There are  type of #BREAKOUTS

type of #BREAKOUTS

Breakout without any retest

Breakout without any retest

Breakout with a re-test

Breakout with a re-test

Breakout with a hard re-test

Breakout with a hard re-test

Failed breakout

Failed breakout

Following tweets explain each one of those with examples from recent breakout alerts

type of #BREAKOUTS

type of #BREAKOUTS Breakout without any retest

Breakout without any retest Breakout with a re-test

Breakout with a re-test Breakout with a hard re-test

Breakout with a hard re-test Failed breakout

Failed breakoutFollowing tweets explain each one of those with examples from recent breakout alerts

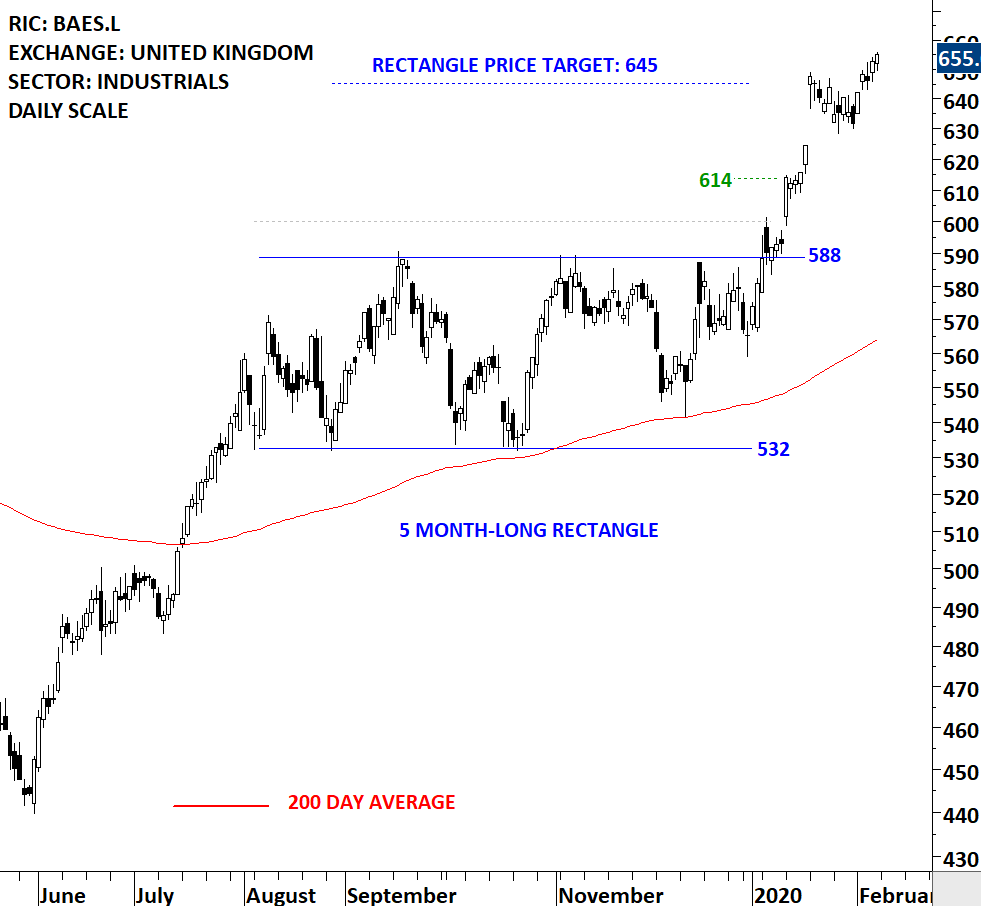

Breakout without any retest

Breakout without any retestIf you have a stop-loss placed below the chart pattern boundary, this is the easiest to trade. Following the breakout your stop-loss will no be challenged and price target will be met.

#BAES #FTSE #UK

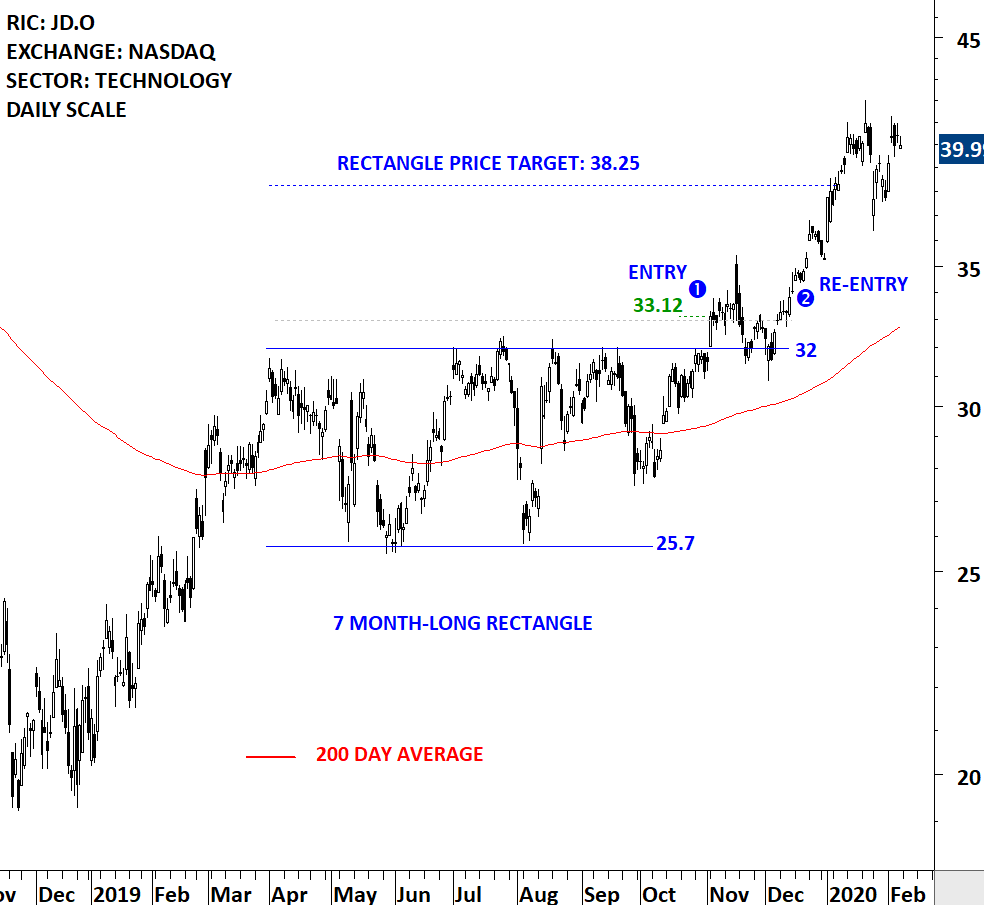

Breakout with a re-test

Breakout with a re-testIf you have a stop-loss placed below the chart pattern boundary, this type of trade may test your patience but still will not challenge your protective stop-loss. Chart pattern boundary will even offer a new entry opportunity.

$NDAQ $QQQ

Breakout with a hard re-test

Breakout with a hard re-testIf you have your stop-loss below the chart pattern boundary and it is a tight stop-loss, you might get stopped out depending on the hard re-test.

A trading tactic to re-enter: immediately after price recovers above pattern boundary

$JD $QQQ

Failed breakout

Failed breakoutIf you have your stop-loss below the chart pattern boundary, price will fail to hold the breakout level and you will get stopped out. These are part of trading breakouts. It is important to always have protective stops (BELOW PATTERN BOUNDARY) in place.

$INCY

There is no perfect stop-loss strategy.

There is no perfect indicator that will warn you of failed breakouts and improve your win rate.

There is "leap of faith" 'courage to pull the trigger" with those breakouts.

There is managing risk via protective stops and position sizing.

There is no perfect indicator that will warn you of failed breakouts and improve your win rate.

There is "leap of faith" 'courage to pull the trigger" with those breakouts.

There is managing risk via protective stops and position sizing.

Read on Twitter

Read on Twitter