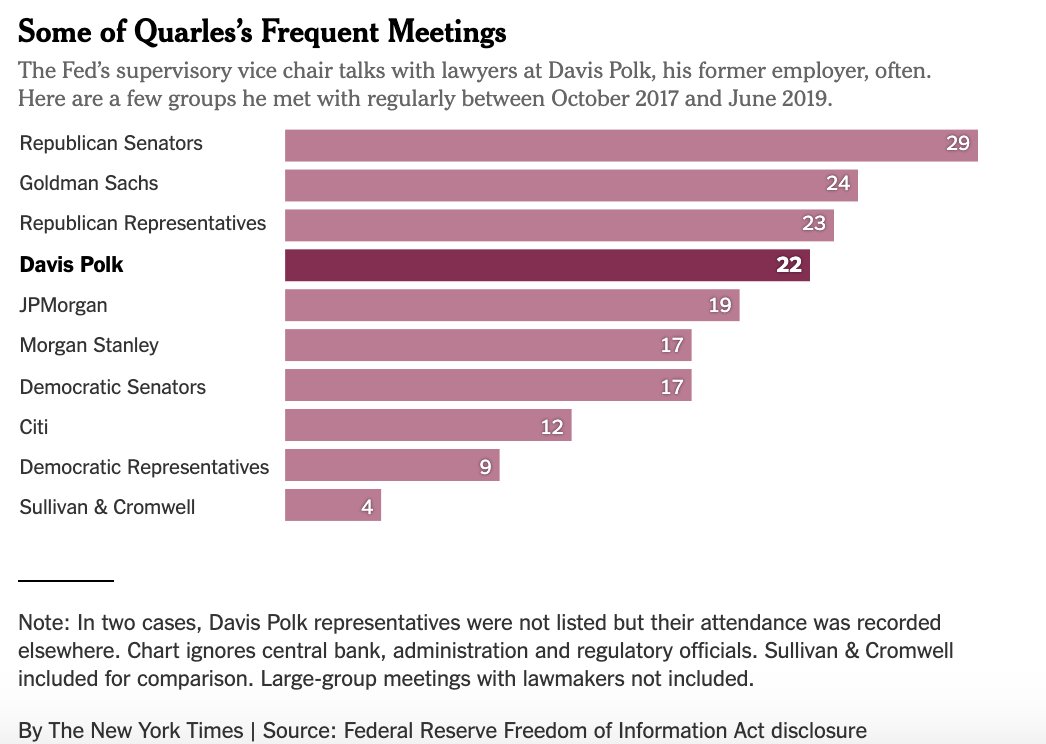

Randy Quarles is arguably America& #39;s most important bank regulator. He is also still friendly with the industry -- he met with his old colleagues at Davis Polk, which represents the big banks, 22 times in his first 21 months. (1/) https://www.nytimes.com/2019/11/29/business/economy/bank-regulations-fed.html?rref=collection%2Fbyline%2Fjeanna-smialek&action=click&contentCollection=undefined®ion=stream&module=stream_unit&version=latest&contentPlacement=1&pgtype=collection">https://www.nytimes.com/2019/11/2...

Quarles& #39; unofficial predecessor, Daniel Tarullo, doesn& #39;t have any recorded meetings with the firm on his schedule.

But this could underline a way Quarles& #39; job is unique -- he is tasked with fine-tuning blunt post-crisis regulation (or rolling it back, depending on who you ask.)

But this could underline a way Quarles& #39; job is unique -- he is tasked with fine-tuning blunt post-crisis regulation (or rolling it back, depending on who you ask.)

Input from banks is key to that rewriting. The Fed has a full comment, but I thought this Quarles quote summed it up:

“I have a pretty open door...I think that’s part of the responsibility of a Fed governor. The Fed as an institution has to be open to receiving input.”

“I have a pretty open door...I think that’s part of the responsibility of a Fed governor. The Fed as an institution has to be open to receiving input.”

The question: are tweaks simply improving efficiency without adding to risk, or will rollbacks leave the system vulnerable at exactly the wrong time?

Lael Brainard& #39;s dissents suggest she& #39;s worried about the latter. Nellie Liang also had a great piece: https://www.brookings.edu/blog/up-front/2019/10/15/a-risky-mix-looser-financial-regulations-when-monetary-policy-is-easing/">https://www.brookings.edu/blog/up-f...

Lael Brainard& #39;s dissents suggest she& #39;s worried about the latter. Nellie Liang also had a great piece: https://www.brookings.edu/blog/up-front/2019/10/15/a-risky-mix-looser-financial-regulations-when-monetary-policy-is-easing/">https://www.brookings.edu/blog/up-f...

Read on Twitter

Read on Twitter