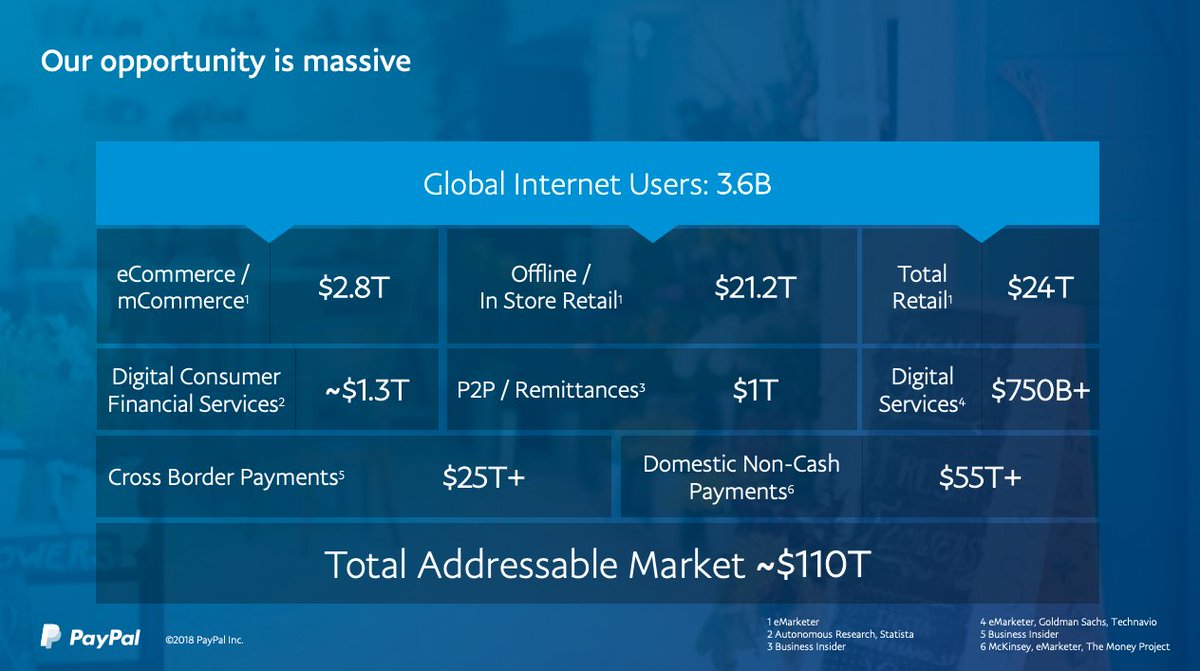

$ 110 Trilion TAM

$ 110 Trilion TAM

It is making a foray into CHINA

It’s Venmo app has over 60m users

Now accepting Bitcoin and 3 other cryptocurrencies

Now accepting Bitcoin and 3 other cryptocurrencies

It’s services are used by 320m consumers

and 26m merchants GLOBALLY

and 26m merchants GLOBALLY

Here is an EASY thread

$PYPL was founded by Peter Thiel, Max Levchin and Luke Nosek in 1998  In 2000, it merged with Elon Musk’s http://X.com and went public in 2002

In 2000, it merged with Elon Musk’s http://X.com and went public in 2002

Quickly after its IPO, it was bought by $EBAY as over 70% of merchants on the auction platform already used $PYPL

as over 70% of merchants on the auction platform already used $PYPL

In 2000, it merged with Elon Musk’s http://X.com and went public in 2002

In 2000, it merged with Elon Musk’s http://X.com and went public in 2002

Quickly after its IPO, it was bought by $EBAY

as over 70% of merchants on the auction platform already used $PYPL

as over 70% of merchants on the auction platform already used $PYPL

Before we go any further

Something we can agree on is that the online payment space is crowded

How to find a winner amongst these names

How to find a winner amongst these names

$PYPL $AAPL $SQ $ADYEY $STNE $PAGS $LSPD

Something we can agree on is that the online payment space is crowded

How to find a winner amongst these names

How to find a winner amongst these names

$PYPL $AAPL $SQ $ADYEY $STNE $PAGS $LSPD

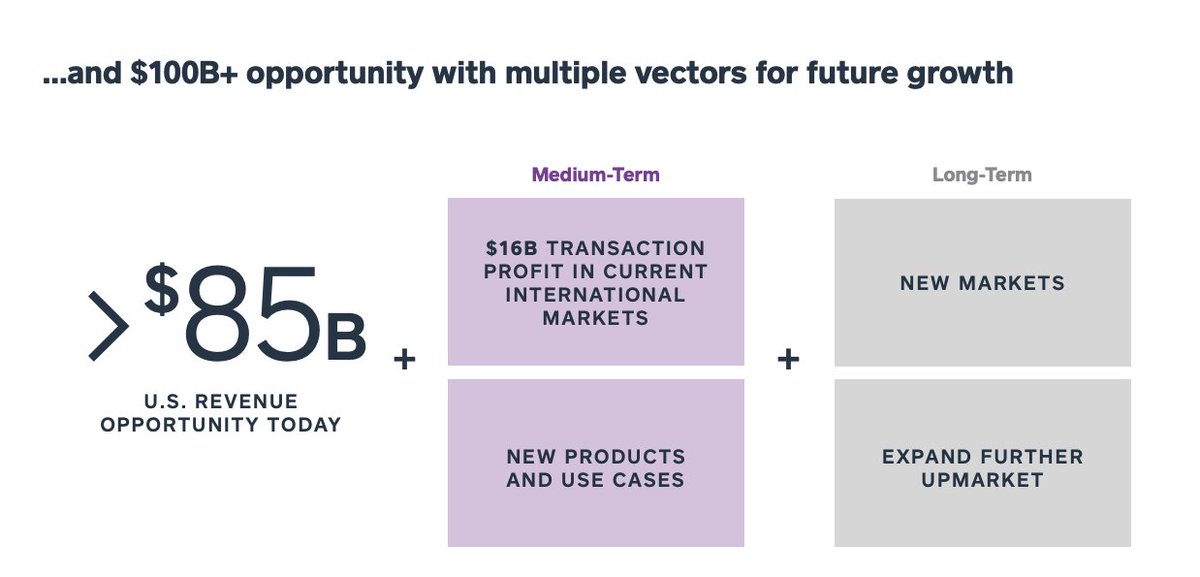

The online payments market is huge

The online payments market is huge

$SQ expects the “business” market to be worth $ 100B and the “consumers” market to be worth $ 60B

$SQ expects the “business” market to be worth $ 100B and the “consumers” market to be worth $ 60B  According to Allied Market Research, the global mobile payment market will grow to $ 12T by 2027

According to Allied Market Research, the global mobile payment market will grow to $ 12T by 2027  Up from $ 1.5T in 2019

Up from $ 1.5T in 2019

Markets And Markets expects the global payment gateway market to reach $ 87B in 2025

Markets And Markets expects the global payment gateway market to reach $ 87B in 2025  Up from $ 31B in 2016

Up from $ 31B in 2016 Mordor Intelligence expects the global gateway market to grow to $ 43B in 2025 up from $ 17B in 2019

Mordor Intelligence expects the global gateway market to grow to $ 43B in 2025 up from $ 17B in 2019  For a CAGR of 16%

For a CAGR of 16%

Frost & Sullivan forecast the Chinese mobile payments market to grow to $ 97T by 2023

Frost & Sullivan forecast the Chinese mobile payments market to grow to $ 97T by 2023  From $30T in 2017

From $30T in 2017 Markets And Markets expects the digital payment market to double in size by 2025 to $ 154B

Markets And Markets expects the digital payment market to double in size by 2025 to $ 154B  from $ 79B in 2020

from $ 79B in 2020

PayPal projects its own TAM to be at $110T

PayPal projects its own TAM to be at $110T  This represents payment volume (in Q2 ’20, payment volume stood at $222B for $ 5.2 B in sales)

This represents payment volume (in Q2 ’20, payment volume stood at $222B for $ 5.2 B in sales)

That’s what we want  A large market evolving towards technology driven solutions

A large market evolving towards technology driven solutions

Eating away incumbent’s market share Banks, financing institutions and legacy POS systems

Banks, financing institutions and legacy POS systems

A large market evolving towards technology driven solutions

A large market evolving towards technology driven solutions

Eating away incumbent’s market share

Banks, financing institutions and legacy POS systems

Banks, financing institutions and legacy POS systems

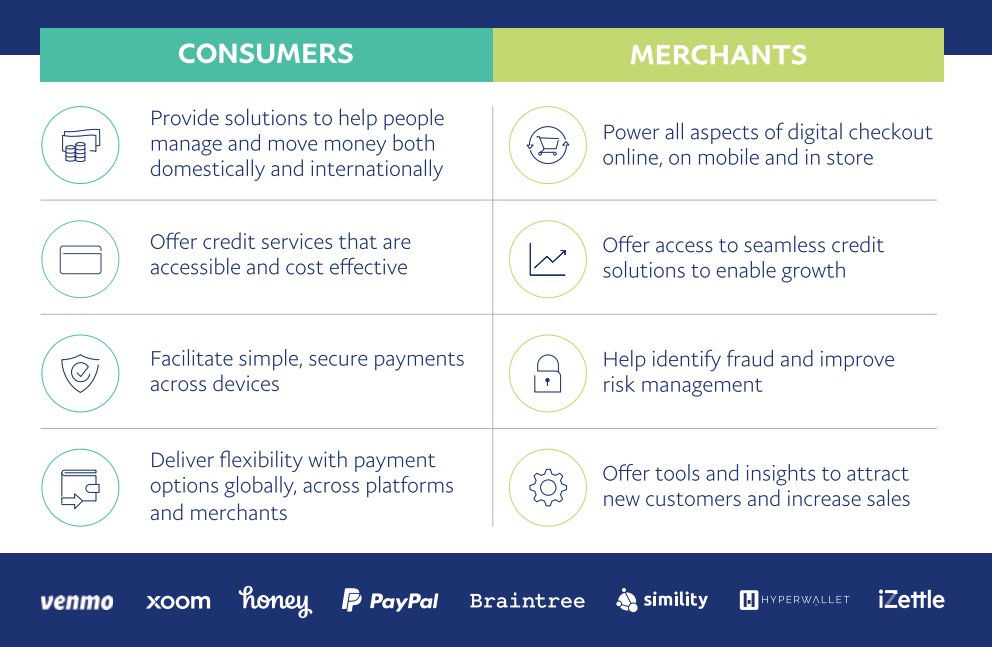

What is $PYPL doing and can it win?

What is $PYPL doing and can it win?In easy terms

$PYPL enables anyone to send and receive money online

$PYPL enables anyone to send and receive money online  It is mainly used by

It is mainly used by

Consumers

Consumers

Businesses

Businesses

$PYPL for consumers

$PYPL for consumers

320m active accounts (a 21% YoY increase) that use $PYPL to pay for items online, send money tho their friends, request money from friends

Also widely used on auction websites such as $EBAY

Of course, $PYPL is not just made of its “PayPal app”

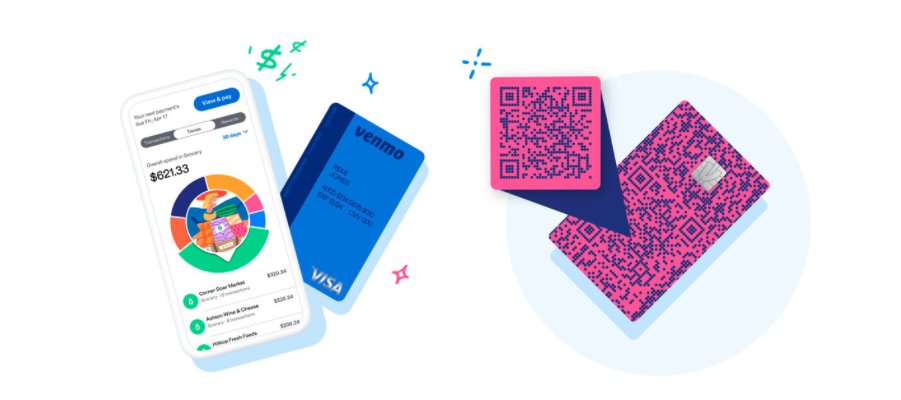

Venmo has over 60m users and processed $37B in payment volume in Q2 ’20 versus $24B in Q2 '19

Venmo has over 60m users and processed $37B in payment volume in Q2 ’20 versus $24B in Q2 '19

Venmo recently introduced its Visa credit card

Venmo recently introduced its Visa credit card

It offers loyalty features, rewards and cash-back incentives

It offers loyalty features, rewards and cash-back incentives

Venmo has over 60m users and processed $37B in payment volume in Q2 ’20 versus $24B in Q2 '19

Venmo has over 60m users and processed $37B in payment volume in Q2 ’20 versus $24B in Q2 '19 Venmo recently introduced its Visa credit card

Venmo recently introduced its Visa credit card It offers loyalty features, rewards and cash-back incentives

It offers loyalty features, rewards and cash-back incentives

More than that, $PYPL announced it would start supporting cryptocurrencies (Bitcoin, Ethereum, Bitcoin Cash, Litecoin) https://www.theverge.com/2020/10/21/21527288/paypal-cryptocurrency-support-buy-sell-venmo-bitcoin

“The shift to digital forms of currencies is inevitable, bringing with it clear advantages in terms of financial inclusion and access; efficiency, speed and resilience of the payments system” - $PYPL CEO Dan Schulman

$PYPL for businesses

$PYPL for businesses

26m merchant accounts use $PYPL to receive payments from customers

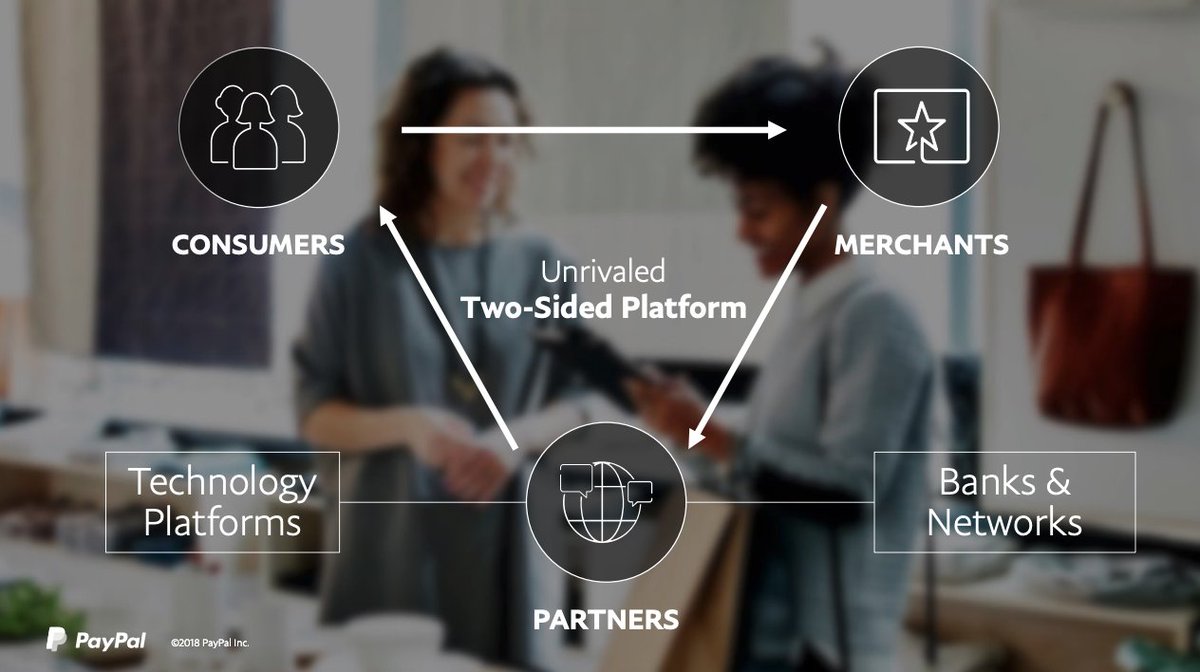

Like $SQ and Stripe, its acts as an aggregator of payments

Like $SQ and Stripe, its acts as an aggregator of paymentsIt then redistributes all collected money to the corresponding merchants’ account

$PYPL is thus a Payment Service Provider (PSP)  For full breakdown of the difference between a PSP and merchant account providers such as $ADYEY, just look here

For full breakdown of the difference between a PSP and merchant account providers such as $ADYEY, just look here https://getbenchmark.substack.com/p/adyen-and-the-virtual-economy-boom

https://getbenchmark.substack.com/p/adyen-and-the-virtual-economy-boom

For full breakdown of the difference between a PSP and merchant account providers such as $ADYEY, just look here

For full breakdown of the difference between a PSP and merchant account providers such as $ADYEY, just look here https://getbenchmark.substack.com/p/adyen-and-the-virtual-economy-boom

https://getbenchmark.substack.com/p/adyen-and-the-virtual-economy-boom

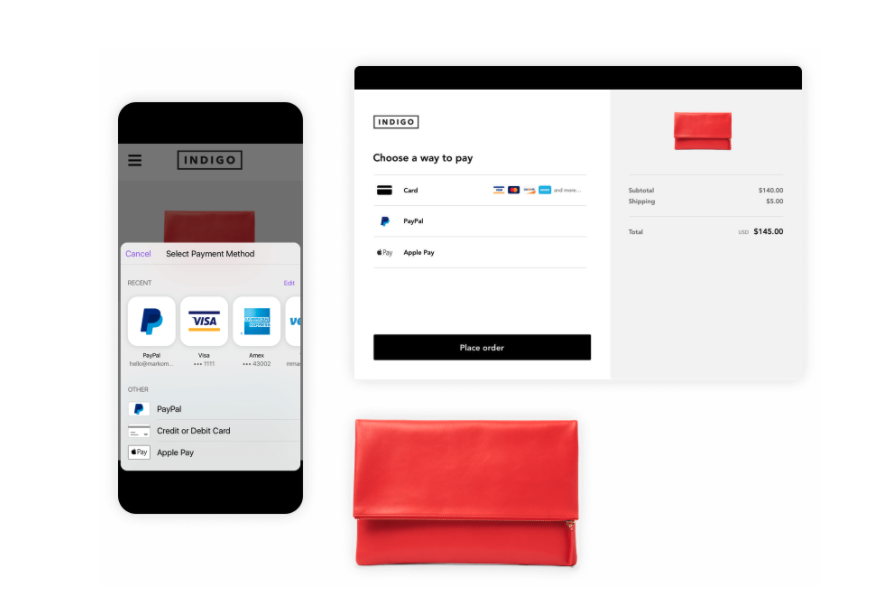

$PYPL thus enables merchants to accept payments by using a technology and platform agnostic approach

Through its different solutions (PayPal, Braintree, iZettle Pay In 4, PayPal for Marketplace) $PYPL covers almost all of the merchants and customers needs on a global scale

Through its different solutions (PayPal, Braintree, iZettle Pay In 4, PayPal for Marketplace) $PYPL covers almost all of the merchants and customers needs on a global scale

Merchants  can use PayPal’s tools for their digital checkout online, on mobile, and in-store (at the point of sale) across all platforms and devices

can use PayPal’s tools for their digital checkout online, on mobile, and in-store (at the point of sale) across all platforms and devices

This enables merchants to securely and simply receive payments from their customers

This enables merchants to securely and simply receive payments from their customers

can use PayPal’s tools for their digital checkout online, on mobile, and in-store (at the point of sale) across all platforms and devices

can use PayPal’s tools for their digital checkout online, on mobile, and in-store (at the point of sale) across all platforms and devices This enables merchants to securely and simply receive payments from their customers

This enables merchants to securely and simply receive payments from their customers

With Braintree, merchants can accept payments with

Credit or debit cards

Credit or debit cards

PayPal, PayPal Credit

PayPal, PayPal Credit

Google Pay, Apple Pay, Samsung Pay

Google Pay, Apple Pay, Samsung Pay

And many other payment solutions

And many other payment solutions

Credit or debit cards

Credit or debit cards PayPal, PayPal Credit

PayPal, PayPal Credit Google Pay, Apple Pay, Samsung Pay

Google Pay, Apple Pay, Samsung Pay And many other payment solutions

And many other payment solutions

iZettle offers a card acceptance service that enables small businesses to accept credit and debit card payments

iZettle offers a card acceptance service that enables small businesses to accept credit and debit card payments It also provides a software solution to record, manage, and analyse sales

It also provides a software solution to record, manage, and analyse sales

PayPal for Marketplaces, a global, end-to-end solution designed to satisfy the unique payment

PayPal for Marketplaces, a global, end-to-end solution designed to satisfy the unique payment  needs of platforms, marketplaces, and crowdfunding sites

needs of platforms, marketplaces, and crowdfunding sites It provides payment solutions for accepting and disbursing funds between consumers and businesses

It provides payment solutions for accepting and disbursing funds between consumers and businesses

$PYPL also recently introduced its own “By Now Pay Later” tool, called “Pay In 4”

$PYPL also recently introduced its own “By Now Pay Later” tool, called “Pay In 4” $PYPL is now competing with Klarna, Afterpay and Affirm https://techcrunch.com/2020/08/31/paypal-joins-the-buy-now-pay-later-race-with-new-pay-in-4-installment-program/

$PYPL is now competing with Klarna, Afterpay and Affirm https://techcrunch.com/2020/08/31/paypal-joins-the-buy-now-pay-later-race-with-new-pay-in-4-installment-program/

$PYPL acquired GoPay in 2019 which is a holder of payment business licenses in China

$PYPL acquired GoPay in 2019 which is a holder of payment business licenses in China

It enables $PYPL to partner with Chinese financial institutions

and technology platforms to provide a comprehensive set of payment solutions to merchants and consumers in China

and technology platforms to provide a comprehensive set of payment solutions to merchants and consumers in China

Here is the full article  https://techcrunch.com/2019/12/19/paypal-completes-gopay-acquisition-allowing-the-payments-platform-to-enter-china/

https://techcrunch.com/2019/12/19/paypal-completes-gopay-acquisition-allowing-the-payments-platform-to-enter-china/

https://techcrunch.com/2019/12/19/paypal-completes-gopay-acquisition-allowing-the-payments-platform-to-enter-china/

https://techcrunch.com/2019/12/19/paypal-completes-gopay-acquisition-allowing-the-payments-platform-to-enter-china/

Good! This means that $PYPL is not ONLY about Venmo and merchant payments

It is also providing BNPL services, entering China, supporting marketplaces, providing access to 4 different cryptocurrencies

It is also providing BNPL services, entering China, supporting marketplaces, providing access to 4 different cryptocurrencies

All while having an ecosystem of 320m consumers and 26m merchants

All while having an ecosystem of 320m consumers and 26m merchants

It is also providing BNPL services, entering China, supporting marketplaces, providing access to 4 different cryptocurrencies

It is also providing BNPL services, entering China, supporting marketplaces, providing access to 4 different cryptocurrencies All while having an ecosystem of 320m consumers and 26m merchants

All while having an ecosystem of 320m consumers and 26m merchants

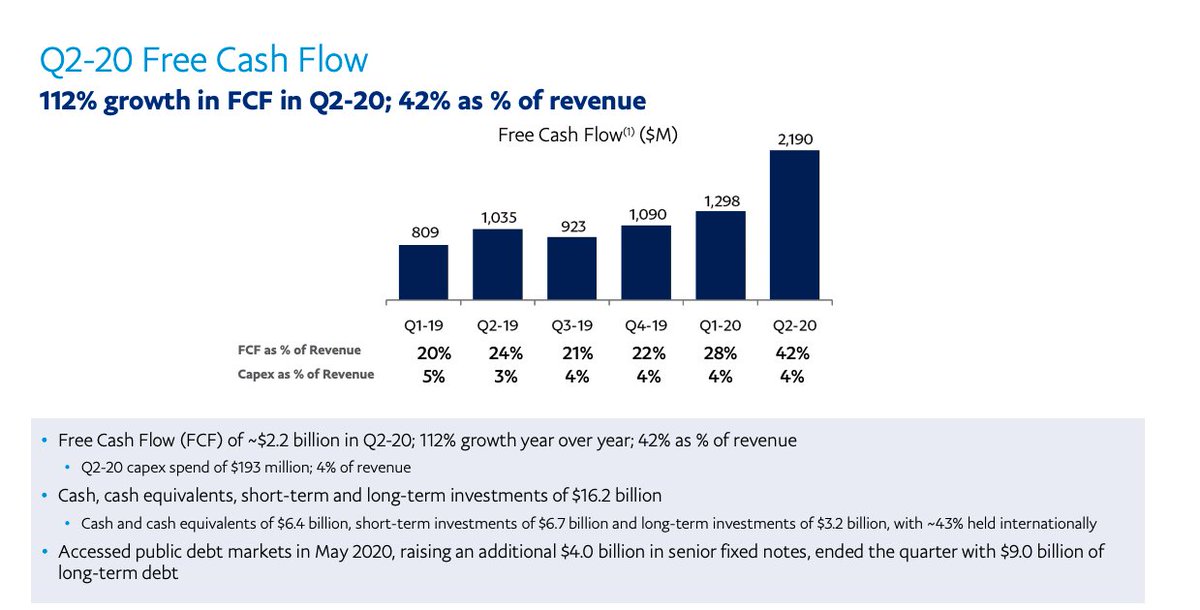

Financials check

Financials check Sales grew by 22% YoY in Q2 ’20

Sales grew by 22% YoY in Q2 ’20  to $ 5.3B

to $ 5.3B

Gross margins stand at 49%

Gross margins stand at 49%  Up from 45% in previous quarters

Up from 45% in previous quarters Income from operations stood at $951m up from $ 705m a year earlier

Income from operations stood at $951m up from $ 705m a year earlier $ 2.4B of Operating Cash Flows up from $ 1.2B a year earlier

$ 2.4B of Operating Cash Flows up from $ 1.2B a year earlier

THE BOTTOM LINE

THE BOTTOM LINE

$PYPL is a player too big to be ignored in the #fintech space - Generating $ 5.2B in sales and growing 22% YoY

$PYPL is a player too big to be ignored in the #fintech space - Generating $ 5.2B in sales and growing 22% YoY Venmo recently introduced its credit card and is adding new features (loyalty, rewards, cash back) to increase customer and merchant usage

Venmo recently introduced its credit card and is adding new features (loyalty, rewards, cash back) to increase customer and merchant usage

Looking past Venmo and $PYPL POS, we can see a compelling story made of opportunities in China, expansion into Buy Now Pay Later and a recent entry into cryptocurrencies

Looking past Venmo and $PYPL POS, we can see a compelling story made of opportunities in China, expansion into Buy Now Pay Later and a recent entry into cryptocurrencies

$PYPL has a large established (and growing) user base and its foray into new markets only make it help more competitive in the world of #fintech 2.0

$PYPL has a large established (and growing) user base and its foray into new markets only make it help more competitive in the world of #fintech 2.0 Market is competitive as $AAPL $SQ and many others (including Chinese, LATAM, European players) are fighting for it

Market is competitive as $AAPL $SQ and many others (including Chinese, LATAM, European players) are fighting for it

We have started a position into $PYPL and will review it with their earnings

We have started a position into $PYPL and will review it with their earnings

$ATHM is on our watchlist

$ATHM is on our watchlist  To Be Reviewed SOON

To Be Reviewed SOON

Please note that this is not a recommendation to buy - You are responsible for conducting your own research

Please note that this is not a recommendation to buy - You are responsible for conducting your own research

Disclaimer - This is not investment advice in any form and investors are responsible for conducting their own research before investing.

Sources

✑ Investor presentation

✑ Company website

✑ TechCrunch

✑ Forbes

✑ Fortune

✑ Similarweb

✑ Pocket Lint

Sources

✑ Investor presentation

✑ Company website

✑ TechCrunch

✑ Forbes

✑ Fortune

✑ Similarweb

✑ Pocket Lint

✑ Merchant Maverick

✑ Mordor Intelligence

✑ Allied Market Research

✑ Markets And Markets

✑ Frost & Sullivan

✑ Mordor Intelligence

✑ Allied Market Research

✑ Markets And Markets

✑ Frost & Sullivan

Hope you liked this thread!

For more content, follow us on Twitter

For more content, follow us on Twitter

Want to get UNDER HYPED companies delivered straight to your inbox

Want to get UNDER HYPED companies delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

For more content, follow us on Twitter

For more content, follow us on Twitter

Want to get UNDER HYPED companies delivered straight to your inbox

Want to get UNDER HYPED companies delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

Read on Twitter

Read on Twitter