNE is probably an above average idea that& #39;s not cool enough to excite anyone. (I have no position, just turning rocks).

Roughly $50bn EV feels low-ish for everything you get! Shareholder yield ex stock price upside considering buybacks+dividend already seems decent!

Roughly $50bn EV feels low-ish for everything you get! Shareholder yield ex stock price upside considering buybacks+dividend already seems decent!

Not sure if old $SNE is in the public conscious like that, but the statement "Second biggest gaming company after Tencent", would be accurate.

And if I& #39;m not mistaken, they& #39;re the biggest "music company" out there.

And if I& #39;m not mistaken, they& #39;re the biggest "music company" out there.

$SNE ticks a lot of boxes. Gaming as a service, music streaming, image-sensors (IoT+EVs). Net-cash, profitable. Low multiples. Obvious value if unlocked from SOTP perspective. Buyback.

Maybe comparable to $MSFT couple years ago: people just stopped looking / taking it seriously.

Maybe comparable to $MSFT couple years ago: people just stopped looking / taking it seriously.

Something that currently goes through my head a lot is the thesis that music as such is mispriced.

E.g. I& #39;m quite sure that the music market size is rather irrelevant for $SPOT. It& #39;s simply human& #39;s time. One has to imagine billions of people "streaming" music many hours a day.

E.g. I& #39;m quite sure that the music market size is rather irrelevant for $SPOT. It& #39;s simply human& #39;s time. One has to imagine billions of people "streaming" music many hours a day.

Let& #39;s play another game of #MagicMerger. This time, we try to corner the music market.

It comes to mind:

$VIVHY ($35bn), $SNE (~$50bn for whole Sony!), $TME ($22bn), $SPOT ($25bn), $SIRI ($32bn)

There aren& #39;t that many music related public companies, right?

It comes to mind:

$VIVHY ($35bn), $SNE (~$50bn for whole Sony!), $TME ($22bn), $SPOT ($25bn), $SIRI ($32bn)

There aren& #39;t that many music related public companies, right?

Even if you just buy them all, it& #39;s still cheaper than $NFLX alone.

...Moat would be very strong if you merge labels with demand aggregators.

Just think about how the dynamic changes for $TME and $SPOT if $TCEHY buys UMG from $VIVHY.

...Moat would be very strong if you merge labels with demand aggregators.

Just think about how the dynamic changes for $TME and $SPOT if $TCEHY buys UMG from $VIVHY.

If "access to music" (ex live, e.g. concerts) was a single public company that you had to use if you want music, I believe its market cap would vastly exceed $100bn.

I think it& #39;s a no-brainer that subscribing to a music streaming service is a future must have. Tech is too good.

I think it& #39;s a no-brainer that subscribing to a music streaming service is a future must have. Tech is too good.

I also think that $AMZN, $AAPL and $GOOG can& #39;t win it all. People WANT consumer-facing companies to succeed that are not big tech. There& #39;s fatigue.

Think nobody mentioned such a thesis yet.

One example: Linux anti-movement maybe was strongest when $MSFT was super dominant.

Think nobody mentioned such a thesis yet.

One example: Linux anti-movement maybe was strongest when $MSFT was super dominant.

Not easy to be sure if $SPOT will be this future music mega cap (sth that I in fact do predict to exist in the future), but I& #39;m quite sure the market is wrong to let $SIRI trade on some current (irrelevant) earnings multiple and give it an EV of $32bn EV vs. $SPOT only $22.5bn.

Disclosure: Long $SPOT, $TME (both in small amounts), and $TCEHY.

I am aware of the $VIVHY thesis, but haven& #39;t done enough work on it yet, as I spent my time on $SPOT because it seems like the better long-term idea.

I think music is mispriced if you can buy it all for <$100bn.

I am aware of the $VIVHY thesis, but haven& #39;t done enough work on it yet, as I spent my time on $SPOT because it seems like the better long-term idea.

I think music is mispriced if you can buy it all for <$100bn.

If somebody has good recent buyside writeups in regard to $SNE, $TME or $VIVHY, please send! Would like to own $SNE if they would be split into gaming, music and so on and give me a timeline for that. At avg. gaming companies& #39; p/s, Sony Gaming would be a winner!

One last thing. If I was $FB, I would buy $SPOT pretty much regardless of price. It would be a ludicrous bargain anyway.

C& #39;mon, WhatsApp for $19bn and $SPOT basically the same price?

$FB would get what they need most: Coolness, utility and public goodwill.

C& #39;mon, WhatsApp for $19bn and $SPOT basically the same price?

$FB would get what they need most: Coolness, utility and public goodwill.

With $FB, $SPOT& #39;s user base would scale quickly.

$FB had an entrance into mass subscription revenue.

The non-advertisement part of $SPOT is a needed balance to $FB& #39;s ads.

Ads on $SPOT would reach bns, annoy, & here we go, $SPOT has many hundreds of millions of new paying subs.

$FB had an entrance into mass subscription revenue.

The non-advertisement part of $SPOT is a needed balance to $FB& #39;s ads.

Ads on $SPOT would reach bns, annoy, & here we go, $SPOT has many hundreds of millions of new paying subs.

$SPOT has a weird problem: They must be/seem as weak as possible versus the labels. So, no $ARPU expansion until the labels are weaker.

$FB can bridge that decade.

At some point, $SPOT ARPU should go higher because access to music is _certainly_ worth >>$120/y to the avg. human.

$FB can bridge that decade.

At some point, $SPOT ARPU should go higher because access to music is _certainly_ worth >>$120/y to the avg. human.

Also, $TCEHY is buying more $SPOT. Zuckerberg missing out on $SPOT in my opinion endangers the long-term success of $FB& #39;s platforms. (Also long $FB, no surprises). An integrated music offering is a killer feature.

Making $SPOT social would be another thing on it& #39;s own. See $TME.

Making $SPOT social would be another thing on it& #39;s own. See $TME.

There& #39;s zero debate about it, but to me, if Mark Zuckerberg doesn& #39;t buy $SPOT, I think this would be one of his biggest mistakes ever.

$SPOT into $FB instantly triples in value and ensures long-term happiness of users.

Connecting people without music = slow-death of platform.

$SPOT into $FB instantly triples in value and ensures long-term happiness of users.

Connecting people without music = slow-death of platform.

$SPOT has a very high chance to be worth much more in the future. Only thing that matters is future ARPU und future sub numbers.

Medium-term ARPU is very irrelevant.

Imo, downside is extremely limited because $FB doesn& #39;t have a music offering vs $AMZN, $GOOG, $AAPL.

Medium-term ARPU is very irrelevant.

Imo, downside is extremely limited because $FB doesn& #39;t have a music offering vs $AMZN, $GOOG, $AAPL.

Read on Twitter

Read on Twitter