Buying options in a highly volatile stock in the expiry week - A thread

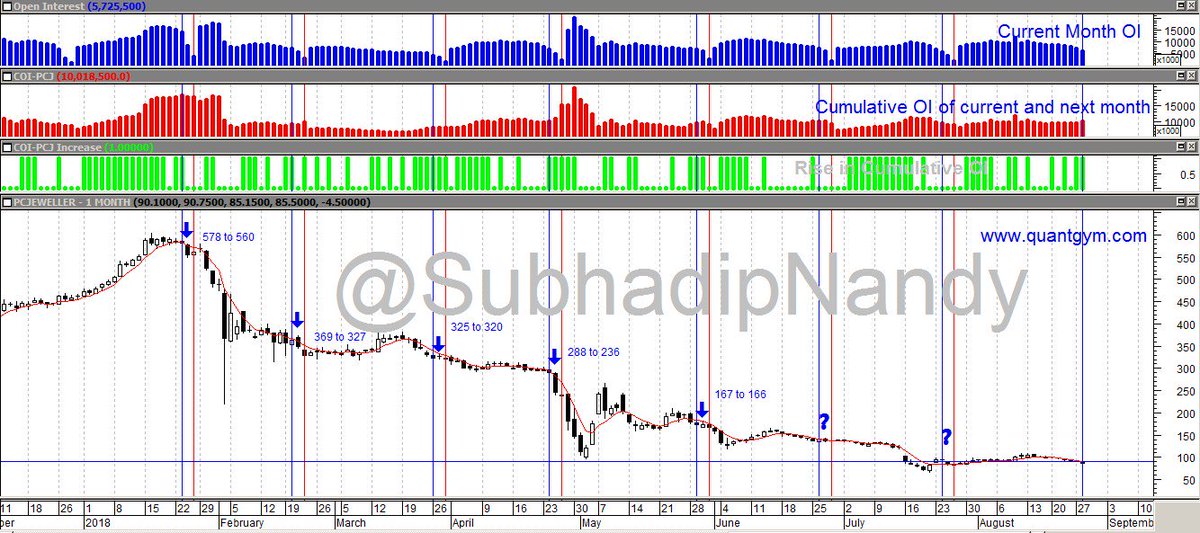

Ref: My massively bearish view on #PCJEWELLER

Ref: My massively bearish view on #PCJEWELLER

What is Open Interest (OI) ? : https://www.investopedia.com/terms/o/openinterest.asp">https://www.investopedia.com/terms/o/o...

What is Cumulative OI ? Total of all OI over all the expiries. Here we are looking at 1stMonth+2ndMonth+3rdMonth OI

The top most panel is the current month(1stMonth) OI

The 2nd panel is the Cumulative OI

The third panel denotes increase in Cumulative OI

The red vertical line is the day of expiry

The blue vertical line is Tuesday, two days prior to expiry

The 2nd panel is the Cumulative OI

The third panel denotes increase in Cumulative OI

The red vertical line is the day of expiry

The blue vertical line is Tuesday, two days prior to expiry

Data says : If the Cumulative OI increases two days prior to expiry OR in the expiry week, expect trend to continue in the same direction.

Often moves are very large and fast.

Often moves are very large and fast.

Due to volatility, maintaining SL on futures is extremely

difficult. But we have options which are dirt cheap.

If we buy options in the direction of the trend, expect Gamma

( https://www.investopedia.com/terms/g/gamma.asp)">https://www.investopedia.com/terms/g/g...

effect to make the option a multibagger if direction is correct.

difficult. But we have options which are dirt cheap.

If we buy options in the direction of the trend, expect Gamma

( https://www.investopedia.com/terms/g/gamma.asp)">https://www.investopedia.com/terms/g/g...

effect to make the option a multibagger if direction is correct.

In PCJ, historically if the Cumulative OI increases in the expiry week, large moves happen. Now we come to the direction of the move.

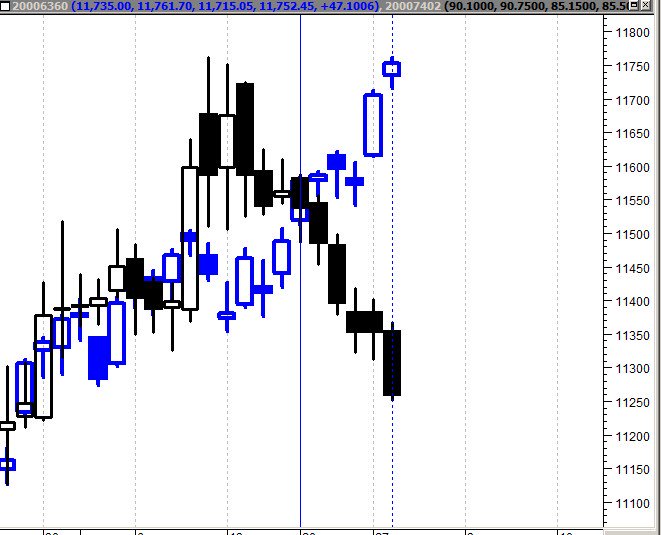

As we can see, the Cumulative OI is increasing since yesterday. The red line is a 6 period weighted moving average. Why 6 ? From last Monday( marked 1) till today, we had six trading sessions.

Prices continuously below this average . What does it mean ?

Prices continuously below this average . What does it mean ?

It means: Even in this melt-up bull market, someone is selling PCJ and he is winning. Those buying PCJ since last week are not getting an exit. Is the selling from retail ? DUM NAHI HAI KISI RETAIL KA SHORT KARNEKA NIFTY DEKHKE. See the relative movement of Nifty fut and PCJ fut

So the selling is by smart money, who knows some info about PCJ and is sure about his shorts. He is shorting even in this straight #melt_up markets. How do we trade this ? Simple, I bought 80 strike PCJ puts today around 3PM at Rs.1.30. I am assuming this 1.30 to be my max risk

The max I can lose on this trade is 1.30. The max I can win ? In PCJ, sky is the limit. But I will be happy if I get 3-5 times :)

Is it 100% sure that PCJ will fall ? Is it sure that this trade will be a winner ?

I DON& #39;T KNOW !

Is it 100% sure that PCJ will fall ? Is it sure that this trade will be a winner ?

I DON& #39;T KNOW !

Nothing is sure in the markets. We just try to get probabilities on our side and have a high Risk-Reward ratio expectation. Do this in every trade, and you my friend... will be a winner  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up">

-----------------------------END---------------------------------

-----------------------------END---------------------------------

Read on Twitter

Read on Twitter