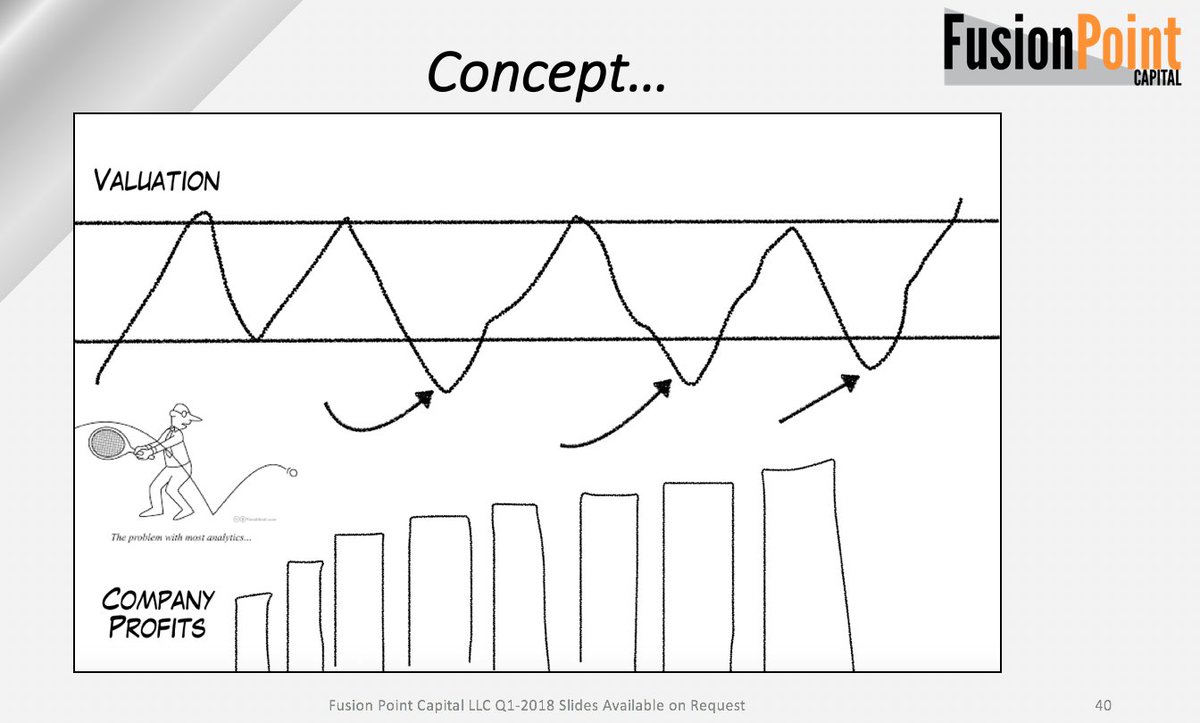

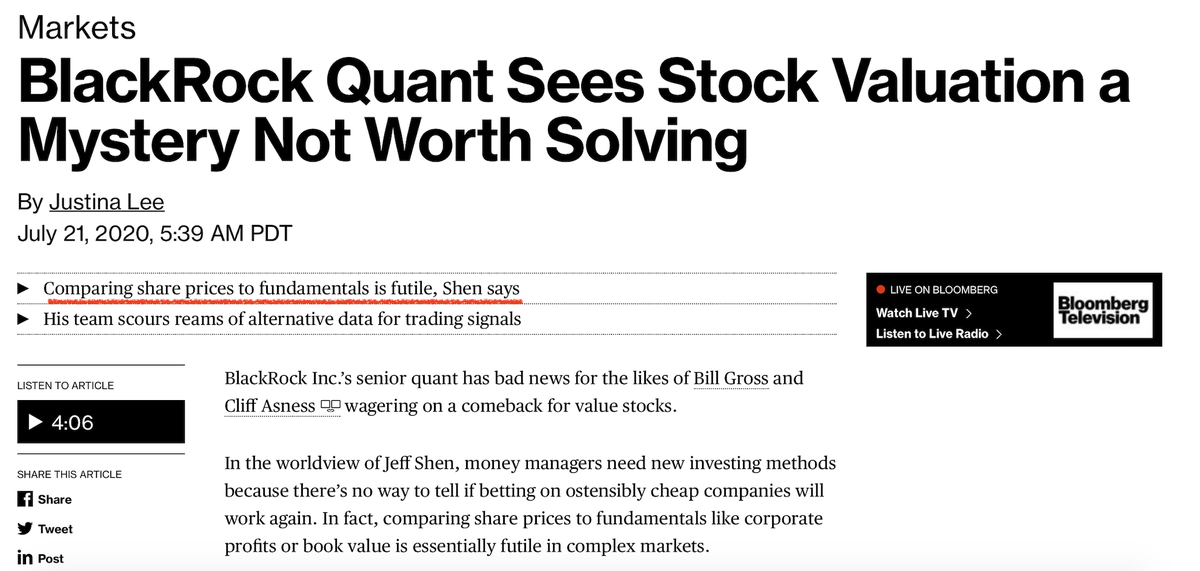

Here& #39;s what they teach about how fundamentals, valuation, and investing works. It& #39;s so engrained in some they have created all sorts of rationalizations when this consistently doesn& #39;t happen (others are stupid, the market is manipulated etc).

$SPX $SPY $INTC $MSFT $CSCO

$SPX $SPY $INTC $MSFT $CSCO

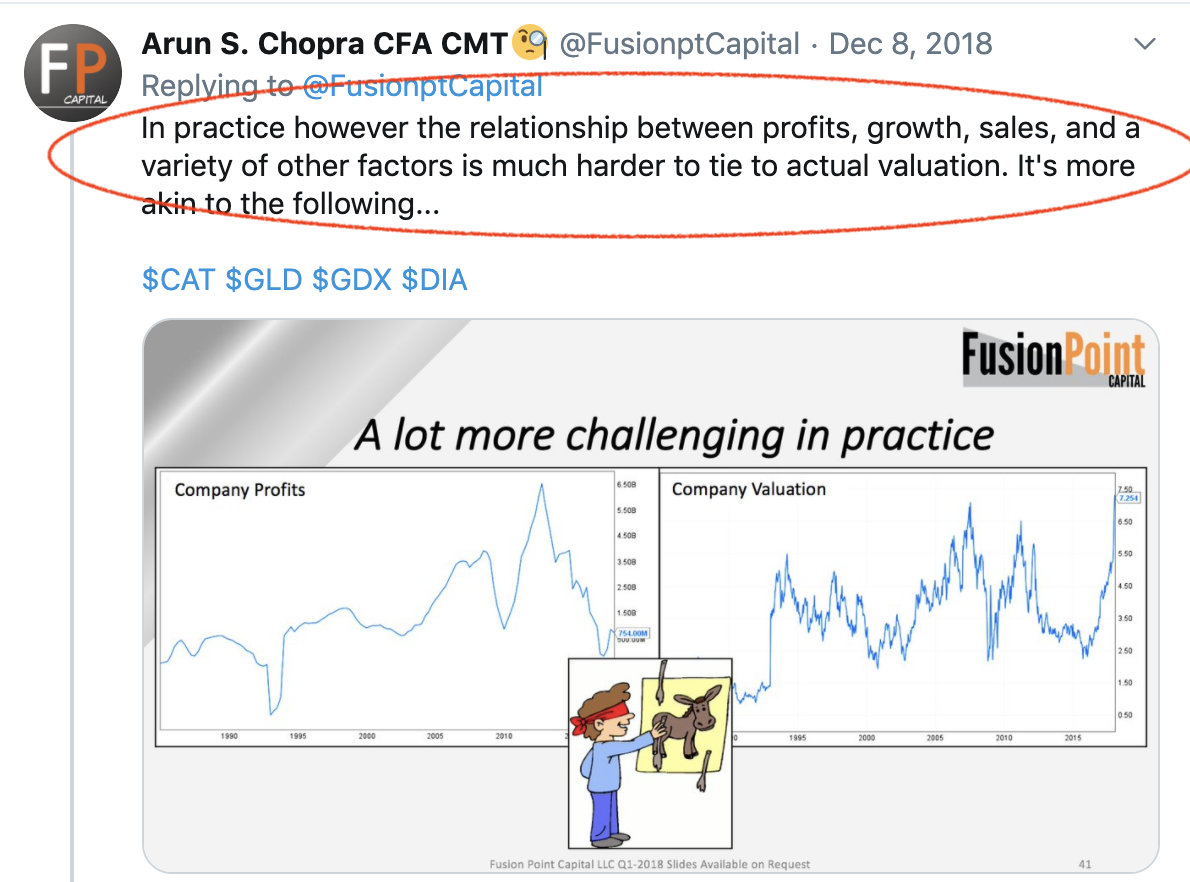

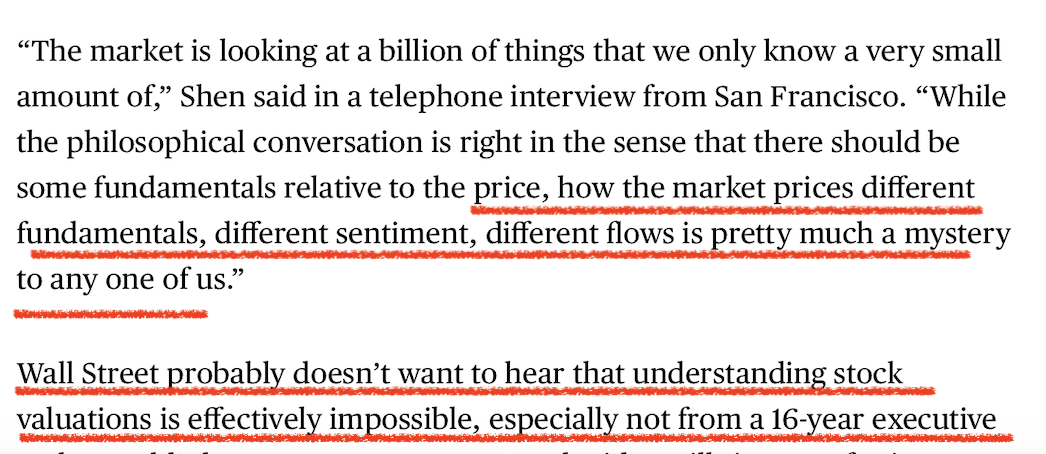

In practice however the relationship between profits, growth, sales, and a variety of other factors is much harder to tie to actual valuation. It& #39;s more akin to the following...

$CAT $GLD $GDX $DIA

$CAT $GLD $GDX $DIA

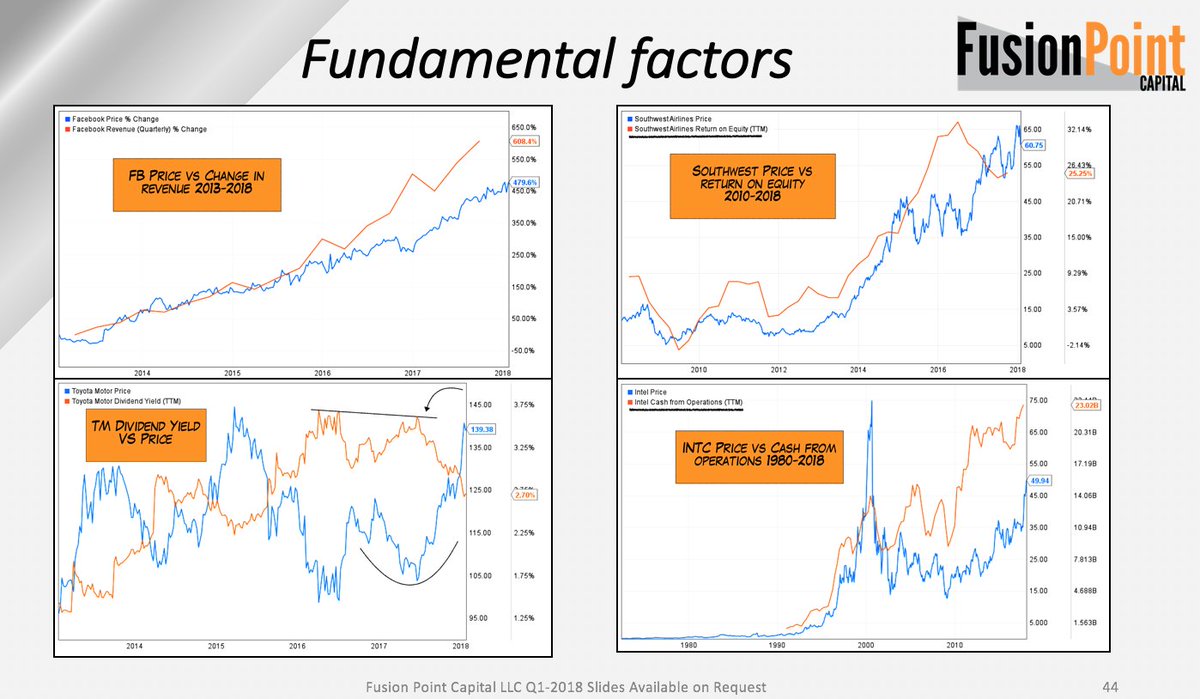

I spend a lot more of my fundamental time focusing on what factors drive businesses returns, and which of those are most affecting (correlated with) share prices. This is also a relatively challenging approach, which is why price action and behavior are so important.

$MSFT $CSCO

$MSFT $CSCO

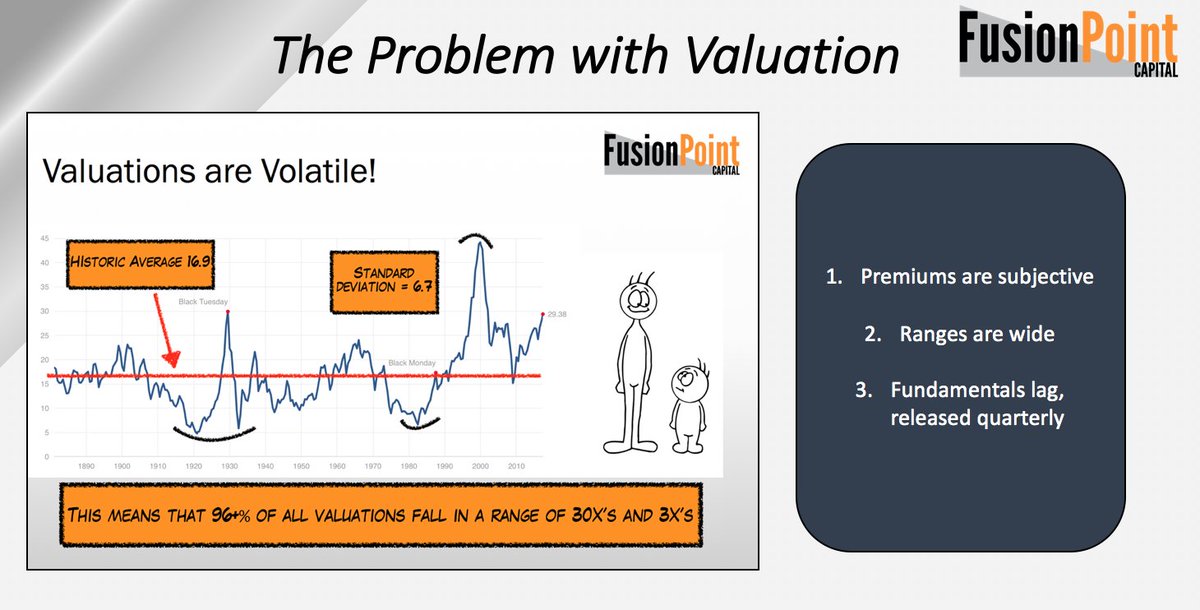

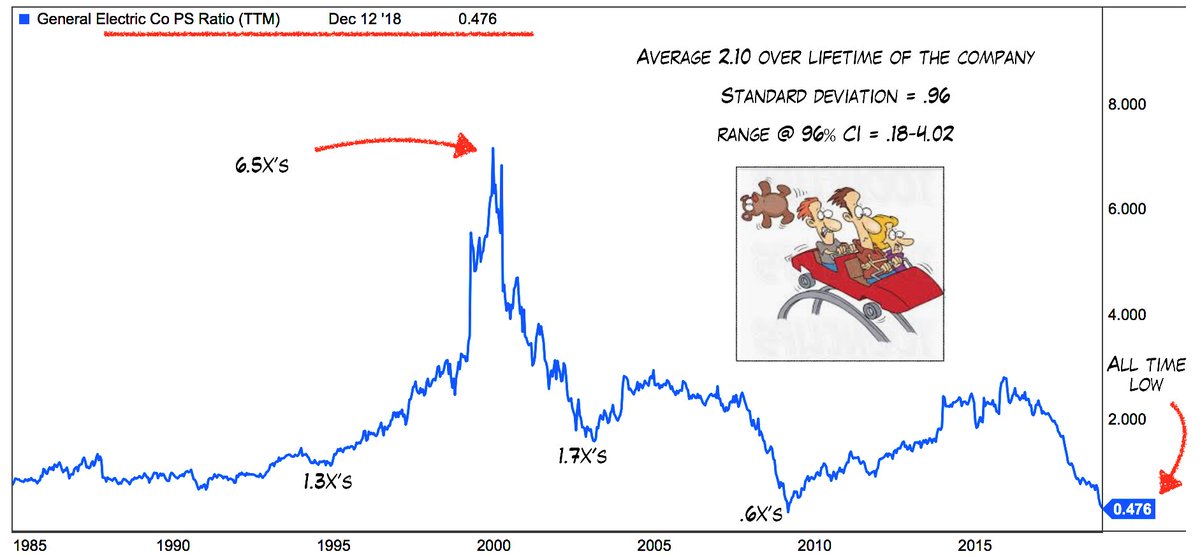

Let& #39;s expand on this thread. I talk a lot about the & #39;volatility& #39; of valuation. If you haven& #39;t seen the slide it& #39;s here. A good exercise is ask someone why they chose the multiple they did, and what is the all time high and low (range). This is how I knew $MU was & #39;clippable& #39;. $SPX

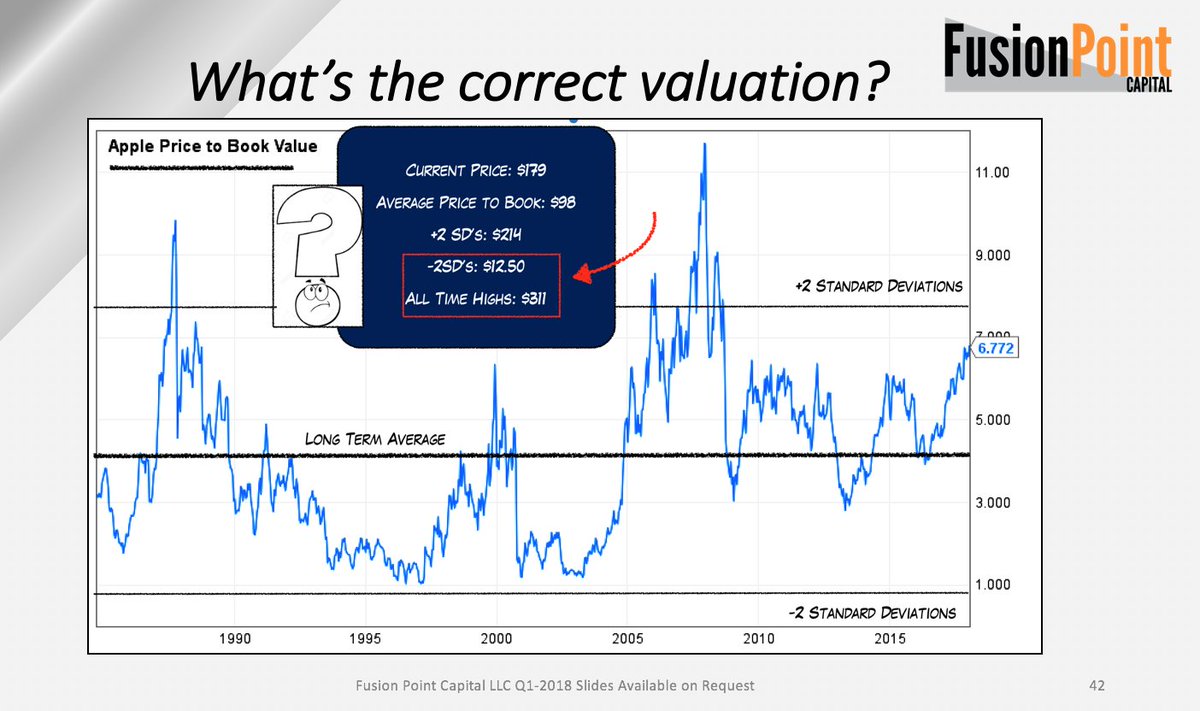

Here& #39;s a slide I did as a thought experiment on $AAPL. Now, let& #39;s not throw everything out the window, there are good reasons why someone would choose a specific multiple (payback period, fed rates etc). That doesn& #39;t negate volatility and risk (see charts and risk management).

And the point of this today, $GE just hit an all-time low in the P/S multiple. This is not some & #39;rouge wave& #39; but within the confines of the longer term volatility (see data). Many people have told me it was a value since 22 (some very smart people + large $& #39;s), yet here we are.

Notes: Many people see these price moves and often say & #39;I can& #39;t believe it& #39;, or & #39;it can& #39;t go lower& #39;, or & #39;no one could see this coming& #39;. This is nonsense. Valuation volatility is incredible and that& #39;s without discussing changing fundamentals (business volatility).

$GE $XLK

$GE $XLK

Read on Twitter

Read on Twitter