1: The global banking industry is showing signs of renewed health:

i. Deep capital reserves-Tier-1 capital is at decade-high ~12.6%.

ii. High liquidity: Loan-to-deposit ratio fell to~90%, as comp. to 120% in 2007

iii. Innovation: Investment in digital capabilities & partnerships

i. Deep capital reserves-Tier-1 capital is at decade-high ~12.6%.

ii. High liquidity: Loan-to-deposit ratio fell to~90%, as comp. to 120% in 2007

iii. Innovation: Investment in digital capabilities & partnerships

2: Banks have taken an axe to costs, yet profits remain elusive (falling ROE and P/B Multiples), leading to depressed valuations.

The unstoppable march of ‘Four Horsemen’ —Disintermediation, Commoditization, Unbundling/Rebundling, and Invisibility— continues.

The unstoppable march of ‘Four Horsemen’ —Disintermediation, Commoditization, Unbundling/Rebundling, and Invisibility— continues.

3: Technology is breaking up traditional value chains into new stacks.

—Traditional Model: Banks vertically integrated. Competition between banks with similar offerings.

—New Model: Modularization. Specialized service providers compete on product innovation and distribution.

—Traditional Model: Banks vertically integrated. Competition between banks with similar offerings.

—New Model: Modularization. Specialized service providers compete on product innovation and distribution.

4: Forcing rapid changes in playbook & operating models: From→ To:

- Short-term Profitability → Customer Obsession

- Mass Standardization → Mass Customization

- Limited Products →Diverse Products

- Channel Islands → Integrated Ecosystems

- Fragmented Products→Focused UX

- Short-term Profitability → Customer Obsession

- Mass Standardization → Mass Customization

- Limited Products →Diverse Products

- Channel Islands → Integrated Ecosystems

- Fragmented Products→Focused UX

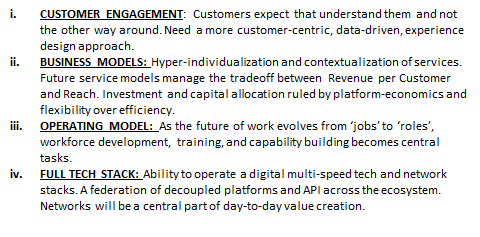

5: To succeed, a digital-bank needs to (re)design its operating DNA and build core capabilities around:

6: There are several independent strategies to build a digital bank:

i. Just a front-end, based on the existing core. No own license.

ii. Develop new front-end solutions on existing core and own products.

iii. Front-ends with own modern core banking, own products, and license

i. Just a front-end, based on the existing core. No own license.

ii. Develop new front-end solutions on existing core and own products.

iii. Front-ends with own modern core banking, own products, and license

7:

iv. Independent bank with own modern core. Proprietary and 3rd party products

v. BaaS i.e. Core banking products offered to the business, FinTechs, Telco& #39;s, No B2C.

vi. Open API’s for 3rd party developers, in order to focus only on core products

iv. Independent bank with own modern core. Proprietary and 3rd party products

v. BaaS i.e. Core banking products offered to the business, FinTechs, Telco& #39;s, No B2C.

vi. Open API’s for 3rd party developers, in order to focus only on core products

8: Neobanks are shaking up traditional banks’ business by offering exciting digital and customer-centric solutions. Digital disruption is the driver. Business-Model is a challenge for many. The jury is out on long-term economic viability and scale beyond early adopter base.

9: Several existing internet co.’s ‘greedily’ expanding into FinTech categories will be disappointed. Success demands a departure from today’s models and competencies to scale new growth models.

10: It helps to critically assess:

—Where to play?

—What network plays to follow?

—How to monetize ecosystem play?

—How to set up critical building blocks?

—How to solve for ‘trust’?

—Where to play?

—What network plays to follow?

—How to monetize ecosystem play?

—How to set up critical building blocks?

—How to solve for ‘trust’?

11: New growth models need a new approach, plan for profitability, and network investment. The new tech will create more equality and surplus.

Read on Twitter

Read on Twitter