1) We are already seeing ramifications from the pending $DHR acquisition of $GE Life Science. Merck KGaA announcing hostile bid for Versum Materials $VSM who had previously announced merger with Entegris $ENTG. https://www.reuters.com/article/us-versum-m-a-merck-kgaa/germanys-merck-makes-5-9-billion-cash-counterbid-for-versum-idUSKCN1QG1TN">https://www.reuters.com/article/u...

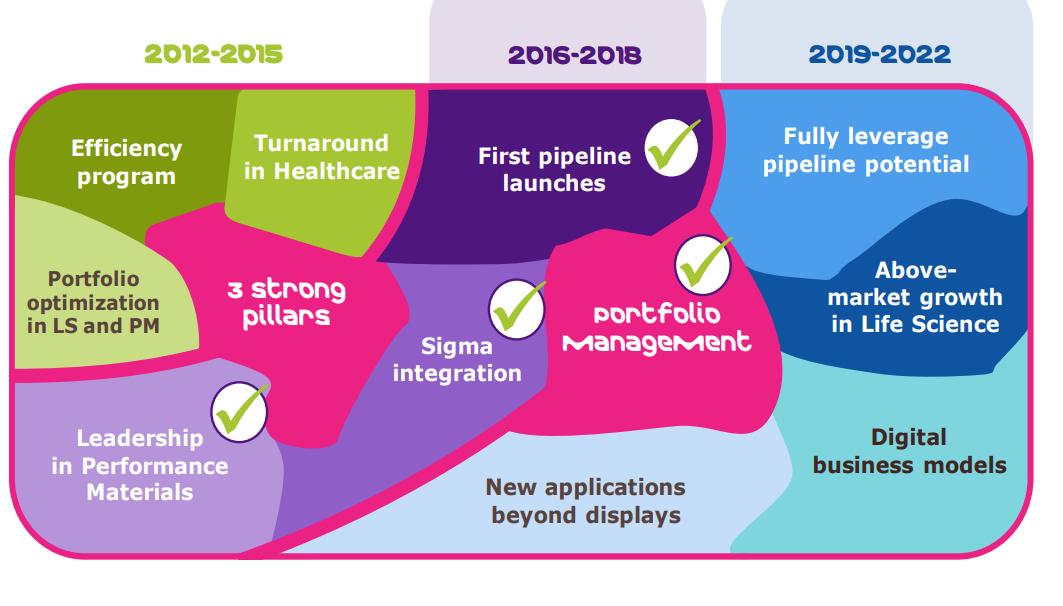

2) This deal pushes Merck deeper in material sciences, which ticks component of strategy to expand beyond OLED displays in material science. Question becomes does LS business possess scale to compete with $TMO $DHR?

3) Merck LS business generating ~$6b in Revenues. Research = 2.4b Applied = 1.6b Process = 2.2b. Process is best asset growing HSD/LDD annually and represents key assets from Sigma Aldrich and Millipore. Beneficiary of the BioProduction theme.

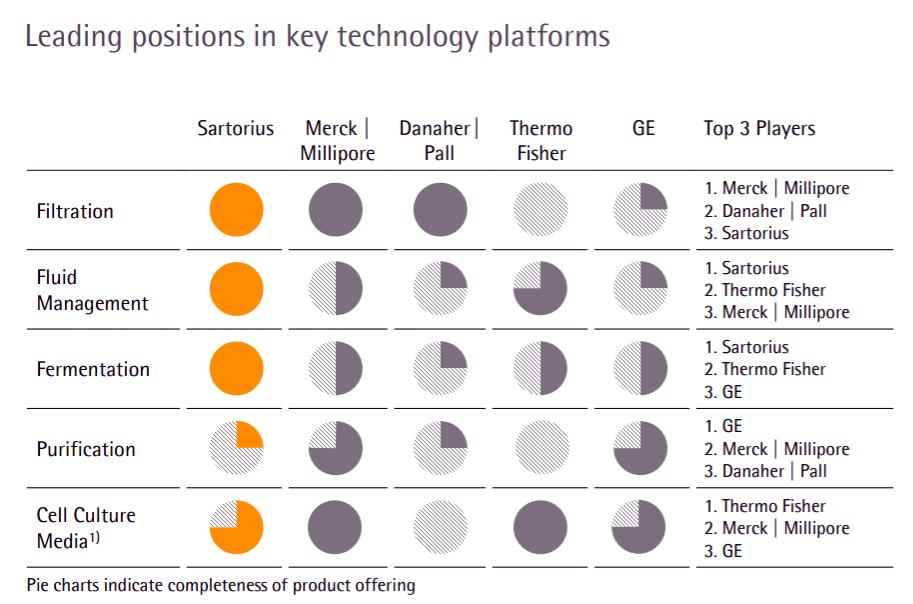

4) Danaher goes from filtration (Pall) and Single-Use bag (ATMI) to broad product offering in space. GE is leader in Protein A media (Purification), Wave Bioreactor (Fermentation), and Cell Culture Media from TMO divestiture.

5) Sidenote. The GE acquisition of TMO& #39;s Cell culture business probably had a phenomenal IRR.

https://www.reuters.com/article/us-thermofisher-sale-ge/thermo-fisher-sells-cell-culture-other-businesses-to-ge-idUSBREA050FS20140106?feedType=RSS&feedName=businessNews">https://www.reuters.com/article/u...

https://www.reuters.com/article/us-thermofisher-sale-ge/thermo-fisher-sells-cell-culture-other-businesses-to-ge-idUSBREA050FS20140106?feedType=RSS&feedName=businessNews">https://www.reuters.com/article/u...

6) Purification market is duopoly between GE and Merck with no possibility of a real challenge. $RGEN is entering market, but it will take years, if not decades, to challenge the Protein A purification market. So this leaves 4 areas of competition.

7) Sartorius can& #39;t be acquired until 2025-2027 because 50% of shares are held in Trust by family. This limits capital flexibility. They have aggressively acquired instruments in clinical trial space, but these acquisitions are small compared to deals done by peers.

8) $TMO has already moved to vertically integrate by acquiring Patheon, a drug manufacturer (CDMO), in 2017. Probably anti-trust concerns about them making large acquisition in this space. Limits them to bolt-ons.

Read on Twitter

Read on Twitter