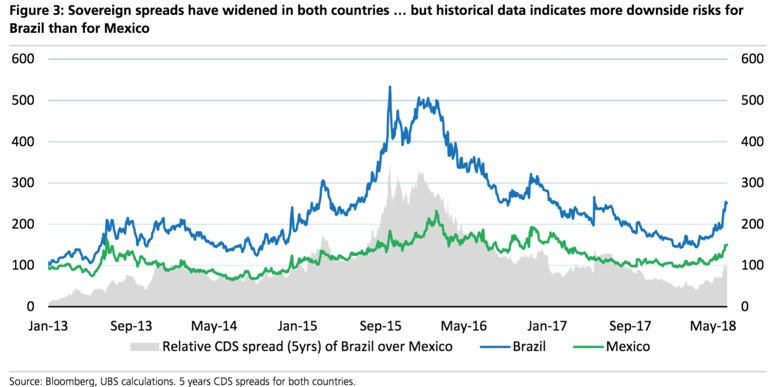

Sovereign spreads widening for both Brazil and Mexico as periphery to core flows accelerate and the stronger $DXY feedback loop kicks into gear. $EWZ $EWW $Macro

The $DXY core/periphery model looks like this.

When liquidity is flush, EM growth is strong, and perception of mrkt risk is low, capital flows out from the core (DM) to the periphery (EM) chasing higher growth/returns.

When reverse is true, capital flows back to core.

When liquidity is flush, EM growth is strong, and perception of mrkt risk is low, capital flows out from the core (DM) to the periphery (EM) chasing higher growth/returns.

When reverse is true, capital flows back to core.

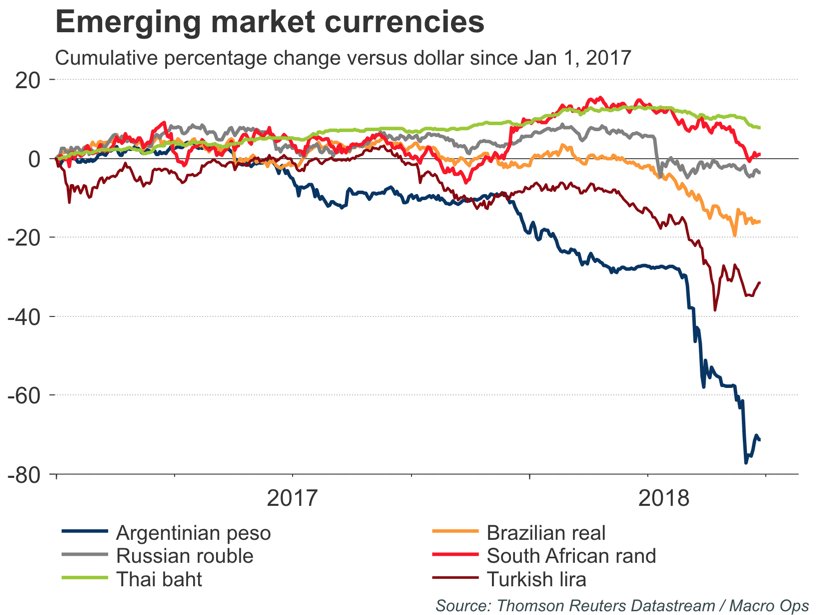

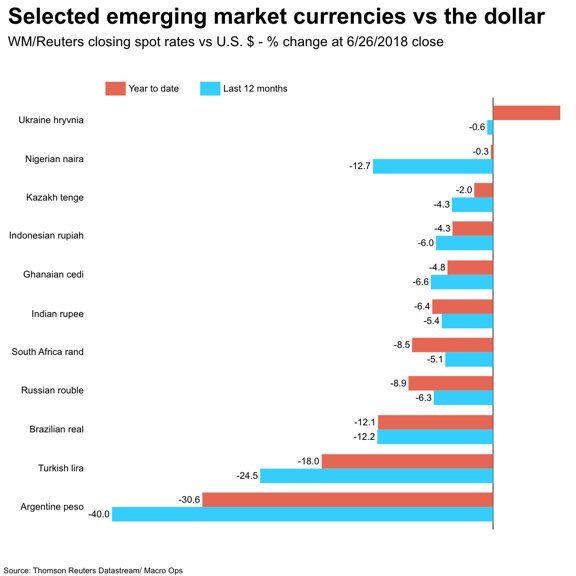

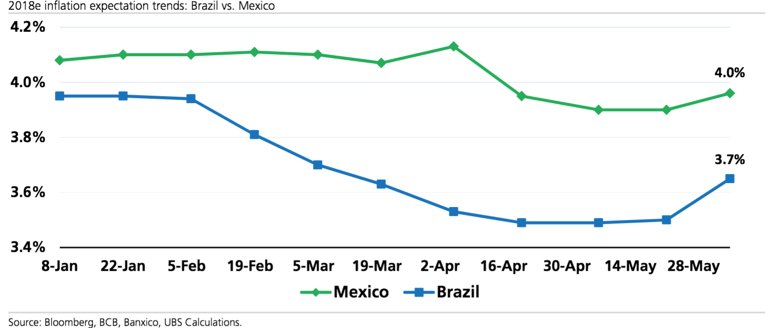

Flows from periphery back to core drive local EM FX down, which raises EM inflation and forces EM CB tightening thus leading to slower growth and greater capital outflows #feedbackloop

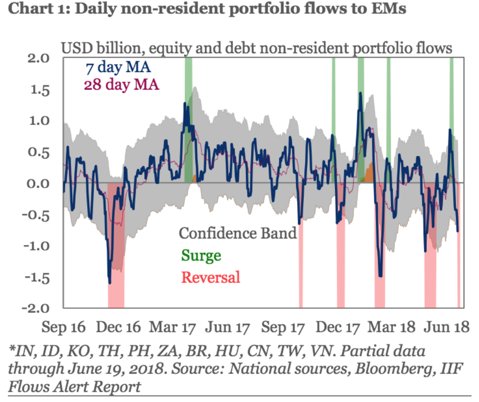

We can see the capital retreating back from the periphery to the core in the chart below. $EEM

Read on Twitter

Read on Twitter