How apps like Acorns hurt your savings and investing rate long term.

The answer is simple : Lack of discipline

These apps save and invest the difference from money already spent. You aren& #39;t creating any discipline or consistency.

The answer is simple : Lack of discipline

These apps save and invest the difference from money already spent. You aren& #39;t creating any discipline or consistency.

Ask yourself? What is your current savings and investing rate? Do you put money aside EVERY time you get paid?

Do you pay YOURSELF first?

No, you just save and invest left over change from dollars already spent and wonder why your account balance isn& #39;t growing.

Do you pay YOURSELF first?

No, you just save and invest left over change from dollars already spent and wonder why your account balance isn& #39;t growing.

Or you probably start savings challenges that have you saving some random amount of money daily/weekly that you never actually see through to finish.

If you want to start actually saving and investing thousands of dollars a year you MUST be disciplined and consistent.

If you want to start actually saving and investing thousands of dollars a year you MUST be disciplined and consistent.

Stick to a set amount EVERY time you get paid. Remember to ALWAYS pay yourself first.

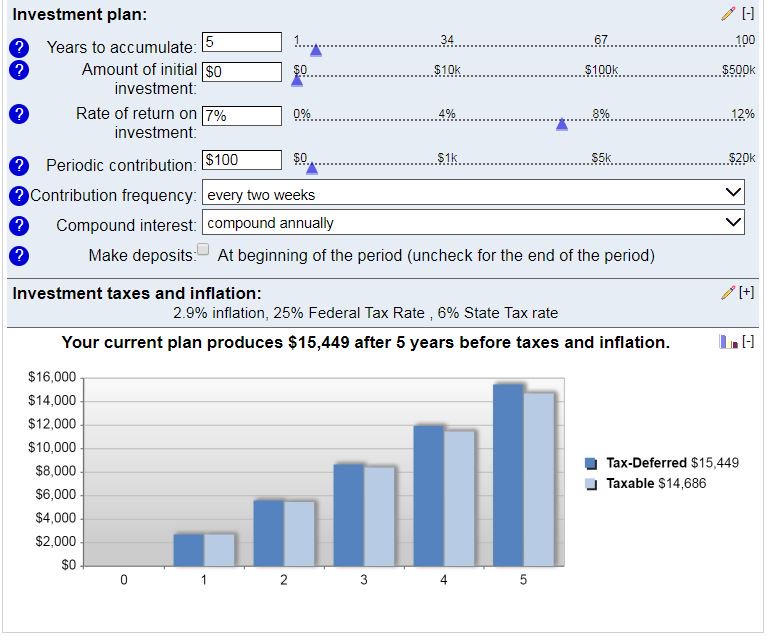

Saving money each check (biweekly, 26 times) goes a long way.

$50/chk = $1300/yr

$100/chk = $2600/yr

$125/chk = $3250/yr

$200/chk = $5200/yr

After 5yrs you saved

6.5K

13K

16.25K

26K

Saving money each check (biweekly, 26 times) goes a long way.

$50/chk = $1300/yr

$100/chk = $2600/yr

$125/chk = $3250/yr

$200/chk = $5200/yr

After 5yrs you saved

6.5K

13K

16.25K

26K

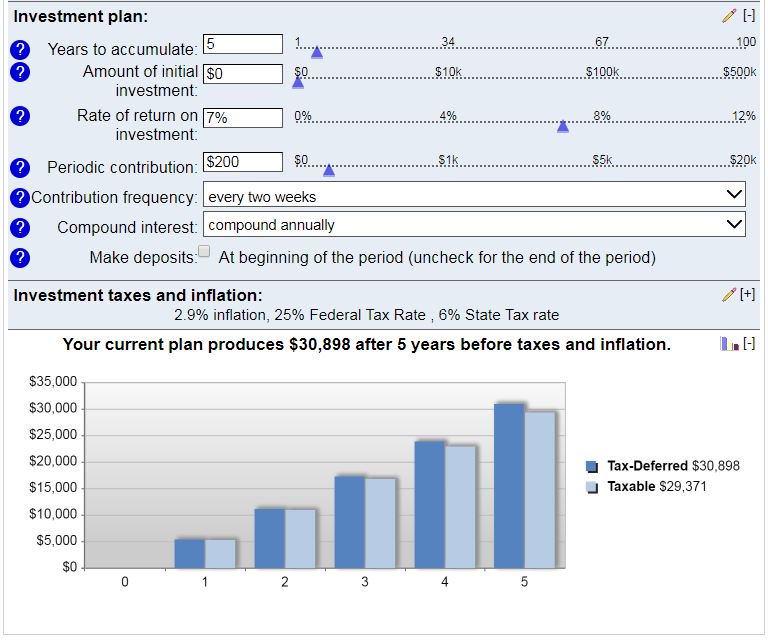

Investing money each check into a mutual fund goes even further due to compound interest

This is best for long term (5-10 yrs minimum)

Parents take advantage. You can start investing as soon as your kids are born. 18years worth of investing can fund college and then some.

This is best for long term (5-10 yrs minimum)

Parents take advantage. You can start investing as soon as your kids are born. 18years worth of investing can fund college and then some.

If you save $200/chk for 18 years you will have 93.6K.

If you invested that $200/chk into a mutual fund the tracks the S&P for 18yrs at 7% return instead you will have $182,675

If you invested that $200/chk into a mutual fund the tracks the S&P for 18yrs at 7% return instead you will have $182,675

If you want to learn about financial literacy and how to make saving/investing easy .

Check out my book Financial Starter Kit http://FinancialStarterKit.com"> http://FinancialStarterKit.com

Check out my book Financial Starter Kit http://FinancialStarterKit.com"> http://FinancialStarterKit.com

Read on Twitter

Read on Twitter