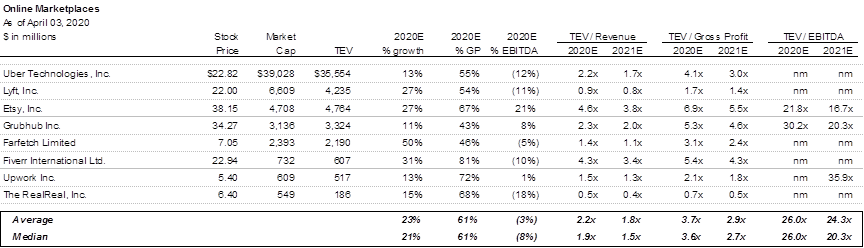

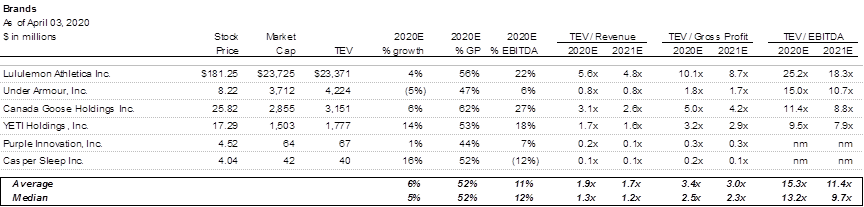

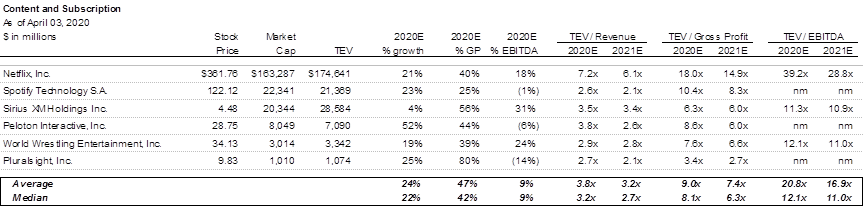

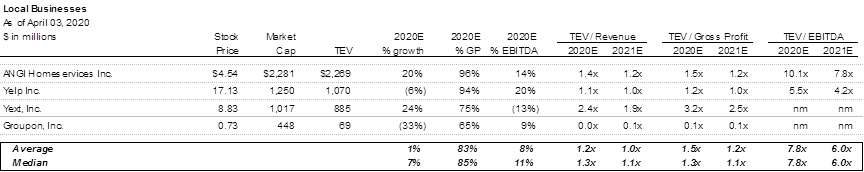

1/ CATEGORIZING GROWTH STOCKS

The opportunity cost of research & analysis spikes in volatile markets.

I& #39;ve tried to categorize growth stocks by sector to help prioritize where I should spend my time.

The opportunity cost of research & analysis spikes in volatile markets.

I& #39;ve tried to categorize growth stocks by sector to help prioritize where I should spend my time.

2/ Please let me know which companies I& #39;m missing, which are miscategorized, and/or any glaring data errors.

I& #39;m hoping to iterate and refine these lists over time.

h/t @CharlieZvible for the idea to open-source the project.

I& #39;m hoping to iterate and refine these lists over time.

h/t @CharlieZvible for the idea to open-source the project.

3/ A few caveats:

- All data is pulled directly from CIQ and the numbers have not been scrubbed

- TEV and related multiples are obviously over-stated for high cash-burn companies

- FDS likely understated

- TEV ignores minority investments (eg uber)

- Metrics ignore SBC

- All data is pulled directly from CIQ and the numbers have not been scrubbed

- TEV and related multiples are obviously over-stated for high cash-burn companies

- FDS likely understated

- TEV ignores minority investments (eg uber)

- Metrics ignore SBC

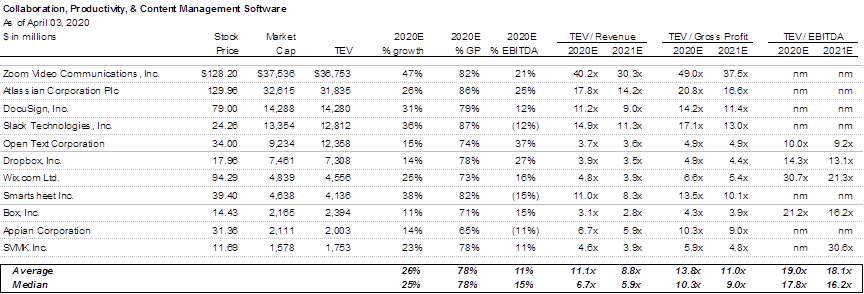

13/ Collaboration, Productivity, & Content Management Software

$zm $team $docu $work $otex $dbx $wix $smar $box $appn $svmk

$zm $team $docu $work $otex $dbx $wix $smar $box $appn $svmk

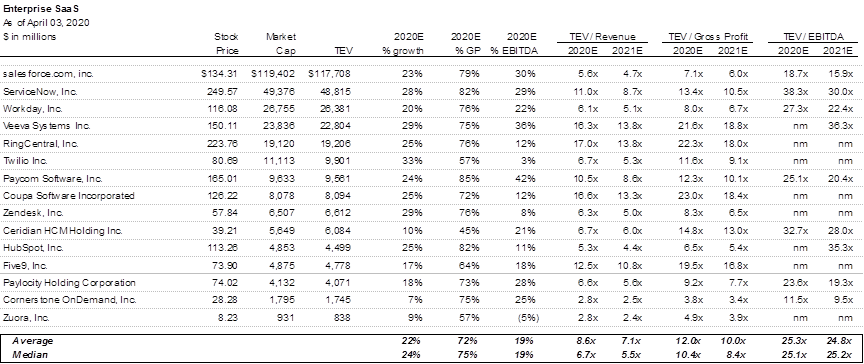

15/ Enterprise SaaS

$crm $now $wday $veev $rng $twlo $payc $coup $zen $cday $hubs $fivn $pcty $csod $zuo

$crm $now $wday $veev $rng $twlo $payc $coup $zen $cday $hubs $fivn $pcty $csod $zuo

Read on Twitter

Read on Twitter