$MNO.V

Project location. Brazil. Location irks a couple pals but there are always at least a couple stories in my portfolio like this. They aren't all Nevada gold.

Some well known companies operate in Brazil.

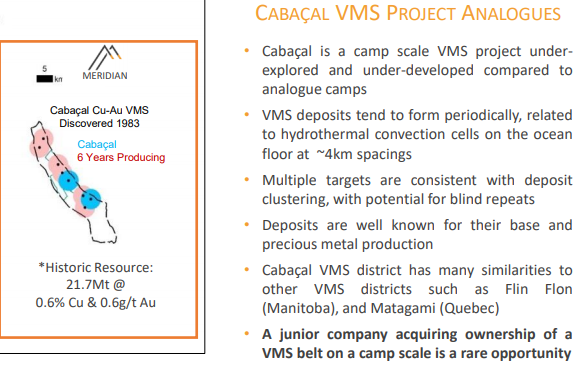

21.7Mt @ 0.6% Cu & 0.6 g/t. VMS with twist. A nice starting point. 1/

Project location. Brazil. Location irks a couple pals but there are always at least a couple stories in my portfolio like this. They aren't all Nevada gold.

Some well known companies operate in Brazil.

21.7Mt @ 0.6% Cu & 0.6 g/t. VMS with twist. A nice starting point. 1/

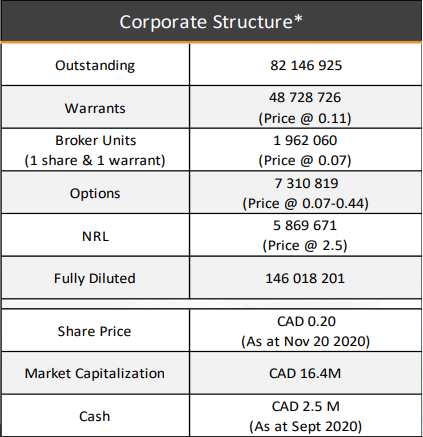

Share structure is not super tight. In addition to this table you can add 21.6m shares and 10.8m $0.30 warrants from the $4.3m December raise at $0.20.

Working capital was $900k at Sept 30th so I would imagine that they have a bit less than $5m cash now. 2/

Working capital was $900k at Sept 30th so I would imagine that they have a bit less than $5m cash now. 2/

There is a few broker warrants from raise too so you can probably call it about 178.5m fully diluted now. Assume about $8.7m extra in cash from warrants if looking at the f.d. with $5.3m of it coming from well in the money $0.11 strike warrants. So balance sheet looks okay. 3/

That said, there are numerous payments to be made over time on the Cabaçal property. The vast majority of the cash outlay is years down the road (post PFS) but there is about $2m USD to be dealt with in the next year. 4/

Timeline. They are working on environmental licensing and landholder access agreements right now. This is important of course. Will want to see good news there early in 2021 as the plan is to be drilling Cabaçal in March, as noted in the most recent presentation. 5/

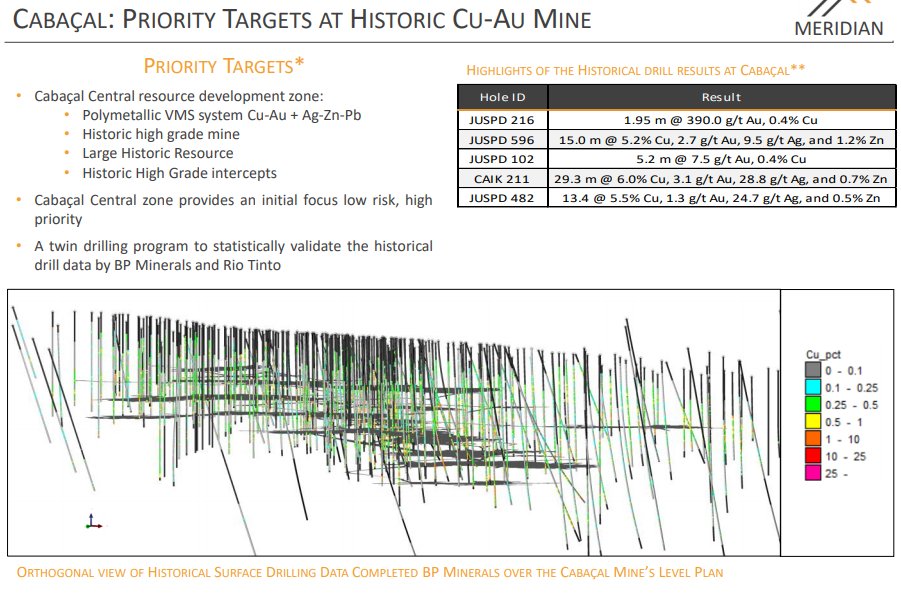

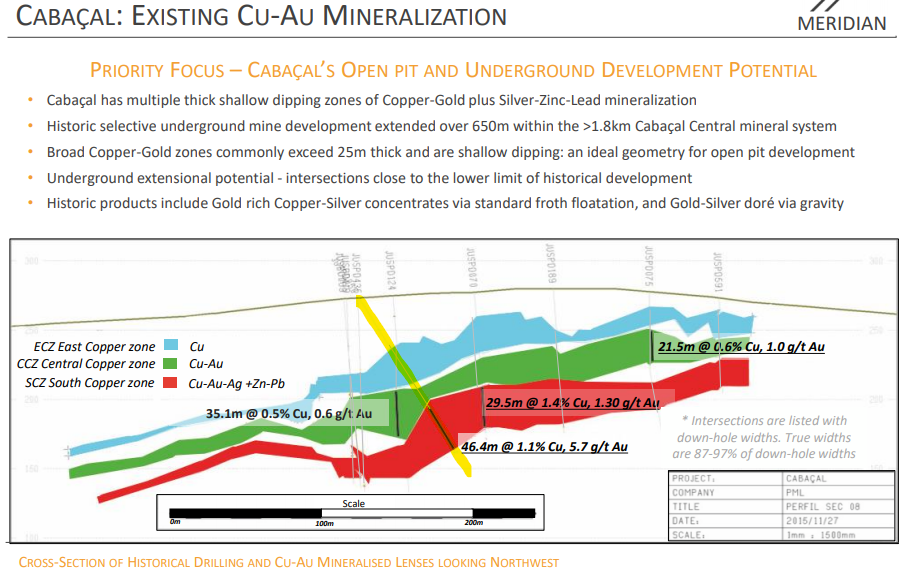

There was a lot of drilling done to define the Cabaçal resource. 600 DDH for 70,000m. I know they think they have numerous targets to test for extensions. But, my broker says he thinks they might prove a higher Au number than 0.6 g/t. Why? 6/

See all these holes? The vast majority of the holes are vertical in nature, especially in the heart of the Cabaçal deposit. 7/

I don't think the presentation explains this well enough but my guy said some of the gold is from a secondary event where the veining occurs sub-vertically. So VMS first, then secondary event. Vertical holes maybe missed a lot of vertical gold? 8/

What happens if you drill angled holes and cut across more of these veins? Well, maybe you get more holes like this one (my yellow highlight) that hit 46m of 5.7 g/t Au to go with 1.1% Cu. I think that is the plan with a lot of the holes in the upcoming program. 9/

Someone puked out a lot of shares in mid Nov. I bought in the $0.15-0.16 range on way back up. I doubt they sold to buy the $0.20 placement but if they did, they played that poorly.  I am not really sure what the story was there. Maybe they were just done with it. Happens. 10/

I am not really sure what the story was there. Maybe they were just done with it. Happens. 10/

I am not really sure what the story was there. Maybe they were just done with it. Happens. 10/

I am not really sure what the story was there. Maybe they were just done with it. Happens. 10/

$MNO.V has other targets at Cabaçal project. Next up will be some more geophysics work. Eventually some holes and BHEM (downhole surveys) to help vector the drilling. 11/

Secondary project is called Espigão and is earlier stage IOCG. Untested. They released some geochem and geophysical work on it in December. My focus is Cabaçal for now but I will attempt to wrap my head around Espigão as time goes on. 12/12

Read on Twitter

Read on Twitter