Might have to do a thread on the WSJ editorial page views on monetary policy through the years https://twitter.com/realDonaldTrump/status/1075001077576151041">https://twitter.com/realDonal...

April 2008 https://www.wsj.com/articles/SB120934012927548363

"As">https://www.wsj.com/articles/... the Fed& #39;s open-market committee meets this week, what the world wants is a revival of American monetary leadership. It wants the Bernanke Fed to stop the global run on the dollar, and that means declaring an end to its rate-cutting mistake."

"As">https://www.wsj.com/articles/... the Fed& #39;s open-market committee meets this week, what the world wants is a revival of American monetary leadership. It wants the Bernanke Fed to stop the global run on the dollar, and that means declaring an end to its rate-cutting mistake."

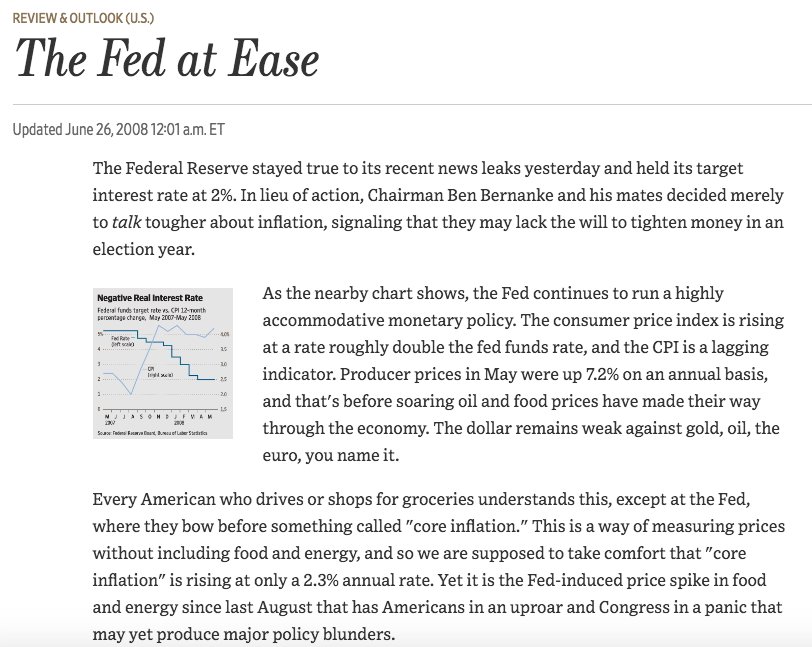

June 2008 https://www.wsj.com/articles/SB121262433590346895

"The">https://www.wsj.com/articles/... Fed& #39;s dollar indifference has sent an inflation shock through those dollar-linked economies...The result has been the largest decline in America& #39;s global economic influence since the 1970s."

"The">https://www.wsj.com/articles/... Fed& #39;s dollar indifference has sent an inflation shock through those dollar-linked economies...The result has been the largest decline in America& #39;s global economic influence since the 1970s."

May 2008 https://www.wsj.com/articles/SB121149903223015801

"...its">https://www.wsj.com/articles/... rate-cutting binge may finally be over, and we can be grateful for that small favor. The consequences of its easy-money bender will roll through the economy for years to come, however, so it& #39;s important to draw the right lessons."

"...its">https://www.wsj.com/articles/... rate-cutting binge may finally be over, and we can be grateful for that small favor. The consequences of its easy-money bender will roll through the economy for years to come, however, so it& #39;s important to draw the right lessons."

June 2008 https://www.wsj.com/articles/SB121400288407493271

"What">https://www.wsj.com/articles/... we can& #39;t figure out is what in the world Fed officials are thinking, assuming that& #39;s even the right word...Central banking isn& #39;t an academic seminar where ideas don& #39;t have consequences."

"What">https://www.wsj.com/articles/... we can& #39;t figure out is what in the world Fed officials are thinking, assuming that& #39;s even the right word...Central banking isn& #39;t an academic seminar where ideas don& #39;t have consequences."

June 2008 https://www.wsj.com/articles/SB121443727459905199

"All">https://www.wsj.com/articles/... of this is evidence that the Bernanke Fed has failed in its main responsibility of maintaining price stability and a stable dollar...It has been an historic blunder, and the damage will only increase the longer the Fed takes to correct it."

"All">https://www.wsj.com/articles/... of this is evidence that the Bernanke Fed has failed in its main responsibility of maintaining price stability and a stable dollar...It has been an historic blunder, and the damage will only increase the longer the Fed takes to correct it."

July 2008 https://www.wsj.com/articles/SB121503712865524297

"But">https://www.wsj.com/articles/... unlike the Fed and other central banks, the ECB seems determined to avoid the stagflation mistakes of the 1970s."

"But">https://www.wsj.com/articles/... unlike the Fed and other central banks, the ECB seems determined to avoid the stagflation mistakes of the 1970s."

July 2008 https://www.wsj.com/articles/SB121520989643629401

"...a">https://www.wsj.com/articles/... glimmer of good news this week: The European Central Bank raised its key interest rate a quarter point... On Thursday, oil hit $146 a barrel, leading us to wonder how high it has to go before Mr. Bernanke admits he has a problem. $200?"

"...a">https://www.wsj.com/articles/... glimmer of good news this week: The European Central Bank raised its key interest rate a quarter point... On Thursday, oil hit $146 a barrel, leading us to wonder how high it has to go before Mr. Bernanke admits he has a problem. $200?"

not The Editorial Board but an August 2008 op-ed https://twitter.com/WSJopinion/status/891726416">https://twitter.com/WSJopinio...

July 2008 https://www.wsj.com/articles/SB121625138777760125?mod=searchresults&page=5&pos=1

"[Bernanke,">https://www.wsj.com/articles/... Kohn, and Mishkin], the Fed& #39;s three intellectual amigos, continue to pursue a reckless policy of negative real interest rates...they have overestimated the risks of recession while underestimating the dangers of inflation."

"[Bernanke,">https://www.wsj.com/articles/... Kohn, and Mishkin], the Fed& #39;s three intellectual amigos, continue to pursue a reckless policy of negative real interest rates...they have overestimated the risks of recession while underestimating the dangers of inflation."

August 2008 https://www.wsj.com/articles/SB121754827357702771?mod=searchresults&page=3&pos=8

"We">https://www.wsj.com/articles/... now know the economy& #39;s weakest point was the fourth quarter of 2007 into early 2008...By tanking the dollar and igniting a commodity spike, however, the Fed has made the recovery more difficult and lengthened the period of malaise ahead."

"We">https://www.wsj.com/articles/... now know the economy& #39;s weakest point was the fourth quarter of 2007 into early 2008...By tanking the dollar and igniting a commodity spike, however, the Fed has made the recovery more difficult and lengthened the period of malaise ahead."

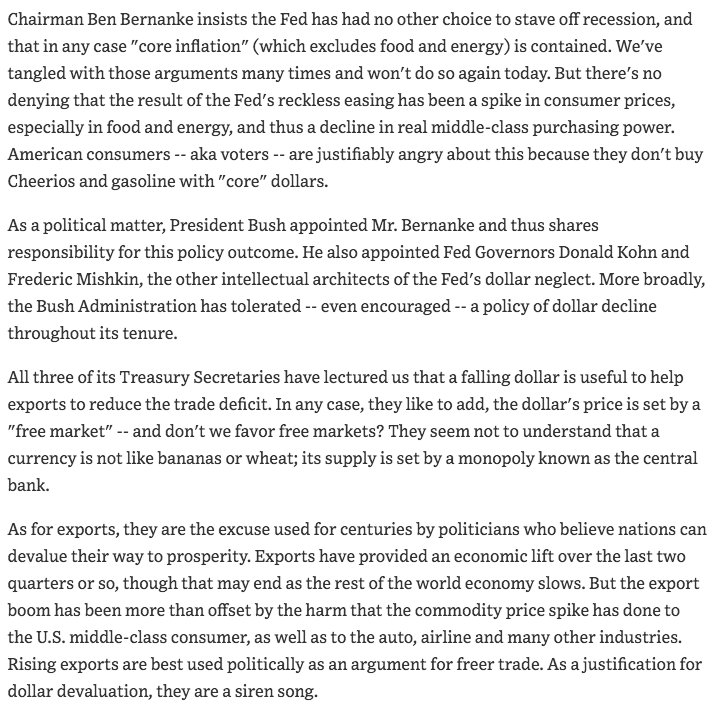

September 2008 https://www.wsj.com/articles/SB122048621675397153?mod=searchresults&page=22&pos=3

"Bernanke">https://www.wsj.com/articles/... insists the Fed has had no other choice to stave off recession, and that in any case "core inflation" (which excludes food and energy) is contained....American consumers... don& #39;t buy Cheerios and gasoline with "core" dollars."

"Bernanke">https://www.wsj.com/articles/... insists the Fed has had no other choice to stave off recession, and that in any case "core inflation" (which excludes food and energy) is contained....American consumers... don& #39;t buy Cheerios and gasoline with "core" dollars."

September 2008 https://www.wsj.com/articles/SB122212660379865213?mod=searchresults&page=18&pos=6

"Mr.">https://www.wsj.com/articles/... Bernanke should add that America& #39;s central bank will do whatever it takes to support the dollar. Especially amid current financial strains, we need investors to favor U.S. assets."

"Mr.">https://www.wsj.com/articles/... Bernanke should add that America& #39;s central bank will do whatever it takes to support the dollar. Especially amid current financial strains, we need investors to favor U.S. assets."

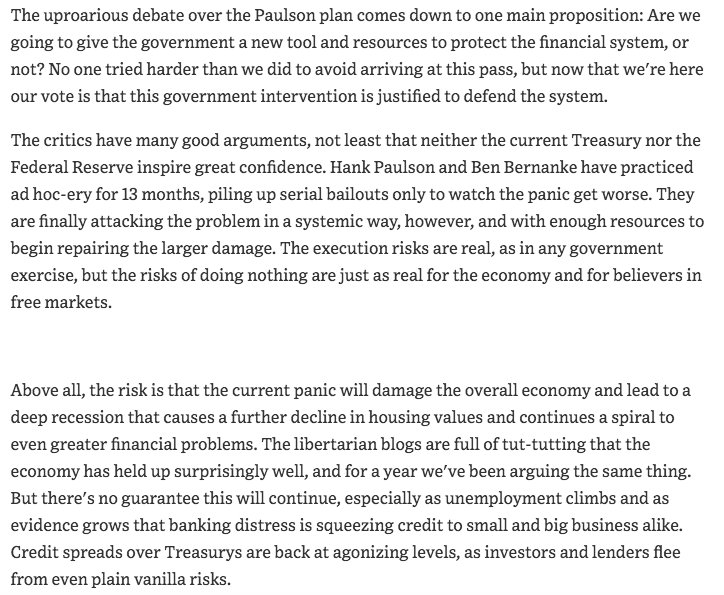

September 2008 https://www.wsj.com/articles/SB122246990185780719?mod=searchresults&page=15&pos=7

"libertarian">https://www.wsj.com/articles/... blogs are full of tut-tutting that the economy has held up surprisingly well, and for a year we& #39;ve been arguing the same thing. But there& #39;s no guarantee this will continue..."

"libertarian">https://www.wsj.com/articles/... blogs are full of tut-tutting that the economy has held up surprisingly well, and for a year we& #39;ve been arguing the same thing. But there& #39;s no guarantee this will continue..."

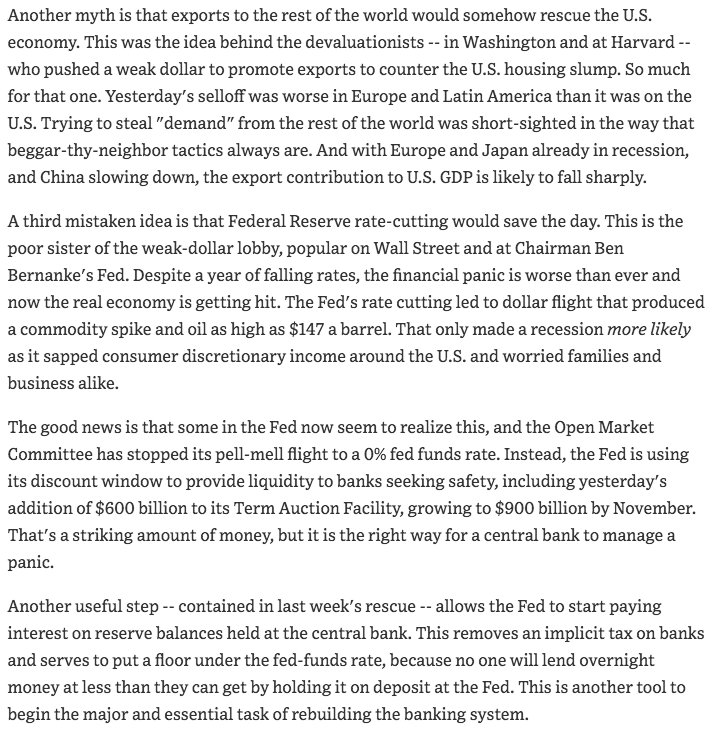

October 2008 https://www.wsj.com/articles/SB122333795053409751?mod=searchresults&page=14&pos=4

"Fed& #39;s">https://www.wsj.com/articles/... rate cutting led to dollar flight that produced a commodity spike and oil as high as $147 a barrel. That only made a recession more likely as it sapped consumer discretionary income around the U.S. and worried families and business"

"Fed& #39;s">https://www.wsj.com/articles/... rate cutting led to dollar flight that produced a commodity spike and oil as high as $147 a barrel. That only made a recession more likely as it sapped consumer discretionary income around the U.S. and worried families and business"

October 2008 https://www.wsj.com/articles/SB122455027730552509?mod=searchresults&page=9&pos=19

"We">https://www.wsj.com/articles/... can remember when tougher Fed chairmen used to refrain from adjusting interest rates close to an election for fear of seeming to be political; they would never have dreamed of meddling in campaign tax and spending debates."

"We">https://www.wsj.com/articles/... can remember when tougher Fed chairmen used to refrain from adjusting interest rates close to an election for fear of seeming to be political; they would never have dreamed of meddling in campaign tax and spending debates."

October 2008 https://www.wsj.com/articles/SB122480934587765107?mod=searchresults&page=8&pos=20

"Reckless">https://www.wsj.com/articles/... monetary policy that did so much to create the credit mania and then compounded the felony with a commodity bubble and run on the dollar whose damage is now becoming apparent."

"Reckless">https://www.wsj.com/articles/... monetary policy that did so much to create the credit mania and then compounded the felony with a commodity bubble and run on the dollar whose damage is now becoming apparent."

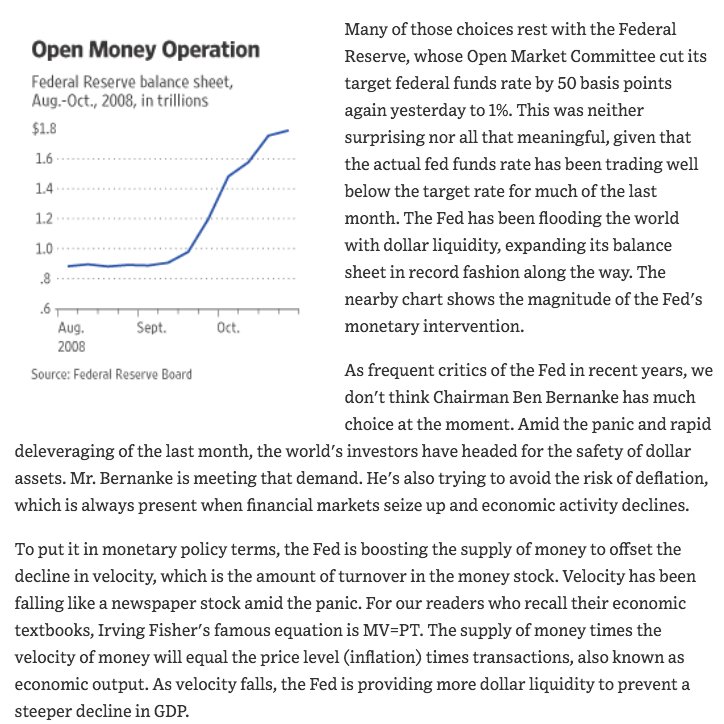

October 2008 https://www.wsj.com/articles/SB122533077030882861?mod=searchresults&page=8&pos=3

"As">https://www.wsj.com/articles/... frequent critics of the Fed in recent years, we don& #39;t think Chairman Ben Bernanke has much choice at the moment."

"As">https://www.wsj.com/articles/... frequent critics of the Fed in recent years, we don& #39;t think Chairman Ben Bernanke has much choice at the moment."

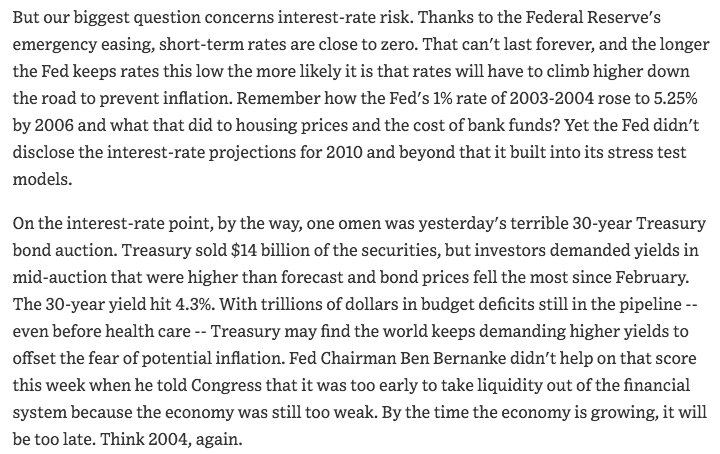

December 2008 https://www.wsj.com/articles/SB122843659214281369?mod=searchresults&page=3&pos=6">https://www.wsj.com/articles/...

"Better choices [for New York Fed President vacancy] would include current Fed Governor Kevin Warsh...or Dallas& #39;s Richard Fisher, who ... dissented from the policy that created the 2007-2008 Bernanke oil and commodity spike."

"Better choices [for New York Fed President vacancy] would include current Fed Governor Kevin Warsh...or Dallas& #39;s Richard Fisher, who ... dissented from the policy that created the 2007-2008 Bernanke oil and commodity spike."

December 2008 https://www.wsj.com/articles/SB122948091644013041?mod=searchresults&page=2&pos=5

"If">https://www.wsj.com/articles/... Ben Bernanke weren& #39;t an economist and central banker, we& #39;d guess he& #39;d be a poker player on one of those cable channels, with dark shades and a penchant for betting all his chips in Texas Hold & #39;Em."

"If">https://www.wsj.com/articles/... Ben Bernanke weren& #39;t an economist and central banker, we& #39;d guess he& #39;d be a poker player on one of those cable channels, with dark shades and a penchant for betting all his chips in Texas Hold & #39;Em."

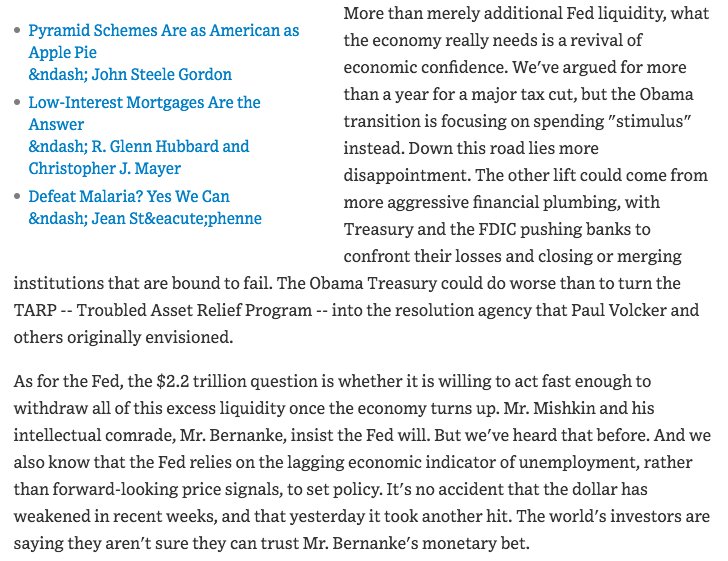

December 2008 https://www.wsj.com/articles/SB122965017184420567?mod=searchresults&page=1&pos=19

"Bernanke& #39;s">https://www.wsj.com/articles/... decision to flood the world with dollars will no doubt succeed in preventing a deflation. What everyone wants to know is whether he also has the fortitude -- or even the desire -- to prevent a run on the world& #39;s reserve currency"

"Bernanke& #39;s">https://www.wsj.com/articles/... decision to flood the world with dollars will no doubt succeed in preventing a deflation. What everyone wants to know is whether he also has the fortitude -- or even the desire -- to prevent a run on the world& #39;s reserve currency"

January 2009 https://www.wsj.com/articles/SB123085958750448009?mod=searchresults&page=7&pos=7

"The">https://www.wsj.com/articles/... current financial storm has also shown the benefits of a common currency."

"The">https://www.wsj.com/articles/... current financial storm has also shown the benefits of a common currency."

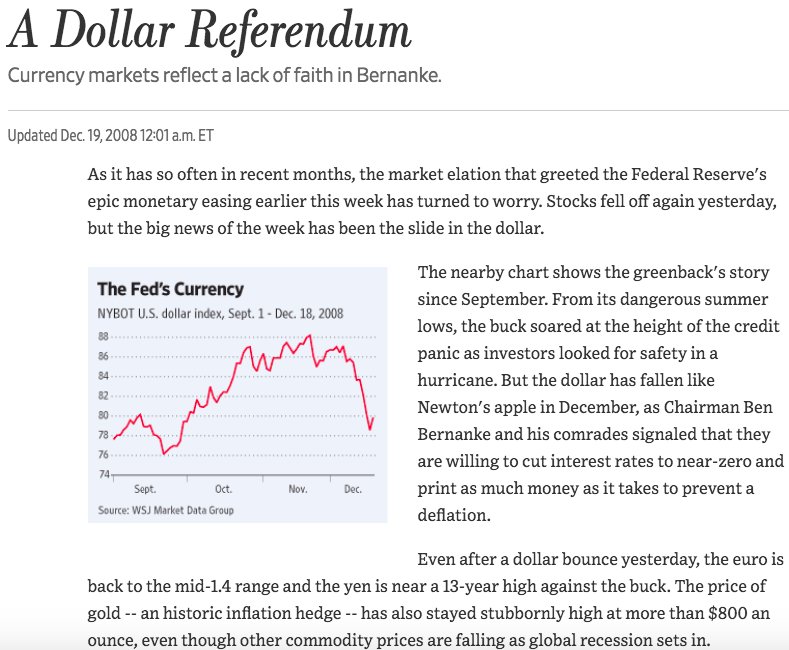

March 2009 https://www.wsj.com/articles/SB123750959910890623?mod=searchresults&page=6&pos=2

"The">https://www.wsj.com/articles/... Bernanke Fed has now dropped even the pretense of independence and has made itself an agent of the Treasury, which means of politicians."

"The">https://www.wsj.com/articles/... Bernanke Fed has now dropped even the pretense of independence and has made itself an agent of the Treasury, which means of politicians."

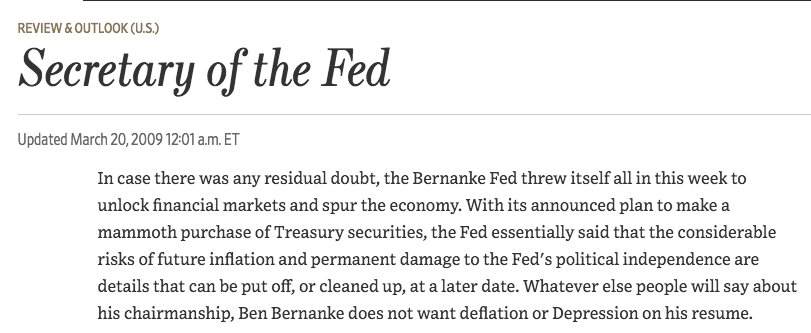

May 2009 https://www.wsj.com/articles/SB124173868341998567?mod=searchresults&page=15&pos=9

"With">https://www.wsj.com/articles/... trillions of dollars in budget deficits still in the pipeline -- even before health care -- Treasury may find the world keeps demanding higher yields to offset the fear of potential inflation."

"With">https://www.wsj.com/articles/... trillions of dollars in budget deficits still in the pipeline -- even before health care -- Treasury may find the world keeps demanding higher yields to offset the fear of potential inflation."

May 2009 https://www.wsj.com/articles/SB124199861037904931?mod=searchresults&page=15&pos=8

"Mr.">https://www.wsj.com/articles/... Kohn and Chairman Ben Bernanke have made the Fed an arm of the Treasury over the last 18 months...for all the harm he has done to the Fed& #39;s political independence, Mr. Kohn should resign too."

"Mr.">https://www.wsj.com/articles/... Kohn and Chairman Ben Bernanke have made the Fed an arm of the Treasury over the last 18 months...for all the harm he has done to the Fed& #39;s political independence, Mr. Kohn should resign too."

May 2009 https://www.wsj.com/articles/SB124208327133908471?mod=searchresults&page=15&pos=3

"The">https://www.wsj.com/articles/... Fed& #39;s loose policy from 2003 to 2005 created the commodity and credit bubbles that made these countries flush with dollars...these countries then recycled those dollars back into dollar-denominated assets, such as Treasurys and [GSE debt]"

"The">https://www.wsj.com/articles/... Fed& #39;s loose policy from 2003 to 2005 created the commodity and credit bubbles that made these countries flush with dollars...these countries then recycled those dollars back into dollar-denominated assets, such as Treasurys and [GSE debt]"

Not an editorial but https://twitter.com/WSJopinion/status/1889725151">https://twitter.com/WSJopinio...

May 2009 https://www.wsj.com/articles/SB124347148949660783?mod=searchresults&page=14&pos=2

"It& #39;s">https://www.wsj.com/articles/... not going too far to say we are watching a showdown between Fed Chairman Ben Bernanke and bond investors, otherwise known as the financial markets. When in doubt, bet on the markets."

"It& #39;s">https://www.wsj.com/articles/... not going too far to say we are watching a showdown between Fed Chairman Ben Bernanke and bond investors, otherwise known as the financial markets. When in doubt, bet on the markets."

June 2009 https://www.wsj.com/articles/SB124407271719283173?mod=searchresults&page=13&pos=5

"The">https://www.wsj.com/articles/... warning that Mrs. Merkel -- and China and the financial markets -- is sounding is whether the Fed will have the political courage to start removing that liquidity even if the unemployment rate is high, and before it creates another mess."

"The">https://www.wsj.com/articles/... warning that Mrs. Merkel -- and China and the financial markets -- is sounding is whether the Fed will have the political courage to start removing that liquidity even if the unemployment rate is high, and before it creates another mess."

We interrupt this programming to say  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤣" title="Rolling on the floor laughing" aria-label="Emoji: Rolling on the floor laughing">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤣" title="Rolling on the floor laughing" aria-label="Emoji: Rolling on the floor laughing"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤣" title="Rolling on the floor laughing" aria-label="Emoji: Rolling on the floor laughing">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤣" title="Rolling on the floor laughing" aria-label="Emoji: Rolling on the floor laughing"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤣" title="Rolling on the floor laughing" aria-label="Emoji: Rolling on the floor laughing"> re:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤣" title="Rolling on the floor laughing" aria-label="Emoji: Rolling on the floor laughing"> re:

"Usually when a politician lobbies a central bank, it& #39;s to demand easier money. We can& #39;t recall a similar tight-money intervention from a national leader, save perhaps Ronald Reagan& #39;s quiet support for Paul Volcker in the 1980s."

"Usually when a politician lobbies a central bank, it& #39;s to demand easier money. We can& #39;t recall a similar tight-money intervention from a national leader, save perhaps Ronald Reagan& #39;s quiet support for Paul Volcker in the 1980s."

June 2009 https://www.wsj.com/articles/SB124572415681540109?mod=searchresults&page=10&pos=18

"Mr.">https://www.wsj.com/articles/... Bernanke will need political courage that we haven& #39;t seen since Paul Volcker was Chairman in order to exit from all of these efforts in time to prevent another bubble or broader inflation."

"Mr.">https://www.wsj.com/articles/... Bernanke will need political courage that we haven& #39;t seen since Paul Volcker was Chairman in order to exit from all of these efforts in time to prevent another bubble or broader inflation."

July 2009 https://www.wsj.com/articles/SB10001424052970203946904574302524030510570?mod=searchresults&page=7&pos=11

"Congress">https://www.wsj.com/articles/... and the White House want the Fed to stay easy as long as unemployment stays high. But if the Fed does so, it will run the risk of acting too late, well after inflation expectations have begun to build."

"Congress">https://www.wsj.com/articles/... and the White House want the Fed to stay easy as long as unemployment stays high. But if the Fed does so, it will run the risk of acting too late, well after inflation expectations have begun to build."

July 2009 https://www.wsj.com/articles/SB10001424052970203609204574316460622633026?mod=searchresults&page=6&pos=2

"The">https://www.wsj.com/articles/... Customer Is Right: Mr. Obama should listen to Chinese warnings on the dollar."

"The">https://www.wsj.com/articles/... Customer Is Right: Mr. Obama should listen to Chinese warnings on the dollar."

August 2009 https://www.wsj.com/articles/SB10001424052970203863204574346793914454028?mod=searchresults&page=4&pos=11

"We& #39;re">https://www.wsj.com/articles/... beginning to wonder if the Ben Bernanke Federal Reserve isn& #39;t populated with French existentialists. A la Jean-Paul Sartre, they have a & #39;no exit strategy when it comes to unwinding their extraordinarily easy monetary policy."

"We& #39;re">https://www.wsj.com/articles/... beginning to wonder if the Ben Bernanke Federal Reserve isn& #39;t populated with French existentialists. A la Jean-Paul Sartre, they have a & #39;no exit strategy when it comes to unwinding their extraordinarily easy monetary policy."

August 2009 https://www.wsj.com/articles/SB10001424052970203706604574372384193773524?mod=searchresults&page=1&pos=14

"It& #39;s">https://www.wsj.com/articles/... notable that both Mr. Obama and Mr. Bernanke used the very same language yesterday in pledging a & #39;strong and independent Federal Reserve.& #39; They both protest too much."

"It& #39;s">https://www.wsj.com/articles/... notable that both Mr. Obama and Mr. Bernanke used the very same language yesterday in pledging a & #39;strong and independent Federal Reserve.& #39; They both protest too much."

September 2009 https://www.wsj.com/articles/SB10001424052970203440104574401212809493056

(a">https://www.wsj.com/articles/... strange one to quote because it is written in the voice of the Chinese Ministry of Finance mocking Bernanke: "We will only be too happy to cease this flight from dollar assets when we observe your determination to tighten money")

(a">https://www.wsj.com/articles/... strange one to quote because it is written in the voice of the Chinese Ministry of Finance mocking Bernanke: "We will only be too happy to cease this flight from dollar assets when we observe your determination to tighten money")

November 2009 https://www.wsj.com/articles/SB10001424052748704431804574540052282519972?mod=searchresults&page=8&pos=20

"President">https://www.wsj.com/articles/... Obama reinforced that message in Tokyo Saturday when he called for "balanced trade," which suggests a weaker greenback to spur U.S. exports...This is a dangerous game that could lead to some serious economic policy mistakes"

"President">https://www.wsj.com/articles/... Obama reinforced that message in Tokyo Saturday when he called for "balanced trade," which suggests a weaker greenback to spur U.S. exports...This is a dangerous game that could lead to some serious economic policy mistakes"

December 2009 https://www.wsj.com/articles/SB10001424052748704107104574572160340353006?mod=searchresults&page=4&pos=20">https://www.wsj.com/articles/...

"At this monetary moment more than any since the late 1970s, the Fed needs a hard-money chairman with the courage and credibility to resist the temptation to escape from the consequences of the last bubble by floating another one."

"At this monetary moment more than any since the late 1970s, the Fed needs a hard-money chairman with the courage and credibility to resist the temptation to escape from the consequences of the last bubble by floating another one."

December 2009 https://www.wsj.com/articles/SB10001424052748704869304574596092863514668?mod=searchresults&page=2&pos=20">https://www.wsj.com/articles/...

December 2009 https://www.wsj.com/articles/SB10001424052748704398304574598540224337478?mod=searchresults&page=2&pos=15

"someone">https://www.wsj.com/articles/... at the Fed will point out that if you remove food and energy...then producer prices rose by only 0.5%... this is the same "core" price rationalization the Fed used earlier this decade to keep monetary policy too easy for too long."

"someone">https://www.wsj.com/articles/... at the Fed will point out that if you remove food and energy...then producer prices rose by only 0.5%... this is the same "core" price rationalization the Fed used earlier this decade to keep monetary policy too easy for too long."

January 2010 https://www.wsj.com/articles/SB10001424052748704562504575021704013095196?mod=searchresults&page=14&pos=18

"The">https://www.wsj.com/articles/... Democrats& #39; loudest complaint, moreover, is that Mr. Bernanke and the Fed haven& #39;t been easy enough in printing money...Is the Fed going to buy another $1.25 trillion, or promise to keep rates at zero for another 14 months?"

"The">https://www.wsj.com/articles/... Democrats& #39; loudest complaint, moreover, is that Mr. Bernanke and the Fed haven& #39;t been easy enough in printing money...Is the Fed going to buy another $1.25 trillion, or promise to keep rates at zero for another 14 months?"

March 2010 https://www.wsj.com/articles/SB10001424052748704131404575117963299838340?mod=searchresults&page=3&pos=10

"Ms.">https://www.wsj.com/articles/... Yellen& #39;s default policy has always been to keep money as easy as possible for as long as possible to reduce unemployment... If that means taking some risks of price spikes in oil or other assets, or of future inflation, so be it."

"Ms.">https://www.wsj.com/articles/... Yellen& #39;s default policy has always been to keep money as easy as possible for as long as possible to reduce unemployment... If that means taking some risks of price spikes in oil or other assets, or of future inflation, so be it."

May 2010 https://www.wsj.com/articles/SB10001424052748704026204575265931382482878

"Ben">https://www.wsj.com/articles/... Bernanke might want to ask the Japanese how their efforts to fight deflation worked out."

"Ben">https://www.wsj.com/articles/... Bernanke might want to ask the Japanese how their efforts to fight deflation worked out."

June 2010 https://www.wsj.com/articles/SB10001424052748704289504575312080651478488?mod=searchresults&page=2&pos=11

"Asian">https://www.wsj.com/articles/... policy makers are right to blame Fed Chairman Ben Bernanke, President Obama and the U.S. Congress...for not maintaining the greenback as the stable spine of the global dollar bloc."

"Asian">https://www.wsj.com/articles/... policy makers are right to blame Fed Chairman Ben Bernanke, President Obama and the U.S. Congress...for not maintaining the greenback as the stable spine of the global dollar bloc."

June 2010 https://www.wsj.com/articles/SB10001424052748704575304575297130299281828

"But">https://www.wsj.com/articles/... Ms. Waters and the House are hunting bigger game—to wit, the political allocation of credit."

"But">https://www.wsj.com/articles/... Ms. Waters and the House are hunting bigger game—to wit, the political allocation of credit."

August 2010 https://www.wsj.com/articles/SB10001424052748704388504575419231591024478?mod=searchresults&page=10&pos=19

"the">https://www.wsj.com/articles/... politicians and the Wall Street Keynesians who cheered the stimulus are asking the Federal Reserve to save the day. Mr. Bernanke should tell them..his job is to maintain a stable price level, not to turn bad policy into wine."

"the">https://www.wsj.com/articles/... politicians and the Wall Street Keynesians who cheered the stimulus are asking the Federal Reserve to save the day. Mr. Bernanke should tell them..his job is to maintain a stable price level, not to turn bad policy into wine."

https://twitter.com/WSJopinion/status/20836989581">https://twitter.com/WSJopinio...

October 2010 https://www.wsj.com/articles/SB10001424052748704483004575523822949744704?mod=searchresults&page=22&pos=12

"The">https://www.wsj.com/articles/... growing danger today is currency protectionism...For a decade, U.S. financial officials have behaved as if they don& #39;t believe U.S. monetary policy has any impact on the rest of the world."

"The">https://www.wsj.com/articles/... growing danger today is currency protectionism...For a decade, U.S. financial officials have behaved as if they don& #39;t believe U.S. monetary policy has any impact on the rest of the world."

October 2010 https://www.wsj.com/articles/SB10001424052748703726404575533513195774270?mod=searchresults&page=22&pos=6

"Ultra-low">https://www.wsj.com/articles/... interest rates or even aggressive quantitative easing aren& #39;t inherently crazy...But Japan is suffering now because its monetary policy has never quite moved out of the & #39;emergency phases& #39;..."

"Ultra-low">https://www.wsj.com/articles/... interest rates or even aggressive quantitative easing aren& #39;t inherently crazy...But Japan is suffering now because its monetary policy has never quite moved out of the & #39;emergency phases& #39;..."

October 2010 https://www.wsj.com/articles/SB10001424052748703735804575535791390597042?mod=searchresults&page=20&pos=18

"& #39;There">https://www.wsj.com/articles/... is no validity whatever in the idea that any inflation, once accepted, can be confined to moderate proportions,& #39; [McChesney Martin] thundered, in a warning that would be vindicated...That& #39;s a warning as well for the QE Street Band."

"& #39;There">https://www.wsj.com/articles/... is no validity whatever in the idea that any inflation, once accepted, can be confined to moderate proportions,& #39; [McChesney Martin] thundered, in a warning that would be vindicated...That& #39;s a warning as well for the QE Street Band."

October 2010 https://www.wsj.com/articles/SB10001424052748704300604575554220786642124?mod=searchresults&page=18&pos=2

"Mr.">https://www.wsj.com/articles/... Bernanke& #39;s message couldn& #39;t be clearer that cutting the U.S. jobless rate is now Job One at the Fed...If other currencies soar in relation to the dollar, that& #39;s someone else& #39;s problem."

"Mr.">https://www.wsj.com/articles/... Bernanke& #39;s message couldn& #39;t be clearer that cutting the U.S. jobless rate is now Job One at the Fed...If other currencies soar in relation to the dollar, that& #39;s someone else& #39;s problem."

November 2010 https://www.wsj.com/articles/SB10001424052748703506904575592591109709212?mod=searchresults&page=13&pos=6

"Where">https://www.wsj.com/articles/... this all stops nobody knows, including, we suspect, the Fed itself. In our experience, central bankers who demand more inflation usually get it, sometimes more than they wanted."

"Where">https://www.wsj.com/articles/... this all stops nobody knows, including, we suspect, the Fed itself. In our experience, central bankers who demand more inflation usually get it, sometimes more than they wanted."

November 2010 https://www.wsj.com/articles/SB10001424052748703514904575602231815453378?mod=searchresults&page=12&pos=1

"According">https://www.wsj.com/articles/... to the prepared text of remarks that she released to National Review online, Mrs. Palin also exhibited a more sophisticated knowledge of monetary policy than any major Republican this side of Wisconsin Representative Paul Ryan."

"According">https://www.wsj.com/articles/... to the prepared text of remarks that she released to National Review online, Mrs. Palin also exhibited a more sophisticated knowledge of monetary policy than any major Republican this side of Wisconsin Representative Paul Ryan."

November 2010 https://www.wsj.com/articles/SB10001424052748704462704575609770024501384?mod=searchresults&page=10&pos=20

"Mr.">https://www.wsj.com/articles/... Obama may come to regret his political embrace of Fed Chairman Ben Bernanke if commodity price increases flow through to consumer prices and leave Americans feeling poorer than they already feel."

"Mr.">https://www.wsj.com/articles/... Obama may come to regret his political embrace of Fed Chairman Ben Bernanke if commodity price increases flow through to consumer prices and leave Americans feeling poorer than they already feel."

November 2010 https://www.wsj.com/articles/SB10001424052748704648604575620522989880684

"[ECB& #39;s">https://www.wsj.com/articles/... founders] explicitly rejected the dual mandate in favor of a single goal of price stability. The ECB has performed far better than the Fed over the last decade by following that single lodestar."

"[ECB& #39;s">https://www.wsj.com/articles/... founders] explicitly rejected the dual mandate in favor of a single goal of price stability. The ECB has performed far better than the Fed over the last decade by following that single lodestar."

December 2010 https://www.wsj.com/articles/SB10001424052748703727804576017340607287086

"the">https://www.wsj.com/articles/... Fed should announce an early end to QE2 and its intention to return as quickly as possible to a more normal interest rate environment...the best way to nurture the economy to a durable expansion is with a return to monetary normalcy."

"the">https://www.wsj.com/articles/... Fed should announce an early end to QE2 and its intention to return as quickly as possible to a more normal interest rate environment...the best way to nurture the economy to a durable expansion is with a return to monetary normalcy."

January 2011 https://www.wsj.com/articles/SB10001424052748703396604576088103825881970?mod=searchresults&page=8&pos=9

"Perhaps">https://www.wsj.com/articles/... Mr. Bernanke is wise enough to know when to return to normal policy.But if he misjudges and the Fed needs new leadership to restore its credibility, we should recall that Mr. Plosser was one of those pointing in the right direction."

"Perhaps">https://www.wsj.com/articles/... Mr. Bernanke is wise enough to know when to return to normal policy.But if he misjudges and the Fed needs new leadership to restore its credibility, we should recall that Mr. Plosser was one of those pointing in the right direction."

February 2011 https://www.wsj.com/articles/SB10001424052748704709304576124132413782592?mod=searchresults&page=3&pos=5

"Friday& #39;s">https://www.wsj.com/articles/... resignation of Fed Governor Kevin Warsh, one of the board& #39;s inflation watchdogs, means that Mr. Bernanke& #39;s easy-money inclinations will have even fewer internal checks."

"Friday& #39;s">https://www.wsj.com/articles/... resignation of Fed Governor Kevin Warsh, one of the board& #39;s inflation watchdogs, means that Mr. Bernanke& #39;s easy-money inclinations will have even fewer internal checks."

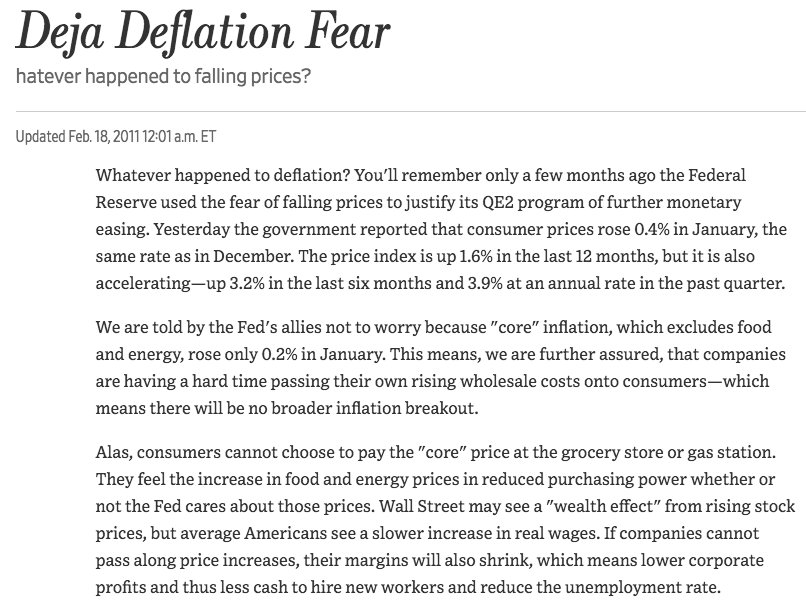

February 2011 https://www.wsj.com/articles/SB10001424052748704657704576150501497853690?mod=searchresults&page=2&pos=14

"We">https://www.wsj.com/articles/... are told by the Fed& #39;s allies not to worry because & #39;core& #39; inflation, which excludes food and energy, rose only 0.2% in January...Alas, consumers cannot choose to pay the & #39;core& #39; price at the grocery store or gas station."

"We">https://www.wsj.com/articles/... are told by the Fed& #39;s allies not to worry because & #39;core& #39; inflation, which excludes food and energy, rose only 0.2% in January...Alas, consumers cannot choose to pay the & #39;core& #39; price at the grocery store or gas station."

February 2011 https://www.wsj.com/articles/SB10001424052748703775704576162533772791142?mod=searchresults&page=1&pos=15

"If">https://www.wsj.com/articles/... the President wants to reduce the chances of an even bigger oil price spike, we& #39;d suggest that his Treasury Secretary advise Mr. Bernanke to pull the plug on QE2 and return to a normal monetary policy."

"If">https://www.wsj.com/articles/... the President wants to reduce the chances of an even bigger oil price spike, we& #39;d suggest that his Treasury Secretary advise Mr. Bernanke to pull the plug on QE2 and return to a normal monetary policy."

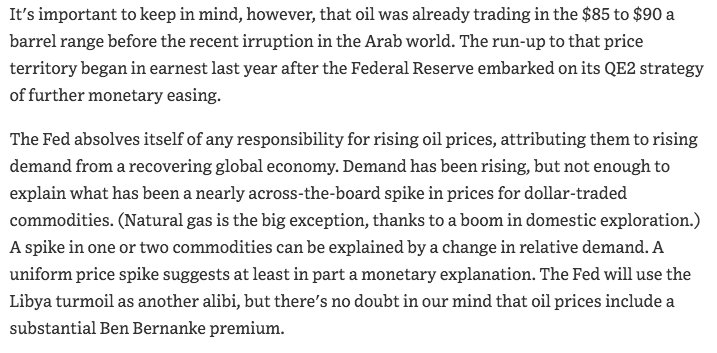

March 2011 https://www.wsj.com/articles/SB10001424052748704893604576199113452719274?mod=searchresults&page=29&pos=12

"Wall">https://www.wsj.com/articles/... Street and Congress may love the Fed& #39;s free-money policy, but Mr. Dudley and Chairman Ben Bernanke ought to worry about losing the confidence of the middle class."

"Wall">https://www.wsj.com/articles/... Street and Congress may love the Fed& #39;s free-money policy, but Mr. Dudley and Chairman Ben Bernanke ought to worry about losing the confidence of the middle class."

April 2011 https://www.wsj.com/articles/SB10001424052748703712504576236723956790418?mod=searchresults&page=26&pos=11

"This">https://www.wsj.com/articles/... great reflation has helped lift the recovery but at the cost of higher prices that are now eating into American incomes."

"This">https://www.wsj.com/articles/... great reflation has helped lift the recovery but at the cost of higher prices that are now eating into American incomes."

April 2011 https://www.wsj.com/articles/SB10001424052748703789104576272983322884562?mod=searchresults&page=23&pos=16

"The">https://www.wsj.com/articles/... larger story is that the world is starting to protect, and perhaps ultimately free, itself from America& #39;s weak dollar standard. The European Central Bank recently raised interest rates and may do so again to prevent an inflation breakout."

"The">https://www.wsj.com/articles/... larger story is that the world is starting to protect, and perhaps ultimately free, itself from America& #39;s weak dollar standard. The European Central Bank recently raised interest rates and may do so again to prevent an inflation breakout."

April 2011 https://www.wsj.com/articles/SB10001424052748704677404576285021008297758?mod=searchresults&page=22&pos=5

"With">https://www.wsj.com/articles/... the failure of their stimulus spending plans, prominent Keynesian economists and pundits in particular have been flogging the Fed to do more. They seem to think Mr. Bernanke must save the dimming reputation of Obamanomics."

"With">https://www.wsj.com/articles/... the failure of their stimulus spending plans, prominent Keynesian economists and pundits in particular have been flogging the Fed to do more. They seem to think Mr. Bernanke must save the dimming reputation of Obamanomics."

April 2011 https://www.wsj.com/articles/SB10001424052748704187604576289361851708284?mod=searchresults&page=18&pos=14

"But">https://www.wsj.com/articles/... the real story of the day is that the central bank continues to be far more worried about jobs than inflation and plans to keep monetary policy wide open for several more months at least."

"But">https://www.wsj.com/articles/... the real story of the day is that the central bank continues to be far more worried about jobs than inflation and plans to keep monetary policy wide open for several more months at least."

April 2011 https://www.wsj.com/articles/SB10001424052748704013604576248803314545230?mod=searchresults&page=5&pos=7

"Now">https://www.wsj.com/articles/... the usual suspects are bellyaching that ECB President Jean-Claude Trichet is nuts to raise rates when so many euro zone economies are in precarious fiscal health. They would do better to direct their complaints elsewhere."

"Now">https://www.wsj.com/articles/... the usual suspects are bellyaching that ECB President Jean-Claude Trichet is nuts to raise rates when so many euro zone economies are in precarious fiscal health. They would do better to direct their complaints elsewhere."

May 2011 https://www.wsj.com/articles/SB10001424052748704904604576333481116878302?mod=searchresults&page=13&pos=2

"...when">https://www.wsj.com/articles/... shares are bid up as much as 171% above the issue price in a few hours, something more is going on than the business fundamentals...In that sense, LinkedIn& #39;s founders can probably thank Ben Bernanke."

"...when">https://www.wsj.com/articles/... shares are bid up as much as 171% above the issue price in a few hours, something more is going on than the business fundamentals...In that sense, LinkedIn& #39;s founders can probably thank Ben Bernanke."

August 2011 https://www.wsj.com/articles/SB10001424053111903639404576514672642520978?mod=searchresults&page=33&pos=6

"Here">https://www.wsj.com/articles/... we have a Presidential candidate, a Texas populist no less, laying out a position in favor of sound money...Mr. Perry seems to appreciate that the Federal Reserve can& #39;t conjure prosperity from the monetary printing presses."

"Here">https://www.wsj.com/articles/... we have a Presidential candidate, a Texas populist no less, laying out a position in favor of sound money...Mr. Perry seems to appreciate that the Federal Reserve can& #39;t conjure prosperity from the monetary printing presses."

August 2011 https://www.wsj.com/articles/SB10001424053111904199404576536692576451976?mod=searchresults&page=25&pos=10

"[Bernanke]">https://www.wsj.com/articles/... has presided over 32 months of historically easy monetary policy... What we have instead is a mild stagflation—1% GDP growth, 9.1% unemployment, and a commodity price bubble that has robbed middle-class real incomes."

"[Bernanke]">https://www.wsj.com/articles/... has presided over 32 months of historically easy monetary policy... What we have instead is a mild stagflation—1% GDP growth, 9.1% unemployment, and a commodity price bubble that has robbed middle-class real incomes."

September 2011 https://www.wsj.com/articles/SB10001424053111904194604576580783827647622?mod=searchresults&page=16&pos=19

"But">https://www.wsj.com/articles/... countries that let politicians dictate monetary policy-e.g., Argentina-typically come to grief. Our complaint is that the Fed under Alan Greenspan and Ben Bernanke has grown too close to the Treasury and White House."

"But">https://www.wsj.com/articles/... countries that let politicians dictate monetary policy-e.g., Argentina-typically come to grief. Our complaint is that the Fed under Alan Greenspan and Ben Bernanke has grown too close to the Treasury and White House."

September 2011 https://www.wsj.com/articles/SB10001424053111903791504576584870618136208?mod=searchresults&page=15&pos=16

"The">https://www.wsj.com/articles/... current Fed has been too political in our view, and Republicans should be speaking up for the cause of Fed independence rather than playing tug-of-war with Mr. Frank over Mr. Bernanke."

"The">https://www.wsj.com/articles/... current Fed has been too political in our view, and Republicans should be speaking up for the cause of Fed independence rather than playing tug-of-war with Mr. Frank over Mr. Bernanke."

January 2012 https://www.wsj.com/articles/SB10001424052970203471004577142883453169136?mod=searchresults&page=41&pos=2

"Board">https://www.wsj.com/articles/... of Governors is now dominated by Obama appointees who share the interventionist designs of their colleagues in the White House...Bernanke may feel surrounded, but we& #39;d have thought he& #39;d have more respect for the integrity of [the Fed]"

"Board">https://www.wsj.com/articles/... of Governors is now dominated by Obama appointees who share the interventionist designs of their colleagues in the White House...Bernanke may feel surrounded, but we& #39;d have thought he& #39;d have more respect for the integrity of [the Fed]"

January 2012 https://www.wsj.com/articles/SB10001424052970204661604577184681681677286?mod=searchresults&page=37&pos=15

"U.S.">https://www.wsj.com/articles/... private economy is performing remarkably well considering all of the burdens government has put on it. Imagine what it could do if...[the Fed] returned to a normal policy that focused on long-term growth rather than reflating bubbles."

"U.S.">https://www.wsj.com/articles/... private economy is performing remarkably well considering all of the burdens government has put on it. Imagine what it could do if...[the Fed] returned to a normal policy that focused on long-term growth rather than reflating bubbles."

February 2012 https://www.wsj.com/articles/SB10001424052970204883304577222663962176968?mod=searchresults&page=34&pos=11

"But">https://www.wsj.com/articles/... as far as a spur for growth goes, don& #39;t get your hopes up. The BOJ already has tried all it can to revive Japan& #39;s economy. The ball still is sitting where it& #39;s been all along: in the politicians& #39; court."

"But">https://www.wsj.com/articles/... as far as a spur for growth goes, don& #39;t get your hopes up. The BOJ already has tried all it can to revive Japan& #39;s economy. The ball still is sitting where it& #39;s been all along: in the politicians& #39; court."

February 2012 https://www.wsj.com/articles/SB10001424052970204795304577223343757678760?mod=searchresults&page=33&pos=17

"the">https://www.wsj.com/articles/... Volcker Rule is at bottom a diversion from the real solutions that would protect taxpayers from a repeat. These include more careful monetary policy, which we are still not getting; less politically directed credit creation, .."

"the">https://www.wsj.com/articles/... Volcker Rule is at bottom a diversion from the real solutions that would protect taxpayers from a repeat. These include more careful monetary policy, which we are still not getting; less politically directed credit creation, .."

March 2012 https://www.wsj.com/articles/SB10001424052970203753704577253703059857444?mod=searchresults&page=30&pos=11

"But">https://www.wsj.com/articles/... sooner or later as growth recovers, the easing has to stop before it begins to produce even more instability...An economy that hangs on the words of a monetary Wizard of Oz is not one that is, to borrow a phrase, & #39;built to last.& #39;"

"But">https://www.wsj.com/articles/... sooner or later as growth recovers, the easing has to stop before it begins to produce even more instability...An economy that hangs on the words of a monetary Wizard of Oz is not one that is, to borrow a phrase, & #39;built to last.& #39;"

March 2012 https://www.wsj.com/articles/SB10001424052702304692804577281633731301786?mod=searchresults&page=27&pos=17

"The">https://www.wsj.com/articles/... balance sheet to worry about belongs to the U.S. government, which in the name of trying to restore growth threw the party of the century. The Treasury is still rolling out $1.3 trillion deficits, three years into a recovery,..."

"The">https://www.wsj.com/articles/... balance sheet to worry about belongs to the U.S. government, which in the name of trying to restore growth threw the party of the century. The Treasury is still rolling out $1.3 trillion deficits, three years into a recovery,..."

Aug 2012 https://www.wsj.com/articles/SB10000872396390444860104577561191515688000?mod=searchresults&page=2&pos=2

"costs">https://www.wsj.com/articles/... of all this have been considerable...Near-zero interest rates have punished savers and retirees. The inflation breakout that some predicted hasn& #39;t materialized, but the commodity bubble has reduced the growth of real middle-class incomes."

"costs">https://www.wsj.com/articles/... of all this have been considerable...Near-zero interest rates have punished savers and retirees. The inflation breakout that some predicted hasn& #39;t materialized, but the commodity bubble has reduced the growth of real middle-class incomes."

Sep 2012 https://www.wsj.com/articles/SB10000872396390444709004577649831698298106?mod=searchresults&page=1&pos=15

"Bernanke">https://www.wsj.com/articles/... says...he has the tools and the will to pull the trigger before inflation builds...good luck picking the right moment, which may be before prices are seen to be rising but also before the expansion has begun to lift middle-class incomes

"Bernanke">https://www.wsj.com/articles/... says...he has the tools and the will to pull the trigger before inflation builds...good luck picking the right moment, which may be before prices are seen to be rising but also before the expansion has begun to lift middle-class incomes

October 2012 https://www.wsj.com/articles/SB10000872396390443675404578056952578987258?mod=searchresults&page=1&pos=10

"This">https://www.wsj.com/articles/... babble is what a world without leadership looks like, specifically without American leadership. The world doesn& #39;t much want to listen to a U.S. that is...picking trade fights for domestic political gain."

"This">https://www.wsj.com/articles/... babble is what a world without leadership looks like, specifically without American leadership. The world doesn& #39;t much want to listen to a U.S. that is...picking trade fights for domestic political gain."

October 2012 https://www.wsj.com/articles/SB10001424052970203406404578072212347661802?mod=searchresults&page=1&pos=9

"Washington">https://www.wsj.com/articles/... will struggle to persuade Asian governments to open trade through Trans-Pacific Partnership negotiations...if Asian leaders are also grappling with the damage from America& #39;s attempts at competitive devaluation."

"Washington">https://www.wsj.com/articles/... will struggle to persuade Asian governments to open trade through Trans-Pacific Partnership negotiations...if Asian leaders are also grappling with the damage from America& #39;s attempts at competitive devaluation."

December 2012 https://www.wsj.com/articles/SB10001424127887323981504578175693687046384?mod=searchresults&page=1&pos=2

"If">https://www.wsj.com/articles/... Mr. Bernanke really wants to drive the President and Congress to reduce future spending, he shouldn& #39;t keep bailing them out with easier money."

"If">https://www.wsj.com/articles/... Mr. Bernanke really wants to drive the President and Congress to reduce future spending, he shouldn& #39;t keep bailing them out with easier money."

February 2013 https://www.wsj.com/articles/SB10001424127887323701904578273950573199828?mod=searchresults&page=1&pos=20

"Stanford">https://www.wsj.com/articles/... economist John Taylor offered a different explanation this week, saying on these pages that the Fed& #39;s excessive ease may actually be hampering growth thanks to unintended consequences."

"Stanford">https://www.wsj.com/articles/... economist John Taylor offered a different explanation this week, saying on these pages that the Fed& #39;s excessive ease may actually be hampering growth thanks to unintended consequences."

February 2013 https://www.wsj.com/articles/SB10001424127887323495104578312032409420630?mod=searchresults&page=1&pos=18

"When">https://www.wsj.com/articles/... the chief central banker of the world& #39;s reserve currency nation announces that he is practicing monetary nationalism, it& #39;s hard to blame anyone else for doing the same."

"When">https://www.wsj.com/articles/... the chief central banker of the world& #39;s reserve currency nation announces that he is practicing monetary nationalism, it& #39;s hard to blame anyone else for doing the same."

June 2013 https://www.wsj.com/articles/SB10001424127887324520904578553132820152650?mod=searchresults&page=1&pos=8

"A">https://www.wsj.com/articles/... crowd will always form in Washington and on Wall Street to say it& #39;s too soon to stop...Our view is that the sooner the Fed begins to unwind, the better...Savers have been punished for a half decade already"

"A">https://www.wsj.com/articles/... crowd will always form in Washington and on Wall Street to say it& #39;s too soon to stop...Our view is that the sooner the Fed begins to unwind, the better...Savers have been punished for a half decade already"

June 2013 https://www.wsj.com/articles/SB10001424127887323393804578555930508330500?mod=searchresults&page=1&pos=6

"How">https://www.wsj.com/articles/... such an accommodative monetary policy meshes with robust growth above 3% would certainly be interesting. We doubt a near-zero rate would survive the collision."

"How">https://www.wsj.com/articles/... such an accommodative monetary policy meshes with robust growth above 3% would certainly be interesting. We doubt a near-zero rate would survive the collision."

June 2013 https://www.wsj.com/articles/SB10001424127887323893504578557863042120272?mod=searchresults&page=1&pos=5

"the">https://www.wsj.com/articles/... selloff may be more than anything a side effect of investor addiction to the world& #39;s central bankers...Central banks can& #39;t keep floating the world economy forever, and our view is the sooner the withdrawal begins the better."

"the">https://www.wsj.com/articles/... selloff may be more than anything a side effect of investor addiction to the world& #39;s central bankers...Central banks can& #39;t keep floating the world economy forever, and our view is the sooner the withdrawal begins the better."

June 2013 https://www.wsj.com/articles/SB10001424127887323873904578573402242249948?mod=searchresults&page=1&pos=1

"We">https://www.wsj.com/articles/... don& #39;t doubt Mr. Bernanke& #39;s assertions that the Fed has the economic tools to unwind its monetary exertions. The real question is whether it has the political will."

"We">https://www.wsj.com/articles/... don& #39;t doubt Mr. Bernanke& #39;s assertions that the Fed has the economic tools to unwind its monetary exertions. The real question is whether it has the political will."

Not an editorial but https://twitter.com/WSJopinion/status/355465803358932993">https://twitter.com/WSJopinio...

July 2013 https://www.wsj.com/articles/SB10001424127887324809004578633922341613866?mod=searchresults&page=1&pos=13

"...neither">https://www.wsj.com/articles/... Ms. Yellen nor Mr. Summers seems likely to do what should be the next chairman& #39;s priority—restoring the Fed& #39;s independence by ending its post-crisis political interventions and focusing above all on maintaining price stability."

"...neither">https://www.wsj.com/articles/... Ms. Yellen nor Mr. Summers seems likely to do what should be the next chairman& #39;s priority—restoring the Fed& #39;s independence by ending its post-crisis political interventions and focusing above all on maintaining price stability."

August 2013 https://www.wsj.com/articles/janet-yellens-record-1375899455?tesla=y

"central">https://www.wsj.com/articles/... bankers are under constant pressure to make people happy by printing money...If the chairman is already inclined to spike the punch bowl, what are the odds that she [Yellen] will impose unpopular sobriety, even when it is needed?

"central">https://www.wsj.com/articles/... bankers are under constant pressure to make people happy by printing money...If the chairman is already inclined to spike the punch bowl, what are the odds that she [Yellen] will impose unpopular sobriety, even when it is needed?

September 2013 https://www.wsj.com/articles/mr-bernanke-blinks-1379547222?mod=searchresults&page=1&pos=19&tesla=y

"...the">https://www.wsj.com/articles/... Fed& #39;s decision to renege on beginning to taper its bond purchases sounds like Vice Chair Yellen, the famous monetary dove, may already be in charge."

"...the">https://www.wsj.com/articles/... Fed& #39;s decision to renege on beginning to taper its bond purchases sounds like Vice Chair Yellen, the famous monetary dove, may already be in charge."

October 2013 https://www.wsj.com/articles/the-yellen-difference-1381357232?mod=searchresults&page=1&pos=7&tesla=y

"The">https://www.wsj.com/articles/... test of a Fed chairman is whether she has the fortitude to tighten money when it is required but when the politicians and Wall Street are saying it& #39;s still premature."

"The">https://www.wsj.com/articles/... test of a Fed chairman is whether she has the fortitude to tighten money when it is required but when the politicians and Wall Street are saying it& #39;s still premature."

November 2013 https://www.wsj.com/articles/the-yellen-bulls-1384475696?mod=searchresults&page=2&pos=7&tesla=y

"Yellen">https://www.wsj.com/articles/... believes in the ability of monetary policy to manipulate the business cycle and generate low employment. We think history shows this is risky business and can end badly."

"Yellen">https://www.wsj.com/articles/... believes in the ability of monetary policy to manipulate the business cycle and generate low employment. We think history shows this is risky business and can end badly."

December 2013 https://www.wsj.com/articles/jobs-and-the-fed-1386371353?mod=searchresults&page=1&pos=14&tesla=y

"the">https://www.wsj.com/articles/... sooner the Fed can get back to a normal monetary policy, the better for policy certainty and the real economy...The end of bond-buying might also contribute to a better allocation of capital in the private economy."

"the">https://www.wsj.com/articles/... sooner the Fed can get back to a normal monetary policy, the better for policy certainty and the real economy...The end of bond-buying might also contribute to a better allocation of capital in the private economy."

December 2013 https://www.wsj.com/articles/bernanke-pulls-the-trigger-1387409281?mod=searchresults&page=1&pos=2&tesla=y

"But">https://www.wsj.com/articles/... annual price increases are still running at 1.2%, which is disinflation rather than deflation...disinflation can suggest useful gains in productivity and helps middle-class earners keep their buying power."

"But">https://www.wsj.com/articles/... annual price increases are still running at 1.2%, which is disinflation rather than deflation...disinflation can suggest useful gains in productivity and helps middle-class earners keep their buying power."

Not an editorial but https://twitter.com/WSJopinion/status/400621722459574272">https://twitter.com/WSJopinio...

January 2014 https://www.wsj.com/articles/the-bernanke-tide-1390603622?mod=searchresults&page=9&pos=19&tesla=y

"Yet">https://www.wsj.com/articles/... sooner or later the world will have to adjust to a normal monetary policy...The end of the Bernanke tide was always going to leave somebody naked, and the sooner they get dressed the better."

"Yet">https://www.wsj.com/articles/... sooner or later the world will have to adjust to a normal monetary policy...The end of the Bernanke tide was always going to leave somebody naked, and the sooner they get dressed the better."

... resuming this thread

January 2014 -- WSJ Editorial Board on Bernanke& #39;s Legacy https://www.wsj.com/articles/the-bernanke-legacy-1390865466">https://www.wsj.com/articles/... "...the intrusion of the Fed into politics and fiscal policy. Mr. Bernanke has helped to finance an historic federal borrowing binge while disguising its future costs."

January 2014 -- WSJ Editorial Board on Bernanke& #39;s Legacy https://www.wsj.com/articles/the-bernanke-legacy-1390865466">https://www.wsj.com/articles/... "...the intrusion of the Fed into politics and fiscal policy. Mr. Bernanke has helped to finance an historic federal borrowing binge while disguising its future costs."

March 2014

"The Fed& #39;s new non-guidance guidance is so vague that Ms. Yellen and her comrades now have the leeway to do whatever they want whenever they want for whatever reason they want."

"The Fed& #39;s new non-guidance guidance is so vague that Ms. Yellen and her comrades now have the leeway to do whatever they want whenever they want for whatever reason they want."

June 2014

"The Senate should confirm President Obama& #39;s nominees" (Lael Brainard, Jay Powell and Stan Fischer) https://www.wsj.com/articles/firepower-for-the-fed-1402442719">https://www.wsj.com/articles/... "Mr. Fischer is too much of a Keynesian for our tastes, but ... he will be a steady hand with the credibility to influence Ms. Yellen."

"The Senate should confirm President Obama& #39;s nominees" (Lael Brainard, Jay Powell and Stan Fischer) https://www.wsj.com/articles/firepower-for-the-fed-1402442719">https://www.wsj.com/articles/... "Mr. Fischer is too much of a Keynesian for our tastes, but ... he will be a steady hand with the credibility to influence Ms. Yellen."

Aug 2014 "Getting off the zero bound would not mean a premature monetary tightening. It might even increase monetary velocity by inducing more bank lending. The Fed could find it does better by jobs and growth by a more rapid return to monetary normalcy." https://www.wsj.com/articles/jobs-and-the-fed-1406933061">https://www.wsj.com/articles/...

September 2014 "The Open Market Committee vote also included two hawkish dissents, from regional bank presidents Richard Fisher and Charles Plosser. Those men have often been right but never decisive in Fed councils." https://www.wsj.com/articles/yellens-discretion-1410996852">https://www.wsj.com/articles/...

October 2014 https://www.wsj.com/articles/more-jobs-flat-incomes-1412377162">https://www.wsj.com/articles/...

October 2014 https://www.wsj.com/articles/the-qe-record-1414622102">https://www.wsj.com/articles/... "The decline in energy prices in recent months has produced what looks like a false scare about deflation that could cause the Fed to further delay its return to normal policy. This will be the real test of Fed Chair Janet Yellen"

November 2014 "The Fed should be held politically accountable in a democracy, but the progressive play here is to make the Fed more dependent on politicians whose default is always easier money." https://www.wsj.com/articles/a-central-bank-for-the-beltway-1416356149">https://www.wsj.com/articles/...

Jan 2015 "John Williams gave currency traders a jolt on Monday by saying the strong dollar means there is less urgency for the Fed to raise rates or begin reducing its $4.5 trillion balance sheet. But delay runs the risk of increasing the distortions..." https://www.wsj.com/articles/the-double-edged-dollar-1420589991">https://www.wsj.com/articles/...

January 2015: "The Obama Administration has been a stalwart supporter of the Federal Reserve’s bond purchases, and one underreported reason appeared in a Fed press release on Friday: The central bank has become a huge money-maker for the Treasury." https://www.wsj.com/articles/the-fed-cash-machine-1421018574">https://www.wsj.com/articles/...

March 2015 "The real reason to start moving is to return to monetary normalcy and reduce the risks of future economic trouble. According to the Taylor Rule, which the Fed sometimes purports to follow, the fed funds rate should already be closer to 2%." https://www.wsj.com/articles/the-patience-of-janet-1426721081">https://www.wsj.com/articles/...

April 2015 "...as if an increase from near-zero to 25 or 50 basis points runs the risk of shocking the economy back into recession. If the economy is that fragile, we’re in more trouble than the White House or anyone else is saying." https://www.wsj.com/articles/the-jobs-slowdown-1428100021">https://www.wsj.com/articles/...

April 2015 "It’s heresy to say so, but maybe after six years of zero-interest rates, and long after the financial crisis ended, the Fed should wonder if its policies haven’t become an impediment to faster growth."

April 2015 "We’re not always right. But we’ve been careful not to join some of our friends in predicting inflation from the Fed’s post-crisis policies." https://www.wsj.com/articles/bernankes-rebuttal-1430436524">https://www.wsj.com/articles/...

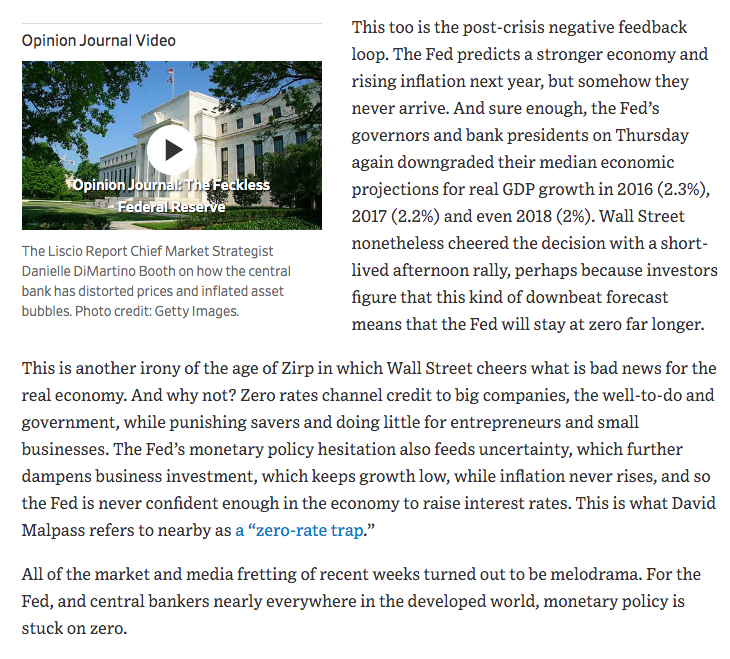

August 2015 "An earlier return to monetary normalcy would have reduced the Fed’s outsized role in allocating capital, while reducing the risk of financial instability by letting asset prices adjust more gradually. Growth would likely have been faster." https://www.wsj.com/articles/a-fine-fed-mess-1440197469">https://www.wsj.com/articles/...

August 2015 "The irony is that the Federal Reserve has been guilty of the biggest currency whipsaw the world has ever seen. And it has beggared its neighbors in the process."

September 2015 "perhaps the folks at the Fed’s Eccles Building should invite Mr. Williamson [ @1954swilliamson] in from the hinterlands for a chat. The longer the Fed stays trapped by zero, the more difficult it will be to get out." https://www.wsj.com/articles/trapped-by-zero-1442358927">https://www.wsj.com/articles/...

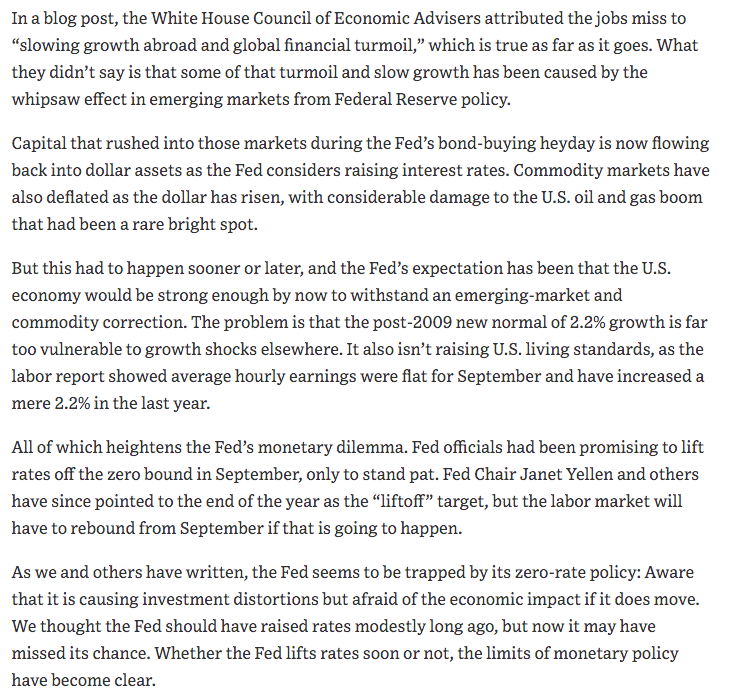

September 2015 "The Fed’s monetary policy hesitation also feeds uncertainty, which further dampens business investment, which keeps growth low, while inflation never rises, and so the Fed is never confident enough in the economy to raise interest rates." https://www.wsj.com/articles/stuck-on-zero-1442532105">https://www.wsj.com/articles/...

October 2015 https://www.wsj.com/articles/the-big-jobs-miss-1443828276">https://www.wsj.com/articles/... "We thought the Fed should have raised rates modestly long ago, but now it may have missed its chance. Whether the Fed lifts rates soon or not, the limits of monetary policy have become clear."

October 2015 "Chair Janet Yellen and other members keep saying that it will soon be time to move, but each time as the date approaches they find another reason not to move...At least if they stay at zero the Fed won’t be blamed for having done nothing." https://www.wsj.com/articles/much-ado-about-the-feds-nothing-1446074502">https://www.wsj.com/articles/...

Nov 2015 "It’s also notable that nearly all of the GOP candidates identify the Federal Reserve’s post-crisis monetary policy as a source of rising inequality that has favored the wealthy. This is a populist note that has the added benefit of being true." https://www.wsj.com/articles/the-gop-on-economics-1447224376">https://www.wsj.com/articles/...

December 2015 "If the fed-funds rate were closer to 2% or 3% now, the Fed would have room to pause its rate increases and might have less financial turmoil to navigate." https://www.wsj.com/articles/the-fed-at-the-brink-1450139103">https://www.wsj.com/articles/...

December 2015 "Some of our friends think the move may even be stimulative if it removes policy uncertainty and begins to revive the moribund interbank lending market." https://www.wsj.com/articles/up-from-zero-1450314233">https://www.wsj.com/articles/...

Dec 2015 "risks created by the Fed’s quantitative easing are a reminder that the post-Bretton Woods system remains inherently unstable...damage of overshooting markets is compounded by the Fed’s scant concern for the global consequences of its actions." https://www.wsj.com/articles/the-feds-global-aftershocks-1450398278">https://www.wsj.com/articles/...

February 2016 "Our own view is that the Fed should have raised rates long ago when the economy was stronger, and it would have more room to maneuver now that growth is flagging" https://www.wsj.com/articles/the-feds-global-aftershocks-1450398278">https://www.wsj.com/articles/...

June 2016 "Look for the liberal pundits to start yelling about a Fed & #39;mistake& #39; if it does raise rates in June or July." https://www.wsj.com/articles/a-rude-jobs-interruption-1464994625">https://www.wsj.com/articles/...

June 2016 "The Federal Open Market Committee, which had been insisting for months that the economy is healthy enough to take rising rates, capitulated on Wednesday and signaled slow economic growth as far as their eyes can see." https://www.wsj.com/articles/the-fed-surrenders-1466032880">https://www.wsj.com/articles/...

August 2016 "If the Fed is going to be a political body, why not hold a hearing for savers whose retirement plans have been upset by seven and a half years of near-zero interest rates?" https://www.wsj.com/articles/the-federal-reserves-politicians-1472420590">https://www.wsj.com/articles/...

September 2016 "Get your head around that one. The central bank may raise rates in December and beyond despite growth rates that in an earlier era would have been defined as stagnation." https://www.wsj.com/articles/central-bankers-at-wits-end-1474499507">https://www.wsj.com/articles/...

Nov 2016 "the next President can’t count on the continuation of low interest rates. The Federal Reserve has been Mr. Obama’s best friend not named Chief Justice John Roberts as its monetary policies have helped finance a record debt blowout at lower cost." https://www.wsj.com/articles/obamas-fiscal-legacy-1478649310">https://www.wsj.com/articles/...

December 2016 "the [Fed& #39;s] 2% growth estimate essentially builds in no benefit from new supply-side economic policies. If growths stays that slow, Mr. Trump will be firing advisers left and right." https://www.wsj.com/articles/the-fed-and-donald-trump-1481762380">https://www.wsj.com/articles/...

March 2017 "The Fed is falling behind the curve of its own labor-market measures for monetary tightening. That’s especially true if Republicans succeed in implementing their pro-growth economic agenda."

June 2017 "There’s nothing tight about any of this. Markets have simply forgotten what normal monetary policy looks like... Markets have learned that central banks can be bullied into keeping the punch bowl on the table a little longer." https://www.wsj.com/articles/central-banks-and-the-new-abnormal-1498778778">https://www.wsj.com/articles/...

August 2017 [not monetary policy]

"Janet Yellen didn’t run for President, but you wouldn’t know it from her policy démarche Friday... shows how political the world’s central bankers have become." https://www.wsj.com/articles/our-political-central-bankers-1503961596">https://www.wsj.com/articles/...

"Janet Yellen didn’t run for President, but you wouldn’t know it from her policy démarche Friday... shows how political the world’s central bankers have become." https://www.wsj.com/articles/our-political-central-bankers-1503961596">https://www.wsj.com/articles/...

September 2017 "[The Fed] this week, at long last, may announce plans to begin unwinding its nearly nine-year experiment with unconventional monetary policy known as quantitative easing. The move is welcome, even if it brings more financial volatility..." https://www.wsj.com/articles/the-feds-long-march-to-normal-1505776664">https://www.wsj.com/articles/...

Sep 2017 "No one should call any of this a tight monetary policy...fed funds rate still at 1-1.25%...may have to reconsider its slow pace of rate increases, lest it repeat its mistake of 2003 and keep rates too low for too long after a pro-growth tax cut." https://www.wsj.com/articles/the-slow-and-steady-fed-1505948734">https://www.wsj.com/articles/...

October 2017 "[Picking Yellen or Powell] would be comparable to promising as a presidential candidate to nominate someone like Antonin Scalia to the Supreme Court and then nominating a younger version of Ruth Bader Ginsburg." https://www.wsj.com/articles/trump-and-the-fed-1507071913">https://www.wsj.com/articles/...

from same editorial:

"Outsiders like Messrs. Warsh and Taylor, or Columbia’s Glenn Hubbard, believe that tax reform and deregulation can increase the economy’s capacity to grow above 3%. They therefore might raise interest rates more slowly than the Yellen-Powell faction would."

"Outsiders like Messrs. Warsh and Taylor, or Columbia’s Glenn Hubbard, believe that tax reform and deregulation can increase the economy’s capacity to grow above 3%. They therefore might raise interest rates more slowly than the Yellen-Powell faction would."

Oct 2017 "the question is whether a Yellen-Powell Fed would accommodate faster growth or feel it must rapidly increase interest rates. Unless it changes its economic models or expectations, the current Fed won’t. All of which argues for new leadership." https://www.wsj.com/articles/a-fed-for-a-growth-economy-1508455555">https://www.wsj.com/articles/...

November 2017 "Mr. Trump is buying monetary policy rooted in the Phillips Curve trade-off between inflation and unemployment. Once the economy hits full employment, in this view, the threat of inflation invariably looms and interest rates must rise." https://www.wsj.com/articles/mnuchin-gets-his-man-1509663270">https://www.wsj.com/articles/...

Nov 2017 "Fed has been on autopilot for several years, but monetary policy could move center stage again if tax reform passes and growth accelerates. An experienced monetary economist who knows the Fed system could be a welcome addition to its councils." https://www.wsj.com/articles/a-goodfriend-for-the-fed-1512087850">https://www.wsj.com/articles/...

Dec 2017 "One of the threats to the expansion will be when monetary officials raise rates and pare back their balance sheets, as the Federal Reserve is beginning to do." https://www.wsj.com/articles/the-economy-revs-up-1512777059">https://www.wsj.com/articles/...

Dec 2017 "Yet the Fed’s predictions of economic growth budged only a little... Beyond that [2018] the Fed’s fearless forecasters have the economy falling back to near 2% and even lower in the & #39;longer run.& #39;" https://www.wsj.com/articles/yellens-fed-farewell-1513211061">https://www.wsj.com/articles/...

January 2018 "This is another way of saying that the biggest threat to growth and financial markets— Donald Trump’s trade agenda or a Speaker Pelosi aside—may be the Federal Reserve as it reverses Mr. Bernanke’s experiment." https://www.wsj.com/articles/the-tax-reform-stock-rally-1516146165">https://www.wsj.com/articles/...

Read on Twitter

Read on Twitter

![July 2008 https://www.wsj.com/articles/... Kohn, and Mishkin], the Fed& #39;s three intellectual amigos, continue to pursue a reckless policy of negative real interest rates...they have overestimated the risks of recession while underestimating the dangers of inflation." July 2008 https://www.wsj.com/articles/... Kohn, and Mishkin], the Fed& #39;s three intellectual amigos, continue to pursue a reckless policy of negative real interest rates...they have overestimated the risks of recession while underestimating the dangers of inflation."](https://pbs.twimg.com/media/DuwAScYUUAUKlX8.jpg)

![December 2008 https://www.wsj.com/articles/... "Better choices [for New York Fed President vacancy] would include current Fed Governor Kevin Warsh...or Dallas& #39;s Richard Fisher, who ... dissented from the policy that created the 2007-2008 Bernanke oil and commodity spike." December 2008 https://www.wsj.com/articles/... "Better choices [for New York Fed President vacancy] would include current Fed Governor Kevin Warsh...or Dallas& #39;s Richard Fisher, who ... dissented from the policy that created the 2007-2008 Bernanke oil and commodity spike."](https://pbs.twimg.com/media/DuwQwaMXQAAZNcs.jpg)

![May 2009 https://www.wsj.com/articles/... Fed& #39;s loose policy from 2003 to 2005 created the commodity and credit bubbles that made these countries flush with dollars...these countries then recycled those dollars back into dollar-denominated assets, such as Treasurys and [GSE debt]" May 2009 https://www.wsj.com/articles/... Fed& #39;s loose policy from 2003 to 2005 created the commodity and credit bubbles that made these countries flush with dollars...these countries then recycled those dollars back into dollar-denominated assets, such as Treasurys and [GSE debt]"](https://pbs.twimg.com/media/Du_VIp9X4AA2FwJ.jpg)

![October 2010 https://www.wsj.com/articles/... is no validity whatever in the idea that any inflation, once accepted, can be confined to moderate proportions,& #39; [McChesney Martin] thundered, in a warning that would be vindicated...That& #39;s a warning as well for the QE Street Band." October 2010 https://www.wsj.com/articles/... is no validity whatever in the idea that any inflation, once accepted, can be confined to moderate proportions,& #39; [McChesney Martin] thundered, in a warning that would be vindicated...That& #39;s a warning as well for the QE Street Band."](https://pbs.twimg.com/media/DvGKUjAUcAAbtPS.jpg)

![November 2010 https://www.wsj.com/articles/... founders] explicitly rejected the dual mandate in favor of a single goal of price stability. The ECB has performed far better than the Fed over the last decade by following that single lodestar." November 2010 https://www.wsj.com/articles/... founders] explicitly rejected the dual mandate in favor of a single goal of price stability. The ECB has performed far better than the Fed over the last decade by following that single lodestar."](https://pbs.twimg.com/media/DvGSfW3UUAAXE5f.jpg)

![January 2012 https://www.wsj.com/articles/... of Governors is now dominated by Obama appointees who share the interventionist designs of their colleagues in the White House...Bernanke may feel surrounded, but we& #39;d have thought he& #39;d have more respect for the integrity of [the Fed]" January 2012 https://www.wsj.com/articles/... of Governors is now dominated by Obama appointees who share the interventionist designs of their colleagues in the White House...Bernanke may feel surrounded, but we& #39;d have thought he& #39;d have more respect for the integrity of [the Fed]"](https://pbs.twimg.com/media/DvIg-zwUUAAUCpG.jpg)

![January 2012 https://www.wsj.com/articles/... private economy is performing remarkably well considering all of the burdens government has put on it. Imagine what it could do if...[the Fed] returned to a normal policy that focused on long-term growth rather than reflating bubbles." January 2012 https://www.wsj.com/articles/... private economy is performing remarkably well considering all of the burdens government has put on it. Imagine what it could do if...[the Fed] returned to a normal policy that focused on long-term growth rather than reflating bubbles."](https://pbs.twimg.com/media/DvLxTAtUwAAu7st.jpg)

![August 2013 https://www.wsj.com/articles/... bankers are under constant pressure to make people happy by printing money...If the chairman is already inclined to spike the punch bowl, what are the odds that she [Yellen] will impose unpopular sobriety, even when it is needed? August 2013 https://www.wsj.com/articles/... bankers are under constant pressure to make people happy by printing money...If the chairman is already inclined to spike the punch bowl, what are the odds that she [Yellen] will impose unpopular sobriety, even when it is needed?](https://pbs.twimg.com/media/DvYCgk9VAAAQ1va.jpg)

![September 2015 "perhaps the folks at the Fed’s Eccles Building should invite Mr. Williamson [ @1954swilliamson] in from the hinterlands for a chat. The longer the Fed stays trapped by zero, the more difficult it will be to get out." https://www.wsj.com/articles/... September 2015 "perhaps the folks at the Fed’s Eccles Building should invite Mr. Williamson [ @1954swilliamson] in from the hinterlands for a chat. The longer the Fed stays trapped by zero, the more difficult it will be to get out." https://www.wsj.com/articles/...](https://pbs.twimg.com/media/EM4RMHKU0AA5KqC.png)

![September 2015 "perhaps the folks at the Fed’s Eccles Building should invite Mr. Williamson [ @1954swilliamson] in from the hinterlands for a chat. The longer the Fed stays trapped by zero, the more difficult it will be to get out." https://www.wsj.com/articles/... September 2015 "perhaps the folks at the Fed’s Eccles Building should invite Mr. Williamson [ @1954swilliamson] in from the hinterlands for a chat. The longer the Fed stays trapped by zero, the more difficult it will be to get out." https://www.wsj.com/articles/...](https://pbs.twimg.com/media/EM4RMHPVAAEl2-9.png)

![December 2016 "the [Fed& #39;s] 2% growth estimate essentially builds in no benefit from new supply-side economic policies. If growths stays that slow, Mr. Trump will be firing advisers left and right." https://www.wsj.com/articles/... December 2016 "the [Fed& #39;s] 2% growth estimate essentially builds in no benefit from new supply-side economic policies. If growths stays that slow, Mr. Trump will be firing advisers left and right." https://www.wsj.com/articles/...](https://pbs.twimg.com/media/EM5nQtPU8AAMQEr.png)

![December 2016 "the [Fed& #39;s] 2% growth estimate essentially builds in no benefit from new supply-side economic policies. If growths stays that slow, Mr. Trump will be firing advisers left and right." https://www.wsj.com/articles/... December 2016 "the [Fed& #39;s] 2% growth estimate essentially builds in no benefit from new supply-side economic policies. If growths stays that slow, Mr. Trump will be firing advisers left and right." https://www.wsj.com/articles/...](https://pbs.twimg.com/media/EM5nQtQUEAApZI4.png)