From 2010 and almost bankrupt

From 2010 and almost bankrupt

To 2020 and Champions of Everything

To 2020 and Champions of Everything

Here is a look at how #LFCFinances have evolved in a transformational decade under FSG incl. significant organic cash generation, reduced financial leverage and how COVID19 could impact (1 of 10)

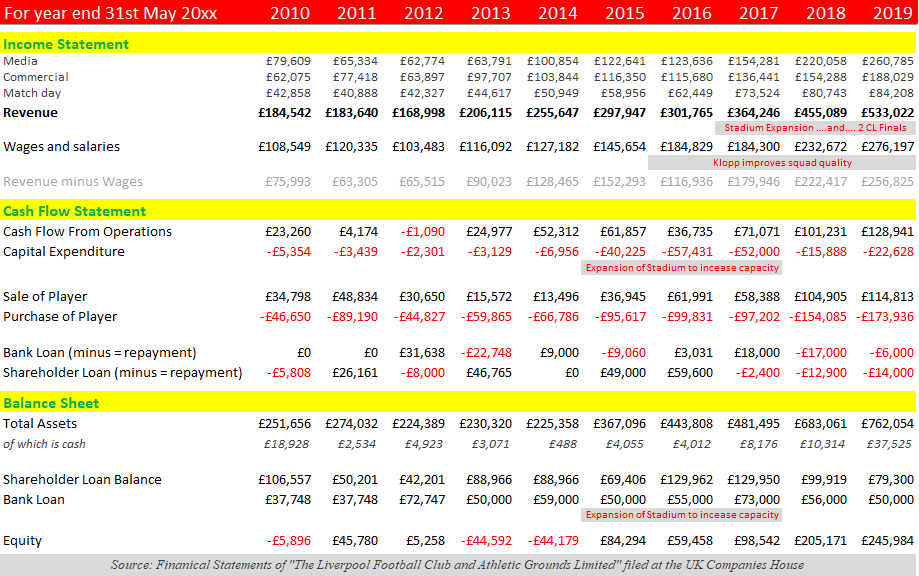

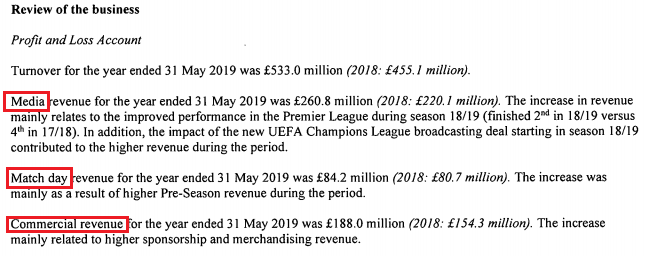

Revenue has grown from £185m in 2010 to £533m in 2019. Of the £348m increase, £181m came from media but the remaining £167m came from better commercial deals and the increased revenue from the stadium expansion

Revenue has grown from £185m in 2010 to £533m in 2019. Of the £348m increase, £181m came from media but the remaining £167m came from better commercial deals and the increased revenue from the stadium expansion#LFCFinances

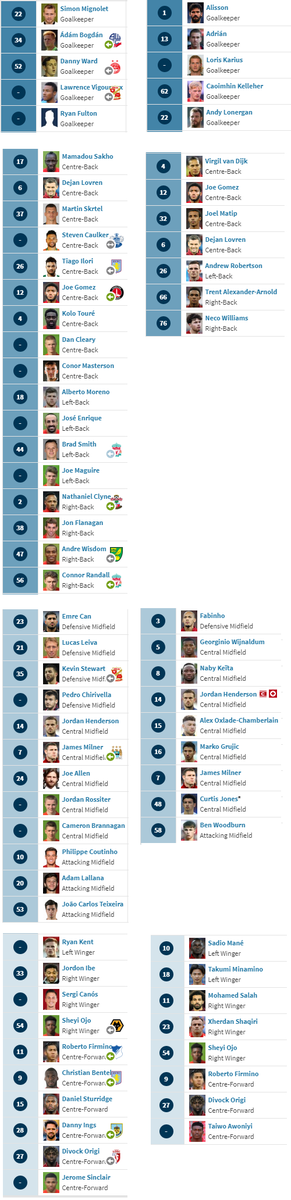

Wages - over 6 years between 2010-16, wages increased by £80m but over 3 years between 2016-19 they increased by £90m. Here is the squad from 2015/16 that Klopp largely inherited against today's squad

Wages - over 6 years between 2010-16, wages increased by £80m but over 3 years between 2016-19 they increased by £90m. Here is the squad from 2015/16 that Klopp largely inherited against today's squad#LFCFinances

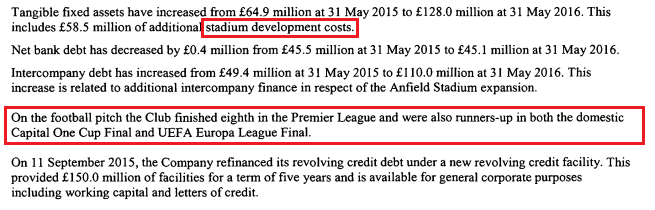

Stadium Investment

Stadium InvestmentCapital Expenditure ran at £2-7m per annum between 2010-2014 but increased over 2015/16/17 to £40-50m to increase the capacity of Anfield

#LFCFinances

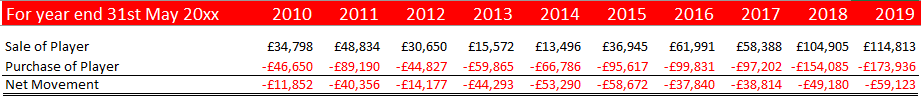

Player Transfers

Player TransfersIn term of cashflow #LFC has run an annual deficit in each year (between £11-59m) over 2010-19 between payments & receipts - cumulative impact is an outflow of £407m.

#LFCFinances

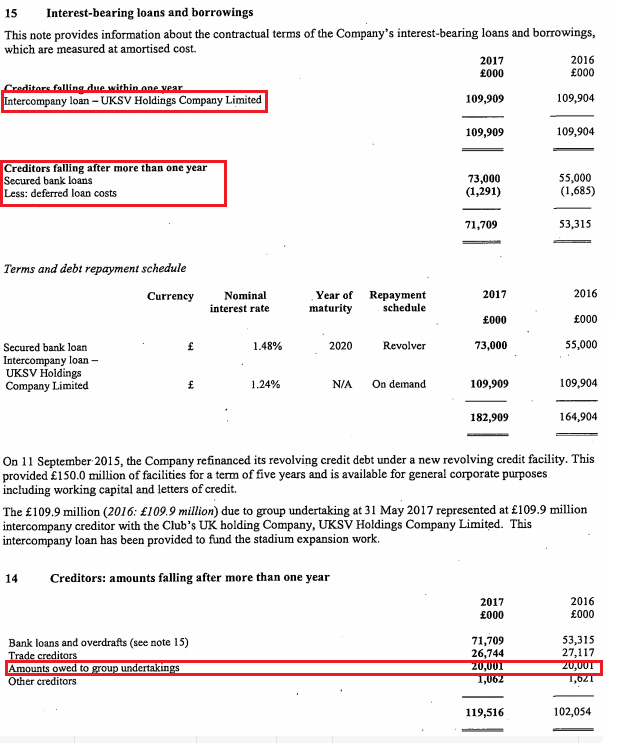

Shareholder Loan (1)

Shareholder Loan (1)With revenue still in early growth, over 2013 & 2014, net transfer spend of negative £98m across these 2 years exceeded Operating Cashflow (after Capex spend) of £67m by £31m. The Shareholder loan doubled from £42m to £89m to fill this gap

#LFCFinances

Shareholder Loan (2)

Shareholder Loan (2)The Shareholder loan increased to £130m by 2017 to help fund the stadium expansion. This has since reduced to £79m and "maybe" with intention to reduce to c.£50m in line with bank debt levels and similar to SH Loan in 2011/12

#LFCFinances

Bank Debt

Bank DebtRose to a high of £73m in 2017 as part of the expansion. But typically, bank debt is kept stable at £50m. However, bank debt as a % of Total Assets has fallen from 50-60% over 2010-14 to 42% in 2017 to 17% in 2019 (leverage has reduced substantially)

#LFCFinances

2020

2020#LFC could generate £100m in free cashflow (after capex) to May20 and required to finance (A) the gap between sales and purchases (was negative £59m in 2019) and (B) SH and bank loans. Finances should be resilient heading into COVID

#LFCFinances

COVID19 and Contracts

COVID19 and Contracts#LFC have some visibility on cash inflow from TV deals and Sponsorship and outflow on player contracts.

#LFC generated Operating Cashflow of £129m in 2019. Match day revenue generated £84m in 2019. Without fans the finances still look ok

#LFCFinances

Conclusion

Conclusion #LFC realising financial potential under FSG

#LFC realising financial potential under FSG Funds reinvested in wages & transfers

Funds reinvested in wages & transfers Debt (incl. SH Loans) to Equity is below 1x at 0.5x (was >20x)

Debt (incl. SH Loans) to Equity is below 1x at 0.5x (was >20x) Without Match Day revenue, a decent transfer could be done but not one that raises the wages bar

Without Match Day revenue, a decent transfer could be done but not one that raises the wages bar#LFCFinances

Read on Twitter

Read on Twitter